- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

BofA now expects 2Q GDP to decline 40%, instead of previous -30% projection.

Posted on 5/21/20 at 10:28 am

Posted on 5/21/20 at 10:28 am

quote:

A three-phase recession will be 'unlike anything we have seen in modern history'

by Myles Udland

May 21, 2020

It’s a long road ahead for the U.S. economy

As of Wednesday, all 50 states had begun to loosen coronavirus-related restrictions in some form or fashion. But the road ahead for the U.S. economy coming out of this pandemic induced recession is a long one.

And according to economists at Bank of America Global Research, things will be even more challenging than initially thought.

“The damage to the economy from this historic shock has been hard to grasp,” the firm wrote in a note to clients published Wednesday. “Indeed, we now believe we have understated the extent of the decline and are revising down the path of GDP.”

The firm now sees the recession playing out in three phases: lockdown, transition, and recovery.

...

In the second quarter, BofA now expects GDP to decline at an annualized rate of 40%, up from its prior estimate of a 30% annualized drop in activity. The firm now expects a peak-to-trough GDP drop of 13% — up from its prior forecast for a 10% drop in GDP — which far exceeds the 4% decline seen at the nadir of the financial crisis.

Driving this sharper-than-forecast initial decline is a massive retrenchment in consumer spending and investment, with BofA calling for a 46% annualized drop in consumption and a 35% annualized drop in investment during the second quarter. Of second quarter GDP data, BofA says plainly: “It will be ugly.”

Looking out over the next 18 months, BofA sees a soft labor market, disinflation, and a lack of investment conspiring to keep growth below pre-COVID levels into 2022.

LINK

Posted on 5/21/20 at 11:13 am to NC_Tigah

I did my best to keep spending. I can't keep carrying the weight around here guys.

Posted on 5/21/20 at 11:21 am to NC_Tigah

quote:

2Q GDP to decline 40%

That’s pretty much in line with the CBO and Fed’s estimates.

Posted on 5/21/20 at 2:38 pm to NC_Tigah

We about to feel market pain

Posted on 5/21/20 at 4:22 pm to NC_Tigah

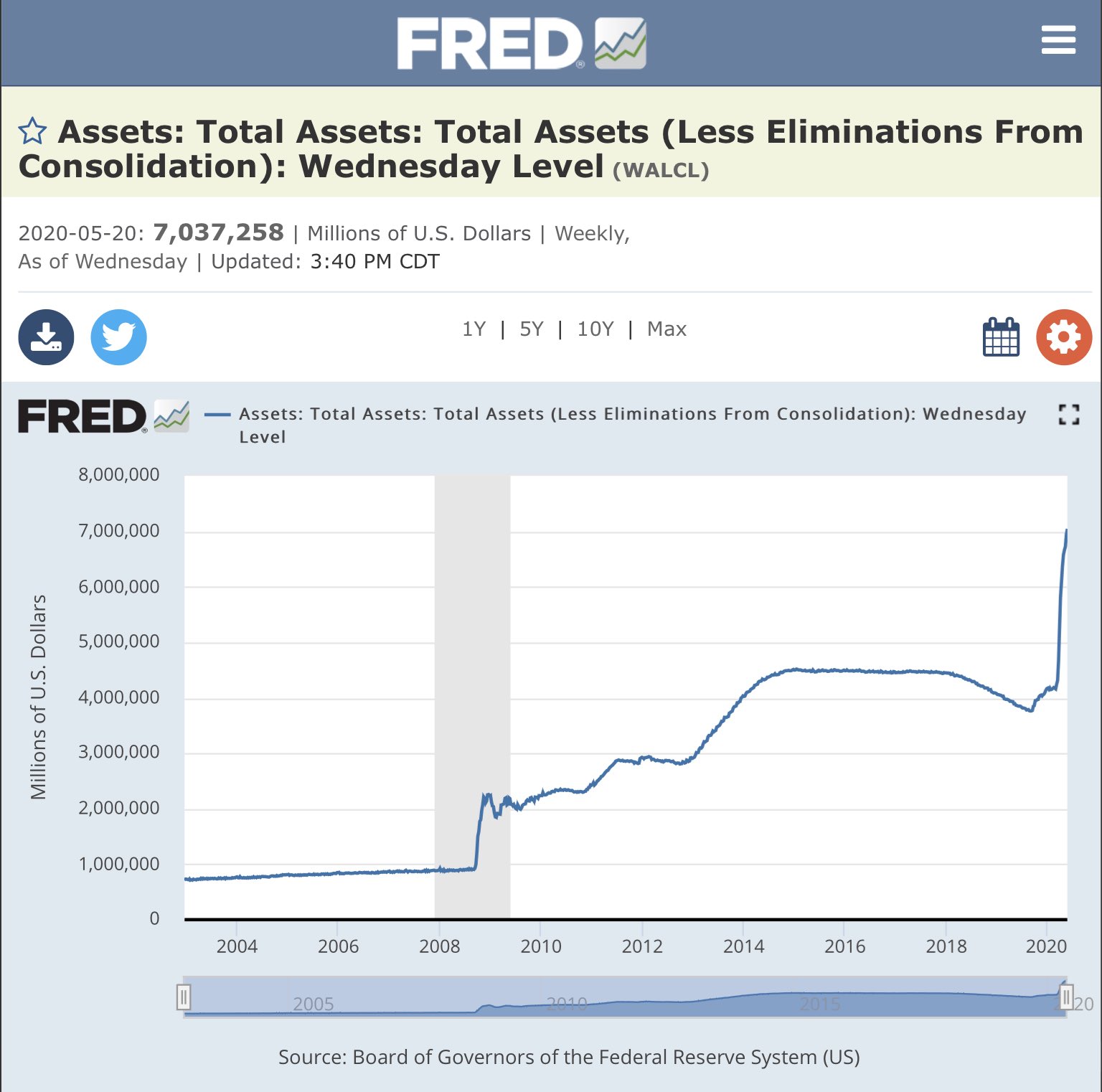

Yet markets up 35% from a couple months ago. It makes zero sense why stocks and the real world economy/Great Depression unemployment are in such a disconnect other than the trillions of magic money worked.

