- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Explain federal tax brackets to me...

Posted on 7/15/22 at 10:09 am

Posted on 7/15/22 at 10:09 am

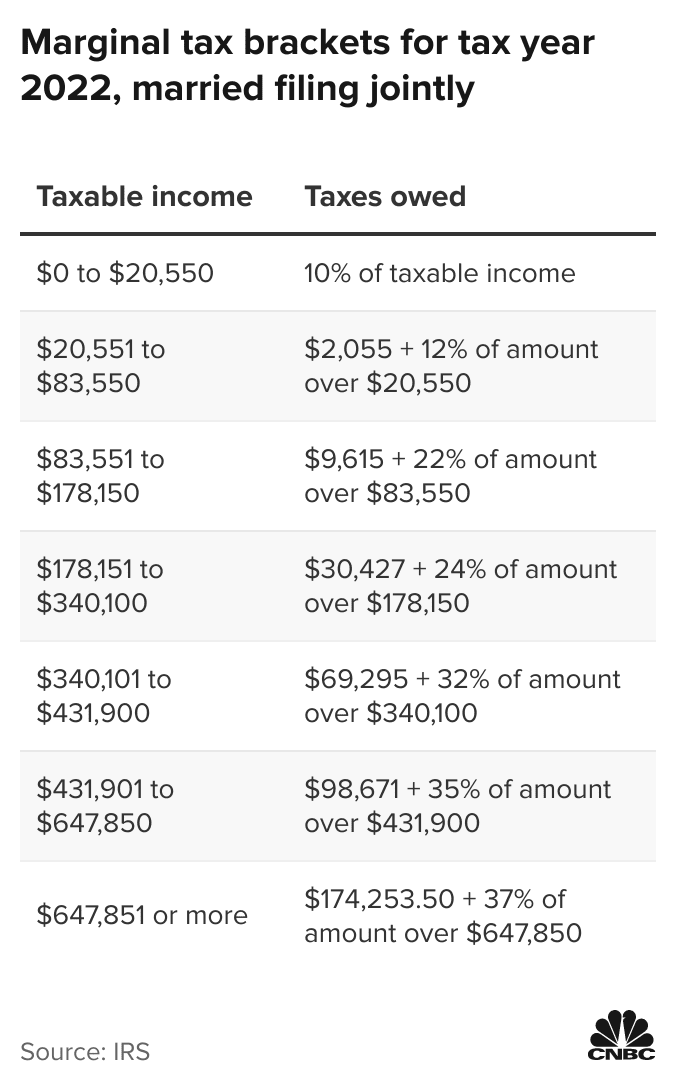

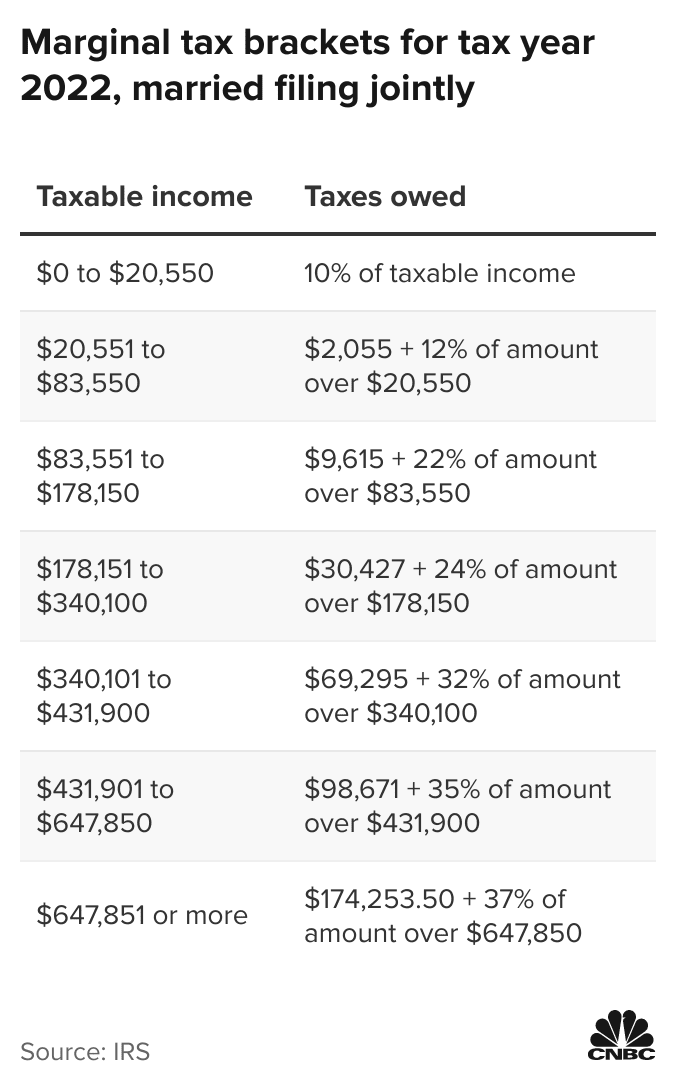

i was one of the dumb ones, and assumed my annual gross income was taxed under one percentage bracket. i've since learned that's not the case as you're taxed in each bracket until you've maxed it out and moved one to the next bracket. however, one thing is still confusing me.

