- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Would you enter the market now?

Posted on 4/20/23 at 10:36 am to LSURussian

Posted on 4/20/23 at 10:36 am to LSURussian

quote:

The best time to enter the market is 30 years ago. The second best time to enter the market is today.

Boomers need millenials to put money in so they can cash out

Posted on 4/20/23 at 12:37 pm to el Gaucho

quote:Pfffttt! Millennials don't have any money. They're too busy squatting in their parents spare bedroom playing video games while they wait for their parents to die so they can inherit their folks' money...

Boomers need millenials to put money in so they can cash out

Posted on 4/20/23 at 12:42 pm to LSURussian

Stealing this quote from someone on MT last year.

“The new economy is just a bunch of unemployed millennials sending the same $20 around via Venmo”

“The new economy is just a bunch of unemployed millennials sending the same $20 around via Venmo”

Posted on 4/20/23 at 1:45 pm to Thundercles

quote:

Short version: If you had no current positions, would you readily buy into stocks and funds today?

Depends on the time horizon

No one can tell you what the stock market will do tomorrow but you can make a decent prediction that it’ll be higher in 10 years and even higher 15 years etc.

So it’s all relative

The more time you have, the more it makes sense to get into the market.

If you’re nervous about it, buy in stages.

Posted on 4/20/23 at 1:58 pm to LSURussian

Y’all make jokes about millenials that are mostly true without thinking of the implications of those jokes

If there’s no millenial blood to water the stock market Ponzi tree then it’s not gonna keep getting bigger

If there’s no millenial blood to water the stock market Ponzi tree then it’s not gonna keep getting bigger

This post was edited on 4/20/23 at 1:59 pm

Posted on 4/20/23 at 2:10 pm to Thundercles

I guess it depends. I think it was worth going in on bank stocks that dropped like BAC.

Posted on 4/20/23 at 2:38 pm to el Gaucho

quote:The stock market is just a price expression of the earnings potential of the global economy. If you think it's wise to bet against the world having earnings in the future, then I don't know what to tell you.

If there’s no millenial blood to water the stock market Ponzi tree then it’s not gonna keep getting bigger

Posted on 4/20/23 at 2:49 pm to Big Scrub TX

the stock market functions like a Ponzi scheme. It goes up because more money gets invested into it. A company selling more widgets doesn’t make their stock price go up until people buy the stock

I don’t think we’re gonna change each others opinions I’m not sure if you want to keep arguing

I’m just gonna say that everyone in first world nations are already facing a sliding standard of living due to globalization and I believe the stock market will reflect that eventually.

I don’t think we’re gonna change each others opinions I’m not sure if you want to keep arguing

I’m just gonna say that everyone in first world nations are already facing a sliding standard of living due to globalization and I believe the stock market will reflect that eventually.

Posted on 4/20/23 at 3:12 pm to el Gaucho

quote:

I’m just gonna say that everyone in first world nations are already facing a sliding standard of living due to globalization and I believe the stock market will reflect that eventually.

That's why you invest in international markets including emerging markets.

Posted on 4/20/23 at 3:16 pm to el Gaucho

quote:I wasn't joking...

Y’all make jokes about millenials

quote:So you believe that every business should be valued at the same amount regardless of profits and cash flows?

the stock market Ponzi

And that a business which is experiencing increasing profits and positive net cash flows year after year should not be increasing in value?

Carried to the extreme, that means you believe a kid's lemonade stand must have the same market value as Apple Computer.

You just made Hussss look like Stephen Hawking...

Posted on 4/20/23 at 3:22 pm to LSURussian

quote:

So you believe that every business should be valued at the same amount regardless of profits and cash flows? And that a business which is experiencing increasing profits and positive net cash flows year after year should not be increasing in value?

A business does good and on a micro level people tell their buddies to invest in it, therefore the price goes up. Stretch that out to a macro level and we have the stock market

The stock price doesn’t go up because the company is doing good, the price goes up because the demand for their stock increases

They can also lower their stock price by issuing shares

This post was edited on 4/20/23 at 3:29 pm

Posted on 4/20/23 at 3:26 pm to el Gaucho

quote:Res ipsa loquitur...

el Gaucho

Posted on 4/20/23 at 7:58 pm to el Gaucho

quote:

Pon·zi scheme

/'pänze ?skem/

noun

a form of fraud in which belief in the success of a nonexistent enterprise is fostered by the payment of quick returns

quote:

form of fraud

- market has areas that are manipulated at times; but long term fraud at the market level?

Save some tin foil for the rest of us.

quote:

success of a nonexistent enterprise

- plenty of shitty zombie companies, yes. But Apple makes great products, Amazon had a stellar service, oil companies keep the gears turning, healthcare companies have extended and improved quality of life, financial operations keep these and countless other innovative and productive companies funded.

Not reality.

quote:

payment of quick returns

Index level investments in all markets public and private can have bear and bull markets. But nobody said investing is a get rich quick scheme when you stick to old school diversification and dripping income into said portfolio.

Invalidated.

