- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: What keeps homebuilding from being profitable and more prolific?

Posted on 10/18/23 at 11:47 pm to LSUShock

Posted on 10/18/23 at 11:47 pm to LSUShock

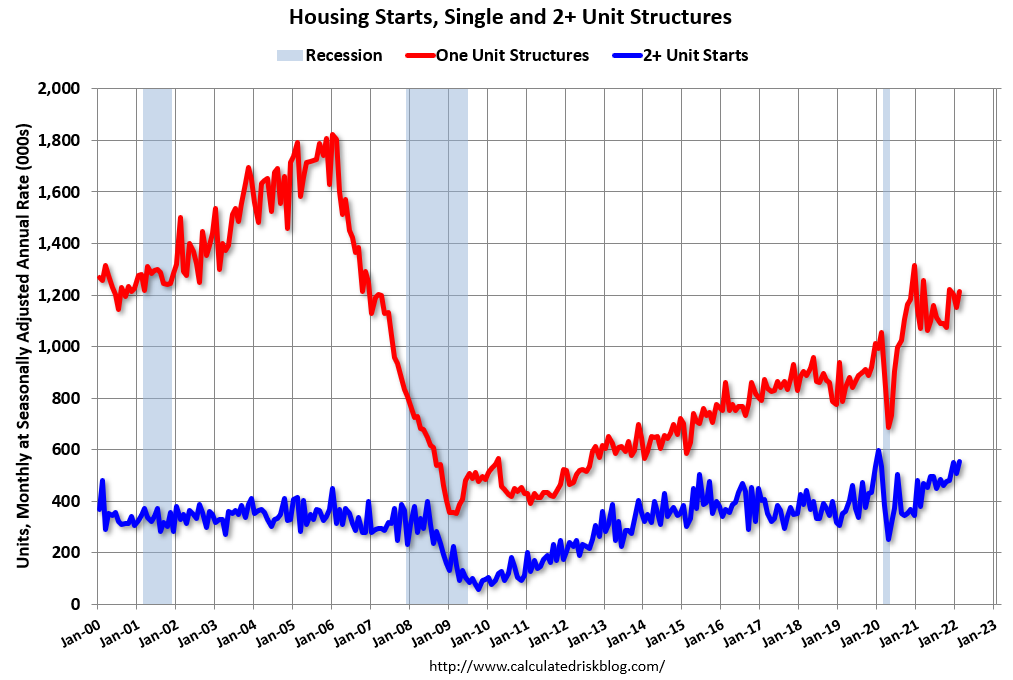

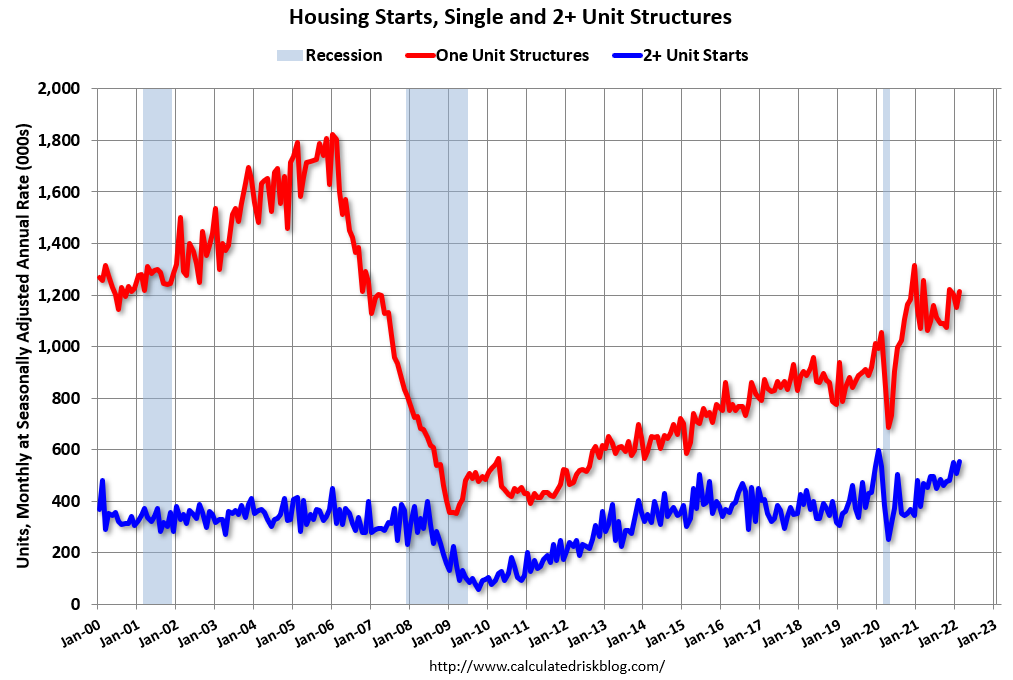

As for the prolific, this graph really says it all. There's never been a recovery from the decimation of builders during the great recession likely because so many dropped out of the business and never came back.

