- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: The Great Recession of March 3,2025

Posted on 3/4/25 at 12:07 pm to hikingfan

Posted on 3/4/25 at 12:07 pm to hikingfan

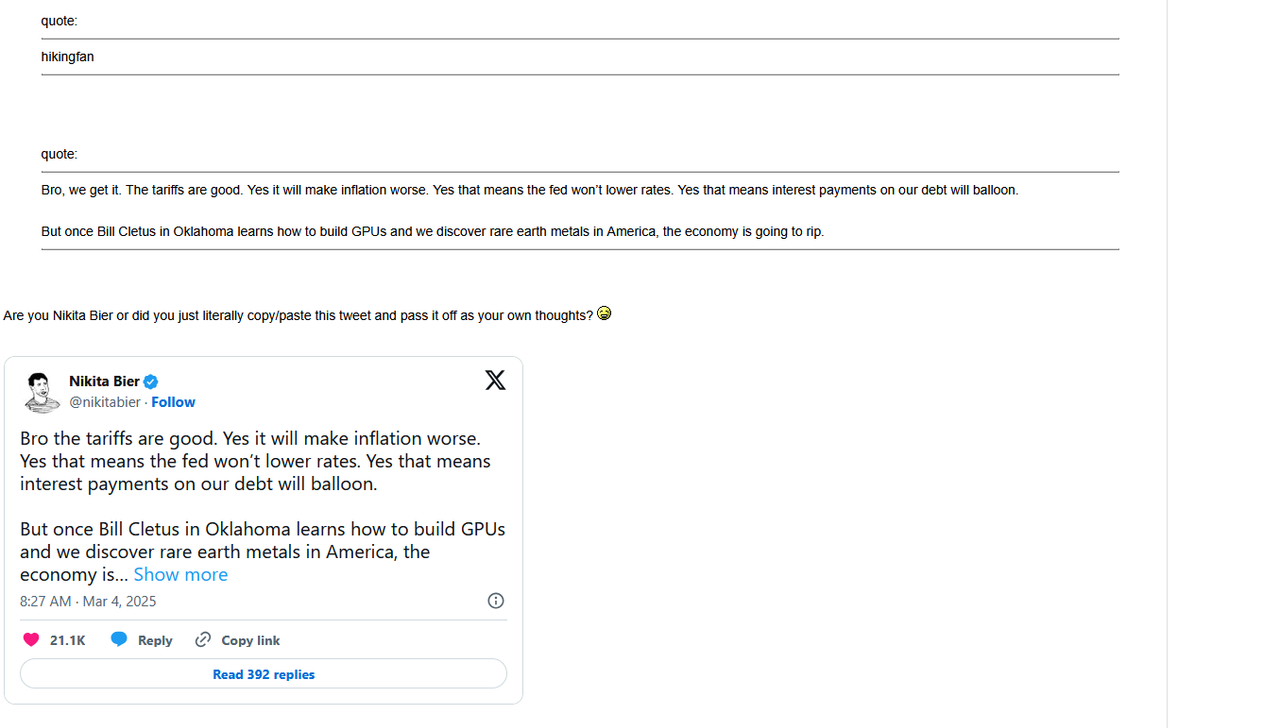

quote:

hikingfan

quote:

Bro, we get it. The tariffs are good. Yes it will make inflation worse. Yes that means the fed won’t lower rates. Yes that means interest payments on our debt will balloon.

But once Bill Cletus in Oklahoma learns how to build GPUs and we discover rare earth metals in America, the economy is going to rip.

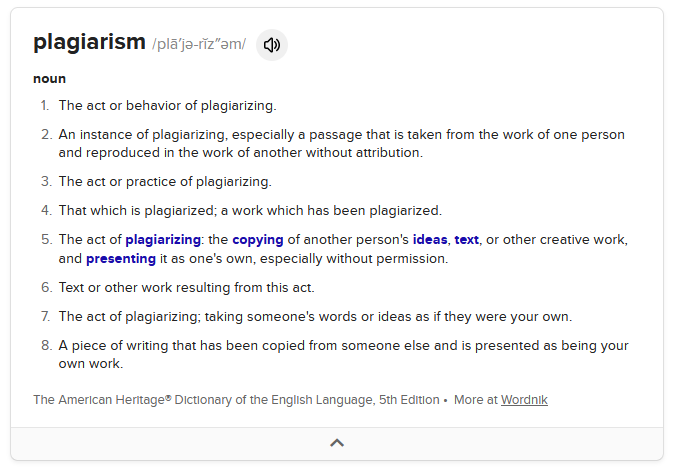

Are you Nikita Bier or did you just literally copy/paste this tweet and pass it off as your own thoughts?

Loading Twitter/X Embed...

If tweet fails to load, click here.This post was edited on 3/4/25 at 12:10 pm

Posted on 3/4/25 at 12:13 pm to hikingfan

quote:

Yes it will make inflation worse.

February 2025 study by the Federal Reserve Bank of Boston estimates that Trump’s 25% tariff on Canada and Mexico and 10% on China would only cause an inflation impact of 0.5 to 0.8%.

That is more than offset in fuel dropping. The AP pointed out that gas prices accounted for more than half of the monthly inflation increase. The group said it would raise production by 2.2 million barrels a day. That will lower prices. Then there is the lowering of taxes too. That means the feds will lower prices.

The over all net gain is massive for the middle class.

Posted on 3/4/25 at 12:21 pm to BCreed1

quote:So added to the latest CPI report, inflation will rise to 3.0%-3.3%. That will likely trigger the Fed to reverse its trend and start raising rates again which will royally piss off POTUS Trump. No bueno...

only cause an inflation impact of 0.5 to 0.8%.

