- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

When should I buy a house and for how much?

Posted on 4/28/22 at 2:26 pm

Posted on 4/28/22 at 2:26 pm

I am currently working and my wife will soon be graduating from college and we are planning to build a house soon. Just some information to go off of and certainly not looking for exact answers.

I make between 100-110k per year

My wife makes roughly 20k a year but will make rough 70k a year when she graduates next May.

We have a paid off piece of property worth roughly 50k.

We have everything paid off so only bills are insurance and a small rent fee. ($200) We stay at her parents rent house, no we do not stay in a shack.

What kind of price range should we be looking to at when she graduates in May? I don't want to be house poor but I would like to stay in the house we build for the next 20 or so years.

I make between 100-110k per year

My wife makes roughly 20k a year but will make rough 70k a year when she graduates next May.

We have a paid off piece of property worth roughly 50k.

We have everything paid off so only bills are insurance and a small rent fee. ($200) We stay at her parents rent house, no we do not stay in a shack.

What kind of price range should we be looking to at when she graduates in May? I don't want to be house poor but I would like to stay in the house we build for the next 20 or so years.

Posted on 4/28/22 at 2:36 pm to tigerclaw10

$350k-$425k would be a good range for you to be comfortable and also not house poor IMO.

Posted on 4/28/22 at 2:37 pm to tigerclaw10

quote:don't you mean build.

When should I buy

Posted on 4/28/22 at 2:40 pm to arcalades

Yes, I mean build. This entire year will be dedicated to saving on my end so I am hoping that we can have another 40-50k tucked away to put down on the house.

Posted on 4/28/22 at 2:50 pm to PhiTiger1764

Just as a heads up most new build quotes I have seen are in the $180ish/ft range. The numbers PhiTiger gave you would have you in a 2,000-2,200ish sqft house depending on finishes.

Posted on 4/28/22 at 3:04 pm to TigerVizz87

We are hoping for those material prices to fall over the next year. I also plan to do some work myself which may save us some big money.

Posted on 4/28/22 at 3:13 pm to tigerclaw10

quote:

a small rent fee. ($200) We stay at her parents rent house, no we do not stay in a shack.

Keep living here.

Posted on 4/28/22 at 3:18 pm to Box Geauxrilla

While that would be great, I would like to have my own place some day

Posted on 4/28/22 at 3:24 pm to Box Geauxrilla

quote:

Keep living here.

I agree with this .

I mean, not forever.. and maybe not even for five years.. but keep living there for 2 or 3 yrs, keep socking money away- and IMO in that time the housing bubble will either burst or correct in huge way, and you can buy a nice house for CASH… you sound young, and that would be an awesome way to start yall’s financial life…. Also, you didnt ask- but maybe consider dont having kids, they are expensive !

Posted on 4/28/22 at 3:57 pm to tigerclaw10

Keep stacking cash. You have no idea how fortunate you are.

Now is the time to set yourself up for a 10 year early retirement.

Now is the time to set yourself up for a 10 year early retirement.

Posted on 4/28/22 at 4:00 pm to tigerclaw10

quote:

tigerclaw10

quote:

Location: My house

quote:

When should I buy a house

Something's not adding up

Posted on 4/28/22 at 4:25 pm to tigerclaw10

Modify the question…

If live at target of X% of your means (eg, 85%), how much house can I afford?

Your future self will thank you

If live at target of X% of your means (eg, 85%), how much house can I afford?

Your future self will thank you

Posted on 4/28/22 at 5:55 pm to tigerclaw10

IMO..

Stay where you're at as long as you can tolerate and save.

When you can't tolerate where you're at any more, use your cash to build the lowest level house you can tolerate, and IMO build it in such a way that you can easily expand and add to it in the future.

I know a lot of people with property will build their "dream house" but everyone I've known has said after a few years they would've changed something in hindsight. I feel like if I had property to build on I'd do builds and add-ons in stages because of this

Stay where you're at as long as you can tolerate and save.

When you can't tolerate where you're at any more, use your cash to build the lowest level house you can tolerate, and IMO build it in such a way that you can easily expand and add to it in the future.

I know a lot of people with property will build their "dream house" but everyone I've known has said after a few years they would've changed something in hindsight. I feel like if I had property to build on I'd do builds and add-ons in stages because of this

Posted on 4/28/22 at 6:33 pm to tigerclaw10

quote:a good rule of thumb is that your housing expenses not exceed 25% of your gross income...

When should I buy a house and for how much?

So, assuming you will make a combined $170k starting next summer...

$170,000 / 12 * 0.25 = $3541 per month.

