- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Maybe I’m wrong and that’s OK. But I need to understand the ethics behind this mortgage.

Posted on 2/26/21 at 9:32 am

Posted on 2/26/21 at 9:32 am

We have engaged a lender. They pre approved. We signed the loan documents. There was a rate fixed. It was never made explicitly clear this was floating. If I had no inquired, they’d have let it float until day after appraisal.

When questioned the loan officer stated “don’t worry we have your best interest”. What this could have done is raised my rate if it would have sat, then I wouldn’t have time to shop the deal and could be locked into a worse rate.

The lenders position was “trust us, we have your best interest at heart.”

My response was “that’s like telling me you’re the government and you’re here to help.”

Maybe it should have been apparent that I needed to specify “Lock now” but apparently that’s not thoroughly explained to some of us ignorant first time home buyers.

This person could take sick days and the the rates jump. I can’t expect they’re going to lock in once they start going up.

When questioned the loan officer stated “don’t worry we have your best interest”. What this could have done is raised my rate if it would have sat, then I wouldn’t have time to shop the deal and could be locked into a worse rate.

The lenders position was “trust us, we have your best interest at heart.”

My response was “that’s like telling me you’re the government and you’re here to help.”

Maybe it should have been apparent that I needed to specify “Lock now” but apparently that’s not thoroughly explained to some of us ignorant first time home buyers.

This person could take sick days and the the rates jump. I can’t expect they’re going to lock in once they start going up.

Posted on 2/26/21 at 10:11 am to DiamondDog

Once you find a good mortgage broker. Stick with them. If you aren't happy with these guys and feel like they're shady. If you can walk away. Walk away.

The company/guy I use for my mortgages and refinances is the freaking bomb. I recommend him to family and friends. I legitimately trust him. Gets rates that I cannot find elsewhere. He's not a Louisiana guy otherwise I'd recommend him to you.

Bottom line. A home is too big of a purchase to deal with someone you think is even 10% shady.

The company/guy I use for my mortgages and refinances is the freaking bomb. I recommend him to family and friends. I legitimately trust him. Gets rates that I cannot find elsewhere. He's not a Louisiana guy otherwise I'd recommend him to you.

Bottom line. A home is too big of a purchase to deal with someone you think is even 10% shady.

Posted on 2/26/21 at 10:28 am to LSURep864

Way too many shady brokers. I’ve had the same issue. If you aren’t stuck with them just move on

Posted on 2/26/21 at 10:35 am to DiamondDog

(no message)

