- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

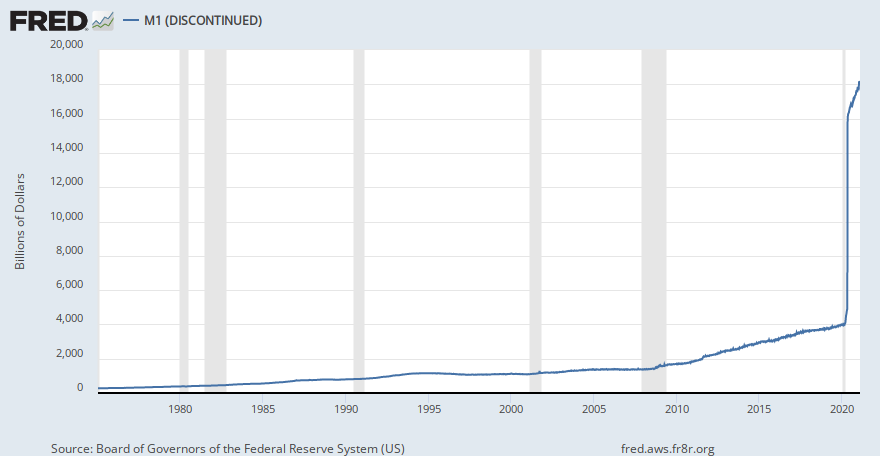

Fed hides weekly M1 supply, says "money doesn't matter"

Posted on 4/8/21 at 5:50 am

Posted on 4/8/21 at 5:50 am

quote:

In response to a questions posed by Congressman Warren Davidson about whether “M2 [money supply] going up by 25% in one year” is going to “diminish the value of the U.S. dollar,” Powell responded, “there was a time when monetary policy aggregates were important determinants of inflation and that has not been the case for a long time.”

Powell added that “the correlation between different aggregates [like] M2 and inflation is just very, very low, and you see that now where inflation is at 1.4% for this year. Inflation dynamics evolve over time, but they don’t tend to change overnight.”

Tell that to Zimbabwe and Venezuela, this chicken will come home to roost.

This post was edited on 4/8/21 at 5:54 am

Posted on 4/8/21 at 6:07 am to Strannix

How do people this clueless get one of the most important jobs on the planet?

It's not a matter of if, but when.

Their goal is a global government and global currency. It is even biblical.

quote:

this chicken will come home to roost.

It's not a matter of if, but when.

Their goal is a global government and global currency. It is even biblical.

Posted on 4/8/21 at 6:27 am to tenderfoot tigah

Nah nah nah!

Or as Simple Joe might say, this is Keynes on steroids

This post was edited on 4/8/21 at 6:28 am

Posted on 4/8/21 at 6:38 am to Strannix

quote:

Powell added that “the correlation between different aggregates [like] M2 and inflation is just very, very low, and you see that now where inflation is at 1.4% for this year. Inflation dynamics evolve over time, but they don’t tend to change overnight.”

He’s not wrong. Are you suggesting he is?

You need actual velocity of money to trigger traditional inflation, and then you need that velocity to be maintained for it to be long lasting inflation.

People have been worrying about runaway inflation since 2009 and it simply hasn’t even come close to materializing in this country.

Posted on 4/8/21 at 6:42 am to slackster

quote:

trigger traditional inflation, and then you need that velocity to be maintained for it to be long lasting inflation.

it's quite amusing you think there's an actual correct way to calculate inflation in the first place when the models are constantly changing

I swear people's minds on fiat is a disease

Posted on 4/8/21 at 6:55 am to Strannix

from a purely non-academic view, it seems that the argument is "we have to create massive inflation to prevent deflation" and that's somewhat scary because (1) it seems to be manipulating and ignoring the natural state of the economy and (2) if that underlying deflationary state ever does resolve, then we are looking at hyperinflation

this seems how you get to crazy economic situations like today with our insanely (paper) wealthy top-level with real wage stagnation....and a society that has an ever-decreasing portion of the population that can afford to buy housing, yet housing prices have skyrocketed.

