- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

US economy slowed but still grew at 2.9% rate last quarter.

Posted on 1/26/23 at 7:44 am

Posted on 1/26/23 at 7:44 am

quote:

The U.S. economy expanded at a 2.9% annual pace from October through December, ending 2022 with momentum despite the pressure of high interest rates and widespread fears of a looming recession.

Thursday’s estimate from the Commerce Department showed that the nation’s gross domestic product — the broadest gauge of economic output — decelerated last quarter from the 3.2% annual growth rate it had posted from July through September. Most economists think the economy will slow further in the current quarter and slide into at least a mild recession by midyear.

The housing market, which is especially vulnerable to higher loan rates, has already been badly bruised: Sales of existing homes have dropped for 11 straight months.

And consumer spending, which fuels roughly 70% of the entire economy, is likely to soften in the months ahead, along with the still-resilient job market.

The economy’s expected slowdown is an intended consequence of the Federal Reserve’s aggressive series of rate hikes. The Fed’s hikes are meant to reduce growth, cool spending and crush the worst inflation bout in four decades. Last year, the Fed raised its benchmark rate seven times. It is set to do so again next week, though this time by a smaller amount.

AP News

This post was edited on 1/26/23 at 7:45 am

Posted on 1/26/23 at 8:16 am to CAPEX

The growth has to be on the back of debt spending by consumers right?

Anyone got a chart to show consumer credit card debt?

Anyone got a chart to show consumer credit card debt?

Posted on 1/26/23 at 8:25 am to SlidellCajun

From the article:

quote:

Federal government spending also helped lift GDP

Posted on 1/26/23 at 8:52 am to SlidellCajun

quote:

Anyone got a chart to show consumer credit card debt?

Not a chart, but bankrate had an article couple weeks back:

Bank Rate article

Key takeaways - average household debt is up, but not on credit cards. Mainly mortgage balances (which must be the result of the pause with folks not paying for months/years) and auto loans (makes since with the shocking increase in average car price since the pandemic).

ETA: CC debt seems to be trending down

This post was edited on 1/26/23 at 8:53 am

Posted on 1/26/23 at 8:53 am to CAPEX

Perplexing to me. How can this number be accurate?

The bond market is pricing a 99% chance of a 25 basis point hike next round.

If the CPI is following the GDP, how can they not continue to hike 50 points if they really want to squash the inflation narrative?

It's looking more and more like the FED might pull off the soft landing. Hard for me to say that out loud.

The bond market is pricing a 99% chance of a 25 basis point hike next round.

If the CPI is following the GDP, how can they not continue to hike 50 points if they really want to squash the inflation narrative?

It's looking more and more like the FED might pull off the soft landing. Hard for me to say that out loud.

Posted on 1/26/23 at 10:10 am to Ace Midnight

quote:

Key takeaways - average household debt is up, but not on credit cards. Mainly mortgage balances (which must be the result of the pause with folks not paying for months/years) and auto loans (makes since with the shocking increase in average car price since the pandemic).

They might want to add in the increase of housing as well

Posted on 1/26/23 at 10:15 am to I Love Bama

quote:

It's looking more and more like the FED might pull off the soft landing. Hard for me to say that out loud.

So you still predicting the end? I was storing my rations and gunpowder.