Posted on 5/21/20 at 4:29 pm to KillTheGophers

quote:

We about to feel market pain

I'm tempted to sell a huge majority of my portfolio and wait and see what happens

Posted on 5/21/20 at 4:58 pm to cgrand

Thanks for the bank reserves, yo

Posted on 5/21/20 at 7:28 pm to Breesus

quote:

I'm tempted to sell a huge majority of my portfolio and wait and see what happens

The question is timing. How long before the end of June's reports do I flee with cash in hand? June 15, June 20...?

What stocks might weather the storm.

Will the storm drive stocks back to the lows of March?

My crystal ball is broken, so I ask here.

Posted on 5/21/20 at 8:09 pm to Auburn1968

The only way the music dies is Congress and the Fed say the stimulus is cut off cold turkey. That will never happen.

Posted on 5/21/20 at 8:10 pm to Breesus

quote:

I'm tempted to sell a huge majority of my portfolio and wait and see what happens

what do you have?

I’m buying if it’s good stuff

If you have a bunch of crap you should have sold it already.

if you have winners, there will be buyers

Posted on 5/21/20 at 10:05 pm to cgrand

(no message)

This post was edited on 5/22/20 at 5:42 am

Posted on 5/21/20 at 10:31 pm to TigerTatorTots

quote:

It makes zero sense why stocks and the real world economy/Great Depression unemployment are in such a disconnect other than the trillions of magic money worked.

Stocks are priced off of future earnings power, not a couple of quarters. This is a pretty unique recession. Also, the tech sector has a disproportionate weighting in the market.

Posted on 5/21/20 at 11:46 pm to Lou Pai

Also it makes decent sense when top 5% earners own over half the market, have safety net bailouts etc. doctors, engineers, upper earners and contributors just arent as impacted by COVID damages.

sorry for you market doom and gloomers that jessy from TJmax’s 3% of her salary 401k isnt going to make or break the market. Most of the top earners are still earning and moving the great majority of the market. Waitresses and barber 401ks only move the market so much. Also the fact that this is an artificial and temporary slow down, lessens the long term impact.

sorry for you market doom and gloomers that jessy from TJmax’s 3% of her salary 401k isnt going to make or break the market. Most of the top earners are still earning and moving the great majority of the market. Waitresses and barber 401ks only move the market so much. Also the fact that this is an artificial and temporary slow down, lessens the long term impact.

Posted on 5/22/20 at 2:54 am to NC_Tigah

A recovery will happen but it will probably take a few years by many measures.

Valuations were inflated before the economy took hits from the virus. A limited number of companies have profited in the last four months but the drop in GDP shows what a large amount of money has been lost as a percentage of the total economy.

Investors in bull markets become overly optimistic. The readjustment of that mindset required a natural bottoming out to realistic values but, with the exception of some stocks (especially in heavily affected industries), most of the market is still overvalued.

The argument that stock prices are more a reflection of future growth than present value can be true in some cases (at low enough prices) But it can't be true for most stocks or when prices remain persistently overvalued (P:E etc) for years. At that point, you are at risk of being among the last to overpay for tulips.

Valuations were inflated before the economy took hits from the virus. A limited number of companies have profited in the last four months but the drop in GDP shows what a large amount of money has been lost as a percentage of the total economy.

Investors in bull markets become overly optimistic. The readjustment of that mindset required a natural bottoming out to realistic values but, with the exception of some stocks (especially in heavily affected industries), most of the market is still overvalued.

The argument that stock prices are more a reflection of future growth than present value can be true in some cases (at low enough prices) But it can't be true for most stocks or when prices remain persistently overvalued (P:E etc) for years. At that point, you are at risk of being among the last to overpay for tulips.

Posted on 5/22/20 at 7:47 am to NC_Tigah

quote:

BofA now expects 2Q GDP to decline 40%, instead of previous -30% projection.

obviously buy calls (money printer: brrrrrrrrr)

-Fed

Posted on 5/22/20 at 8:16 am to molsusports

There's new research indicating valuation is simply a product of demographics. When we are growing valuations go up and when we have more people retiring and drawing down savings valuations contract and value "outperforms." Mike Green I think.

But on top of that I'd guess most foreign investment goes into the indexes because the tech trade is the only game in town right now.

But on top of that I'd guess most foreign investment goes into the indexes because the tech trade is the only game in town right now.

Posted on 5/22/20 at 11:44 am to TigerTatorTots

What other vehicle is there for stashing wealth? With interest rates so low there isn't a reason to save as you lose immediate value.

The stock market is being propped up because, besides property, there is no other method of asset allocation.

The stock market is being propped up because, besides property, there is no other method of asset allocation.

Posted on 5/22/20 at 11:54 am to SEC. 593

Gold, Silver, Land, RE, Volatility, Private Equity, Commodities and Bonds. There's also a ton of alternative strategies that can boost yields.

Posted on 5/22/20 at 12:14 pm to wutangfinancial

quote:

new research indicating valuation is simply a product of demographics

Can you expand on this or provide a link that does?

Back to top

8

8