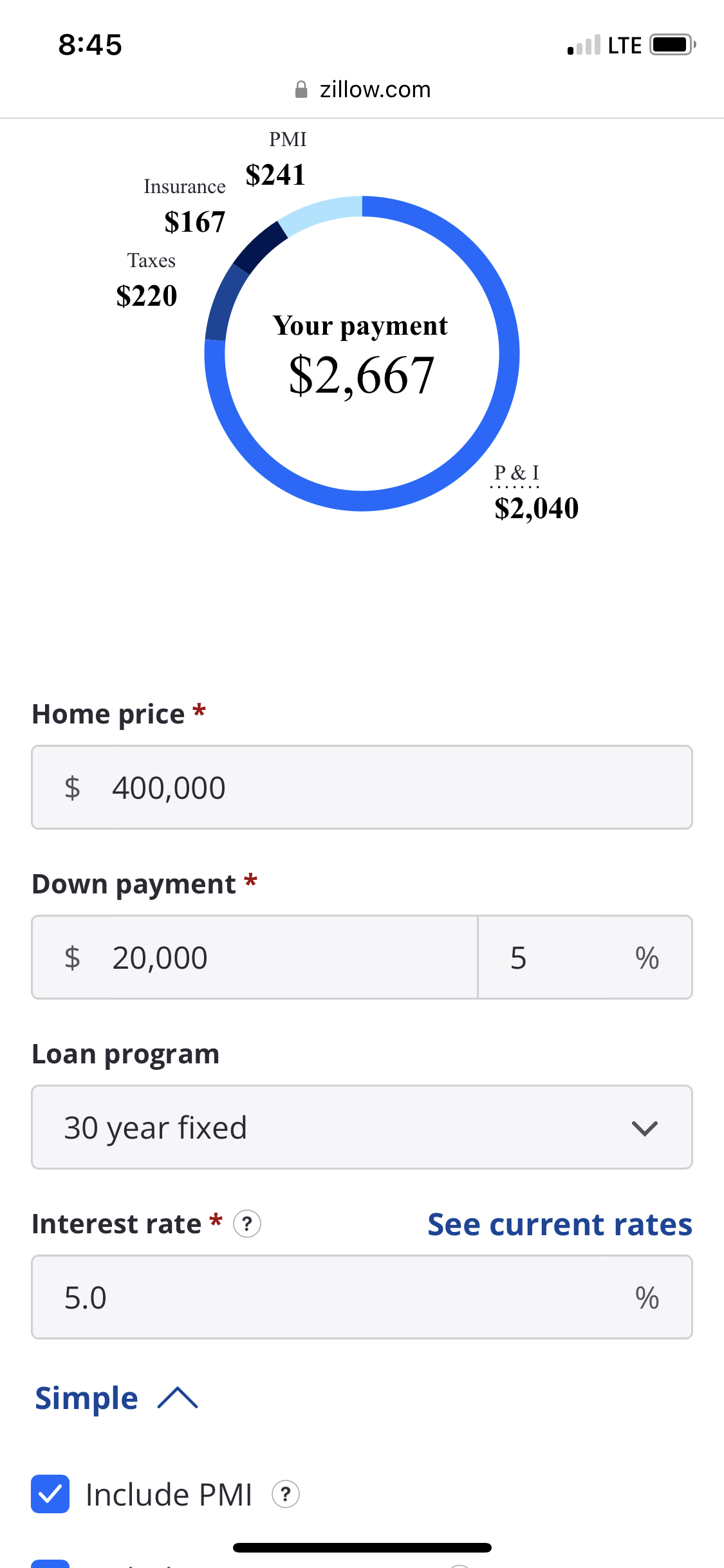

Use that number and play around on Zillow's Mortgage Calculator:

LINK

The key will be your down payment...shoot for at least 20% down...

Posted on 4/28/22 at 10:56 pm to Chicken

25% of gross is a quick way to get house poor. I wouldn’t want to exceed 25% of take home.

Posted on 4/29/22 at 8:56 am to lynxcat

quote:

25% of gross is a quick way to get house poor. I wouldn’t want to exceed 25% of take home.

Totally agree. So… using Chicken’s link above, and assuming 5% down payment (because this is reality for most first time home buyers).

I’ll assume they gross $170k and net 75% of that after taxes and retirement savings. That’s $10,625/month. 25% of that is $2,656.

So that’s a $400,000 house not to be house poor.. tough look for all the down voters in the first response in the thread.

Posted on 4/29/22 at 9:04 am to tigerclaw10

quote:

small rent fee. ($200)

Stack rental property and never leave your $200 monthly rent place, my goodness. This is from someone who loves real estate and enjoys a very nice home. $200 a month in rent. Wow! That's amazing.

My property taxes run like $600 a month.

Posted on 4/29/22 at 9:18 am to Billy Blanks

quote:

$200 a month in rent. Wow! That's amazing.

Amazing because his in-laws own the house. Those suggesting that he stay there forever need to consider that his in-laws may be wanting to get some real revenue coming in from their investment.

Posted on 4/29/22 at 9:28 am to AUHighPlainsDrifter

Yeah, was going to say this as well. You want to keep that relationship healthy, and never have them resenting a long term view towards a very kind gesture.

The 75% above is way too generous for take home, if trying to max retirement while you have this no rent/mortgage oasis of 200$. Maxing 401k alone at 175k gross is 23.5%. 29% if max iras as well. That's before taxes, etc.

The 75% above is way too generous for take home, if trying to max retirement while you have this no rent/mortgage oasis of 200$. Maxing 401k alone at 175k gross is 23.5%. 29% if max iras as well. That's before taxes, etc.

Posted on 4/29/22 at 9:47 am to AUHighPlainsDrifter

quote:

$200 a month in rent. Wow! That's amazing.

Amazing because his in-laws own the house. Those suggesting that he stay there forever need to consider that his in-laws may be wanting to get some real revenue coming in from their investment.

True. I'm just jealous

Popular

Back to top

14

14