Posted on 1/26/23 at 10:28 am to LSUfan20005

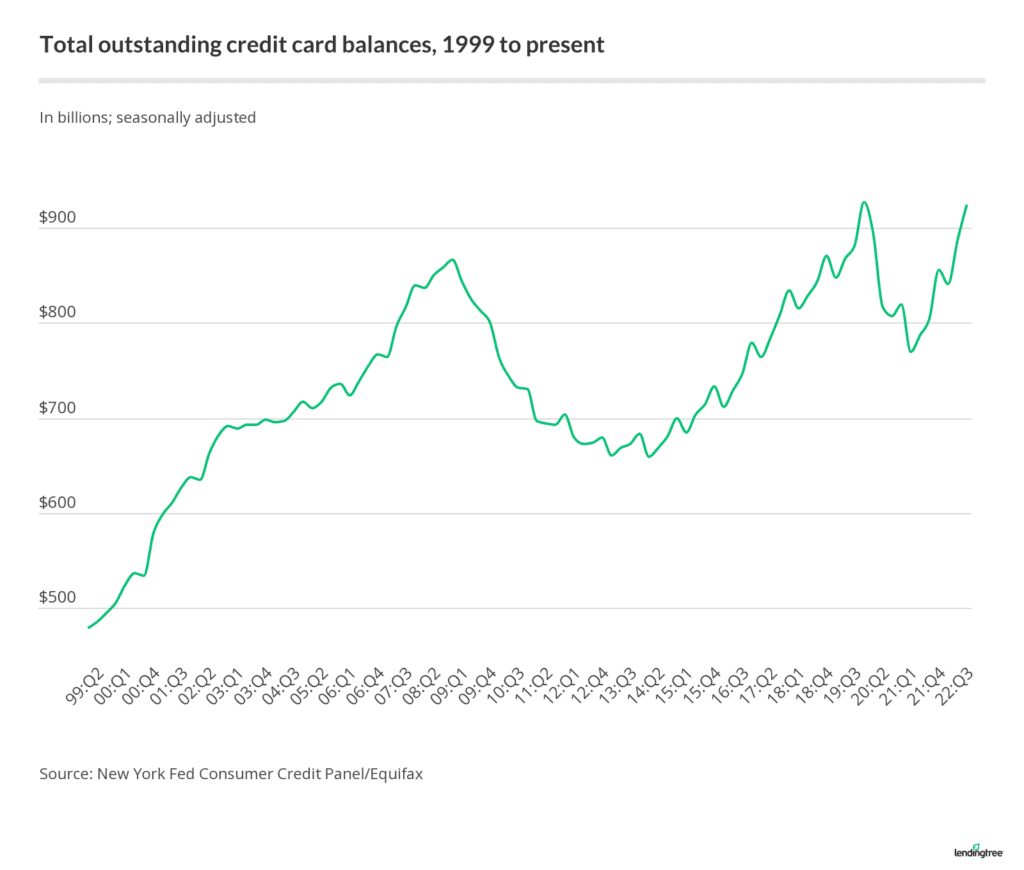

So CC balances just creeped above ‘08 levels.

This is rudimentary, but…

If incomes have risen over that time period.. seems like debt service numbers are sustainable for the average households.. no?

This is rudimentary, but…

If incomes have risen over that time period.. seems like debt service numbers are sustainable for the average households.. no?

Posted on 1/26/23 at 10:59 am to Ace Midnight

quote:

CC debt seems to be trending down

LSUFan chart shows all time high on credit card debt… am I missing something?

Posted on 1/26/23 at 11:11 am to SlidellCajun

Quick look at the link reads as though it is balance per credit card whereas the graph is total credit card balance nationally. I wonder if we just have more credit cards now so the balance per card is lower but the total balance is higher. That would be a poor way of evaluating debt. The link says total CC balance is $930M which looks to be aligned with the graph. It is also important to note that these balances include balances that are paid off in full every month. This is not necessarily $930M in CC debt where interest is accruing.

IMO, looking at CC balances in absolute numbers is pointless as well. Comparing balances in 2022 to 1999 is somewhat pointless without a normalizing for income. If I missed some normalization factor then I stand corrected but from my quick glance, I did not see anything.

IMO, looking at CC balances in absolute numbers is pointless as well. Comparing balances in 2022 to 1999 is somewhat pointless without a normalizing for income. If I missed some normalization factor then I stand corrected but from my quick glance, I did not see anything.

Posted on 1/26/23 at 11:30 am to LSUfan20005

That chart always gets me. For a cool trillion, which is nothing to our government at this point, we could pay off 100% of outstanding credit card debt for Americans.

It sounds dumb, but it would help middle- and low-class people more than a lot of the last few trillion-dollar handouts they have given.

It sounds dumb, but it would help middle- and low-class people more than a lot of the last few trillion-dollar handouts they have given.

Posted on 1/26/23 at 12:04 pm to TigerFanatic99

quote:

For a cool trillion, which is nothing to our government at this point, we could pay off 100% of outstanding credit card debt for Americans.

