- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 10/2/23 at 10:01 am to KLSU

Weird …my insurance actually went down… as a matter fact the last couple times I’ve had to renew it went down

Posted on 10/2/23 at 10:03 am to KLSU

quote:

There has to be a better way...

Unfortunately, the only solution is moving. Virginia's auto insurance is half of what it is here. Other states are similar. Our politicians have no interest in changing it. And apparently the people don't either because we continue to elect them. Landry DGAF about your insurance rates and he'll win in a landslide.

Posted on 10/2/23 at 10:03 am to KLSU

No. Safeco jumped by >35% for me. Just shopped around and got Progressive for close to what I was paying before the increase.

Posted on 10/2/23 at 10:04 am to KLSU

All insurances..

Homeowner 15% last year, 16% this year

Auto 25% increase this year

Homeowner 15% last year, 16% this year

Auto 25% increase this year

Posted on 10/2/23 at 10:06 am to KLSU

Happening to everyone.

I recently switched to Farm Bureau. They had the best rates.

I recently switched to Farm Bureau. They had the best rates.

Posted on 10/2/23 at 10:07 am to KLSU

Mine went down $5 per month, I was expecting the increase. Maybe SF will get me next time. My car is older and paid for, and I’m middle aged, maybe that helped.

Posted on 10/2/23 at 10:07 am to EnglebertHumperdink

quote:

shopped around and got Progressive for close to what I was paying before the increase.

Progressive is notorious for giving a low teaser policy to new customers. Be prepared to be gouged on the renewal.

Do a google search about it. Well documented.

Posted on 10/2/23 at 10:11 am to LSUAlum2001

quote:

Homeowner 15% last year, 16% this year

lucky, my homeowners went up 72% this year alone.

auto went up because i had a fender bender last year. broke a tail light now i have to pay an extra $240 annually.

ETA:

any one with SF use the Drive Safe and Save discount? thought about doing it but dont like the idea of them critiquing my driving and telling me i accelerate to fast.

This post was edited on 10/2/23 at 10:13 am

Posted on 10/2/23 at 10:17 am to KLSU

usually it is regional. State Farm didn't do such a raise for me. I'm still paying less than before Covid.

Posted on 10/2/23 at 10:28 am to Pezzo

quote:

auto went up because i had a fender bender last year. broke a tail light now i have to pay an extra $240 annually.

Mine increased $2880 annually. No claims against anyone.

USAA.

This post was edited on 10/2/23 at 10:37 am

Posted on 10/2/23 at 10:35 am to KLSU

By next year this will be a full blown crisis.

Posted on 10/2/23 at 10:36 am to KLSU

Gordon doesn’t give a shite.

He’s getting paid.

:mad:

He’s getting paid.

:mad:

Posted on 10/2/23 at 10:38 am to KLSU

Mine went up about 12% last year and 12% again this year with Farm Bureau.

Posted on 10/2/23 at 10:38 am to KLSU

quote:there is….

There has to be a better way...

Posted on 10/2/23 at 10:42 am to KLSU

Rates will decrease when our next army cop hero trial attorney governor wins here in a few months.

Posted on 10/2/23 at 10:45 am to lsu13lsu

quote:

Sue happy state.

Floods.

Hurricanes.

Roofers filing claims left and right for any and all hailstorms.

What do you expect?

that isnt what it is

repairs and cost to replace vehicles is through the roof. Think about how much more your vehicle is worth vs when you bought it, apply that across the board.

on top of that, you have the sue happy state and so many without insurance. those things effects those that do pay way more.

Posted on 10/2/23 at 10:46 am to KLSU

I was with them...never again

Posted on 10/2/23 at 10:49 am to KLSU

Homeowners exploded again but we only have two oe three options so stayed with State Farm / Dover Bay as even with the increase they were still cheaper.

Auto exploded with State Farm at renewal over the summer. Found a GEICO policy that was about the same price SF used to be, so switched. SF agent said GEICO was a few months behind them in submitting rate increases for approval. So I might have to do this again next time, but at least I save some money for now.

