- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Pay Extra on Student Loan vs Invest?

Posted on 2/13/24 at 9:43 am

Posted on 2/13/24 at 9:43 am

3 Student Loans Remaining Balance: $52,702

Minimum Payment:$615.47

Standard Payoff Date October 2033

Interest rates of 5.3%($13k), 5.28%($19.8k), 4.3%($19.8k)

We are leaning towards paying $2,750-$3,000/mo and snowball the remaining based on interest rate and and have this sucker paid off by September/October of 2025 or maybe even 1-2 months sooner based on overtime, bonuses, etc.

We can comfortably budget this amount, or do you have any other recommendation that could save/make money in a similar amount of time? We just want it GONE.

Minimum Payment:$615.47

Standard Payoff Date October 2033

Interest rates of 5.3%($13k), 5.28%($19.8k), 4.3%($19.8k)

We are leaning towards paying $2,750-$3,000/mo and snowball the remaining based on interest rate and and have this sucker paid off by September/October of 2025 or maybe even 1-2 months sooner based on overtime, bonuses, etc.

We can comfortably budget this amount, or do you have any other recommendation that could save/make money in a similar amount of time? We just want it GONE.

Posted on 2/13/24 at 9:53 am to Roux57

We just want it GONE.

--

Pay it off and move forward.

--

Pay it off and move forward.

Posted on 2/13/24 at 9:54 am to Roux57

I like your plan.

Get this SL debt knocked out asap

Then start putting that $3k a month in an S&P index fund

Not sure of your age but you sound fairly young

That $36k per year in a S&P index is going to make you a multi millionaire in 20 years

Get this SL debt knocked out asap

Then start putting that $3k a month in an S&P index fund

Not sure of your age but you sound fairly young

That $36k per year in a S&P index is going to make you a multi millionaire in 20 years

Posted on 2/13/24 at 10:00 am to masoncj

This is the current plan.

Physician assistant and engineer both 26 y/o. Plan on having kids around 29/30 and dont want this SL lingering over our heads.

Physician assistant and engineer both 26 y/o. Plan on having kids around 29/30 and dont want this SL lingering over our heads.

Posted on 2/13/24 at 10:10 am to Roux57

If you aren't eligible for any possible forgiveness that may be handed out and you already have 6 month emergency fund built up pay off this debt as soon as you can. yes you may be able to invest the extra amount monthly and make slightly better gain but no guarantee and if market correction thats be warned over and over ever happens then you took a step backwards.

we refinanced a year ago and got like 2.75% over 7yr so we are only paying the min required but have been stacking away the extra required to have loan paid off in 2 years since saving account is earning 4.5% interest. if rates flip and loan rate is higher then we will pay the larger amount for the remaining months to still be able to pay it off in 2 yrs. end of 2 years if savings account still making 2x loan rate we will just continue to pay monthly min and collect the interest difference.

we refinanced a year ago and got like 2.75% over 7yr so we are only paying the min required but have been stacking away the extra required to have loan paid off in 2 years since saving account is earning 4.5% interest. if rates flip and loan rate is higher then we will pay the larger amount for the remaining months to still be able to pay it off in 2 yrs. end of 2 years if savings account still making 2x loan rate we will just continue to pay monthly min and collect the interest difference.

Posted on 2/13/24 at 10:13 am to Roux57

Sounds like a great plan. If you can get used to paying $3K/mo on student loans and still live comfortably, don’t let that money stay in your bank account when it’s paid off.

Investing the $3k every month will help you avoid lifestyle creep and set you up for the future. Of course, don’t forget to enjoy life now.

Investing the $3k every month will help you avoid lifestyle creep and set you up for the future. Of course, don’t forget to enjoy life now.

Posted on 2/13/24 at 10:40 am to ks_nola

Not eligible for any forgiveness, nor do I believe in forgiveness for something we knew she was taking out.

We have a $20k emergency fund now incase anything happens, this should cover all current expenses as we budget today for ~6 months, could stretch longer if needed.

Looked into refinancing, but those rates are long gone lol. She just graduated a year or so ago so working with what we got rate wise.

