- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: US economy slowed but still grew at 2.9% rate last quarter.

Posted on 1/26/23 at 9:15 pm to bod312

Posted on 1/26/23 at 9:15 pm to bod312

I haven’t dug into the weeds. If imports are crashing harder than exports it’s a positive contribution to GDP. I’d start there. The TGA drawdown was $300Bish. Price increases versus volume is another thing I’d look into. Add in holiday consumption and rich people still being rich it isn’t hard to imagine.

Doesn’t mean the economy is thriving. I’d argue we’ve been in a depression since 2007 but that doesn’t mean people can’t thrive. It just means at the margins everything’s bad.

Doesn’t mean the economy is thriving. I’d argue we’ve been in a depression since 2007 but that doesn’t mean people can’t thrive. It just means at the margins everything’s bad.

Posted on 1/27/23 at 2:52 am to I Love Bama

quote:

looking more and more like the FED might pull off the soft landing.

The Fed has stated the terminal rate to reach 5% this year and there won't be any rate cuts in 2023.

Meanwhile, the bond market is pricing in the FFR to only reach 4.8% and rate cuts to begin Nov 2023.

So who's wrong? And what is the implication of rate cuts this year?

The GDP numbers aren't surprising, but anyone taking a victory lap is prematurely celebrating. China's reopening and work to stimulate their economy complicates the fight against inflation. Commodities are rallying and oil looks to be going back above $90.

Posted on 1/27/23 at 6:25 am to JimMorrison

but Obiden said yesterday the economy is great and he will not let the GOP destroy it! and the sheep just lap it up!

#FJB

#FJB

Posted on 1/27/23 at 6:36 am to johnadams1776

The average price of things (CPI) has gone up over double what we have spent on things. We may avoid it for a while but eventually there will be a massive deleveraging in this country. There is no way debt levels can continue at this rate.

Posted on 1/27/23 at 7:02 am to JimMorrison

quote:

Commodities are rallying and oil looks to be going back above $90.

Exactly! Which is why the FED should bump another 50 basis points. Just feels like they are taking their foot off the gas too soon but what the hell do i know.

Posted on 1/27/23 at 10:39 am to I Love Bama

quote:

Which is why the FED should bump another 50 basis points. Just feels like they are taking their foot off the gas too soon but what the hell do i know.

They've stated there will be a .5 increase across 2023 with .25 expected at the next meeting.

I think .5 right now would be too much, especially basing it off food and energy increases. Those items aren't increasing in cost primarily due to currency devaluation but due to things like shitty government involvement (O&G), poor weather, etc (food). The only way rate hikes bring those down is if they cause Unemployment to jump enough so that enough people could not afford them (thus increasing Supply).

I've said for a while now that those items and shelter remaining high and/or increasing are what will keep inflation sticky going forward. Rate hikes are already impacting shelter but we're only at the beginning of that. Food and energy though? Those are going to be outside the Fed's influence in this case.

Posted on 1/27/23 at 11:23 am to Bard

Food Processing Industry Profits

All you need to know about food and bev is that the price increases are not driven by anything other than market power, so those are sticky. Check out the margin expansion.

What I don't understand is why you know (and are right) that the Fed can't effect O&G and food prices. But then you completely contradict yourself with shelter, knowing about the issues with OER. This is not a flame, I want to understand why you think that housing is effected by overnight lending rates. The only area I see is on the MBS side where costs of secondary market activities are increasing and becoming more difficult (Best Effort locks are more prominent) because they are injecting volatility into credit markets. That has nothing to do with home prices, supply or demand. Maybe in the commercial space I could see cause and effect becuase they finance those projects with variable rates from what I've read. But supply/demand dynamics in that space are probably more related to the corporate response to covid (work from home/de-urbanization). Just curious what your thought process is.

All you need to know about food and bev is that the price increases are not driven by anything other than market power, so those are sticky. Check out the margin expansion.

