- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Official CryptoTalk Thread

Posted on 5/23/21 at 1:37 pm to JayDeerTay84

Posted on 5/23/21 at 1:37 pm to JayDeerTay84

Haven’t been able to log into Voyager for days now. Luckily for me, I’ve been moving everything out of there, but not quite there yet.

Posted on 5/23/21 at 1:50 pm to SuddenJerk

Voyager is garbage. It’s down all the time. My experience with it was a short one. Took everything off there.

Posted on 5/23/21 at 1:55 pm to umrebel2009

quote:Bad advice, dollar cost average starting now over the next few years and you will be very happy.

You're wanting to start buying at what many think is the beginning of the bear market which will dump for 3 years? Wait till late 2023 / early 2024 to start buying and save yourself some headache

Posted on 5/23/21 at 1:57 pm to Michael J Cocks

quote:Realistically no one can provide you anything but a guess. Technicals don't really matter in a major sell off.

Realistically, how deep do you veterans see BTC falling?

This pain gets the juices flowing. Cheap sats, keep stacking. All you new people that didn't go through 2018 will become numb to the pain in a couple years for the next bull market crash!

Posted on 5/23/21 at 2:05 pm to TigerTatorTots

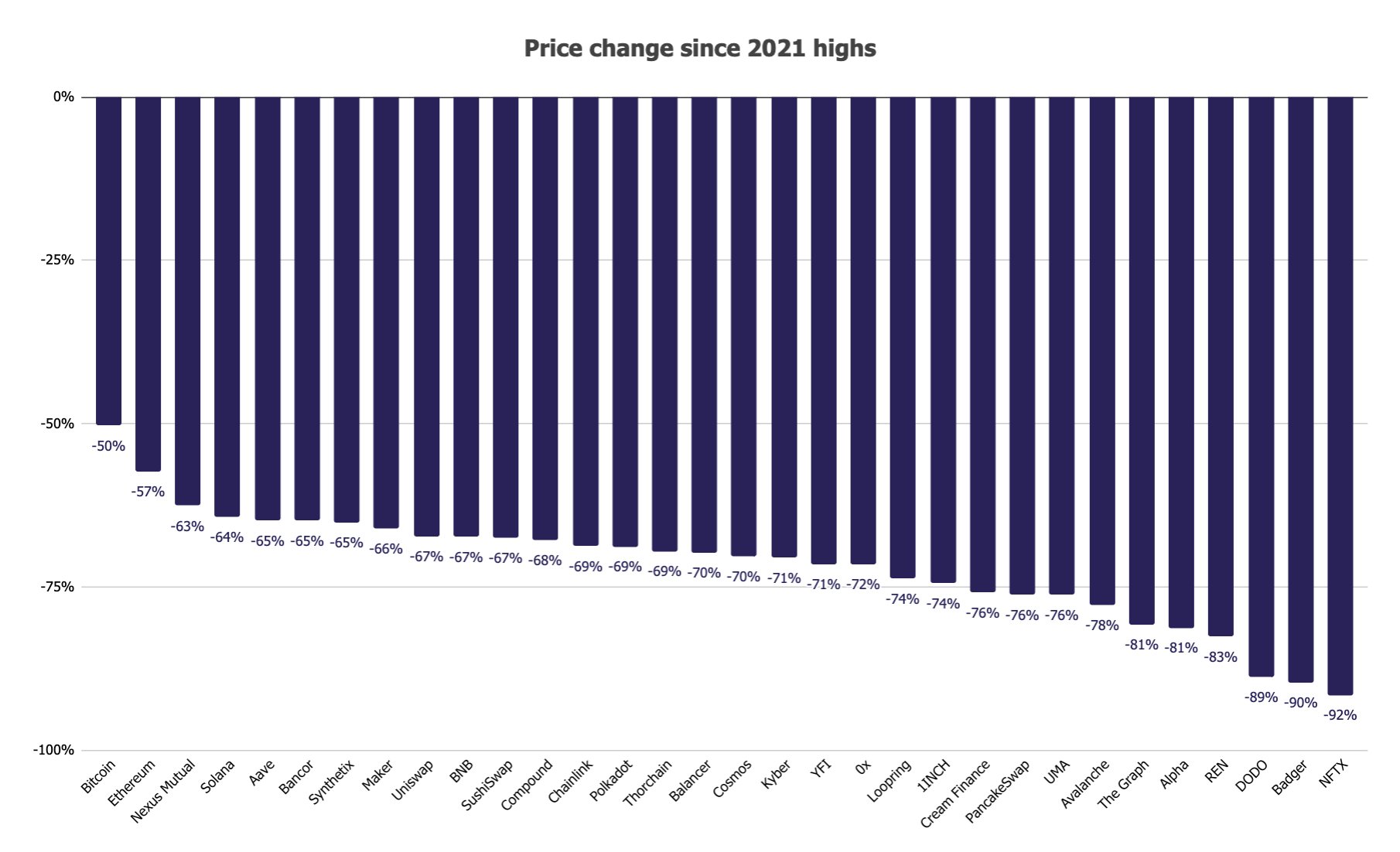

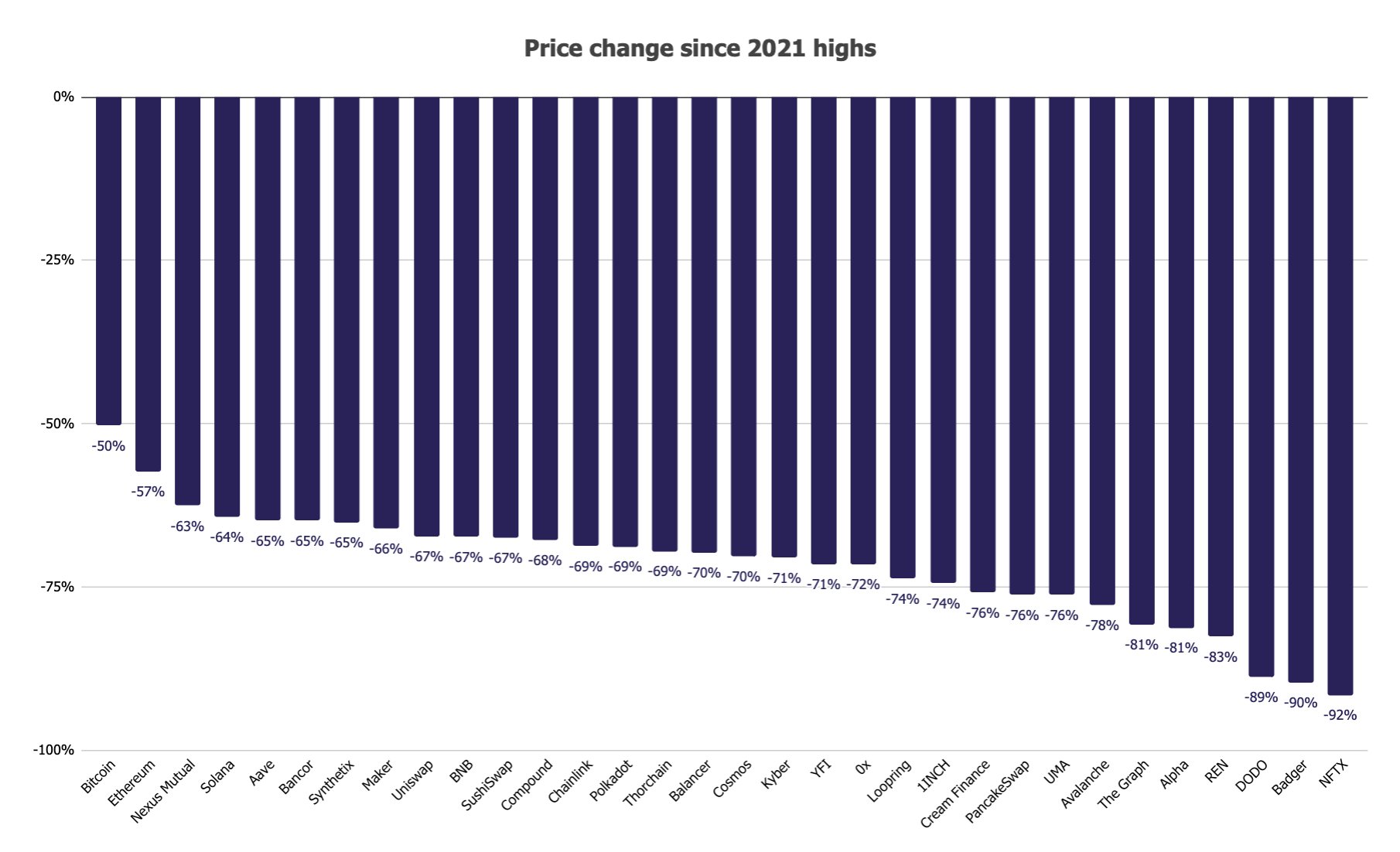

and these are mostly considered the "good" ones

Posted on 5/23/21 at 2:09 pm to rocket31

While you may miss out on the wild gains, this is another reason why I like holding a majority BTC. You don't get completely wiped out during the bad times

Posted on 5/23/21 at 2:12 pm to rocket31

