- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Insurance rates lead to major softening of Florida Real Estate market

Posted on 3/16/24 at 9:15 am

Posted on 3/16/24 at 9:15 am

LINK

quote:

The number of "motivated sellers" in Florida has grown in the past two weeks, as more homeowners are trying to offload their properties quickly amidst a worsening of the state's insurance crisis.

According to data shared on ResiClub, Florida's active home-for-sale inventory increased by 45.8 percent year-over-year in February, while Texas's increased by 22.8 percent. At a nationwide level, inventory rose by 15.0 percent in the same period.

Posted on 3/16/24 at 9:23 am to TejasHorn

Yes- they are dropping listing prices to offset the monthly hoa fees for condos and the insurance premiums for single family. All this bluster about realtor fees (which isn't even a requirement to sell or own property) when the insurance industry continues to run amok.

Posted on 3/16/24 at 9:23 am to TejasHorn

I love FL but anything coastal is becoming unsustainable from an insurance standpoint.

20% of homes are already self insured and owners are seeing increases YOY of 40% with some condos getting 100% increases. The lack of underwriters added to interest rate hikes are going to make it a cash only real estate economy and that’s just not sustainable in the face of prices doubling or more since Covid.

20% of homes are already self insured and owners are seeing increases YOY of 40% with some condos getting 100% increases. The lack of underwriters added to interest rate hikes are going to make it a cash only real estate economy and that’s just not sustainable in the face of prices doubling or more since Covid.

Posted on 3/16/24 at 9:36 am to TejasHorn

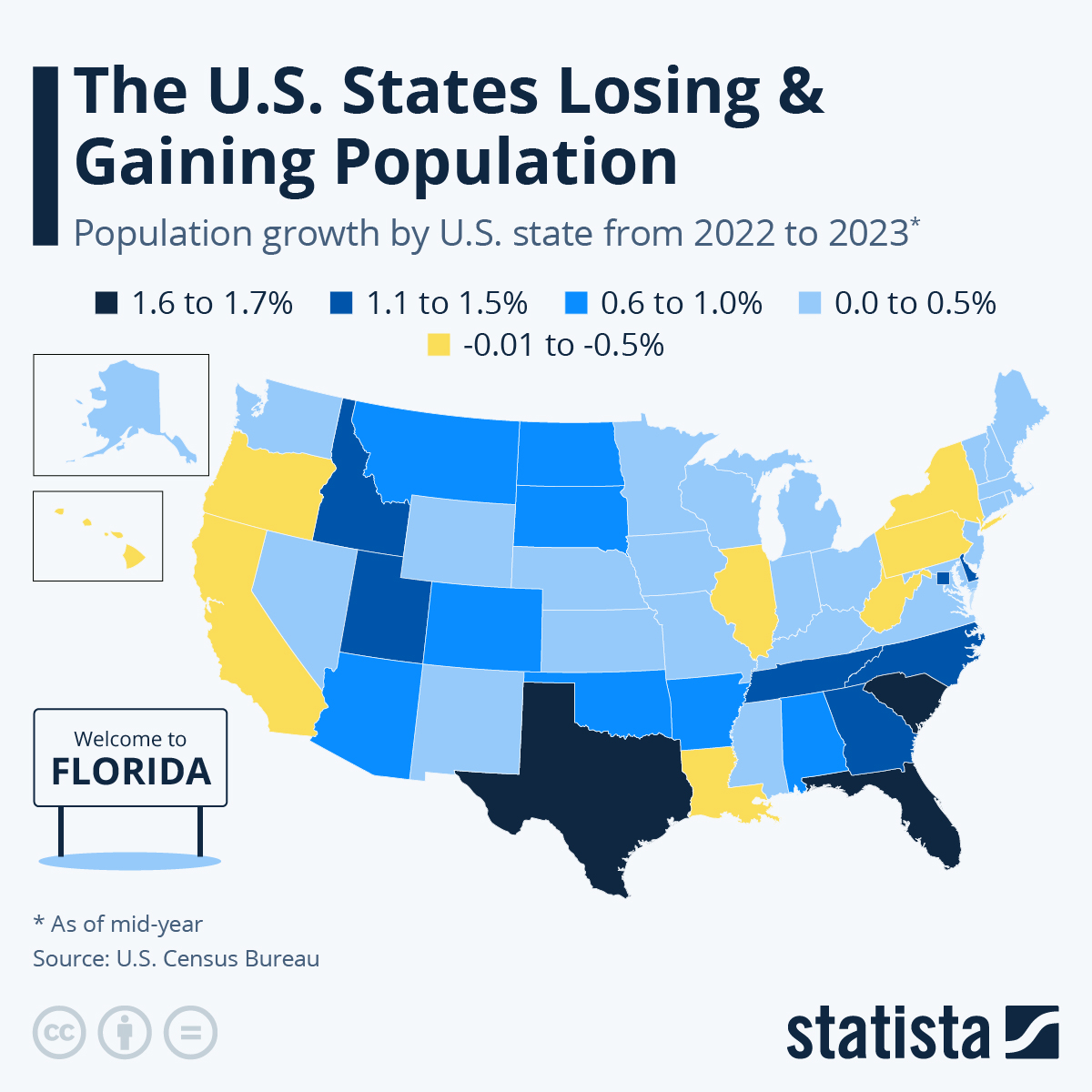

Click bait article. Florida leads the nation in popularity move.

High interest rates on mortgage lowers asking price on real estate.

Also retirees sell houses because they need the money to live in inflationary economy. Buying opportunities are now.