What I don't understand is why you know (and are right) that the Fed can't effect O&G and food prices. But then you completely contradict yourself with shelter, knowing about the issues with OER. This is not a flame, I want to understand why you think that housing is effected by overnight lending rates. The only area I see is on the MBS side where costs of secondary market activities are increasing and becoming more difficult (Best Effort locks are more prominent) because they are injecting volatility into credit markets. That has nothing to do with home prices, supply or demand. Maybe in the commercial space I could see cause and effect becuase they finance those projects with variable rates from what I've read. But supply/demand dynamics in that space are probably more related to the corporate response to covid (work from home/de-urbanization). Just curious what your thought process is.

Posted on 1/27/23 at 4:51 pm to wutangfinancial

quote:

Check out the margin expansion.

That's... frick. Has there ever been such a massive jump of profitability in that sector over just one quarter?

And why the hell hasn't my WEAT taken off yet?

quote:

What I don't understand is why you know (and are right) that the Fed can't effect O&G and food prices. But then you completely contradict yourself with shelter, knowing about the issues with OER.

I meant shelter as actual home prices and rents, not OER (I fricking hate using that). I know I mixed going in and out of CPI categories a bit, the fault is all mine. The difference I am talking about is what I think what we're likely to see as opposed to the skewing of CPI and it's Shelter category because of OER.

quote:

I want to understand why you think that housing is effected by overnight lending rates.

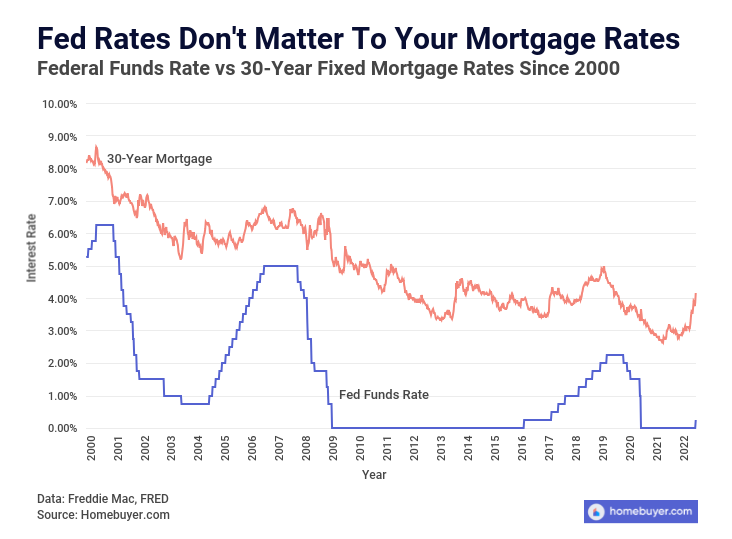

Because banks aren't going to loan out for home loans at a lower rate than they are paying to borrow money from other banks. Normally this isn't an issue as rate changes are minor, but with the amount of change we've seen over the last year, I think it's why we see the 10yr Treasury and the 30yr mortgage rate criss-cross and then remaining far closer to one another than normal. LINK

It's not so much that they are a normal driver, but the extreme amount of increases in such a short amount of time has no choice but to drive rates up because not doing so means lenders would lose money otherwise.

Notice how the two never intersect?

Posted on 1/27/23 at 4:54 pm to CAPEX

That’s fake bruh

Us economy dead

Wen nukes, save us Putin

Us economy dead

Wen nukes, save us Putin

Posted on 1/28/23 at 12:20 pm to Bard

quote:

That's... frick. Has there ever been such a massive jump of profitability in that sector over just one quarter?

I doubt it, but if the price increases are supply chain driven you wouldn't see the margin expansion. I'm pretty sure even in demand-push inflation the margins get squeezed because of competition.

quote:

Because banks aren't going to loan out for home loans at a lower rate than they are paying to borrow money from other banks

So I struggle with this. There are several bulge bracket banks that have large production operations. But is that really an option for them? You can't just tell one side of the bank to stop operations because we can lend money to the Fed at higher rates. But in theory what you are saying should be true. 80% of players don't operate in the Repo space. Margins have been slammed in Q4 to such a degree that it's an uneconomical industry for IMBs. But that doesn't mean everybody stops producing and puts their balance sheet in t-bills that have 2-300 bps in excess yield over MBS sales. I'm starting to believe the price transparency on bid-ask spreads is so bad that people think prices haven't come down enough to bring in more borrowers. There's no bid on homes right now but because we're such a coddled industry you don't see the corrections like you think you would price wise.

