- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Fed hides weekly M1 supply, says "money doesn't matter"

Posted on 5/5/21 at 7:07 pm to Strannix

Posted on 5/5/21 at 7:07 pm to Strannix

Dude it's been explained ad nauseam I'm sorry that you haven't picked up on it. Extracting bonds from the market for bank reserves doesn't do anything to the real economy all other things equal. It just inflates bond prices.

Posted on 5/5/21 at 7:11 pm to Strannix

quote:

If 10 trillion isn't what figure would you say is? 50 trillion? 100 trillion?

QE =/= helicopter money

Posted on 5/5/21 at 7:12 pm to Strannix

quote:

Which should have been done in 2008, they're basically degenerate gamblers.

I don’t disagree there, although 2008 would have been early.

Posted on 5/5/21 at 7:29 pm to wutangfinancial

quote:

real economy

Please differentiate what the "not real" economy is, if it doesn't do anything then why do it?

This post was edited on 5/5/21 at 7:50 pm

Posted on 5/5/21 at 8:05 pm to RedStickBR

The financial economy absolutely effects the real economy

Posted on 5/5/21 at 8:12 pm to Strannix

That’s the Fed view. Where’s the evidence?

Posted on 5/5/21 at 8:14 pm to Strannix

quote:

I'll bump this when you all look like retards, Yellen and everyone at the fed are stupid idiots

I'm not a fan of Yellen but this is comical coming from you

Posted on 5/5/21 at 8:39 pm to Powerman

quote:

I'm not a fan of Yellen but this is comical coming from you

Coming from the dumbest poster on TD, low IQ prog

Posted on 5/5/21 at 8:42 pm to Strannix

The fact that you think I'm a prog is essentially proof of your idiocy

Posted on 5/5/21 at 8:47 pm to RedStickBR

quote:

That’s the Fed view.

The fed that brought us the 2008 meltdown?

Posted on 5/5/21 at 8:48 pm to Powerman

quote:

The fact that you think I'm a prog is essentially proof of your idiocy

And you either trying to pretend or even worse actually believing you aren't is proof of yours

Posted on 5/5/21 at 10:24 pm to Strannix

quote:

Tell that to Zimbabwe and Venezuela, this chicken will come home to roost.

Or maybe...just maybeeeee...these guys are walking a tightrope between inflation and deflation and might just pull off the greatest monetary policy feat of all time.

Just sayin. We knock these guys, but I’ve been waiting for inflation to reappear for a long time as well.

Posted on 5/5/21 at 10:43 pm to RedStickBR

quote:

Also, I ignored the second part of your quip as what has happened over the last DECADE is irrelevant to the tightening happening TODAY.

Am I wrong in that the reason lending decreases was because of the past 10 years they have been lending like crazy? All that debt. Crisis hits. No money left. Fed prints. It goes to banks.

Am I wrong here? Or are we acting like decreased velocity is because.......

I mean, to me it’s like we maxed out one credit card, get another (fed prints) max that out (fed prints) rinse repeat.

Of course lending tightens when you are over leveraged.

Posted on 5/5/21 at 10:49 pm to JayDeerTay84

a can of coke will cost $20 and redstick would still be out saying we are worried about deflation

Posted on 5/5/21 at 11:13 pm to TDFreak

quote:

these guys are walking a tightrope between inflation and deflation and might just pull off the greatest monetary policy feat of all time.

the end game is binary though

1. deflationary collapse

2. continued monetary expansion

Posted on 5/6/21 at 3:17 am to TDFreak

quote:

Or maybe...just maybeeeee...these guys are walking a tightrope between inflation and deflation and might just pull off the greatest monetary policy feat of all time.

Interestingly enough that tightrope always leans toward never ending inflation to make their endless piggy bank money easier to print....

Posted on 5/6/21 at 8:18 am to Strannix

The never ending inflation was because of population growth and a growing labor force with rapidly increasing productivity. Precisely when the monetary base should be growing in theory.

Posted on 5/6/21 at 8:30 am to rocket31

quote:

a can of coke will cost $20 and redstick would still be out saying we are worried about deflation

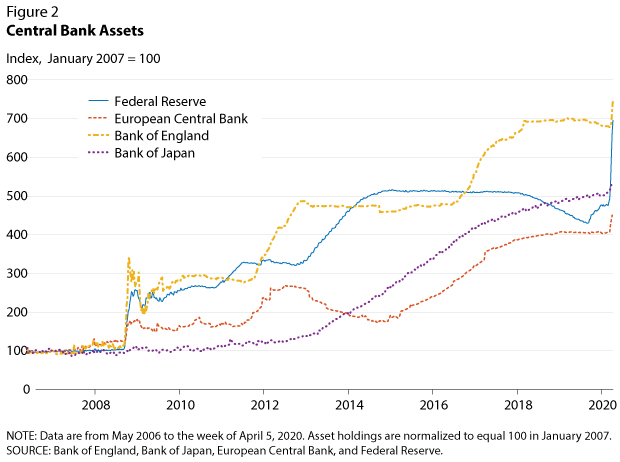

Please show me any developed world economy (ECB, BOE, Fed, BOJ) who has experienced any sustained inflation (let’s call that 2% or more). Here are the balance sheets. You show me the inflation.

Posted on 5/6/21 at 8:50 am to RedStickBR

But muh house prices and muh healthcare costs that I don't pay for and muh education vacation costs!

Back to top

2

2