Posted on 10/19/23 at 5:59 am to Diseasefreeforall

quote:

There's never been a recovery from the decimation of builders during the great recession likely because so many dropped out of the business and never came back.

The "there is no housing shortage" folks ignore the overall age and condition of the vast majority of homes that might be considered "starters", too. Our housing inventory is aging rapidly. There was a building boom from the mid-80s through the Great Recession, but that was about it. There are relatively fewer builders and developers working up 200 to 300 unit subdivisions with spec houses. Everyone wants to do custom or semi-custom in much smaller developments for the upper middle class.

Posted on 10/19/23 at 6:40 am to Thundercles

It’s a super capital intensive that doesn’t provide outsized returns on the risk.

It’s also difficult to do it at scale unless again, you have a ton of capital deploy and most with that capital are going to do something else.

It’s also difficult to do it at scale unless again, you have a ton of capital deploy and most with that capital are going to do something else.

Posted on 10/19/23 at 9:09 am to Thundercles

Anecdotal but there's a ton of new housing being developed around Charlotte, just not SFH. Developers maximize their profits jamming cheap triplexes on these small lots in any area they deem remotely "desirable". Very rarely, these days, will you see a new SFH being built unless zoning won't allow MF or the proposal gets NIMBY'd. While it is housing but I do not imagine most people want to raise a family in a triplex and you also get hit with HOA.

Posted on 10/19/23 at 10:10 am to Thundercles

quote:It's almost always a 5-12% margin business. This is mainly due to land being ~4X as volatile as structures.

What keeps homebuilding from being profitable and more prolific?

Posted on 10/20/23 at 7:40 am to Big Scrub TX

5-12% margin on what money? Most houses are built with loans. I am a real estate investor. I can have a house built and sold with very little of my own money as long as I look good to banks. My profit per house exceeds my out of pocket. I just have to stay strong enough financially to have enough money until the house sells.

Posted on 10/20/23 at 9:39 am to KWL85

quote:

I can have a house built and sold with very little of my own money as long as I look good to banks

So you're in a position where you feel you could ID some land, get a loan, a design and some builders and get a house up in about a year and sell for a profit. The variable being on how long it takes to finish the house and how long it takes to to sell at a profitable price point to you once finished? What stops you (purely curious, this might hint at the larger market)?

I guess it makes sense if rates seem unpredictable, as people who would be willing to buy a house at 400k at 3% are very different than someone who would buy at 400k at 8%. So if you're a builder, scale looks risky at present.

Posted on 10/20/23 at 10:10 am to Thundercles

Does anyone know someone that lives on the street because they can't afford a house yet they have the rest of their life together and are a college graduate with a good job? The answer is no.

There's no home supply issue, there's a home supply complaint issue. As said, there's a supply issue where demand is high which in turn you know, jacks up prices.

Vacation homes and STR's have affected that, absolutely. But that's called capitalism and if they are being purchased for more than someone is benefiting them and if they are renting for more than someone is benefiting. So why the hell are we complaining about those? Yes, lets have someone else pay less taxes and make less money because...because we should be communist? GTFO.

Housing is also arguably in a large bubble and prices are going down. I'm not so sure in 3 years homes are quite a bit lower still by 10-20% from todays prices.

There's no home supply issue, there's a home supply complaint issue. As said, there's a supply issue where demand is high which in turn you know, jacks up prices.

Vacation homes and STR's have affected that, absolutely. But that's called capitalism and if they are being purchased for more than someone is benefiting them and if they are renting for more than someone is benefiting. So why the hell are we complaining about those? Yes, lets have someone else pay less taxes and make less money because...because we should be communist? GTFO.

Housing is also arguably in a large bubble and prices are going down. I'm not so sure in 3 years homes are quite a bit lower still by 10-20% from todays prices.

Posted on 10/20/23 at 12:25 pm to KWL85

quote:Homebuilder equity?

5-12% margin on what money?

It's a very thin-margin business. Like I said, the big value swings happen with land, not structures.

Posted on 10/20/23 at 12:26 pm to baldona

quote:It housing went down 20% in 3 years, that wouldn't really constitute a bubble.

I'm not so sure in 3 years homes are quite a bit lower still by 10-20% from todays prices.

Posted on 10/20/23 at 2:47 pm to Thundercles

In NY and CA, government bureaucracy is a big part of the problem.

Posted on 10/20/23 at 3:39 pm to KWL85

Around the northshore most contractors are charging 20-25% to build a house. Some 15% if you're lucky. I would suspect the margins for the major builders, DRH and the rest of the shitty ones are getting at least that.

This post was edited on 10/20/23 at 3:54 pm

Posted on 10/20/23 at 6:03 pm to LSUShock

quote:

Most people in this country can't afford to miss one paycheck, let alone save up enough cash to afford a house.

You and I know a completely different set of “most people”

Posted on 10/21/23 at 9:07 pm to Thundercles

So you're in a position where you feel you could ID some land, get a loan, a design and some builders and get a house up in about a year and sell for a profit. The variable being on how long it takes to finish the house and how long it takes to to sell at a profitable price point to you once finished? What stops you (purely curious, this might hint at the larger market)?