Richie May HDMA Dashboard

Anyways on another front Q2 jobs were revised down 1.1M

Posted on 1/30/23 at 12:18 am to I Love Bama

quote:

It's looking more and more like the FED might pull off the soft landing. Hard for me to say that out loud.

FEd says US on track for soft landing as inflation eases Sept. 2007

You may be right, but I have already seen this week’s movie played a couple of times recently and the ending is pretty tough to watch. Maybe this time will be different, but I am betting we are down significantly in the coming days/weeks. Retesting 3500 before we break out above 4300 will not surprise me.

This post was edited on 1/30/23 at 10:44 am

Posted on 1/30/23 at 7:01 am to go ta hell ole miss

quote:

You may be right, but I have already seen this week’s movie played a couple of times recently and the ending is pretty tough to watch. Maybe this time will be different, but I am betting we are down significantly in the coming days/weeks. Retesting 3500 before we break out above 4300 not surprise me.

I was JUST coming here to update this. After reviewing more data, I am even more in the "sky is falling" camp.

This next FED meeting will be the most important of all and tell us where we are going.

The data is changing. Stock market running wild again, commodities (including oil) keep pushing higher.

Bond markets are pricing in like a 98% chance of a 25 basis point increase but inflation is going to pick back up if JP does not hammer the market with a 50 point increase.

Look at the most important inflation measure - LINK

So no soft landing. JP wants to see unemployment rates up and stock market down. His legacy is on the line and he knows it.

BEARISH [ON] OFF

SELL EVERYTHING

Posted on 1/30/23 at 7:29 am to wutangfinancial

Does that chart go back farther?

I have been in food manufacturing for 17yrs and here’s what I’ve seen:

-Many were breaking even and losing $ into early 2022. Profits were wayyy down

-The labor crisis was huge, flying in temp labor and raising minimum pay to $25/hr. Capacity was reduced due to lack of labor alone.

-Supply chain costs were up, but that’s a storm most have experience weathering.

-Every raw ingredient was up. Even if simply due to labor on their side.

-Plastic was up almost 20%, corrugate costs were up nearly double digits.

-I’ve seen cost increases on some items at 40% just yo break even.

-12% Ebita is a good break even point for many

I have been in food manufacturing for 17yrs and here’s what I’ve seen:

-Many were breaking even and losing $ into early 2022. Profits were wayyy down

-The labor crisis was huge, flying in temp labor and raising minimum pay to $25/hr. Capacity was reduced due to lack of labor alone.

-Supply chain costs were up, but that’s a storm most have experience weathering.

-Every raw ingredient was up. Even if simply due to labor on their side.

-Plastic was up almost 20%, corrugate costs were up nearly double digits.

-I’ve seen cost increases on some items at 40% just yo break even.

-12% Ebita is a good break even point for many

Posted on 1/30/23 at 10:29 am to LSUfan20005

quote:

I have been in food manufacturing for 17yrs and here’s what I’ve seen:

I'm guessing we're neighbors. Do you live in Bentonville/Rogers?

The real question is are you at a large multinational or are you a vendor for them? I'm guessing 90% of that data is Tyson, Ore-Ida etc...Companies that can get financing terms better than the federal government. Good stuff with the data I hope you respond

Posted on 1/30/23 at 3:41 pm to wutangfinancial

Did some consulting over the last 9 months and developed a good perspective across North America. Some of those limited commodity players are a zone I don't understand very well, all I know is everyone was bleeding.

Posted on 1/30/23 at 7:40 pm to LSUcam7

quote:

So CC balances just creeped above ‘08 levels.

This is rudimentary, but…

If incomes have risen over that time period.. seems like debt service numbers are sustainable for the average households.. no?

Is that adjusted for inflation? Figure 2008 dollars are about the worth of $1.25 actual dollars.

Posted on 1/30/23 at 7:55 pm to Ace Midnight

quote:

CC debt seems to be trending down

I find this hard to believe

Popular

Back to top

0

0