- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: What are you stock holdings and what does each stock represent as a % of your portfolio?

Posted on 9/10/25 at 10:55 am to bayoubengals88

Posted on 9/10/25 at 10:55 am to bayoubengals88

I was bragging on your conviction in another thread but you might be too convinced

Good luck

Good luck

Posted on 9/10/25 at 11:55 am to slackster

quote:

I was bragging on your conviction in another thread but you might be too convinced

I honestly feel that a large position in NBIS is what's best for my situation.

But I'm also not afraid to admit when I'm wrong.

For years, I was 85% or more in AUPH.

I totally cut ties with it last fall. After 7.5 years I essentially broke even.

That hurt.

NBIS and a few other positions (riding quantum last December) have made up for lost time.

I will continue to add to NBIS as I see it having a legitimate shot at $500/share by 2030.

This post was edited on 9/10/25 at 11:57 am

Posted on 9/10/25 at 11:58 am to bayoubengals88

quote:

$500/share by 2030.

Dont play with my emotions

68% NBIS

32% VOO

Posted on 9/10/25 at 12:12 pm to sonoma8

haha

quote:

68% NBIS

32% VOO

Posted on 9/10/25 at 12:14 pm to Arthur Bach

BLX is the largest percentage. Only one over 10% of the total.

That's due to #gainz, not from hitting it hard as a buyer. RCL is second. I got it at $37/share.

That's due to #gainz, not from hitting it hard as a buyer. RCL is second. I got it at $37/share.

Posted on 9/10/25 at 12:59 pm to TheOcean

quote:

quote:

100% S&P 500 index funds

This is the right answer for most people

I second this advice.

Posted on 9/10/25 at 1:14 pm to bayoubengals88

Get a hunch-bet a bunch!

Posted on 9/10/25 at 1:22 pm to Arthur Bach

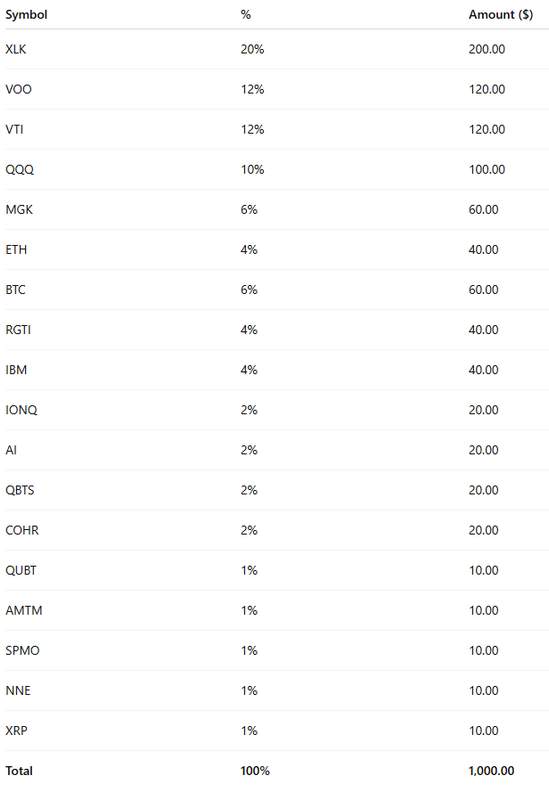

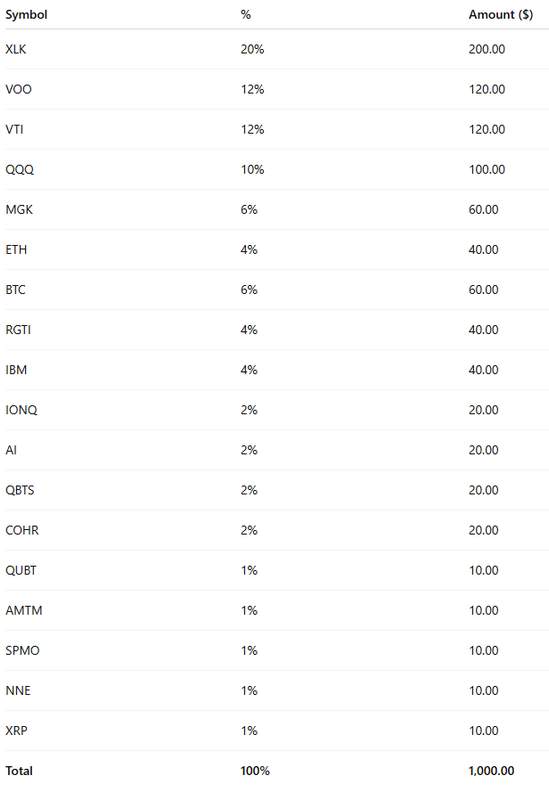

My 401k is a date managed portfolio that I max out each year. That's my safety net. This is my play account I manage personally. I am currently putting in 1k twice a month:

on top of that I have been putting $250 a month into NBIS, but I'll probably wind that down here sooner than later since it hit my target.

on top of that I have been putting $250 a month into NBIS, but I'll probably wind that down here sooner than later since it hit my target.

