- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Coinbase facing legal reckoning as early as this week

Posted on 3/25/23 at 5:48 pm

Posted on 3/25/23 at 5:48 pm

quote:

Coinbase has taken an increasingly defiant stance, publicly criticizing the SEC and urging regulators to write new rules for crypto rather than enforce existing ones. Coming into SEC compliance, the firm says, would effectively mean shutting down its business.

quote:

Since 2021, Mr. Gensler has warned platforms such as Coinbase that they were breaking the law by letting investors trade cryptocurrencies that should have been registered as securities, the legal category that includes stocks and bonds. He has demanded the firms comply with SEC rules by registering as securities exchanges and separating parts of their business that create potential conflicts of interest.

quote:

If it registered as a securities exchange, as Mr. Gensler has demanded, Coinbase would be able to list only SEC-registered securities. Yet no prominent cryptocurrencies—nor any of the 242 assets currently listed on Coinbase—are currently registered with the agency.

quote:

the formal process that began this week could potentially end in a court’s ordering Coinbase to shutter or restructure significant parts of its business in the U.S.

WSJ Source

Good luck to those whose who still have assets on this platform.

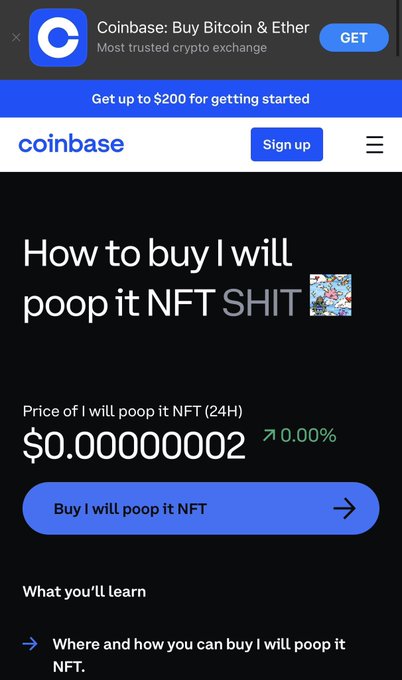

My favorite Response

This post was edited on 3/25/23 at 6:07 pm

Posted on 3/25/23 at 6:04 pm to UltimaParadox

Will this crash crypto

Posted on 3/25/23 at 6:09 pm to thelawnwranglers

Will a lot less people buy/sell crypto. Yes, but that was already a small percentage of people anyways.

Will it crash the price, I doubt it. Tether (USDT) has been printing like crazy. Market cap has increased by almost 15B since December.

I am sure they have all those real dollars back it up

Will it crash the price, I doubt it. Tether (USDT) has been printing like crazy. Market cap has increased by almost 15B since December.

I am sure they have all those real dollars back it up

This post was edited on 3/25/23 at 6:11 pm

Posted on 3/25/23 at 6:11 pm to UltimaParadox

Even if your crypto survives the gauntlet and doesn’t vanish over night remind me again what we’re going to do with it down the road?

Posted on 3/25/23 at 6:14 pm to rocksteady

They can kill all the on/off ramps like exchanges but they cant kill P2P with other crypto enthusiasts just like today. I know no one actually does that and everyone hodls it hoping it goes back up in value so they can unload it on the next guy for a nice gain on an exchange.

This post was edited on 3/25/23 at 6:14 pm

Posted on 3/25/23 at 6:19 pm to UltimaParadox

Is this where everyone on MT who’s salty about crypto cheers on Gary Gensler and the Biden Administration?

Posted on 3/25/23 at 6:49 pm to UltimaParadox

It's fricked up that coinbase has begged and begged for government guidance, and instead they recieved a long silence followed by legal action.

This post was edited on 3/25/23 at 6:50 pm

Posted on 3/25/23 at 9:27 pm to UltimaParadox

quote:

UltimaParadox

You're creaming your panties with excitement. Congratulations.

Posted on 3/25/23 at 10:05 pm to BottomlandBrew

quote:Yea, whether or not you support crypto, you're an idiot if you're backing up the SEC on this.

It's fricked up that coinbase has begged and begged for government guidance, and instead they recieved a long silence followed by legal action.

The people leading our financial systems are a joke. Crypto is going nowhere. Just because one doesn't understand it, doesn't mean you have to hate it.