Wait, what?! I didn’t buy a house I couldn’t afford in ‘07 and the government forgives a bunch of debt for those who did… then I pay off my student loans and they forgive those for people who haven’t…now you want them to pay off credit cards even though I pay mine off every few weeks? You suck!

Posted on 1/26/23 at 12:30 pm to TigerFanatic99

quote:

t sounds dumb, but it would help middle- and low-class people more than a lot of the last few trillion-dollar handouts they have given.

I don't think it would help the people you think. Only 1/2 of low-income households have access to a credit card. The numbers are for total balance even the balance that you pay off in full before the due date. So the billionaires with $10M monthly spend on their Amex black would be paid off as well. This also would not solve an issue because the next month the balance will reappear although at a lower amount that would gradually grow over time back to the same value.

Posted on 1/26/23 at 1:03 pm to SlidellCajun

quote:

Anyone got a chart to show consumer credit card debt?

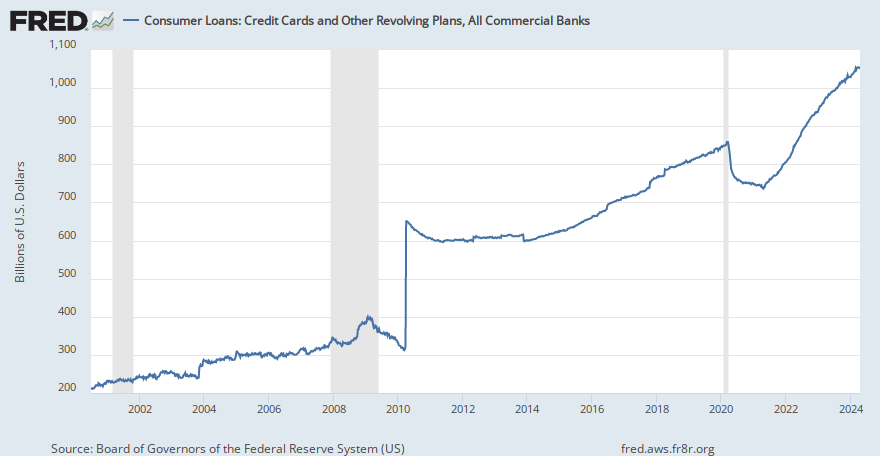

This is a solid one.

I added Personal Savings, came out with this:

It's a little misleading because at the distance needed to view both, you don't adequately see the growth of debt. Here's credit card debt by itself:

With Unemployment increasing, energy on the rise again, food still rising and rents seeming to have plateaued after two years of strong increases, that comparative graph should be worrisome. There's a recession expected (an "official" one, I guess?) and we're already in a rough economy.

This post was edited on 1/26/23 at 1:06 pm

Posted on 1/26/23 at 1:04 pm to I Love Bama

quote:

It's looking more and more like the FED might pull off the soft landing.

They very well could pull it off. The past few months have gotten me more hopeful for this outcome.

Posted on 1/26/23 at 1:14 pm to TigerFanatic99

quote:

It sounds dumb

Uh, yeah. Because it is dumb. Do you really want to send a message that bad financial decisions get rewarded? Positive reinforcement for overextension will only lead to it happening again and more.

Use the money to educate, train, and provide critical job skills that will actually elevate people’s lives and grow the economy.

Posted on 1/26/23 at 1:19 pm to Bard

Those are great charts. General story that folks saved and reduced debt with Covid $ and savings, but now those savings are gone and debt is rising.

Food prices consistently increasing will worsen this trend.

Food prices consistently increasing will worsen this trend.

Posted on 1/26/23 at 1:58 pm to LSUfan20005

quote:

General story that folks saved and reduced debt with Covid $ and savings, but now those savings are gone and debt is rising.

Not only are those savings gone, but debt has been rapidly increasing.

quote:

Food prices consistently increasing will worsen this trend.

And fuel. We're likely to be at $4/gallon for gasoline nationally before the swap to summer blends begins and this time there's no SPR to draw down on to ease the pain.

Posted on 1/26/23 at 2:26 pm to Bard

I found this one interesting. Looking at consumer loans versus GDP growth.

edit: showing as ratio of consumer loans to GDP.

edit: showing as ratio of consumer loans to GDP.

This post was edited on 1/26/23 at 3:22 pm

Popular

Back to top

3

3