- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Fannie Mae says a recession is likely; could hit the housing market

Posted on 5/20/22 at 2:11 pm to frequent flyer

Posted on 5/20/22 at 2:11 pm to frequent flyer

quote:

could hit the housing market

Could hit?

It definitely needs to hit the housing market.

Posted on 5/20/22 at 2:14 pm to Paul Allen

quote:

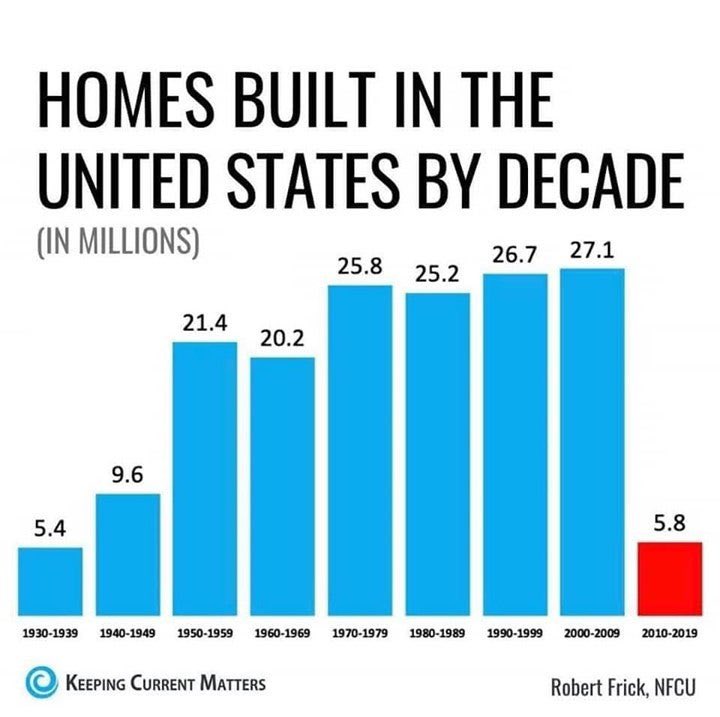

Adequate inventory is still years away.

There has been almost no new homes built in my community since 2008 - but there are plans in the works for a bunch of large scale developments. We'll see what happens , I guess. I'm not planning on selling or moving anytime soon. A decrease in my homes value would only help me. My fricking property taxes are outrageous.

This post was edited on 5/20/22 at 2:15 pm

Posted on 5/20/22 at 2:19 pm to frequent flyer

I have been hearing rumblings of this happening for @ a month now and expect that within the next 3-6 months, we’re going to see an increase in foreclosures.

This time it’s not the same as 08. Different causation.

I don’t think this will be as bad as 08. This one likely to be more of a market cleaning house. Not the systemic issues that were big part of 08 with sub prime and Collateralized debt obligations and lax lending practices.

This time it’s not the same as 08. Different causation.

I don’t think this will be as bad as 08. This one likely to be more of a market cleaning house. Not the systemic issues that were big part of 08 with sub prime and Collateralized debt obligations and lax lending practices.

This post was edited on 5/20/22 at 2:26 pm

Posted on 5/20/22 at 2:20 pm to SlidellCajun

I’m hoping it doesn’t make it to difficult to sell in the next few weeks.

Posted on 5/20/22 at 2:24 pm to Paul Allen

quote:

Adequate inventory is still years away. Home prices will more than likely stabilize before they would drastically dip.

Aren’t prices already falling in some

Metros?

When the interest rates are at 8-10% I just can’t see prices staying inflated. Lots of people will stay in their current homes with their 2-3% interest.

Posted on 5/20/22 at 2:25 pm to frequent flyer

Adults are in charge.

Posted on 5/20/22 at 2:37 pm to waiting4saturday

quote:

When the interest rates are at 8-10% I just can’t see prices staying inflated. Lots of people will stay in their current homes with their 2-3% interest.

Yes, but to your own point people aren't selling their homes. So unless more homes are built the supply side of the supply/demand chart isn't fixed.

Up until now we have little supply and extreme demand. That has led to crazy prices(30% increase in value year over year). Now we still have little supply with decreased demand, but still demand which will result in year over year value increases that aren't outrageous.

Prices of homes won't stay even or drop unless demand craters (8-10% interest rates) or supply increase.

But supply won't increase from people selling their homes because

A) Rent is also stupid high right now

B) Everyone has a historicly low interest rate

So the only way supply will increase is if more homes are built. But with high material cost and supply chain issues, combined with slowing demand, nobody wants to start ramping up home production. Which will in turn keep demand from falling too far.

The whole thing is a mess, and fixing it starts with fixing the supply chain issues and in turn getting the cost of materials to decrease.

Posted on 5/20/22 at 3:08 pm to Paul Allen

quote:

Adequate inventory is still years away. Home prices will more than likely stabilize before they would drastically dip.