I’m real close to calling the flippening next cycle.

Significant chance eth turns mildly deflationary with the protocol changes and movement towards PoS.

Next halvening won’t have as dramatic of an effect on the price of btc.

Expect the flippening narrative to run rampant and become a self fulfilling prophecy as psychology takes over.

Significant chance eth turns mildly deflationary with the protocol changes and movement towards PoS.

Next halvening won’t have as dramatic of an effect on the price of btc.

Expect the flippening narrative to run rampant and become a self fulfilling prophecy as psychology takes over.

Posted on 5/23/21 at 2:14 pm to Tiguar

I guess the idea is Ethereum’s maximum potential is absorbing the market cap of a lot of financial institutions combined

BTC will ideally absorb things people view as stores of value like precious metals and bonds

seems like there is more value to be had with Ethereum in that regard, although it will have to share that market cap with Cardano and BNB

BTC will ideally absorb things people view as stores of value like precious metals and bonds

seems like there is more value to be had with Ethereum in that regard, although it will have to share that market cap with Cardano and BNB

Posted on 5/23/21 at 2:16 pm to ronricks

quote:

Voyager is garbage. It’s down all the time. My experience with it was a short one. Took everything off there.

It’s also new so growing pains should be expected, just like every broker before it. It has had huge growth since launching and have been very transparent about scaling up their servers to accommodate 10 million users.