Oh and don't forget all the older people whose time had come to meet the Lord, and their children sell off the houses for quick money. Florida is full of the latter day saints.

Posted on 3/16/24 at 9:37 am to BigAppleTiger

quote:

when the insurance industry continues to run amok

It’s not the insurers, they would love to write policies on those expensive properties, the issue is the underwriters have left the space.

State Farm isn’t really an insurance company, they’re a marketing firm that resells policies to underwriters who hold most of the risk in return for a percentage of the policy. If the underwriters exit their business model doesn’t work and you’re left with small time insurers who write without underwriting for a much higher rate and who face much higher risk of failure because their risk pool is much smaller and more locally focused.

The out of control litigious situation has to be addressed to make the market more appealing, then the claims process needs to be fixed so owners don’t get screwed when claims are filed and all of that will require the legislature to get involved asap before the bottom drops out.

And yes, some properties that are in flood or risk zones will need to be remediated to lower the risk of catastrophic claims. For example a house built to S FL wind codes can basically get hit by a small tornado and be fine while a poorly built home would be a total loss from the same storm.

Think we end up seeing only houses with metal roofs, hurricane brackets and a lot more concrete first floors near the coast. I mean you go to NC/SC and coastal homes are on pilings whereas in FL you see 1 story ranch houses from the 70s right on the water with asphalt shingles. Any sort of surge or wind and they’re a total loss.

Posted on 3/16/24 at 9:41 am to tide06

Outstanding, succinct, and knowledgeable post.

Well done, sir.

Well done, sir.

Posted on 3/16/24 at 10:54 am to tide06

Every company buys reinsurance on their risks. To say SF isn’t an insurance company is the silliest shite I’ve heard in a long time. We just reported a 13.4 Billion dollar underwriting loss for 2023. After Hurricane Andrew, State Farm started a separate entity in Florida called State Farm Florida for all fire policies. We 100% underwrite all of our risks.

This is the biggest issue facing Florida.

quote:

The out of control litigious situation has to be addressed to make the market more appealing, then the claims process needs to be fixed so owners don’t get screwed when claims are filed and all of that will require the legislature to get involved asap before the bottom drops out.

This is the biggest issue facing Florida.

This post was edited on 3/16/24 at 11:04 am

Posted on 3/16/24 at 12:54 pm to tide06

quote:

State Farm isn’t really an insurance company, they’re a marketing firm that resells policies to underwriters who hold most of the risk in return for a percentage of the policy.

You are wrong in what you said but your concept is right. There are about half a dozen or more different State Farm’s and there is definitely a State Farm Florida. Look it up in AM Best ratings. There is a State Farm Florida, State Farm Texas, etc. Hell, there is even an SF Lloyds. Saying State Farm sells all the risk to another company is reinsurance. It is a common practice for all insurance companies. To say SF just sells all their exposure is wrong as they keep a large portion of it and even use their own reinsurance companies. Florida also requires where if an insurance company goes bankrupt or doesn’t have the funds to pay a claim, the claims the other company committed to paying get paid by all the other insurers left in the state. By selling off some of the risk, they also sell off that exposures.

What you are talking about is called reinsurance. The company who sells the policy then sells some of the risk to the reinsurers. This is common for big risks. For example, when the world trade centers were insured, that risk had about a dozen or more carriers with coverage on the building. The owners of the building didn’t go to 25 different carriers. One group took on the risk and sold parts of that risk to other company’s for a portion of the premium.

It is incredibly common in the insurance industry. Florida is just unsustainable due to the massive amounts of regular losses.

Posted on 3/16/24 at 1:13 pm to jscrims

build according to current windstorm specs and insurance drops by half. Meet the flood elevation requirements and that dropped by 2/3.

Posted on 3/16/24 at 1:20 pm to TejasHorn

The problem is claims against insurance companies for frivolous reasons in Florida is like the auto insurance industry in Louisiana.

Stucco is cracked? They will sue everyone from the yard man to the guy who painted the inside. It's out of control. They also have a 10 year SOL (recently reduced to 7). So up to three to four carriers being placed on notice is not uncommon.

Source: Handle claims in Florida.

Stucco is cracked? They will sue everyone from the yard man to the guy who painted the inside. It's out of control. They also have a 10 year SOL (recently reduced to 7). So up to three to four carriers being placed on notice is not uncommon.

Source: Handle claims in Florida.

Posted on 3/16/24 at 1:21 pm to Trevaylin

Put on $70k roof and my insurance went down. $7k per year..Martin County Florida

Posted on 3/16/24 at 3:19 pm to jscrims

You’re spot on.

Source: I’m a SF agent in Florida on the coast

Source: I’m a SF agent in Florida on the coast

Posted on 3/16/24 at 3:22 pm to TejasHorn

Everyones insuruance went up this year. Mine almost doubled.

Posted on 3/16/24 at 3:51 pm to TejasHorn

Between my yearly increase for Insurance and Property taxes could not imagine living in Fl. if my Mortgage rate was 6% or higher. This is getting ridiculous.

Posted on 3/16/24 at 6:24 pm to TejasHorn

The rustbelt scum needs to scurry on back home and quit destroying Florida.

Posted on 3/16/24 at 6:41 pm to tide06

The very old surviving houses in Daytona on the peninsula were all classic Spanish style made of stucco with smallish windows and recessed roofs. Very resistant to wind damage.

Posted on 3/16/24 at 9:00 pm to tide06

In all honesty, that’s what SHOULD be happening 100%. Why do people inland have to subsidize coastal homes that get destroyed every few years? You want to live on the ocean and enjoy that beauty, pay the piper.

Popular

Back to top

7

7