This post was edited on 3/4/21 at 12:38 pm

Posted on 2/26/21 at 1:13 pm to DiamondDog

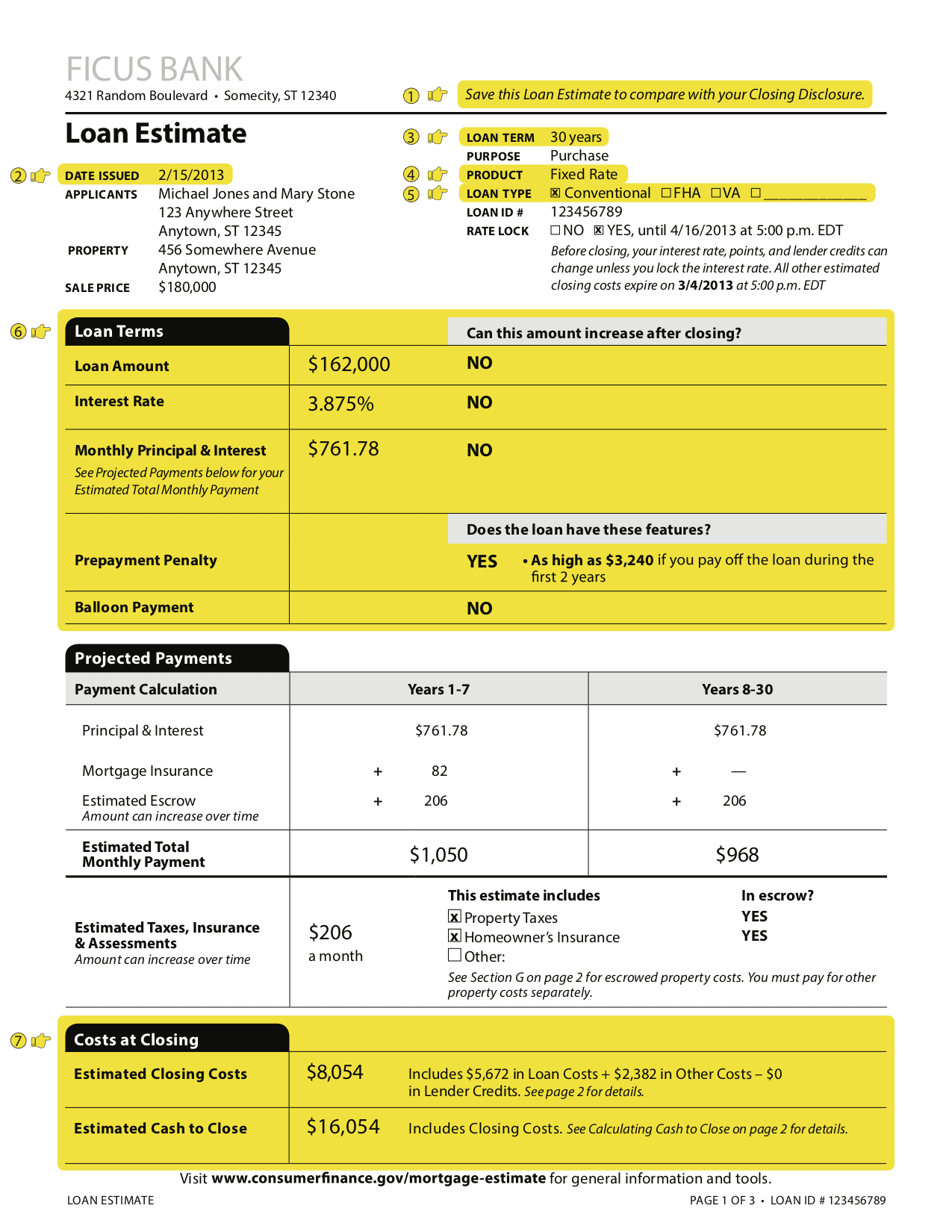

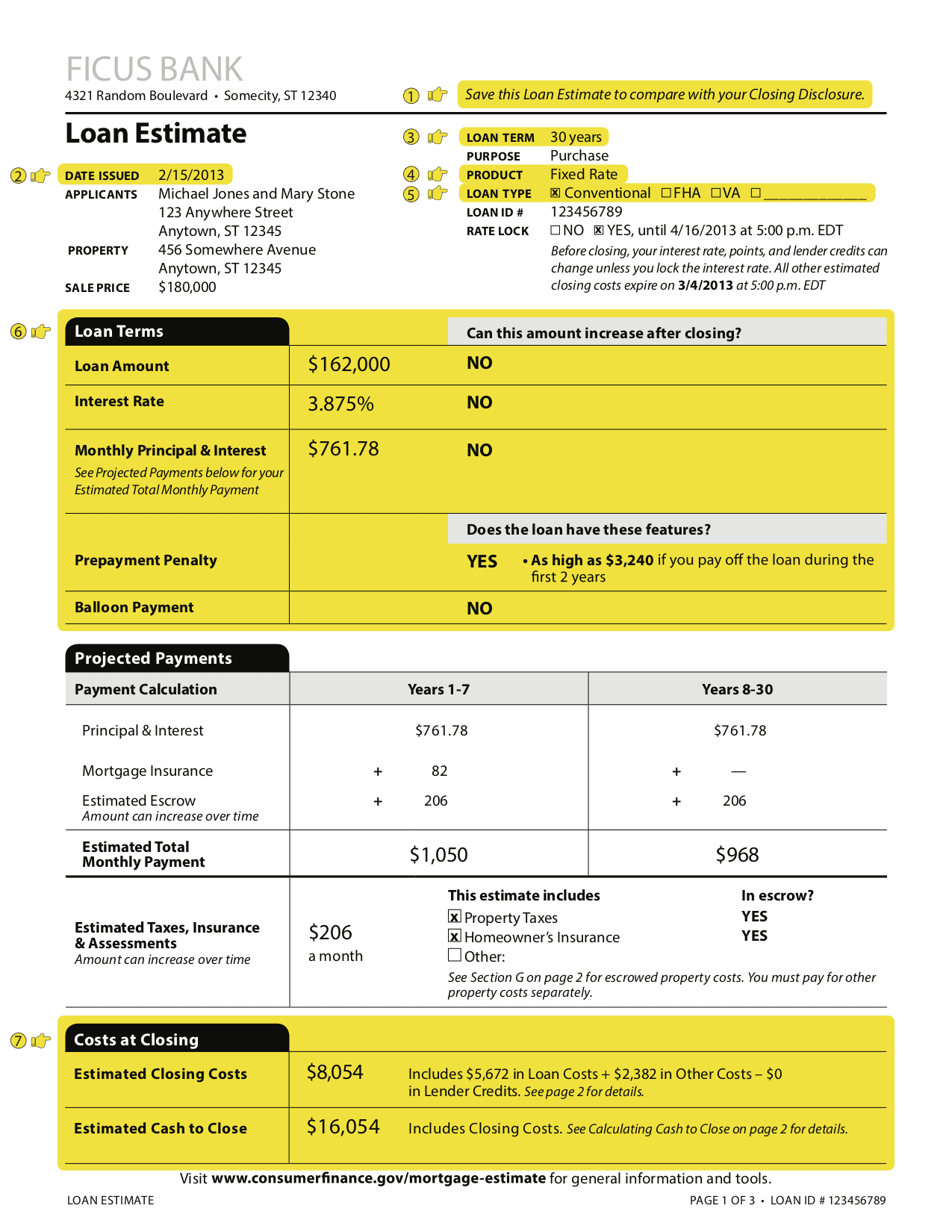

I think you should have received the Loan Estimate document that details loan amount, rate, etc. within three business days of application.