If you want to invest in crypto this shouldn’t be a huge deal. If you like to flip crypto every hour I can see why this might not be for you yet.

Posted on 5/23/21 at 2:18 pm to Ross

What I’m wondering is if eth will turn into a better vehicle for storing value than btc as btc becomes less volatile and the increases in value from pre halvening become less impressive.

People like to argue volatility is bad for storage of value but predictable volatility is a good thing over long term periods as long as that volatility takes some steps up the staircase.

Eth has held value well as an inflationary asset....what will it look like as deflationary?

People like to argue volatility is bad for storage of value but predictable volatility is a good thing over long term periods as long as that volatility takes some steps up the staircase.

Eth has held value well as an inflationary asset....what will it look like as deflationary?

Posted on 5/23/21 at 2:20 pm to Tiguar

quote:

Significant chance eth turns mildly deflationary with the protocol changes and movement towards PoS.

it could also turn inflationary. no one really knows how that's going to play out just yet

the hope is that it turns deflationary but that's tbd

Posted on 5/23/21 at 2:21 pm to Tiguar

Well I don’t view this hyper monetization phase as storing value necessarily, but rather price discovery

To me storing value ideally means low volatility and slow price growth and the only reason the price grows is because the underlying fiat you are pricing BTC in is degrading, not because BTC is any more or less valuable. Volatility in this sense would be a sign that we haven’t yet discovered the baseline value of the commodity.

