- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Proposed 401k limit -- $2400 per year

Posted on 10/21/17 at 10:28 am to ghost2most

Posted on 10/21/17 at 10:28 am to ghost2most

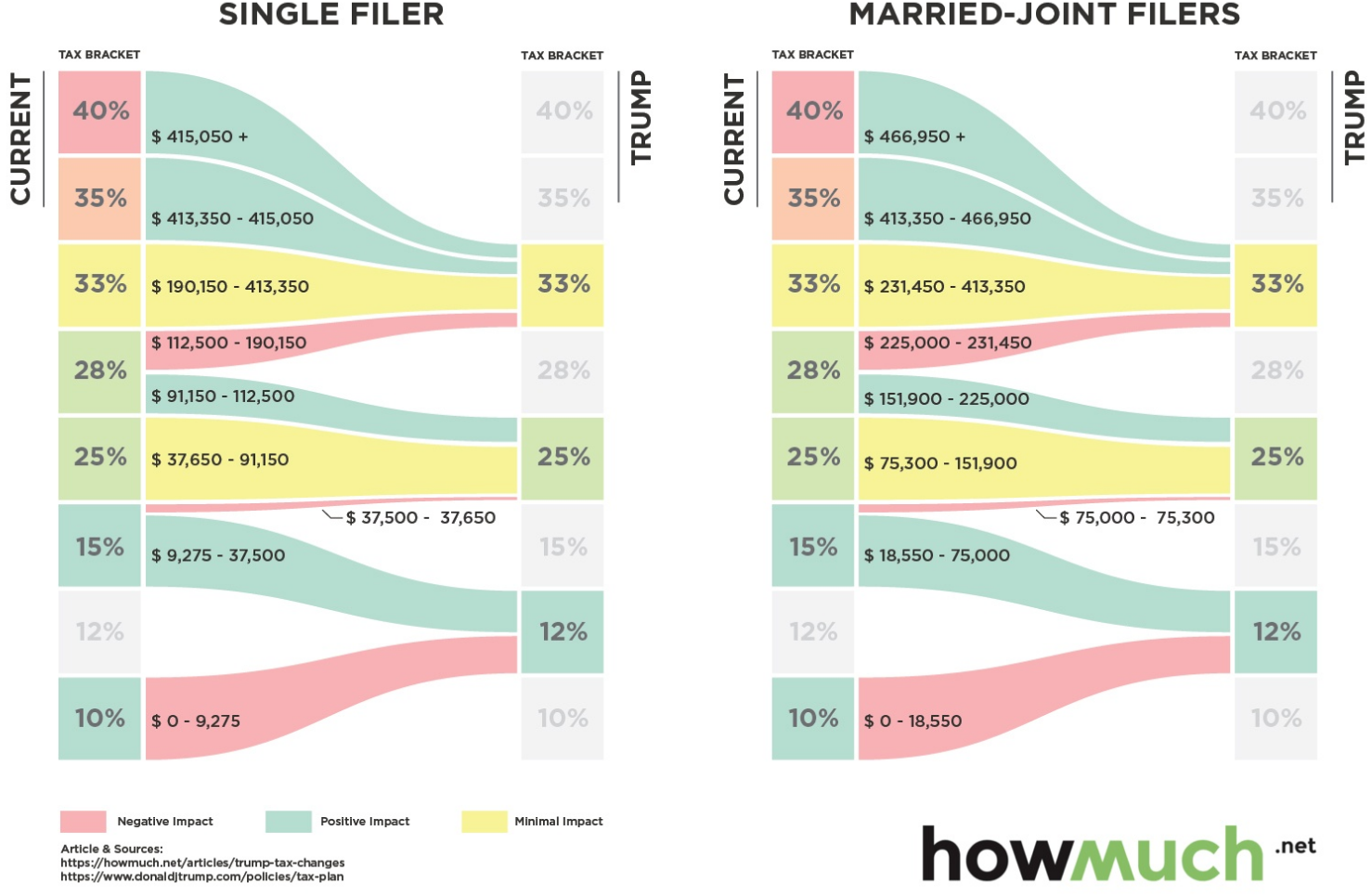

Proposed plan.