it's pretty clear that this monetary policy just gives certain populations this money and it's going into relatively specific things (like premier stocks and housing) and if you're not on the gravy train, you're fricked, b/c it certainly isn't going into developing an economy that is better or produces more, raising wages.

this seems how you get to crazy economic situations like today with our insanely (paper) wealthy top-level with real wage stagnation....and a society that has an ever-decreasing portion of the population that can afford to buy housing, yet housing prices have skyrocketed.

it's pretty clear that this monetary policy just gives certain populations this money and it's going into relatively specific things (like premier stocks and housing) and if you're not on the gravy train, you're fricked, b/c it certainly isn't going into developing an economy that is better or produces more, raising wages.

Posted on 4/8/21 at 6:58 am to slackster

quote:

People have been worrying about runaway inflation since 2009 and it simply hasn’t even come close to materializing in this country.

if the underlying fundamentals would predict inflation and it hasn't happened over this decade-ish period, you have to ask, "why not?"

are we living in a neo-economy where traditional fundamentals no longer exist? if so, what is the extent of our society's ability to exist on fake/printed money?

is there massive inflation, just not across the board?

is there actual inflation, just inflation over deflating assets?

etc.

Posted on 4/8/21 at 6:59 am to slackster

quote:

He’s not wrong. Are you suggesting he is?

Posted on 4/8/21 at 7:39 am to slackster

quote:

People have been worrying about runaway inflation since 2009 and it simply hasn’t even come close to materializing in this country.

In terms of CPI? No. In terms of housing and the stock market, absolutely it has.

Asset class inflation like this only serves to increase wealth inequality and in my view it absolutely does reduce faith in the USD, which will reduce the demand for treasury bonds, which will create a positive feedback loop in which our ability to raise capital comes more from the creation of money rather than the borrowing of it, which will absolutely eventually be an inflationary risk.

Posted on 4/8/21 at 7:43 am to rocket31

quote:

it's quite amusing you think there's an actual correct way to calculate inflation in the first place when the models are constantly changing

attempting to model inflation as a scalar number seems inherently incorrect to me, or at least very flawed

I get there are multiple ways to compute it like core CPI versus CPI but the velocity of money term slackster mentioned is drastically different depending on what asset or good you are looking at

Posted on 4/8/21 at 7:45 am to SlowFlowPro

quote:

from a purely non-academic vie

That is the academic view

Posted on 4/8/21 at 7:53 am to Ross

quote:

which will reduce the demand for treasury bonds, which will create a positive feedback loop in which our ability to raise capital comes more from the creation of money rather than the borrowing of it, which will absolutely eventually be an inflationary risk.

So you're on the insolvency train? I heard somebody do back napkin math on the corporate sector. If we go back to late 2000s interest rate levels corporate profits take a 33% haircut without even considering credit deterioration and the inability for companies to roll their debt at those levels

Posted on 4/8/21 at 7:55 am to wutangfinancial

I get that interest rates increasing creates short term pain in the stock market, but what I just described sounds inherently unsustainable to me and our historical models seem like they are flawed because of the unprecedented capital generation we saw last year.

And I just don’t know how long you can expect institutions to put meaningful amounts of their treasury reserve in an treasury note with negative real yield tbh, when a host of equities seem incapable of meaningfully decreasing in value with this new paradigm and have much better real yield compared to the cost of capital.

Sounds to me like bad fiscal policy got us stuck between a rock and a hard place

And I just don’t know how long you can expect institutions to put meaningful amounts of their treasury reserve in an treasury note with negative real yield tbh, when a host of equities seem incapable of meaningfully decreasing in value with this new paradigm and have much better real yield compared to the cost of capital.