Posted on 3/4/25 at 12:22 pm to Sl0thstronautEsq

quote:

Are you Nikita Bier or did you just literally copy/paste this tweet and pass it off as your own thoughts?

Busted his arse

Posted on 3/4/25 at 12:26 pm to IMSA_Fan

quote:

What trump is doing right now is just not going to end well. It is way too much geopolitical and economic volatility too quickly. If I’m a bank risk officer, there is no way I’m approving loans with the amount of uncertainty

At this exact moment.....yeah I'm here.

I like what he's doing - especially with DOGE and Ukraine, but it's happening faster than I think we are all expecting.

He's taking hard stances on tariffs. I know he's negotiating them, but it's impacting the market faster than those negotiations happen.

Posted on 3/4/25 at 12:27 pm to LSURussian

quote:

So added to the latest CPI report, inflation will rise to 3.0%-3.3%.

WOW!

OK

Posted on 3/4/25 at 12:28 pm to BCreed1

quote:

February 2025 study by the Federal Reserve Bank of Boston estimates that Trump’s 25% tariff on Canada and Mexico and 10% on China would only cause an inflation impact of 0.5 to 0.8%.

Interesting.

Posted on 3/4/25 at 12:37 pm to onepiecemayne

quote:

Manufacturing back to the U.S...The world isn't operating in the 1950s anymore.

I think if it were just the tariffs, it wouldn't be a big deal. It's also the incredibly well executed immigration policy's impact to the labor pool, the well deserved potential disruption of funding to Ukraine, the curbing of wasteful spending/subsidization of some elements of the research and media industries, and the fact that some of these tariffs seem to be dropped/altered very quickly based on negotiations with the trade partner. Trump has acted with lightning speed on almost everything he said he would address - much faster than even his supporters expected.

I think that the above all needed to happen. But it's happening fast and it's hard to predict and plan for the future. There is some frustration with my company right now directly caused by the rapid shift in federal policy recently.

Sometimes the medicine we need doesn't taste very good. That may be what's happening here.

Posted on 3/4/25 at 12:39 pm to dewster

quote:

think if it were just the tariffs, it wouldn't be a big deal. It's also the incredibly well executed immigration policy's impact to the labor pool, the well deserved potential disruption of funding to Ukraine, the curbing of wasteful spending/subsidization of some elements of the research and media industries, and the fact that some of these tariffs seem to be dropped/altered very quickly based on negotiations with the trade pa

Very well thought out!

quote:

There is some frustration with my company right now directly caused by the rapid shift in federal policy recently.

Sometimes the medicine we need doesn't taste very good. That may be what's happening here.

Hell of a post

Posted on 3/4/25 at 12:46 pm to Boss

Td should have a label for those who got GEDs

Posted on 3/4/25 at 12:58 pm to fareplay

quote:

Td should have a label for those who got GEDs

You can narrow it down a bit if they post things such as, 'they rose prices' or use the word 'sum' when they mean 'some' or 'no' when they mean 'know.'

Posted on 3/4/25 at 1:14 pm to NoMercy

Wait how is my portfolio green today after being green yesterday? I was told this is the end here dammit.

Posted on 3/4/25 at 1:23 pm to fareplay

quote:

Regardless the American consumer is hurt which means less consumption and growth

I fail to see how this is a net positive

Trump creates the stick of tariffs but then offers the carrot of avoiding those tariffs by onshoring business and you don't see at least a potential net positive in that? What if he throws in a cut to the corporate tax to sweeten the deal?

Beyond that, growth has been an illusion built on ever-growing debt creation since at least COVID. There's no reality where the monetary abuse of and since COVID doesn't eventually bring a recession. After a recession, there's growth. How much of that growth do you want to stay domestic and how much do you want to ship out of the country? If Trump really does push a deal which removes tariffs from companies which relocate to the US and sweetens that deal with a cut to the corporate tax rate, that sets the stage for lowering recessionary impacts as businesses onshore more money and it positions those businesses (and thus the US economy) for better growth once the economy starts recovering.

Posted on 3/4/25 at 1:36 pm to LSURussian

quote:

So added to the latest CPI report, inflation will rise to 3.0%-3.3%.

Incredible

Posted on 3/4/25 at 1:45 pm to SDVTiger

You've frequently demonstrated that you're really bad at math but I thought this simple computation would be doable even by you.

Latest CPI report = 2.5%

Projected increase attributable to the tariffs (according to the poster I replied to): +0.5% to +0.8%.

Add the two factors together = 3.0% to 3.3%.

As President W. Bush once said, "This ain't rocket surgery..."

Latest CPI report = 2.5%

Projected increase attributable to the tariffs (according to the poster I replied to): +0.5% to +0.8%.

Add the two factors together = 3.0% to 3.3%.

As President W. Bush once said, "This ain't rocket surgery..."

Posted on 3/4/25 at 1:48 pm to LSURussian

That's not the issue I'm laughing at. It is the failure/refusal you have to incorporate the other part. Fuel and inflation.

Posted on 3/4/25 at 1:51 pm to BCreed1

quote:I didn't fail nor refuse anything. Tell me what those numbers are and I can cipher them for you, Jethro.

It is the failure/refusal you have to incorporate the other part. Fuel and inflation.

Posted on 3/4/25 at 2:01 pm to LSURussian

quote:

You've frequently demonstrated that you're really bad at math but I thought this simple computation would be doable even by you.

Posted on 3/4/25 at 2:07 pm to SDVTiger

It's admirable that you're able to laugh at your dyscalculia.

Posted on 3/4/25 at 2:09 pm to Sl0thstronautEsq

This is the absolute best thing produced in this thread

For the record on what has happened here

For the record on what has happened here

This post was edited on 3/4/25 at 2:12 pm

Popular

Back to top

2

2