We have a $20k emergency fund now incase anything happens, this should cover all current expenses as we budget today for ~6 months, could stretch longer if needed.

Looked into refinancing, but those rates are long gone lol. She just graduated a year or so ago so working with what we got rate wise.

Posted on 2/13/24 at 10:42 am to Tifway419

Definitely still enjoying life now, we made sure to account for travel and other entertainment into our budget. We aren't tightening up the boot straps too tight.

Posted on 2/13/24 at 10:44 am to Roux57

What are you contributing to retirement plans? Taking full advantage of any match? Roth IRAs?

I'd prioritize maxing tax advantaged investment accounts before paying off relatively low interest loans. I once paid a 5.5% mortgage early and looking back missed out on tons of stock market gains.

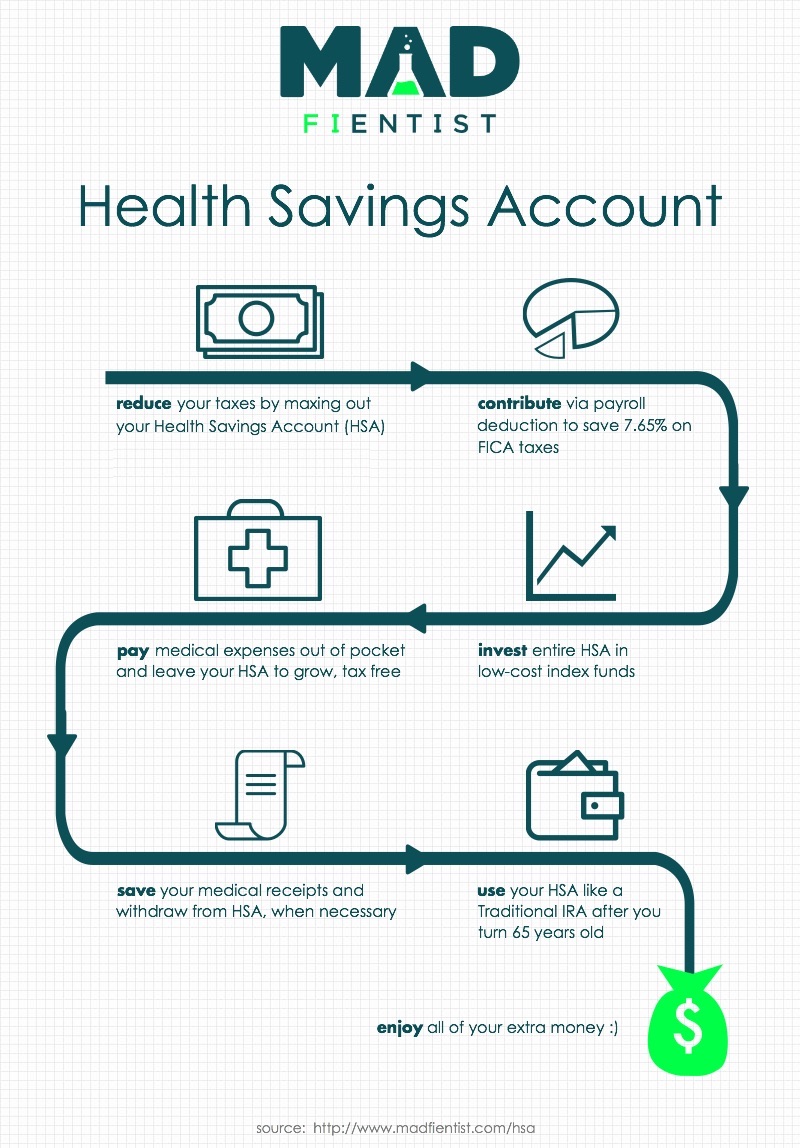

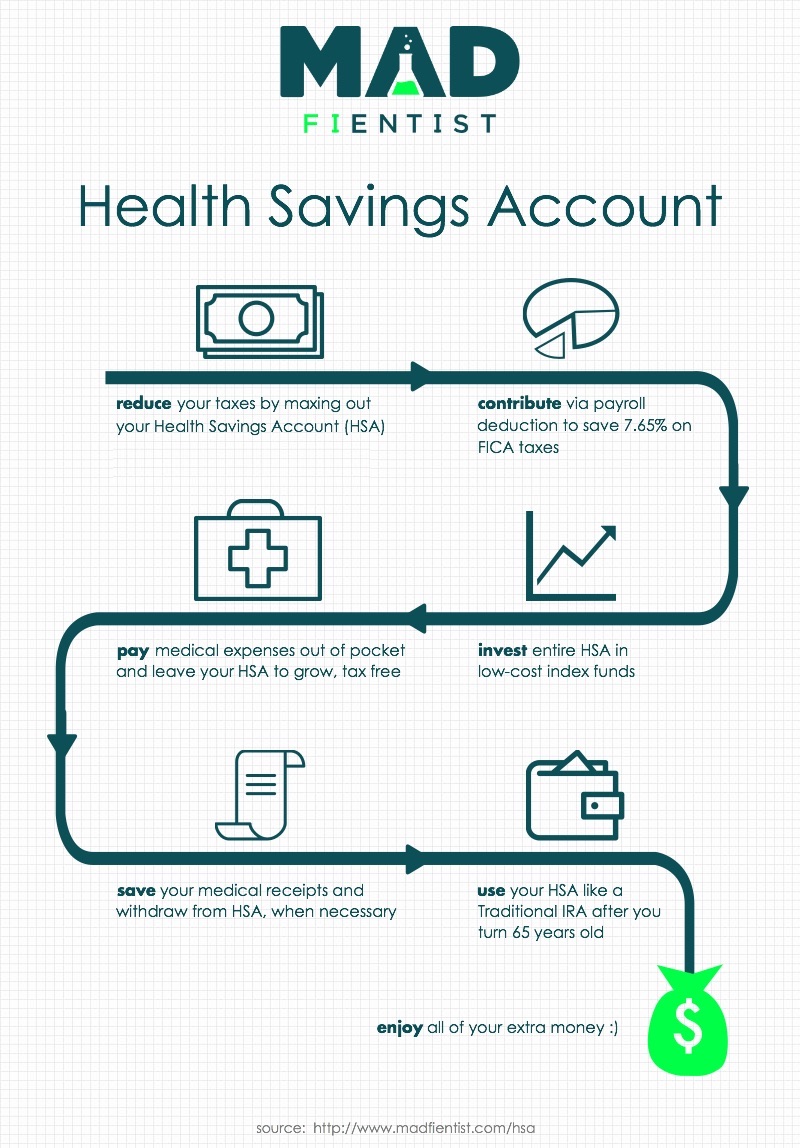

If you're fully investing in retirement, HSAs etc. then I'd consider paying off those loans before taxable brokerage but it would be more psychological not math.

If you're not realistically going to invest the difference then go for the loan payoff. Best of intentions are often overcome by lifestyle/spending creep unless you have very intentional goals and discipline in place.

I'd prioritize maxing tax advantaged investment accounts before paying off relatively low interest loans. I once paid a 5.5% mortgage early and looking back missed out on tons of stock market gains.

If you're fully investing in retirement, HSAs etc. then I'd consider paying off those loans before taxable brokerage but it would be more psychological not math.

If you're not realistically going to invest the difference then go for the loan payoff. Best of intentions are often overcome by lifestyle/spending creep unless you have very intentional goals and discipline in place.

This post was edited on 3/20/24 at 4:24 pm

Posted on 2/13/24 at 11:41 am to TorchtheFlyingTiger

Fully maxing both Roths this year, have some going to an HSA + company contribution into HSA (I just started putting towards this past open enrollment) and I've been getting company match + some, totaling 10% into 1 401k account for the last 4-ish years.

This post was edited on 2/13/24 at 11:42 am

Posted on 2/13/24 at 12:53 pm to Roux57

Great job with your finances. Good advice in this thread. We don't know if you have car payments and such. The 4.3 one is very borderline depending on what else you would do with that amount instead. But the feeling of getting them paid off is very rewarding.

Posted on 2/13/24 at 1:17 pm to KWL85

No note on her car, few more payments on my truck at $270/mo, but I pay a little extra on it. Once its done, will roll what im paying on it into her student loans. For reference, we just started budgeting together after she moved in recently. Getting married in 4 months.