Posted on 9/10/25 at 1:47 pm to Arthur Bach

I re-read your post and saw you did not want ETFs. Here are my current holdings

This post was edited on 9/10/25 at 1:48 pm

Posted on 9/10/25 at 1:47 pm to Arthur Bach

My main retirement allocation is the following.

GRNY - 10%

SCHX - 40%

SCHD - 5%

FTEC - 35%

SCHG - 10%

GRNY - 10%

SCHX - 40%

SCHD - 5%

FTEC - 35%

SCHG - 10%

Posted on 9/10/25 at 1:48 pm to TigerFanatic99

my top five stock holdings are

S&P 500 Index Components

# Company Symbol Weight Price

1 Nvidia NVDA 7.32% 176.57

2 Microsoft MSFT 6.34% 500.96

3 Apple Inc. AAPL 5.73% 226.84

4 Amazon AMZN 4.19% 230.72

5 Meta Platforms META 3.24% 756.62

S&P 500 Index Components

# Company Symbol Weight Price

1 Nvidia NVDA 7.32% 176.57

2 Microsoft MSFT 6.34% 500.96

3 Apple Inc. AAPL 5.73% 226.84

4 Amazon AMZN 4.19% 230.72

5 Meta Platforms META 3.24% 756.62

Posted on 9/10/25 at 1:50 pm to MekaWarriors

quote:Follow this guy.

MekaWarriors

Posted on 9/10/25 at 1:53 pm to bayoubengals88

I honestly can not express how much research I put into my investments, it has become almost unsustainable to manage this many positions.

Posted on 9/10/25 at 1:56 pm to MekaWarriors

quote:That is evident in your energy picks for sure.

I honestly can not express how much research I put into my investments

Are you always trimming and rebalancing?

Are you retired? Is this your full time "hobby"?

This post was edited on 9/10/25 at 2:04 pm

Posted on 9/10/25 at 2:12 pm to bayoubengals88

quote:

That is evident in your energy picks for sure.

Are you always trimming and rebalancing?

Are you retired? Is this your full time "hobby"?

I continuously trade in and out, however I maintain a minimal position. The positions you see with a handful of shares, I am awaiting a correction to jump back-in.

I am not retired (wish I was), I am 58 years old and trying my best to build investments to pass to my children so they never have to worry about finances. I do have a pension fund as well.

I guess you could say this is my hobby, however I farm as a hobby as well. I read approximately 40 books a year as well as listen to geopolitical podcasts on my daily commute to work to get an idea where to throw my money into.

Posted on 9/10/25 at 3:35 pm to Arthur Bach

Individual stocks are approx 10% of total.

No one stock exceeds 3% of total.

Nearing retirement so higher % of bonds. No more risk than needed, these past few years, to get to retire at 55.

May take more risk over time once comfortable sequence of returns risk is in rear view mirror.

No one stock exceeds 3% of total.

Nearing retirement so higher % of bonds. No more risk than needed, these past few years, to get to retire at 55.

May take more risk over time once comfortable sequence of returns risk is in rear view mirror.

Posted on 9/11/25 at 9:36 am to Arthur Bach

I am deeeeep into GLXY. Bought around $19.5. Having a good day today, but expecting it to shine in 2026.

Posted on 9/15/25 at 7:21 am to LChama

quote:

Why are you short ATYR? They are on the precipice

Oh. I see now. Had been contemplating getting back in but i think im good. Hope you did well

Posted on 9/15/25 at 3:59 pm to MekaWarriors

quote:

MekaWarriors

This is what I’m looking for, my man.

Posted on 9/16/25 at 5:30 am to MSTiger33

quote:What can you tell us about it?

am deeeeep into GLXY. Bought around $19.5. Having a good day today, but expecting it to shine in 2026.

Popular

Back to top

1

1