- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: How bad was State Farm the last few years

Posted on 9/19/23 at 12:54 pm to Shankapotamous

Posted on 9/19/23 at 12:54 pm to Shankapotamous

quote:

Any chance I can get this guys name and number? I'm currently in litigation against State Farm on a home owners claim, and would love to get my attorney in touch with someone like this.

Yea sure, let me do that and you can then give me your attorney’s number since I’ll need it after divulging my customer’s info

Sorry baw, I enjoy my paycheck.

Posted on 9/19/23 at 12:57 pm to tigerbutt

quote:

My State Farm agent called me to review my policy about a year ago. Went in and found out they had me down for $200,000 content coverage. I was like WTF. He said they take a percentage of the value of your home and determine content coverage. I told him to reduce down to $50K which is still more than enough. You have to watch these guys. Still paying way too much for home insurance.

That’s common on the HO3 across all carriers I believe. Been a while since I was in P&C though so I may be wrong.

Posted on 9/19/23 at 1:11 pm to TheHarahanian

quote:

Been through Katrina and Ida claims (both non-State Farm and both replacement) and never had funds withheld.

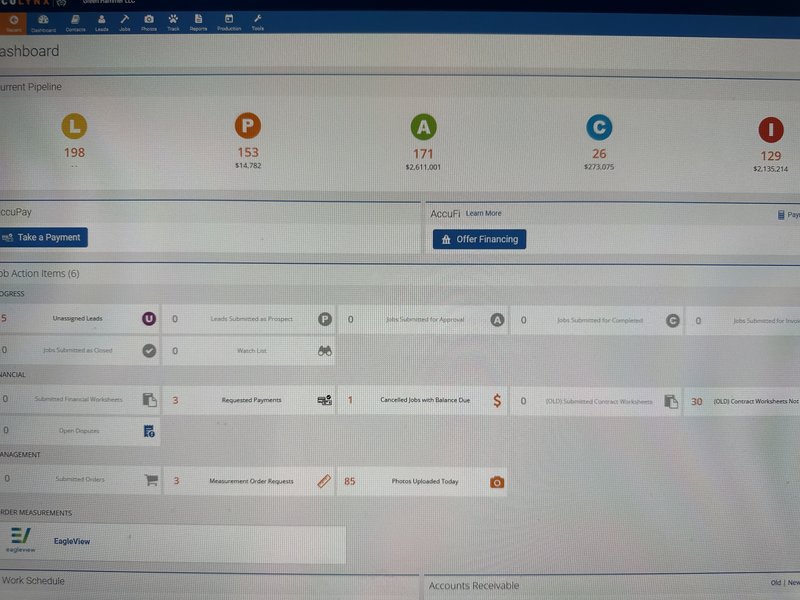

Here’s my current CRM, as of 5 minutes ago. 90% of my work is homeowners insurance claims. State Farm having the highest number of claims. I’m not making it up when I say i deal with it every day.

How your claim for Katrina was handled is not what State Farm is doing. The 75/25, initial/depreciation funds you’re talking about is just false.

This post was edited on 9/19/23 at 1:14 pm

Posted on 9/19/23 at 1:27 pm to TheHarahanian

quote:

It’s not State Farm’s business what anybody does with the money. People pay for insurance policies, not a conscience or a babysitter.

SF doing that or the mortgage lender? My mortgage company did that after Katrina claim.

Posted on 9/19/23 at 2:02 pm to Gee Grenouille

quote:

I have a quote and it's a little more than Cajun

Before you make the move based purely on price, you better take the time to do a line-by-line comparison to make sure you don't have any major differences. In my limited experience, it is very common for SF to quote higher deductibles than other carriers to reduce the customer's premium and make the pricing comparable.

Posted on 9/19/23 at 2:35 pm to TheHarahanian

Even if State Farm gave you all of the money up front, unless your home is paid for the check will have your mortgage lien holder on it as a payee

And most if not all banks won’t just sign the check. You sign and send it to them for endorsement, and instead of signing they hold the funds and dole it back out to you like a construction loan.

Flood insurance works the same way, and that’s Uncle Sam not State Farm.

And most if not all banks won’t just sign the check. You sign and send it to them for endorsement, and instead of signing they hold the funds and dole it back out to you like a construction loan.

Flood insurance works the same way, and that’s Uncle Sam not State Farm.

Posted on 9/19/23 at 3:15 pm to iwyLSUiwy

quote:

I learned really quickly that Shelter or Farm Bureau are who i needed to be with. For the most part they have good adjusters and actually do right by their homeowners. They might be a little more expensive but well worth.

That's what I was looking for, thanks for the info.

Posted on 9/19/23 at 3:27 pm to TDsngumbo

quote:

State Farm has been issuing 75% of settlement checks on homeowners claims, and telling policy holders they’ll get the remaining 25% when they show proof that the repair work was done satifactorily.

If you have a rcv policy through anyone is the most likely scenario for anyone not just SF. It protects the insured, insuree, and contractor that the homeowner doesn’t go take money for the insurance claim and do something.