I guess it makes sense if rates seem unpredictable, as people who would be willing to buy a house at 400k at 3% are very different than someone who would buy at 400k at 8%. So if you're a builder, scale looks risky at present.

___________________________

So I keep a few lots on a regular basis and am always looking for good lots. Timing has been different since Covid, but we normally can start and sell a house in a year. I have been doing this 20 years and usually have an existing design. I normally use builders that split profit 50-50, but have used several different arrangements. Small and medium sized builders can build more houses than they can get loans for, and are willing to use investors.

Interest rates have changed the scene a bit, but we are still doing houses and making a good profit. We keep enough liquid assets to cover delays in selling when they occur. I think that is key. Keeps stress at a minimum. I don't scale up to a level that I am not comfortable with.

I guess it makes sense if rates seem unpredictable, as people who would be willing to buy a house at 400k at 3% are very different than someone who would buy at 400k at 8%. So if you're a builder, scale looks risky at present.

___________________________

So I keep a few lots on a regular basis and am always looking for good lots. Timing has been different since Covid, but we normally can start and sell a house in a year. I have been doing this 20 years and usually have an existing design. I normally use builders that split profit 50-50, but have used several different arrangements. Small and medium sized builders can build more houses than they can get loans for, and are willing to use investors.

Interest rates have changed the scene a bit, but we are still doing houses and making a good profit. We keep enough liquid assets to cover delays in selling when they occur. I think that is key. Keeps stress at a minimum. I don't scale up to a level that I am not comfortable with.

Posted on 10/22/23 at 9:43 am to Thundercles

Right now, I believe the issue is likely Access To Capital ….. and the cost of that capital if you can get it.

The banks have severely tightened lending standards for builders , both large and small. I was a licensed builder during the late 70’s /80s in the Florida panhandle, building custom and spec homes in the residential market, as well as a half-owner of a specialty commercial contractor (convenience stores) . I mention this because the situation then reminds of what is happing in the current economic cycle.

The large, corporate builders have access, but maybe not the level they once had. The smaller builders have a big challenges right now. Significant challenges ….. like financial costs, material shortages, cost increases, crew availability, theft, etc, etc.

If you’re in this group of builders, you need an edge … beyond just sweat equity. Profit margins back then were about 7-8% on spec homes, 15% on custom homes if you used subcontractors for the key stages (site prep, concrete, framing, dry-in.)

But with spec homes, TIME is the critical measure, IMO. Any delays at all will eat into profits quickly due to the higher rates on borrowing. In 1982 we were paying 15.75% on construction loans , max term 1 year) Meaning, I had to have located a buyer before completion or it would quickly be a loser. The increased risk is enormous.

IMO, the smart builders are also licensed RE agents, and have the ability to develop small projects ( e.g. < 12 homes) In this way, they get a cut for both functions, effectively leveraging thier profit margins up to the 20%+ range .

The commercial acquisitions by Blackrock, Vanguard, et al ….. is mostly in the large metro areas. Has anyone noticed them doing this in rural areas? I haven’t, they might bu I haven’t seen it.

The banks have severely tightened lending standards for builders , both large and small. I was a licensed builder during the late 70’s /80s in the Florida panhandle, building custom and spec homes in the residential market, as well as a half-owner of a specialty commercial contractor (convenience stores) . I mention this because the situation then reminds of what is happing in the current economic cycle.

The large, corporate builders have access, but maybe not the level they once had. The smaller builders have a big challenges right now. Significant challenges ….. like financial costs, material shortages, cost increases, crew availability, theft, etc, etc.

If you’re in this group of builders, you need an edge … beyond just sweat equity. Profit margins back then were about 7-8% on spec homes, 15% on custom homes if you used subcontractors for the key stages (site prep, concrete, framing, dry-in.)

But with spec homes, TIME is the critical measure, IMO. Any delays at all will eat into profits quickly due to the higher rates on borrowing. In 1982 we were paying 15.75% on construction loans , max term 1 year) Meaning, I had to have located a buyer before completion or it would quickly be a loser. The increased risk is enormous.

IMO, the smart builders are also licensed RE agents, and have the ability to develop small projects ( e.g. < 12 homes) In this way, they get a cut for both functions, effectively leveraging thier profit margins up to the 20%+ range .

The commercial acquisitions by Blackrock, Vanguard, et al ….. is mostly in the large metro areas. Has anyone noticed them doing this in rural areas? I haven’t, they might bu I haven’t seen it.

This post was edited on 10/22/23 at 9:57 am

Posted on 10/22/23 at 10:04 am to cadillacattack

The big firms have stayed in the major metro areas probably just due to the volume they are targeting.

There are some local smaller groups targeting certain areas in LA, around LSU, Laff metro and St.T if you consider that rural.

There are some local smaller groups targeting certain areas in LA, around LSU, Laff metro and St.T if you consider that rural.

Popular

Back to top

1

1