Sounds to me like bad fiscal policy got us stuck between a rock and a hard place

This post was edited on 4/8/21 at 8:02 am

Posted on 4/8/21 at 8:03 am to Ross

quote:

n terms of CPI? No. In terms of housing and the stock market, absolutely it has.

Asset class inflation like this only serves to increase wealth inequality and in my view it absolutely does reduce faith in the USD, which will reduce the demand for treasury bonds, which will create a positive feedback loop in which our ability to raise capital comes more from the creation of money rather than the borrowing of it, which will absolutely eventually be an inflationary risk.

People forget the USD and treasuries don’t exist in a bubble. Restive to the rest of the world the USD and treasuries are very strong and in very high demand.

Posted on 4/8/21 at 8:08 am to rocket31

quote:

it's quite amusing you think there's an actual correct way to calculate inflation in the first place when the models are constantly changing

I swear people's minds on fiat is a disease

Says the guy who calculates his crypto growth relative to fiat.

This post was edited on 4/8/21 at 8:08 am

Posted on 4/8/21 at 8:17 am to slackster

I obviously don’t share your faith in this entire fiat system as is currently constructed and its long term viability because I think people and institutions will choose to opt out of bonds in favor of stronger assets, but projections are hard and you may end up being correct.

You’ve seen me post here, so you probably know I think an asset class like BTC has the ability to gobble up treasury bonds in people’s and institutions’ portfolios. But even if it isn’t BTC, some other nonsovereign store of value that people trust more than the bond seems inevitable to me. I just personally think BTC is the most robust of these assets.

For the record, it’s not like I actually want to be right about this

You’ve seen me post here, so you probably know I think an asset class like BTC has the ability to gobble up treasury bonds in people’s and institutions’ portfolios. But even if it isn’t BTC, some other nonsovereign store of value that people trust more than the bond seems inevitable to me. I just personally think BTC is the most robust of these assets.

For the record, it’s not like I actually want to be right about this

Posted on 4/8/21 at 8:20 am to Ross

quote:

Sounds to me like bad fiscal policy got us stuck between a rock and a hard place

It's actually bad monetary and fiscal policy in unison. You can't target stable prices and low unemployment by mandate and NOT concentrate wealth like we have. You need the volatility and creative destruction that comes with it to prevent the situation we're in. Something like 20% of the S&P are zombies but survive insolvency by rolling debt at rates their credit shouldn't allow them to. Luckily the entire global banking system relies on our Treasuries. We're just weak minded people in general. In 01 nobody noticed, in 08 people would have cried with a corporate bailout and cried more without one. In 19 there would have been riots if the public knew and in 20 nobody cares because stimi payments. All creating the zombie economy we probably won't ever escape. Adding the human element of politics makes everything so much worse.

Posted on 4/8/21 at 8:31 am to wutangfinancial

quote:

Luckily the entire global banking system relies on our Treasuries.

I agree with your entire post - but I’m not so sure that this sentence or the sentiment that the petrodollar guaranteed USD supremacy are going to be valid sentiments for another decade.

opinions may vary, but I disagree with Powell that there are no consequences for debasing your currency. It starts with artificially propping up the stock market and concentrating wealth, but I think it ends with people opting out of your bonds and ultimately your currency if you push hard enough and let the positive feedback loop go forever.

Just my opinion. Engineer by trade, with only a passing interest in the financial sector so I’m sure my analysis will have flaws.

Posted on 4/8/21 at 8:32 am to slackster

quote:If it isn't inflation, what do we call the increase in price of the following over the past decade:

slackster

Food

Housing

Medical costs

Education

Memorabilia

Childcare

And more recently:

Commodities

Posted on 4/8/21 at 8:33 am to slackster

quote:

He’s not wrong. Are you suggesting he is?

Then what dictates $1.2T spending bill or $4.5T spending bill? Why not $100T? Why doesn’t the gvt just give half the country $1m a year?

Popular

Back to top

11

11