the different percentages/brackets:

do they include just the withholding tax, or do those percentages include social security and medicare as well?

and to clarify, this is just your standard basic income. nothing more.

we're in the mid-year, and i'm trying to calc whether my wife an i are on track for the year. we screwed up last year by not checking the "married filing jointly" step 2 checkbox with our employer when we got married and ended up having to pay $7k.

the different percentages/brackets:

do they include just the withholding tax, or do those percentages include social security and medicare as well?

and to clarify, this is just your standard basic income. nothing more.

we're in the mid-year, and i'm trying to calc whether my wife an i are on track for the year. we screwed up last year by not checking the "married filing jointly" step 2 checkbox with our employer when we got married and ended up having to pay $7k.

Posted on 7/15/22 at 10:28 am to finchmeister08

quote:

we're in the mid-year, and i'm trying to calc whether my wife an i are on track for the year. we screwed up last year by not checking the "married filing jointly" step 2 checkbox with our employer when we got married and ended up having to pay $7k.

Married filing jointly wouldn’t have helped you fill that gap in withholding.

The only tax that counts for federal income tax is the federal income tax withholding. OASDI (social security and Medicare) doesn’t count for your federal tax withholding.

Why don’t you post a rough amount of your household taxable income YTD and your household federal withholding and we’ll see how on track you are. Or, hire a CPA.

Posted on 7/15/22 at 10:34 am to finchmeister08

FICA (social security/medicare) is in addition to your income tax; it's not included in the bracket rates.

Also, you're not taxed on gross wages - you would have to figure out your taxable wages, which will be gross wages less any pretax deductions for health insurance, 401k, etc. Assuming you don't itemize deductions, reduce that amount by $25,900 for your standard deduction (if filing jointly) to get your taxable income. Once you have that number, you can plug it into the tax table and figure out what your actual tax bill will be and if you're on target with your withholdings.

Also, you're not taxed on gross wages - you would have to figure out your taxable wages, which will be gross wages less any pretax deductions for health insurance, 401k, etc. Assuming you don't itemize deductions, reduce that amount by $25,900 for your standard deduction (if filing jointly) to get your taxable income. Once you have that number, you can plug it into the tax table and figure out what your actual tax bill will be and if you're on target with your withholdings.

This post was edited on 7/15/22 at 10:37 am

Posted on 7/15/22 at 10:46 am to Brummy

Payroll withholding calculations are dumb systems. They don’t consider what you’ve been paid already, nor do they consider what you will be paid. They take your paycheck frequency and multiply your taxable income by that amount to derive your annual income estimate for the appropriate withholding.

For example - If you’re paid twice a month and one check is a commission check ($10,000) while the other is a draw ($1,000), they may withhold nothing from the draw check (annual income of $24,000 would have no tax liability for a married couple) and way too much from the commission check (annual income of $240,000 would require $39,000 in withholding, so $1625/chk on those 12 checks). You’d end up withholding nearly $5k more than your actually liability on your $132,000 of income as a result.

You can fine tune W-4s if you’re into that sort of thing - I am.

For example - If you’re paid twice a month and one check is a commission check ($10,000) while the other is a draw ($1,000), they may withhold nothing from the draw check (annual income of $24,000 would have no tax liability for a married couple) and way too much from the commission check (annual income of $240,000 would require $39,000 in withholding, so $1625/chk on those 12 checks). You’d end up withholding nearly $5k more than your actually liability on your $132,000 of income as a result.

You can fine tune W-4s if you’re into that sort of thing - I am.

Posted on 7/15/22 at 11:50 am to Brummy

My income tax burden sickens me.

When I include SS, Medicare, sales, property, utility, gas, and state taxes, my wife and I pay more in taxes than the median American household income.

They say people aren’t paying their fair share and I agree… I’m paying a wholly unfair share of taxes.

When I include SS, Medicare, sales, property, utility, gas, and state taxes, my wife and I pay more in taxes than the median American household income.

They say people aren’t paying their fair share and I agree… I’m paying a wholly unfair share of taxes.

Posted on 7/15/22 at 12:21 pm to fjlee90

Actually, sounds like you are paying your fair share. Congrats on being rich.