I agree for now.

But the likelihood of the "hard landing" that the Fed is trying to avoid just seems to get higher and higher ever day. Nearly every major financial institution has adjusted their forecasts to include a higher risk factor for a recession in 2022 and 2023. I don't think current policy makers in Washington understand economic issues at all, and the Fed has a horrific record at combating inflation without causing a recession. It's just not a pretty picture right now, and we are very vulnerable.

I still agree that the housing market will stabilize, but I'm not as confident that we'll avoid a major downturn as I was a year ago. Stagflation could very well lead to job losses and families not being able to cover their mortgage. And that could lead to a flurry of fore closures, which will cool the housing market with quickness.

Posted on 5/20/22 at 3:14 pm to waiting4saturday

quote:

hen the interest rates are at 8-10% I just can’t see prices staying inflated. Lots of people will stay in their current homes with their 2-3% interest.

Yeah I was skeptical of posters saying that we'd see 7% rates by new years. Mostly because I assumed the Fed would continue under estimating the inflation risk and the media would just avoid pressing policymakers on inflation and economic issues.

Now I'm not so sure that we won't see rates that high by Thanksgiving. And that would certainly cool the market a bit.

Posted on 5/20/22 at 3:17 pm to PrecedentedTimes

quote:

But for places that lack any economic basis for having inflated prices (Prairieville, for example), hold on to your butts.

This is comical. Have you driven down hwy 30? 2 new hospitals and restaurants opening up daily in the parish. Ascension parish is becoming the new Baton Rouge. Frito Lay just announced yesterday that they are relocating to Ascension with a larger warehouse from Baton Rouge.

The developing moratorium alone will keep prices elevated. Lowering inventory because they can’t develop any more subdivisions.

Plenty of industry in parish and surrounding parishes and great schools.

Now if BR was a flourishing parish with great schools I would be concerned. People within their own parish want to split (St George).

This post was edited on 5/20/22 at 3:28 pm

Posted on 5/20/22 at 5:39 pm to Paul Allen

quote:

I’m not in real estate but I know what homes are going for in the top 10 hotter markets across the country. It’s widely known that supply is still a good ways away from catching up to demand.

So you are assuming demand will remain the same?

The entire point is that demand is going to tank at an incredible rate. Do you disagree that demand will decrease with rising inflation and interest rates?

I think a lot of people are delusional right now. They don’t realize just how bad things are and how much worse they are going to get.

This post was edited on 5/20/22 at 5:40 pm

Posted on 5/20/22 at 6:38 pm to frequent flyer

We are way into it already

Posted on 5/20/22 at 6:47 pm to dlambe5

quote:

Ascension parish is becoming the new Baton Rouge.

Easy there, killer

Posted on 5/20/22 at 7:15 pm to Paul Allen

Have to agree with those predicting real estate to remain high because of lack of inventory, and I'm not seeing anything positive on the horizon to improve things.

Posted on 5/20/22 at 7:24 pm to shutterspeed

quote:

Have to agree with those predicting real estate to remain high because of lack of inventory, and I'm not seeing anything positive on the horizon to improve things.

I have a house I am putting up in a couple of weeks and going to price it to sell. Which will still leave me up 50k or so.

Posted on 5/20/22 at 7:49 pm to Paul Allen

Housing demand will still outpace supply.

That’s mostly what’s happening now…supply side shortages.

I suspect houses will still appreciate, but at maybe 10% per year.

Millennials were slowed by the Great Recession, but they have some money now and need housing.

That’s mostly what’s happening now…supply side shortages.

I suspect houses will still appreciate, but at maybe 10% per year.

Millennials were slowed by the Great Recession, but they have some money now and need housing.

Posted on 5/20/22 at 7:51 pm to goofball

Y’all are hilarious. Do you understand that it doesn’t matter how few homes are built if people don’t have the money to buy one?

It’s SUPPLY and DEMAND. don’t forget about the demand part.

And if the houses that are available can’t be bought at the current prices because interest rates are rising and people can’t afford the monthly payment, what happens? The prices come down.

It’s 5th grade economics

It’s SUPPLY and DEMAND. don’t forget about the demand part.

And if the houses that are available can’t be bought at the current prices because interest rates are rising and people can’t afford the monthly payment, what happens? The prices come down.

It’s 5th grade economics

Posted on 5/20/22 at 7:54 pm to Eli Goldfinger

quote:

Millennials were slowed by the Great Recession, but they have some money now and need housing.

Do you anticipate real wages rising faster than inflation?

If you don’t, how are people going to pay for the mortgages that not only increase in principle but have twice the interest rate?

I feel like I’m taking crazy pills

This post was edited on 5/20/22 at 7:55 pm

Popular

Back to top

0

0