That’s just the way I view it I guess. You have the price discovery phase and volatility slowly decreases as we hone in on a true value, then at that point it would only really move based on the value of whatever you price it in.

It’s hard to say what the market will do in the future, but I certainly have bought in wholesale to the idea that Bitcoin is digital gold

To me storing value ideally means low volatility and slow price growth and the only reason the price grows is because the underlying fiat you are pricing BTC in is degrading, not because BTC is any more or less valuable. Volatility in this sense would be a sign that we haven’t yet discovered the baseline value of the commodity.

That’s just the way I view it I guess. You have the price discovery phase and volatility slowly decreases as we hone in on a true value, then at that point it would only really move based on the value of whatever you price it in.

It’s hard to say what the market will do in the future, but I certainly have bought in wholesale to the idea that Bitcoin is digital gold

This post was edited on 5/23/21 at 2:23 pm

Posted on 5/23/21 at 2:23 pm to rocket31

Even if it’s inflationary, it will be less so than it is now, correct?

Posted on 5/23/21 at 2:23 pm to Ross

Doge at 4. It's here to stay. Them baws got diamond hands over there

Posted on 5/23/21 at 2:36 pm to Tiguar

yes.

id push back on your theory with eth as a store of value because of trust. if the foundation/Vitalik can change the monetary issuance as they deem necessary it's hard to have faith it will remain the same moving forward

I do agree that the "deflationary, ultra sound money" marketing propaganda will be effective, however.

bitcoin is simpler by design but the protocol is not going to change and there is stability in that.

we also have to ask ourselves why the entire market is crashing because of Bitcoin energy/china fud? shouldn't eth be doing well under these circumstances?

id push back on your theory with eth as a store of value because of trust. if the foundation/Vitalik can change the monetary issuance as they deem necessary it's hard to have faith it will remain the same moving forward

I do agree that the "deflationary, ultra sound money" marketing propaganda will be effective, however.

bitcoin is simpler by design but the protocol is not going to change and there is stability in that.

we also have to ask ourselves why the entire market is crashing because of Bitcoin energy/china fud? shouldn't eth be doing well under these circumstances?

Posted on 5/23/21 at 2:42 pm to rocket31

Because the FUD is not directly affecting the markets in the sense that the actual news matters. People love to correlate negative news to dips which infact is a self fulfilling prophecy.

People sell everything off because they know everything is going to go down.

I think how in your graph only btc and eth have sustained less than a 60% dip is a strong indicator of institutional money.

People sell everything off because they know everything is going to go down.

I think how in your graph only btc and eth have sustained less than a 60% dip is a strong indicator of institutional money.

Posted on 5/23/21 at 2:46 pm to rocket31

quote:

we also have to ask ourselves why the entire market is crashing because of Bitcoin energy/china fud? shouldn't eth be doing well under these circumstances?

Still weird af

Posted on 5/23/21 at 2:52 pm to 21JumpStreet

I decided to peek at my portfolio a few minutes ago

Posted on 5/23/21 at 2:57 pm to Hulkklogan

I just keep telling myself. 10-20 years... 10-20 years...

Posted on 5/23/21 at 3:06 pm to Tiguar

quote:

I think how in your graph only btc and eth have sustained less than a 60% dip is a strong indicator of institutional money.

This part makes sense, we all knew BTC was the least vulnerable, follwed by ETH then the ofhers.

What doesn’t make sense is why each of these tiny rallies are halted almost immediately. All signals say buy heavy. So here’s the question: Is there really anybody sitting behind their computer waiting for a 1-2% gain to sell, after losing 20-30% just this morning?? Doubt it.

Popular

Back to top

0

0