On the first page there is a check box that tells whether or not the rate is locked. If it is locked, it should tell you when that expires.

On the first page there is a check box that tells whether or not the rate is locked. If it is locked, it should tell you when that expires.

This post was edited on 2/26/21 at 1:17 pm

Posted on 2/26/21 at 1:23 pm to DiamondDog

Your broker didn't lock your rate because:

A-They were unsure of how long it would take to get your loan approved and didn't want to chance the rate lock expiring

B-In order to get your business, they promised you a rate that was costing them money to buy at the time

C-They're gambling that their pricing for that rate would go down, allowing them to make more $ on the backend

Most likely, it's option C

A-They were unsure of how long it would take to get your loan approved and didn't want to chance the rate lock expiring

B-In order to get your business, they promised you a rate that was costing them money to buy at the time

C-They're gambling that their pricing for that rate would go down, allowing them to make more $ on the backend

Most likely, it's option C

Posted on 2/26/21 at 2:21 pm to DiamondDog

The reality is that a mortgage is a complex transaction, and you have to do your homework.

Posted on 2/26/21 at 3:13 pm to LSUFanHouston

My only thing is this. You call me and walk me through the loan as a lender...it probably would be good business to tell your clients “hey, this rate is floating and not guaranteed. If you like it, lock it.”

This was never explained until I got this loan document with a small box that says it’s not locked. Well, I didn’t read the details and figured “this trusted person” would have given me the run down on how this works.

Comes to find out, they don’t tell you that upfront.

I’m chalking it up to my ignorance not knowing but I don’t have anybody in my circle that I could have went to explain these things.

I’ll take responsibility but I don’t think this is common knowledge and would build good faith to explain how this works.

This was never explained until I got this loan document with a small box that says it’s not locked. Well, I didn’t read the details and figured “this trusted person” would have given me the run down on how this works.

Comes to find out, they don’t tell you that upfront.

I’m chalking it up to my ignorance not knowing but I don’t have anybody in my circle that I could have went to explain these things.

I’ll take responsibility but I don’t think this is common knowledge and would build good faith to explain how this works.

Posted on 2/26/21 at 4:50 pm to AUHighPlainsDrifter

quote:

Your broker didn't lock your rate because:

A-They were unsure of how long it would take to get your loan approved and didn't want to chance the rate lock expiring

B-In order to get your business, they promised you a rate that was costing them money to buy at the time

C-They're gambling that their pricing for that rate would go down, allowing them to make more $ on the backend

Most likely, it's option C

I agree with all of this.

However, a ton of mortgage "shoppers" are more than happy to shop a rate with a mortgage lender and then jump ship to another company if there is a dip in the pricing down the road.

No mortgage company is going to lock a rate in for you "for your best interest" without your expressed consent. It would be against their interest to do so.

Posted on 2/27/21 at 7:29 am to AUHighPlainsDrifter

quote:

B-In order to get your business, they promised you a rate that was costing them money to buy at the time

C-They're gambling that their pricing for that rate would go down, allowing them to make more $ on the backend

Most likely, it's option C

Both of these are asinine statements

Option C is the most ridiculous

Posted on 2/27/21 at 1:29 pm to DiamondDog

quote:

We have engaged a lender. They pre approved. We signed the loan documents. There was a rate fixed. It was never made explicitly clear this was floating. If I had no inquired, they’d have let it float until day after appraisal.

The rate they proposed for you was fixed, unlike a variable rate. You have the power to lock and have to tell them. Should they have explained that to you, yeah. But I think you might be conflating fixed rate product vs locking in your rate. Two totally different things.

Posted on 2/28/21 at 5:14 am to TigerDeBaiter

quote:

Should they have explained that to you, yeah.

All I’m saying. I understand fixed vs variable rates and how they’re applied relative to mortgages. I’m uninformed not uneducated.

Posted on 3/1/21 at 7:15 am to TigerDeBaiter

Very true, but who is offering ARM'S now? On the initial approval the loan officer should have stated that the rate is floating and the OP should have the option to lock or float.

If that conversation didn't happen that's on the loan officer (but ship has sailed).

If that conversation didn't happen that's on the loan officer (but ship has sailed).

Posted on 3/1/21 at 10:06 am to DiamondDog

quote:

Comes to find out, they don’t tell you that upfront.

He probably should have told you that, but wouldn't one of your first questions be "is this rate locked in, or what do i need to do to make sure I get this rate?"

Posted on 3/1/21 at 12:14 pm to DiamondDog

Were you harmed by the lender not locking in the rate? You would likely be furious if they locked without your consent and the rates went down.

A lender is not going to lock in an interest rate until they have a good idea they can close within 20-30 days. Yes, they do appear to have been working in your interest in this situation.

A lender is not going to lock in an interest rate until they have a good idea they can close within 20-30 days. Yes, they do appear to have been working in your interest in this situation.

Popular

Back to top

7

7