- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

| Favorite team: | LSU |

| Location: | Dallas |

| Biography: | Born in the 60s |

| Interests: | |

| Occupation: | |

| Number of Posts: | 893 |

| Registered on: | 1/27/2010 |

| Online Status: | Not Online |

Forum

Message

re: Needs met stay 100% invested?

Posted by kaaj24 on 2/12/26 at 3:33 pm to TorchtheFlyingTiger

I plan to have 2 years of living expenses in cash.

The rest in stocks. If stock market is up 4% or more collect money from stocks for living expenses for the year.

If down 4% or more take living expenses from cash.

Replenish cash in good stock market years.

The rest in stocks. If stock market is up 4% or more collect money from stocks for living expenses for the year.

If down 4% or more take living expenses from cash.

Replenish cash in good stock market years.

I think Bitcoin will be up over long term. A lot of money has been flowing out of BTC to PM last several months.

That’ll change. These corrections are healthy. It’s interesting how a few weeks or few months of a charge in prices gets people spooked.

That’ll change. These corrections are healthy. It’s interesting how a few weeks or few months of a charge in prices gets people spooked.

Scared money don’t make money.

This is a speculative play.

Thanks

This is a speculative play.

Thanks

Hard to say floor but it got ahead of itself.

Gold probably finishes the year low to mid 5k.

Silver probably high 60s

I’m not better than a blind monkey so don’t trade on my lack of knowledge

Gold probably finishes the year low to mid 5k.

Silver probably high 60s

I’m not better than a blind monkey so don’t trade on my lack of knowledge

Not an LSU bar but Loose Box in London shows all the SEC football games. Stays open till 4am

re: Trump’s Justice Department launches a criminal investigation of Fed chair; JPow responds

Posted by kaaj24 on 1/11/26 at 9:10 pm to rickgrimes

Silly move by Trump. Very much dislike what is going on at the federal government by executive branch. Legislative branch is worthless.

A buying opportunity.

A buying opportunity.

re: Pay off small condo or invest?

Posted by kaaj24 on 1/11/26 at 6:42 pm to Billy Blanks

Invest is the better math.

Payoff brings peace of mind.

Whichever works for you best

Payoff brings peace of mind.

Whichever works for you best

Check your state laws. They dictate how long you can wait to pay after pay period ends

Yeah, this is a terrible idea. Something the new mayor of New York would peddle as it sounds good on the surface.

A lot of bad unintended consequences will happen

A lot of bad unintended consequences will happen

re: Thoughts on Costco stock

Posted by kaaj24 on 1/5/26 at 7:13 pm to UltimaParadox

Yes, I look at the hot dog and soda metric. If they keep it locked in. I never see the place empty by me

re: Thoughts on Costco stock

Posted by kaaj24 on 1/5/26 at 7:04 pm to TorchtheFlyingTiger

Inverse Cramer does well.

Cramer is entertaining but I wouldn’t take stock advice from him.

Cramer is entertaining but I wouldn’t take stock advice from him.

Costco is a buy and hold stock in my portfolio

It’ll be a blip Monday.

See how China responds

See how China responds

Diversify into other asset classes besides stocks.

re: Retirement begins in 30 days

Posted by kaaj24 on 12/31/25 at 6:10 pm to Everyday Is Saturday

Congratulations.

I’ve got 9 years to go!!

I’ve got 9 years to go!!

It’s relatively cheap.

So I would just evaluate how much net worth you want to protect.

My insurance provider max out at 5M

So I would just evaluate how much net worth you want to protect.

My insurance provider max out at 5M

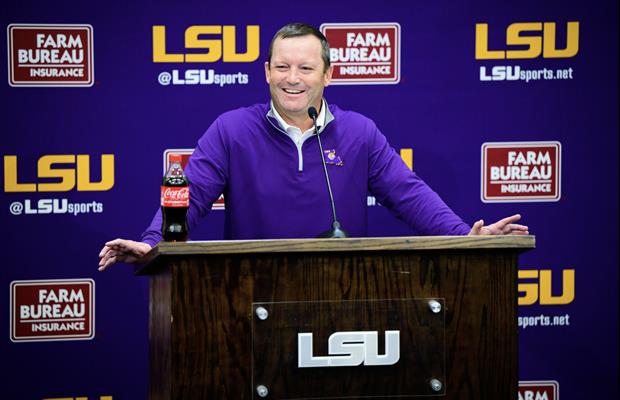

re: Daily temperature check - Lane Kiffin

Posted by kaaj24 on 11/23/25 at 7:44 pm to olemissfan26

Lane trolling.

