- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: How much do you have built up in CC points/rewards?

Posted on 3/7/23 at 8:50 am to NATidefan

Posted on 3/7/23 at 8:50 am to NATidefan

quote:

Spend 100 and get 5 dollars back (5%). You credit that to your statement and make another 100 dollar purchase (95 with your credit).

Interesting. It may be cc specific, but that's not how my cc works. When I apply to a statement credit, it comes across as if I paid it with cash myself.

Posted on 3/7/23 at 9:29 am to Billy Blanks

quote:

A what?

Minimum Spending Requirement

Basically the bonus you get with a new card after spending a certain amount within a certain amount of time.

Posted on 3/7/23 at 9:45 am to Weekend Warrior79

quote:

Interesting. It may be cc specific, but that's not how my cc works. When I apply to a statement credit, it comes across as if I paid it with cash myself.

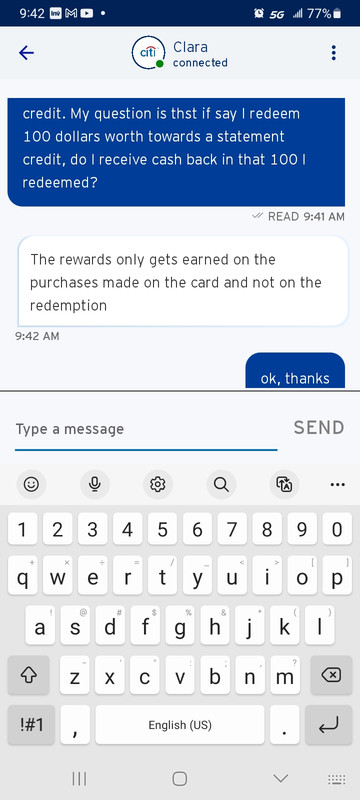

Possibly, I just asked about my citi double cash card.

Posted on 3/7/23 at 11:35 am to NATidefan

I just cashed mine out for my season tickets for next year. I usually don't let them go more than a year without cashing in my rewards, usually put the points/cash towards our big vacation.

I loved in when our son was in daycare because I could put that on the card and rack up the rewards quickly.

I loved in when our son was in daycare because I could put that on the card and rack up the rewards quickly.

Posted on 3/7/23 at 11:47 am to LSUcam7

quote:

Racking up CC points for the sake of the points is like sticking cash I’m under the mattress.

Depends on what you're saving them for. My dad saves up points on his GM card and uses them when he buys a new truck.

Posted on 3/7/23 at 1:50 pm to Billy Blanks

Just bought a retail business and we’re running inventory purchases through CC’s and paying off weekly. I’ve got 125k w/ AMEX Business Plus and about to have 200k w/ Chase Ink Business Premier.

Pretty much got the sign up bonus with both, and started using Chase mainly. Looks like I’m going to average 75-100k/mo going forward, but it’s honestly half arse overwhelming when you just browse different ways you can use them. Thought about going ahead and using what I’ve got for an office desktop, but looks like there’s more value in saving them for travel?

Pretty much got the sign up bonus with both, and started using Chase mainly. Looks like I’m going to average 75-100k/mo going forward, but it’s honestly half arse overwhelming when you just browse different ways you can use them. Thought about going ahead and using what I’ve got for an office desktop, but looks like there’s more value in saving them for travel?

Posted on 3/7/23 at 3:34 pm to Joshjrn

quote:

As for people getting Chase UR, I feel like I basically use that for Hyatt hotels 90% of the time Same for me, if not at a higher percentage. If Chase ever dropped Hyatt, I would probably just burn my points on a a few flights and then move to a different ecosystem. But Hyatt keeps me around

What’s your process for deciding how to transfer and use the UR points to Hyatt? I have a few hundred K UR and have only used them through the Chase travel portal.

Posted on 3/7/23 at 4:00 pm to prostyleoffensetime

quote:

but looks like there’s more value in saving them for travel?

IMO, the single best use is for international business class tickets. I just used 348000 Amex MR points for Emirates business class round trip from JFK to Milan. They're $8700 tickets so I obviously got a much better redemption than using them for goods.

This post was edited on 3/7/23 at 4:01 pm

Posted on 3/7/23 at 5:18 pm to Billy Blanks

No one would believe me lol.

This year alone, wife and I I have J/F flights to and from Vietnam/Singapore, Maldives, Turkey, Thailand/Dubai, Bali/Philippines.

This year alone, wife and I I have J/F flights to and from Vietnam/Singapore, Maldives, Turkey, Thailand/Dubai, Bali/Philippines.

Posted on 3/7/23 at 9:24 pm to achenator

quote:

What’s your process for deciding how to transfer and use the UR points to Hyatt? I have a few hundred K UR and have only used them through the Chase travel portal.

I think I understand what you’re asking, but if you’re asking a hotel selection question, I can address that in another post.