This post was edited on 10/21/17 at 10:31 am

Posted on 10/21/17 at 10:29 am to lynxcat

quote:

You are making assumptions that the person does not require liquidity in the near term. Young, single people have student debt, are going back to school and need to pay tuition, are saving for a home purchase, and building an emergency fund, etc. Anecdotally, I could easily fully fund a 401k but choose liquidity over it. I’ll always put at least the amount my company matches but excess is not the right decision for me at this moment in time.

I'm 32. He's making roughly 120k a year. Unless he paid full rate to law school or MBA, his debt load is very manageable.

Posted on 10/21/17 at 10:30 am to lynxcat

quote:

Has anything related to the bands been released? I have only seen the proposed rates which are practically meaningless talking points without the bands.

There were bands released a while ago but not sure they are using the same ones. IIRC if you made around 100k a year you actually went up a tax bracket on that last bit of income, but everyone else came out better.

This post was edited on 10/21/17 at 10:31 am

Posted on 10/21/17 at 10:45 am to jimbeam

I wish, thought it was possible for a minute then they started hitting us with the pay cuts.

Posted on 10/21/17 at 10:50 am to GREENHEAD22

Based on the above I'm fricked

Posted on 10/21/17 at 11:01 am to jimbeam

They need to bump the minimum for the 33 bracket closer to 150K.

Posted on 10/21/17 at 11:07 am to GREENHEAD22

Yep, the $112k at 33% is way too high of a rate unless there are significant deductions that reduce AGI.

This post was edited on 10/21/17 at 11:08 am

Posted on 10/21/17 at 11:11 am to lynxcat

Well I know part of the plan is doing away with a lot of reductions so that probably won't be the case. 150 is probably even low 200 is a decent starting point.

For a family it should be 300k, 225 is way low as well.

For a family it should be 300k, 225 is way low as well.

This post was edited on 10/21/17 at 11:12 am

Posted on 10/21/17 at 11:30 am to GREENHEAD22

That’s $225k AGI. So you’re nearing $275-290k+ depending on your pretax and deductions.

Posted on 10/21/17 at 12:48 pm to bbrownso

Jesus. I'm a 29 year old and I already have 30k or so in savings, and I feel like I've kinda failed.

Posted on 10/21/17 at 1:01 pm to Jcorye1

I turn 30 at the end of the month, came out of school late so have been throwing money into savings. I feel like I am starting to catch up to where I should be had I started working at 22-23 like most people.

This post was edited on 10/21/17 at 1:07 pm

Posted on 10/21/17 at 1:56 pm to bbrownso

It is amazing to me to see people in their late 50s early 60s having less than 20K saved for retirement.

Posted on 10/21/17 at 2:17 pm to matthew25

That's a massive hit to the working middle class.

WTF TRUMP??????????????????????????????????

WTF TRUMP??????????????????????????????????

Posted on 10/21/17 at 2:45 pm to Golfer

quote:

That’s $225k AGI. So you’re nearing $275-290k+ depending on your pretax and deductions.

$225k after deductions isn't a ton to live off of when you have serious student debt. Heaven forbid you have children or live in an high cost of living city.

Top rate should start around 300k AGI. In my opinion.

Posted on 10/21/17 at 3:53 pm to Oenophile Brah

Do you realize the entitlement in your post? You honestly believe “$225k isn’t a ton to live off”?

This post was edited on 10/21/17 at 3:54 pm

Posted on 10/21/17 at 4:31 pm to lynxcat

I’m not sure how much his student loan bill is but even at 2 grand he can afford a home and a 80k car without blinking an eye

Edit: that’s two grand a month payment.

Edit: that’s two grand a month payment.

This post was edited on 10/21/17 at 4:33 pm

Posted on 10/21/17 at 7:14 pm to Volvagia

quote:

Why? If you are making enough money to even maximize the current limit you probably would prefer to have the pre-tax treatment.

My problem with this is that it will discourage company match of the 401k. My company does 6%. Thats a ton of cash to leave on the table to pay for raising the standard deduction.

Posted on 10/21/17 at 7:15 pm to Oenophile Brah

Or heaven forbid they do a cost of living adjustment to your tax rate.

Why isnt this done now?

Why isnt this done now?

Posted on 10/21/17 at 8:00 pm to lynxcat

quote:

Do you realize the entitlement in your post? You honestly believe “$225k isn’t a ton to live off”?

$225k is easily not worrying about money status in louisiana and probably most of the south.

Popular

Back to top

1

1