Auto exploded with State Farm at renewal over the summer. Found a GEICO policy that was about the same price SF used to be, so switched. SF agent said GEICO was a few months behind them in submitting rate increases for approval. So I might have to do this again next time, but at least I save some money for now.

Posted on 10/2/23 at 10:51 am to White Bear

quote:

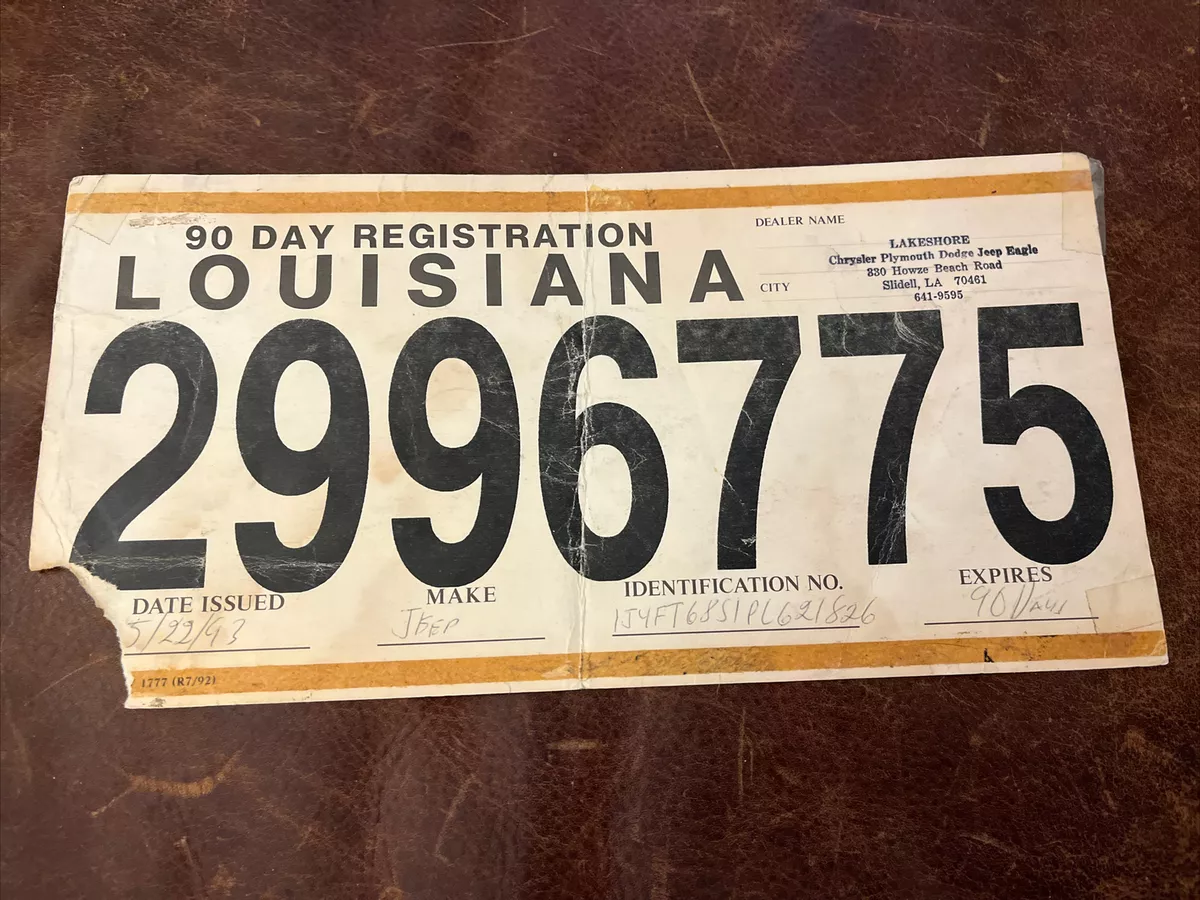

—Lakeshore—

Chrysler Plymouth Dodge Jeep Eagle

Damn, their radio and tv ads always cracked me up.

Just sell Ford, Chevy, and yotas too ffs

Popular

Back to top

0

0