“Eating a deductible” is ILLEGAL”. Have you ever gone to the dr and said “hey doc…I think you can do better on my deductible” or “hey doc if you don’t eat my deductible, I’ll just go to someone who can”.

A homeowner is responsible to pay their deductible. People that play that game are disgusting.

You are the reason insurance is so high.

You are the reason contractors have bad names bc you go with the shitey contractor who will eat your deductible, do shotty work, not return calls or texts, not come back if something is done wrong….and then want to blame all contractors.

And you’re taking $ out of peoples business bc you THINK you have a right to do what you want with the insurance money.

O and SF is garbage. Currently having to fight them on 6 replacements.

This post was edited on 9/19/23 at 3:28 pm

Posted on 9/19/23 at 7:10 pm to LemmyLives

quote:

Cajun the actual insurance carrier

NO

quote:

reselling Progressive, Travelers, etc?

General Agency for some smaller carriers. Mainly Safepoint

Posted on 9/19/23 at 7:28 pm to Gee Grenouille

Bastards just went up on my car insurance $78 a month.

Posted on 9/19/23 at 7:33 pm to iwyLSUiwy

quote:

How your claim for Katrina was handled is not what State Farm is doing. The 75/25, initial/depreciation funds you’re talking about is just false.

I haven’t had State Farm insurance since the 80s, so my Katrina claim wasn’t State Farm.

But I just watched a friend go through having 25% withheld from a hail damage claim with State Farm, so it is happening.

Posted on 9/20/23 at 9:00 am to TheHarahanian

quote:

haven’t had State Farm insurance since the 80s, so my Katrina claim wasn’t State Farm. But I just watched a friend go through having 25% withheld from a hail damage claim with State Farm, so it is happening.

Got ya. What do you do for work? Just asking so in case me or my friend have done it/gone through it one time. So I can pretend I know what I’m talking about when someone is asking for advice and make sure I disagree with you since you do it for a living.

Posted on 9/20/23 at 9:03 am to Gee Grenouille

frick State Farm.

When their racist asses replaced White "Jake" with a black one.

The real Jake needs to file charges for identity theft.

When their racist asses replaced White "Jake" with a black one.

The real Jake needs to file charges for identity theft.

Posted on 9/20/23 at 9:07 am to Gee Grenouille

I guess I’m a lucky one. I’ve had two major claims with them and they paid out quick and no issues. Plus I ran a red light and hit a truck. They paid gif their damage plus med bills plus totaled my car with just cosmetic damage. I actuss as lol made money by fixing less than estimate called for and I’m still covered. I thought for sure I would be dropped.

Posted on 9/20/23 at 9:17 am to iwyLSUiwy

quote:

Just asking so in case me or my friend have done it/gone through it one time. So I can pretend I know what I’m talking about when someone is asking for advice and make sure I disagree with you since you do it for a living.

I acknowledge that you have more experience in the insurance field. I’m not disputing that. I’m relaying what I’ve seen with my own eyes firsthand.

Posted on 9/20/23 at 10:10 am to Gee Grenouille

State Farm is the worst insurer in the market to its insureds. You’ll get treated like shite in your most important times of need.

Posted on 9/20/23 at 10:15 am to The Boat

quote:

State Farm when to shite when they changed Jake from State Farm to a black guy

Yeah, for some reason they thought they would just get more policies written out failing to realize they'd attract customers that put in claims on everything.

Posted on 9/20/23 at 10:37 am to couv1217

I appreciate your experience. I had a claim some years ago and quickly realized that the insurance company/contractor/mortgage company payout process was set up to severely limit the homeowners ability to add value to the repair process. It is what it is. But the 25 % holdback is broke as a ducks dick. Insurance company would not release the holdback until I provided a paid receipt from the contractor indicating he released the property from any workman's liens. Even though third party inspection reported work complete. I had to get a 9000 dollar 90 day loan from the bank, to pay the contractor, to get him to sign the release/reciept and submit to the insurance company for final settlement with a mortgage company copay check that took 50 days to clear.

The insurance company at one point said just sign the receipt and workman's lien for the contractor and submit. My response was that sounded like a hard time fellony. Would you agree?

The insurance company at one point said just sign the receipt and workman's lien for the contractor and submit. My response was that sounded like a hard time fellony. Would you agree?

Posted on 9/20/23 at 10:22 pm to Trevaylin

That's a shame. That's why you really need to learn about the contractor first. We handle everything for you. Once the job is complete, we take pictures, get you to sign a letter of completion, and send in the invoice on your behalf so that they can release the depreciation portion of the claim. Then we just wait for it to come back in and collect. I'm never going to ask a homeowner to take a loan to pay me then reimburse yourself. That's just crappy. Heck right now I've been waiting almost a year for a depreciation from a client. We are working on the second check because the first was lost and each time we have to send to the mortgage company it's like the sloths from Zootopia are working there.

Popular

Back to top

0

0