Posted on 3/25/23 at 10:09 pm to saint tiger225

I agree. The tards cheering on the SEC for this are beyond stupid

Posted on 3/25/23 at 10:45 pm to UltimaParadox

Explain like I’m 5 why it’s illegal to facilitate the buying/selling of strings of digital code?

This post was edited on 3/25/23 at 10:46 pm

Posted on 3/26/23 at 6:48 am to Jon Ham

Because what that code accomplishes arguably fits within the definition of a security.

You can oversimplify anything for rhetoric sake: ELI5 why it's illegal to facilitate the buying selling of this piece of dead tree with writing on it.(Because it's still a security).

You can oversimplify anything for rhetoric sake: ELI5 why it's illegal to facilitate the buying selling of this piece of dead tree with writing on it.(Because it's still a security).

Posted on 3/26/23 at 7:17 am to UltimaParadox

quote:

l P2P with other crypto enthusiasts

quote:

so they can unload it on the next guy for a nice gain on an exchange.

Are you set up to exchange foreign currency for USD and then explain how you came upon the money?

They are attacking the ways to convert crypto into actual USD. You do that and crypto craters (as an asset, which may stabilize it to be used P2P, making it, ironically, less like a security).

Posted on 3/26/23 at 7:28 am to BigHusky

quote:

BigHusky

Guessing you hold assets on Coinbase. I think you would be crazy not to pull them off as soon as possible. If they go bankrupt they own those assets not you. It is clearly spelled out in the terms of service.

Posted on 3/26/23 at 7:30 am to Jon Ham

quote:

Explain like I’m 5 why it’s illegal to facilitate the buying/selling of strings of digital code?

I can't do that but THIS is the statutory (not even regulatory or judicial) definition of "security"

quote:

The term “security” means any note, stock, treasury stock, security future, security-based swap, bond, debenture, evidence of indebtedness, certificate of interest or participation in any profit-sharing agreement, collateral-trust certificate, preorganization certificate or subscription, transferable share, investment contract, voting-trust certificate, certificate of deposit for a security, fractional undivided interest in oil, gas, or other mineral rights, any put, call, straddle, option, or privilege on any security, certificate of deposit, or group or index of securities (including any interest therein or based on the value thereof), or any put, call, straddle, option, or privilege entered into on a national securities exchange relating to foreign currency, or, in general, any interest or instrument commonly known as a “security”, or any certificate of interest or participation in, temporary or interim certificate for, receipt for, guarantee of, or warrant or right to subscribe to or purchase, any of the foregoing.

VERY wide range of stuff falls under that definition.

Gensler can't actually answer your question in a detailed way

quote:

“A really important question is whether a cryptocurrency is a security for regulatory purposes under the Howey or some other tests. Based on your public statements, it’s pretty clear that you believe that some are securities, but others are not. So I’m frustrated by the lack of helpful SEC public guidance, explaining how you make this distinction. What makes some of them securities, while others are not securities,” Toomey asked in his opening remarks.

For his part, Gensler said in his remarks that “a small number” of cryptocurrencies are not securities, but he believes many are.

Her is an article by Biglaw (aka smart people) on the issues with using Reeves to regulate crypto

quote:

Second, assuming the instrument does not bear a strong resemblance to one of those categories, the presumption may yet be rebutted if the balance of four factors indicates the note is not a security. Those factors are:

The motivations of the buyer and seller: “If the seller’s purpose is to raise money for the general use of a business enterprise or to finance substantial investments and the buyer is interested primarily in the profit the note is expected to generate, the instrument is likely to be a ‘security.’”[11]

The plan of distribution: If there is “common trading for speculation or investment” in the note, it is more likely to be a security.[12]

The reasonable expectations of the investing public: If the public reasonably considers the notes to be securities, the Court may consider them as such despite a different economic reality.[13]

Risk-reducing considerations: If some factor reduces the risk of investment, like an alternative regulatory scheme or underlying collateral, such that application of the securities laws is unnecessary, the instrument may not be a security.[14]

quote:

While the legal analysis is fact-specific (and not very clear), it centers on one main question: Is the instrument both sold and purchased as an investment?