Honestly, we believe the feeling of getting them completely paid off in 18 months, debt free aside from my 3% interest mortgage, will completely outweigh any other situation. I've quickly learned the last few years that I cannot stand owing someone money, eats me up.

Honestly, we believe the feeling of getting them completely paid off in 18 months, debt free aside from my 3% interest mortgage, will completely outweigh any other situation. I've quickly learned the last few years that I cannot stand owing someone money, eats me up.

Posted on 2/13/24 at 7:54 pm to Roux57

Student loan debt would be the last thing I paid off. If you die, the debt dies with you. The interest can be written off. On average, you will make more in an S&P 500 index fund and can use those earnings to pay the debt.

If you are paying it off for peace of mind, no numbers can calculate how much you value that. It may be worth way more than an extra 4%-6% on investment for you to have peace of mind.

If you are paying it off for peace of mind, no numbers can calculate how much you value that. It may be worth way more than an extra 4%-6% on investment for you to have peace of mind.

Posted on 2/13/24 at 8:24 pm to go ta hell ole miss

quote:

On average, you will make more in an S&P 500 index fund and can use those earnings to pay the debt.

This is mostly where my train of thought is. I worked a big turnaround one time, made a pile of money and took some of it and paid off my truck and my student loan. About $35k combined. Dumb decision on my part, the student loan was 4% and the truck was like 2.75%. When I made this decision I had no idea what an interest rate even was at the time....sadly. I remember paying off the debts in a job trailer on night shift. I remember being greatly underwhelmed by the feeling of "paying a loan off" when I clicked those 2 pay off buttons online.

Unless it will greatly free up your DTI or it is holding you from doing something else growth related with your money I would let it ride.

This post was edited on 2/13/24 at 8:26 pm

Posted on 2/13/24 at 8:38 pm to go ta hell ole miss

quote:

The interest can be written off.

Not with their income

Posted on 2/13/24 at 8:41 pm to Roux57

Max that HSA while eligible. It is triple tax advantaged and you can invest it, pay health expenses out of pocket , save reciepts and withdraw without tax or penalty later.

This post was edited on 2/13/24 at 8:49 pm

Posted on 2/13/24 at 8:44 pm to Roux57

Basically depends on how much you value being out from under it.

The interest rates on the loan balance are about the same as the returns on a CD, so the typical argument (being better off investing) doesn't apply.

You could do better in stocks, but those are unreliable in the short term. If that money goes into stocks and we get a bear market in the near future, you're worse off.

Then hit it as hard as you can. Put the amount budgeted toward the loans. Also pay any extras left over at the end of each month, like the electric bill coming in under budget.

The interest rates on the loan balance are about the same as the returns on a CD, so the typical argument (being better off investing) doesn't apply.

You could do better in stocks, but those are unreliable in the short term. If that money goes into stocks and we get a bear market in the near future, you're worse off.

quote:

We just want it GONE.

Then hit it as hard as you can. Put the amount budgeted toward the loans. Also pay any extras left over at the end of each month, like the electric bill coming in under budget.

Posted on 2/14/24 at 10:27 am to DaBeerz

quote:

Not with their income

I missed the part about their income (I am still missing it, actually).. I assume anyone that can comfortably afford to increase their student loan payments an additional $2400 a month over what they are currently paying is likely itemizing.

Posted on 2/14/24 at 10:48 am to go ta hell ole miss

quote:

I missed the part about their income (I am still missing it, actually).. I assume anyone that can comfortably afford to increase their student loan payments an additional $2400 a month over what they are currently paying is likely itemizing

Student loan Interest deduction phases out at 155k joint filers… PA and engineer will exceed that, so you don’t get to deduct the interest

Posted on 2/14/24 at 11:37 am to Roux57

quote:

I've quickly learned the last few years that I cannot stand owing someone money, eats me up.

Then get rid of it and don't think twice. Also since you are considering kids in the next few years, having this gone around the same time you'll be so use to not having these funds that the financial impact of kids could be minimized.

Back to top

7

7