Basically, you look up the room and see what it would cost you to book it, including taxes and fees. Take that number and divide it by your rewards multiplier (1.25 for Preferred, 1.5 for Reserve, etc). That’s your travel portal number. Then go on Hyatt’s website and search the same room and make sure you click the box to show award options. Note how many points it requires.

UR transfers to Hyatt at a 1:1 ratio. So if a room costs $1,000, it would cost roughly 66k UR at my 1.5 multiplier. So if Hyatt points value it lower than that, it makes more sense to transfer to Hyatt and book from there. As a general rule, I only book through Hyatt if I’m getting at least a 2x value from just paying cash. If I’m getting less than that, I save the points.

But at nicer properties, it’s not uncommon for me to get 3-4x, which enables me to stay at properties that I would have a very hard time justifying spending the cash, even if I can afford it. The bed just feels softer if I spent 40k points per night instead of $1,500

This post was edited on 3/7/23 at 9:27 pm

Posted on 3/7/23 at 10:51 pm to Drizzt

quote:

There isn’t a price increase for flights booked close to the flight date.

Unless they are dynamically priced which most domestic airlines are doing. Hurts.

Posted on 3/7/23 at 10:59 pm to Joshjrn

Ya, it's not hard for me to get 3-4cpp for a few reasons.

1) I'm traveling with very young kids a lot so I'm getting suites to separate them from us so they'll sleep. Plus one room is crowded and a suite is approximately the same cost as connecting rooms and I don't need all those beds yet, though I'll do two rooms if I have to.

2) I book the nicest Hyatt I can find that gives me a suite, or is super expensive. Going to Cape Thompson on a few weeks where cash rate for base room is about $1k a night.

The combination of 1 and 2 is the suite I have for a week at the Grand Hyatt Kauai this summer. That one is probably at least 6 cpp right now.

my son isn't even in kindergarten sitting on 50,000 SW miles.

my son isn't even in kindergarten sitting on 50,000 SW miles.

1) I'm traveling with very young kids a lot so I'm getting suites to separate them from us so they'll sleep. Plus one room is crowded and a suite is approximately the same cost as connecting rooms and I don't need all those beds yet, though I'll do two rooms if I have to.

2) I book the nicest Hyatt I can find that gives me a suite, or is super expensive. Going to Cape Thompson on a few weeks where cash rate for base room is about $1k a night.

The combination of 1 and 2 is the suite I have for a week at the Grand Hyatt Kauai this summer. That one is probably at least 6 cpp right now.

This post was edited on 3/7/23 at 11:12 pm

Posted on 3/8/23 at 7:43 am to Teddy Ruxpin

Nice

Speaking of, you still working the game like the old days? I've found myself getting pretty stagnant on it for the last few years. Haven't applied for any new cards because none of the intro offers are interesting (other than the current 100k Ink Preferred offer, but I don't feel like chasing $15k worth of spend right now). Hell, I've paid the full annual fee on my CSR for the last couple of years. I feel like a peasant

Speaking of, you still working the game like the old days? I've found myself getting pretty stagnant on it for the last few years. Haven't applied for any new cards because none of the intro offers are interesting (other than the current 100k Ink Preferred offer, but I don't feel like chasing $15k worth of spend right now). Hell, I've paid the full annual fee on my CSR for the last couple of years. I feel like a peasant

Posted on 3/8/23 at 1:46 pm to Joshjrn

Not too hard. I'm about to type too much. Strap in.

1) my spend is generating enough points on its own. COVID plus having kids kept the need for even more points for international business class tickets depressed. This will change in a few years, and then I'll have to get more aggressive again if the market is still good.

2) Since I'm a two player household with the wife, I hit pretty much top end Plat and Gold bonuses during COVID, and that created about 800k points so ya, I'm good for now. Hell, burned 180k(ish?) with ANA (previous canceled COVID Japan trip) to use on Turkish to Croatia and still not a dent to my MRs.

3) I have about 400,000 AA miles because I was going to Myanmar on Cathay in Biz until my friend had a rare illness (he's fine) back in 2018. Might actually get to burn those on JAL soon.

4) Have over 100k each in United and I have 140k Alaska.

Basically I have so many random currencies I haven't burned yet and everything else (hotels) isn't that appealing with Hyatt being lucrative there hasn't been a need. I did have my wife refer me CSP as my four years were up, and I referred her a SW card recently. I also got caught in the SW Christmas fiasco and got another 100k from them so nothing to do there for now.

That Ink had me thinking though! I need to research that more (I have old "Bold" and Ink Cash for years). Like the no fee angle.

I can't justify CSR myself. The CSP and Unlimited offer 3x dining. I can get 4/5x airfare with other cards, and I can get 2x gas and at hotels if I pay for them, and I have a Hyatt card which is 5x for those so the difference is marginal in that travel category. I don't redeem for cash so the difference with CSP is null, and the other benefits I get somewhere else. Don't be a peasant!