Analysis from a crypto case from 2021:

quote:

The SEC then found further that the mTokens were securities under Reves. In its view, all four factors favored that result: (1) the mTokens were sold “to raise funds” for DMM’s business (purchasing income-generating assets and building out its smart contracts) and were purchased as investments (to generate interest from DMM’s investments); (2) the tokens were sold to the general public; (3) DMM promoted mTokens as investments; and (4) no factor reduced the risk of the tokens.[32]

The writer's analysis:

quote:

That same problem makes it difficult to analyze these functions under Reves’ multi-factor test. As noted, Reves analyzes whether a particular note is bought and sold as an investment. But in many DeFi protocols, a buyer-seller or investor-investee relationship is hard to identify. Even assuming the buyer is primarily interested in profit, a particular seller or entity raising money “for the general use of a business enterprise or to finance substantial investments”[35] may be absent. Often a party transacts directly with a liquidity pool operated by a smart contract, which is just computer code deployed to a blockchain. In fulfilling that function, the protocol does not appear to be “rais[ing] capital for its general business operations.”[36] And in that regard, the protocol does not appear to act as the kind of seller that concerns the securities laws: the transaction does not implicate the kind of information asymmetry or duty of disclosure that might traditionally exist between an issuer and a buyer, which is an animating concern of securities laws.[37]

Posted on 3/26/23 at 7:51 am to SlowFlowPro

SEC gave a talk on this subject back in Sept 2022.

SEC.gov from Sept 8th 2022

It is clear the SEC believes most of these crytoassests are securities. So therefore unless Coinbase wants to fight that every token it lists is not a security, they are basically going to need to register. However every knows they don't want to do that because they would have to remove their staking service. Without their staking service everyone will leave their platform.

Considering the NY AG is also suing KuCoin and alleging that ETHis a security as well. Coindesk source

quote:

Why do I think a majority of crypto tokens are securities? As Justice Thurgood Marshall put it in describing the scope of the securities laws, Congress painted the definition of a security “with a broad brush.”[3] He further stated, “Congress’ purpose in enacting the securities laws was to regulate investments, in whatever form they are made and by whatever name they are called.”[4] In general, the investing public is buying or selling crypto security tokens because they’re expecting profits derived from the efforts of others in a common enterprise.

quote:

Some in the crypto industry have called for greater “guidance” with respect to crypto tokens. For the past five years, though, the Commission has spoken with a pretty clear voice here: through the DAO Report, the Munchee Order, and dozens of Enforcement actions, all voted on by the Commission.[8] Chairman Clayton often spoke to the applicability of the securities laws in the crypto space.[9] Not liking the message isn’t the same thing as not receiving it.

quote:

Given that many crypto tokens are securities, it follows that many crypto intermediaries are transacting in securities and have to register with the SEC in some capacity.[18] Crypto intermediaries — whether they call themselves centralized or decentralized (e.g., DeFi) — often are an amalgam of services that typically are separated from each other in the rest of the securities markets: exchange functions, broker-dealer functions, custodial and clearing functions, and lending functions.

quote:

Finally, many crypto intermediaries provide lending functions for a return.[19] Make no mistake: If a lending platform is offering and selling securities, it too comes under SEC jurisdiction.

SEC.gov from Sept 8th 2022

It is clear the SEC believes most of these crytoassests are securities. So therefore unless Coinbase wants to fight that every token it lists is not a security, they are basically going to need to register. However every knows they don't want to do that because they would have to remove their staking service. Without their staking service everyone will leave their platform.

Considering the NY AG is also suing KuCoin and alleging that ETHis a security as well. Coindesk source

Posted on 3/26/23 at 8:11 am to UltimaParadox

quote:Sounds like what I do with my stocks on Fidelity

everyone hodls it hoping it goes back up in value so they can unload it on the next guy for a nice gain on an exchange.

Posted on 3/26/23 at 8:15 am to TigerTatorTots

quote:

"legal reckoning"

Hey it is WSJ, what do you expect.

That being said, I do think if Coinbase does try to fight the SEC in court and losses that is probably the end for them. They were already losing money. Staking especially via the now free-falling USDC and ETH was basically their only growth spot.

This post was edited on 3/26/23 at 8:18 am

Posted on 3/26/23 at 8:16 am to TigerTatorTots

quote:

Sounds like what I do with my stocks on Fidelity

And those are registered securities

Popular

Back to top

9

9