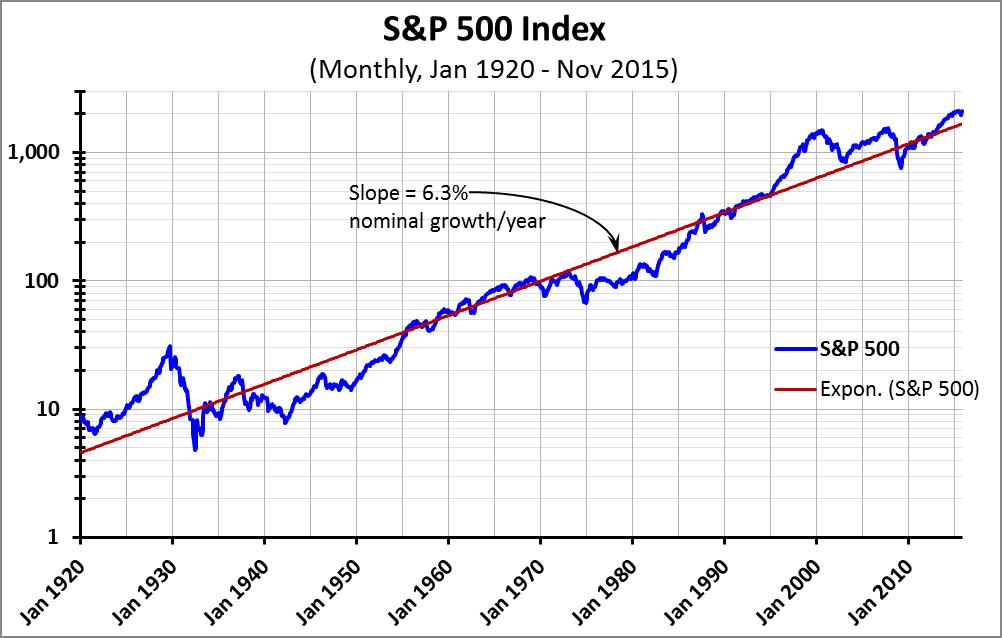

US capital markets have been a tremendous place for the masses to build wealth for over 100 years whether you agree or don’t. Other countries have taken note of the success and have adopted our free market policies, catching up quick.

Posted on 4/20/23 at 8:07 pm to el Gaucho

quote:I don't think you know what a Ponzi scheme is.

the stock market functions like a Ponzi scheme.

quote:No. It goes up because corporate earnings exist.

It goes up because more money gets invested into it.

quote:This statement just doesn't make any actual sense.

A company selling more widgets doesn’t make their stock price go up until people buy the stock

quote:I would like to have a shot at changing what you believe the facts to be - and not so much your "opinion".

I don’t think we’re gonna change each others opinions I’m not sure if you want to keep arguing

quote:I think stocks are too high right now, yes (18-20X, depending on what/how you look at it). 15Xish is more "fair value". And when there are big bear markets, we often overshoot that way to the downside.

I’m just gonna say that everyone in first world nations are already facing a sliding standard of living due to globalization and I believe the stock market will reflect that eventually.

I could see the market settling into a long-term equilibrium where the average multiple is lower than 15, but not sure what you are saying. Unless earnings simply go away (hard to do with 9 billion people wanting to trade goods and services with each other daily), then there simply will be a stock market that trades based on that fact. And if you buy it, you will receive whatever the implied dividend yield is. And if those earnings grow, then - even if the multiple stays the same - those stocks will "go up".

I'm just not clear what you think might happen other than what I've stated. Stocks become literally worthless? Help me out here.

The very easiest way for the average joe to participate in the earnings engine of the world that they are a part of is public stocks. (Ironically, I have very little public stocks in my portfolio, but I'm not the average joe.)

Posted on 4/20/23 at 9:29 pm to el Gaucho

Gaucho I don't know if you're trolling here but I actually have seen some rumblings of this. The generation just under millenials don't have near the faith in the market that previous ones did and aren't expected to invest at the same pace, which could actually spell real trouble for the long term future.

No telling if those younger generations will age and change their tune, but there is a lot of disillusionment with the market brewing among those under 30.

No telling if those younger generations will age and change their tune, but there is a lot of disillusionment with the market brewing among those under 30.

Posted on 4/20/23 at 9:40 pm to Thundercles

quote:Where is the disillusionment supposedly coming from? Those under 30 just came of age and lived through one of the craziest bull markets in decades.

No telling if those younger generations will age and change their tune, but there is a lot of disillusionment with the market brewing among those under 30.

Posted on 4/21/23 at 12:02 am to Big Scrub TX

quote:

Where is the disillusionment supposedly coming from?

Increasing transparency that the deck is stacked toward the ultra wealthy and politicians, along with increasingly unaffordable pieces of life-- cars and houses cost an absurd amount, people are celebrating inflation being only 5%. There is a lot of reason to worry about a financial future 40 years from now, so if you're a youth just beginning to earn there are places you'd rather go than the stock market.

Posted on 4/21/23 at 6:42 am to Big Scrub TX

quote:

Where is the disillusionment supposedly coming from? Those under 30 just came of age and lived through one of the craziest bull markets in decades.

That we largely couldn’t do anything with because we were broke and now we’re dealing with the worst market in history. Basically a bull trap leading to a rug pull

The 30 year olds perception of the market is GameStop which shows how rigged it is. Most of them didn’t have an ancient Tiger to love and pick for them. Also none of them have any money or career prospects. It really do be bleak out here

We need a millennial Luther king jr

ETA:

quote:

Where is the disillusionment supposedly coming from?

I’m the last person on earth without an ebt card. I’m driving to work in the rain and it’s still dark. The stock market is dead and a savings account pays better. I’ll never be able to get married because every chick weighs more than me and has a septum piercing. Do I need to go on or are you getting it?

This post was edited on 4/21/23 at 6:49 am

Posted on 4/21/23 at 6:47 am to gpburdell

That was a great article. I tell people if they're worried we're at the top then dollar cost average (or break up a huge amount into smaller portions and invest them over time).

This post was edited on 4/21/23 at 6:49 am

Popular

Back to top

1

1