Update: said screw it and got the business unlimited 90k offer. Figured if I didn't auto approve I'd just leave it alone. Auto approved

1) my spend is generating enough points on its own. COVID plus having kids kept the need for even more points for international business class tickets depressed. This will change in a few years, and then I'll have to get more aggressive again if the market is still good.

2) Since I'm a two player household with the wife, I hit pretty much top end Plat and Gold bonuses during COVID, and that created about 800k points so ya, I'm good for now. Hell, burned 180k(ish?) with ANA (previous canceled COVID Japan trip) to use on Turkish to Croatia and still not a dent to my MRs.

3) I have about 400,000 AA miles because I was going to Myanmar on Cathay in Biz until my friend had a rare illness (he's fine) back in 2018. Might actually get to burn those on JAL soon.

4) Have over 100k each in United and I have 140k Alaska.

Basically I have so many random currencies I haven't burned yet and everything else (hotels) isn't that appealing with Hyatt being lucrative there hasn't been a need. I did have my wife refer me CSP as my four years were up, and I referred her a SW card recently. I also got caught in the SW Christmas fiasco and got another 100k from them so nothing to do there for now.

That Ink had me thinking though! I need to research that more (I have old "Bold" and Ink Cash for years). Like the no fee angle.

I can't justify CSR myself. The CSP and Unlimited offer 3x dining. I can get 4/5x airfare with other cards, and I can get 2x gas and at hotels if I pay for them, and I have a Hyatt card which is 5x for those so the difference is marginal in that travel category. I don't redeem for cash so the difference with CSP is null, and the other benefits I get somewhere else. Don't be a peasant!

Update: said screw it and got the business unlimited 90k offer. Figured if I didn't auto approve I'd just leave it alone. Auto approved

This post was edited on 3/9/23 at 12:43 am

Posted on 3/9/23 at 12:46 pm to Billy Blanks

I've got about 200k with Amex, 180k with Delta, 400k with Bonvoy, and maybe 80k with Chase. No clue how I'm going to deploy them, but it will be fun. Probably Tokyo.

Posted on 3/9/23 at 12:58 pm to prostyleoffensetime

quote:

about to have 200k w/ Chase Ink Business Premier.

This is what we use so we can get the 3* points for shipping costs up to $150k spent. I'm about to hit the max amount in our 8th month

quote:

looks like there’s more value in saving them for travel

Just FYI, before you book your travel, if that's how you decide to spend it, shop around. We have a Marriott card and there are times where the hotels costs through the points is 15-20% higher than if we just decided to use the cc then reimburse ourselves through statement credits.

Posted on 3/10/23 at 7:05 pm to Weekend Warrior79

As of now $11,827.33 cash with capital one spark business card. Biggest check was $104,313.58. Since 2018, a little over 250K. I highly recommend this card.

This post was edited on 3/10/23 at 7:06 pm

Posted on 3/11/23 at 7:10 pm to Teddy Ruxpin

Just got my wifey the 90k offer a couple weeks ago.

Right now I have 1.5mm UR, 1.25mm MR, 200k TY, and multiple airlines with 100-150k miles (AS, KA, SW, UA, and Virgin). Have been focusing on Biz or 1st class flying only. I'm not purposely hoarding, I just earn more than I can spend right now, but with the numerous devals over the last few weeks it shows again it makes the most sense to spend them as quickly as you can.

BTW, since a lot of you are spending them on Hyatt, great choice, they will be raising rates pretty big at the end of the month. Hold some reservations by March 28th. All-ins are really getting hit big.

Right now I have 1.5mm UR, 1.25mm MR, 200k TY, and multiple airlines with 100-150k miles (AS, KA, SW, UA, and Virgin). Have been focusing on Biz or 1st class flying only. I'm not purposely hoarding, I just earn more than I can spend right now, but with the numerous devals over the last few weeks it shows again it makes the most sense to spend them as quickly as you can.

BTW, since a lot of you are spending them on Hyatt, great choice, they will be raising rates pretty big at the end of the month. Hold some reservations by March 28th. All-ins are really getting hit big.

Posted on 3/11/23 at 7:59 pm to Sho Nuff

I had stayed at a few of the American properties getting hit/already have a reservation (Park Hyatt Beaver Creek and Grand Hyatt Kauai for example).

I wasn't as upset about the deval. A lot made sense to me and most foreign properties weren't raised.

Chicago Athletic Club going up from 4 to 5 hurts, but that property was NOT a four to begin with.

I wasn't as upset about the deval. A lot made sense to me and most foreign properties weren't raised.

Chicago Athletic Club going up from 4 to 5 hurts, but that property was NOT a four to begin with.

Popular

Back to top

1

1