Posted on 7/15/22 at 12:29 pm to fjlee90

What sucks is that people with “nothing” that don’t work get like 10k a month in food stamps and welfare and drive brand new cars and jet skis while people in a “high tax bracket” have to work all the time and eat cat food just to get by

There’s no such thing as middle class. Either you’re Jeff bezos and eat steak and lobster every night and don’t pay taxes or you’re “poor” and eat steak and lobster every night and don’t pay taxes or you’re a taxpayer and live in poverty

The only reason they call it the middle is because you’re getting screwed on both ends

There’s no such thing as middle class. Either you’re Jeff bezos and eat steak and lobster every night and don’t pay taxes or you’re “poor” and eat steak and lobster every night and don’t pay taxes or you’re a taxpayer and live in poverty

The only reason they call it the middle is because you’re getting screwed on both ends

Posted on 7/15/22 at 12:31 pm to fjlee90

quote:My quarterly payments are 10k more than my annual salary at my first job. I despise the federal govt, all of them regardless of party. They can all go to hell.

When I include SS, Medicare, sales, property, utility, gas, and state taxes, my wife and I pay more in taxes than the median American household income.

They say people aren’t paying their fair share and I agree… I’m paying a wholly unfair share of taxes.

Posted on 7/15/22 at 12:39 pm to weeniedawg

quote:

weeniedawg

Mississippi St. Fan

Member since Oct 2019

3 posts

Post less

Posted on 7/15/22 at 1:16 pm to el Gaucho

quote:

What sucks is that people with “nothing” that don’t work get like 10k a month in food stamps and welfare and drive brand new cars and jet skis while people in a “high tax bracket” have to work all the time and eat cat food just to get by

Posted on 7/15/22 at 1:24 pm to finchmeister08

quote:No they do not.

or do those percentages include social security and medicare as well?

The hardest is figuring out your taxable income. Past that, it's pretty straightforward

This post was edited on 7/15/22 at 1:28 pm

Posted on 7/15/22 at 3:39 pm to finchmeister08

Here is an example of how Federal and payroll taxes would be calculated on $200k of TAXABLE income. This is called a "progressive" tax system. You are taxed at a progressively higher rate but only on income in that higher range.

ETA: Payroll tax rates double if you're self-employed.

ETA: Payroll tax rates double if you're self-employed.

This post was edited on 7/15/22 at 3:40 pm

Posted on 7/15/22 at 4:50 pm to finchmeister08

Posted on 7/15/22 at 8:36 pm to fjlee90

quote:

They say people aren’t paying their fair share and I agree… I’m paying a wholly unfair share of taxes.

Something like 50% of people didn’t pay federal income tax in 2021. That’s mostly due to COVID but it’s normally around 40%.

And a majority of those were not rich people.

But no one understands their taxes because they’re too lazy to look so the line “get the rich to pay their fair share” will always work.

This post was edited on 7/15/22 at 8:39 pm

Posted on 7/15/22 at 9:06 pm to Brummy

That’s an unbelievably depressing chart.

I’ve always said if I could make one single change in this country I’d eliminate payroll tax deductions.

You should be forced to write a check once a year for the full amount you owe.

It’s easy to forget or ignore how much you actually pay in taxes when it’s simply auto-deducted from your auto-deposited paychecks.

If once a year you had to write a check for 30-40% of your entire income you’d be much much more involved in politics and pay much more attention to whom you vote for and why.

I’ve always said if I could make one single change in this country I’d eliminate payroll tax deductions.

You should be forced to write a check once a year for the full amount you owe.

It’s easy to forget or ignore how much you actually pay in taxes when it’s simply auto-deducted from your auto-deposited paychecks.

If once a year you had to write a check for 30-40% of your entire income you’d be much much more involved in politics and pay much more attention to whom you vote for and why.

Posted on 7/15/22 at 9:09 pm to weeniedawg

quote:

Actually, sounds like you are paying your fair share. Congrats on being rich.

I work a minimum of 3 month a year directly for the federal government with no income and no say in how that money is spent with heavy penalties if I refuse to pay.

That’s called slavery.

This post was edited on 7/15/22 at 11:29 pm

Posted on 7/15/22 at 9:21 pm to Chef Free Gold Bloom

quote:

That’s an unbelievably depressing chart.

Its outright depressing to even look at that chart. Makes me sick..

Posted on 7/15/22 at 10:16 pm to Chef Free Gold Bloom

quote:

It’s called taxation without representation.

You live in DC?

Posted on 7/16/22 at 7:04 am to Chef Free Gold Bloom

quote:

work a minimum of 3 month a year directly for the federal government

It's true, but damn that is such a depressing way to look at it.

Posted on 7/16/22 at 1:54 pm to DownshiftAndFloorIt

One more question fellas. At what point would the standard deduction be calc’d into the equation?

For 2022, I think it’s 25,900.

For 2022, I think it’s 25,900.

Popular

Back to top

5

5