Staying at Ole Miss

Staying at Ole Miss

I think sales will be up low single digits. Shoppers will be more value focused.

I’m sure after the last 2 weeks we all feel less wealthy since stock market has been taking it in the bottoms.

I never bet against the American consumer. People will shop and find a way to do so.

I’m sure after the last 2 weeks we all feel less wealthy since stock market has been taking it in the bottoms.

I never bet against the American consumer. People will shop and find a way to do so.

re: Hope you have some diversification in your portfolio

Posted by kaaj24 on 11/21/25 at 12:21 pm to FLObserver

Best to stick to your plan.

20%+ annual gains don’t come without some heartburn. No free lunch

20%+ annual gains don’t come without some heartburn. No free lunch

re: Jeff Duncan: Saints to play a game in Paris as soon as Fall 2026

Posted by kaaj24 on 11/20/25 at 6:10 pm to HoustonTiger99

Might have to think about this one. Depends on when the game is played

re: Anyone else taking profit and sitting the cash on the side? Getting a little nervous.

Posted by kaaj24 on 11/19/25 at 6:20 pm to GREENHEAD22

Market sentiment has been driving stocks down.

Earnings have been positive.

In my opinion, we’re in a short term correction but will be higher at 12/31.

Markets get frothy and these periodic settlements are just markets doing there thing

Earnings have been positive.

In my opinion, we’re in a short term correction but will be higher at 12/31.

Markets get frothy and these periodic settlements are just markets doing there thing

re: Another example for why we need to abolish presidential pardons

Posted by kaaj24 on 11/15/25 at 7:25 am to rickgrimes

I agree. It’s outta of control regardless of which party is in power.

re: Nebius - NBIS - AI Infrastructure Company

Posted by kaaj24 on 11/15/25 at 6:52 am to AuBeerStud

Still feeling very good about the long term.

It’s hard to stomach weeks like this past one. Sentiment has turned negative on AI trade. Almost impossible to do anything about it. It’s only temporary so hang in there friends.

It’s hard to stomach weeks like this past one. Sentiment has turned negative on AI trade. Almost impossible to do anything about it. It’s only temporary so hang in there friends.

re: Which Brad Pitt movie is better, “Legends of the Fall” or “A River Runs Through It”?

Posted by kaaj24 on 11/8/25 at 5:58 am to theantiquetiger

Love both movies.

However, A River Run Though It is my first choice.

Great movie, Redford narrating and as we get older movie has more meaning to me.

However, A River Run Though It is my first choice.

Great movie, Redford narrating and as we get older movie has more meaning to me.

Yeah, doesn’t make sense. But still feel strong about the long term.

It never makes sense. These days/weeks seem to happen. Dust settles and stocks march forward.

People get spooked, sell stock, large investors come in buy shares at lower price. Little guys get comfortable, start reinvesting in market. Rinse repeat.

People get spooked, sell stock, large investors come in buy shares at lower price. Little guys get comfortable, start reinvesting in market. Rinse repeat.

re: Michael Burry goes short on $PLTR and $NVDA in his latest 13F filing

Posted by kaaj24 on 11/4/25 at 7:25 am to Upperdecker

I want people to earn as much as they can.

I don’t stress over market swings. things go on sale…..

I don’t stress over market swings. things go on sale…..

re: Michael Burry goes short on $PLTR and $NVDA in his latest 13F filing

Posted by kaaj24 on 11/4/25 at 5:26 am to Upperdecker

Maybe he’s right. Maybe he’s wrong.

I don’t plan to retire until about 10 years out so we can ride out the waves.

I don’t plan to retire until about 10 years out so we can ride out the waves.

re: Nebius - NBIS - AI Infrastructure Company

Posted by kaaj24 on 11/4/25 at 5:23 am to astonvilla

It’ll be ok. Still long in the stock and feel good about the next several years. Never a straight line up!

Base portfolio are index funds

NVDA

NBIS

RYCEY

AAPL

Interested what others are doing.

NVDA

NBIS

RYCEY

AAPL

Interested what others are doing.

I’m curious to see what impact a prolonged government shutdown will have on markets.

Last week sentiment shifted as I’ve started seeing a lot of narrative about the AI bubble. Think this is more of an opportunity to take some profits. And the periodic settling that occurs after stock market runs.

Last week sentiment shifted as I’ve started seeing a lot of narrative about the AI bubble. Think this is more of an opportunity to take some profits. And the periodic settling that occurs after stock market runs.

Popular

0

0