- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: After today, I'm only $38,000 down from where I was 2 weeks ago

Posted on 3/12/25 at 8:04 pm to rickgrimes

Posted on 3/12/25 at 8:04 pm to rickgrimes

quote:

rickgrimes

First screen shot I’ve seen around here in a while.

Posted on 3/12/25 at 8:10 pm to Big Scrub TX

quote:

You did? Certainly not in your OP. quote:Let me guess, you've made an absolute killing in the market the last 2-3 weeks shorting everything under the sun lol. I honestly don't know who's worse, you or your boyfriend STDTiger. That's quite a non-sequitur rant. Here's something though: I understand the concept of denominators and scale. Rickgrimes evidently does too. ETA: IMO, it's dumb to quote absolute dollars at all. Just say what % you are down. That's all that matters. Ditto the "Dow is down 200 points!" guys. Always give the %.

I’ve got so many different accounts it would take me forever to figure out the percentage.

5 accounts with EJ

1 E*Trade

1 Fidelity

My 401k

My wife’s 401k

My wife’s old company 401k

Could I transfer my E*trade stuff to my Fidelity and close out my E*Trade or would I have to sell the stock?

Posted on 3/12/25 at 8:12 pm to Rize

You can transfer stock positions from one firm to another without liquidating.

Posted on 3/12/25 at 8:13 pm to Rize

quote:You honestly don't have any kind of at least jury-rigged consolidated dashboard to track your assets? I would humbly suggest that you set such up.

5 accounts with EJ

1 E*Trade

1 Fidelity

My 401k

My wife’s 401k

My wife’s old company 401k

If you don't even know your own denominator, then how can you make rational decisions of risk and reward?

Posted on 3/12/25 at 8:32 pm to Big Scrub TX

quote:

You honestly don't have any kind of at least jury-rigged consolidated dashboard to track your assets? I would humbly suggest that you set such up. If you don't even know your own denominator, then how can you make rational decisions of risk and reward?

I’m new to all this shite. I’m in the process of trying to consolidate my EJ stuff from 5 to 3 accounts. I just opened my EJ a couple weeks ago to look at what he had me invested in and don’t even know what I’m in after looking at it. I had no idea had any bonds but it looks like I’ve got about maybe 20% in bonds and cash with them.

Just figured out how to send my E*Trade stuff to fidelity to eliminate that account and going to have my wife roll her old 401k into her new work 401k.

This post was edited on 3/12/25 at 8:45 pm

Posted on 3/12/25 at 8:37 pm to Tomatocantender

I'm close to that., but in a better position when it returns to those levels. I will reach a new all time high!

Posted on 3/12/25 at 10:20 pm to Rize

quote:Well, I'm sure you'll get it all sorted. There are probably some people on here more versed in the mechanics of doing that.

I’m new to all this shite. I’m in the process of trying to consolidate my EJ stuff from 5 to 3 accounts. I just opened my EJ a couple weeks ago to look at what he had me invested in and don’t even know what I’m in after looking at it. I had no idea had any bonds but it looks like I’ve got about maybe 20% in bonds and cash with them.

Just figured out how to send my E*Trade stuff to fidelity to eliminate that account and going to have my wife roll her old 401k into her new work 401k.

But purely from the investment size, it really pays to have a full view of all your assets and liabilities so that all decisions can be sized properly. I see even very wealthy people hung up on the absolute dollar fallacy.

Posted on 3/13/25 at 8:42 am to Big Scrub TX

quote:

It's amazing to me how indifferent to denominator so many of you are. This post means literally nothing if there is no scale.

Or we are not pompous arse holes like yourself.

Some of us have been poor enough in life, that while $38,000 or $100,000 might not mean much now, it still means something psychology. My salary out of college was $22,000/yr. In the past 2 weeks, I have lost the equivalent of 5 years of salary from my younger years. Does not matter it is a single digit % drop, it still hurts man

Posted on 3/13/25 at 10:14 am to rickgrimes

Mind I ask how old you are? My Ira nowhere near close. I’m early 30s

This post was edited on 3/13/25 at 10:15 am

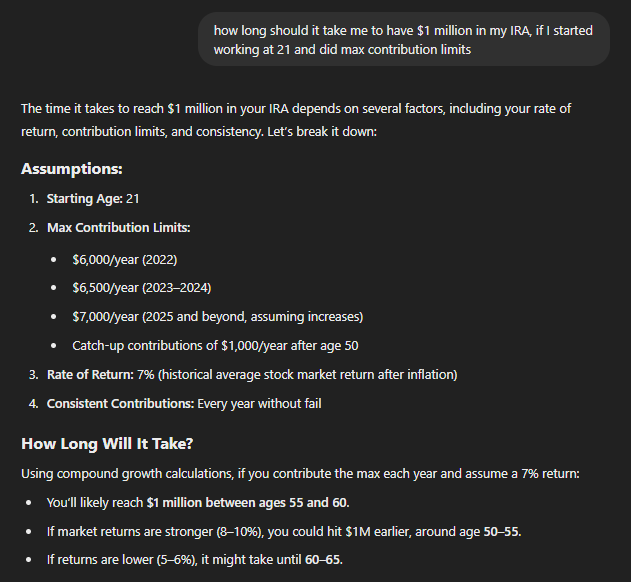

Posted on 3/13/25 at 10:45 am to fareplay

quote:

My Ira nowhere near close. I’m early 30s

It is almost impossible to have near $1million in your IRA by your early 30s, do not fear.

There are contribution limitations, so you would have needed to nail some 1000% returns.

Posted on 3/13/25 at 10:47 am to DarthRebel

I didn’t really invest till late 20s since I didn’t make much at the time. Right now I think my Roth is only like 50k (don’t worry I have non Roth). Just amazing to see it can get to 1MM

Actually I lied, I think I started right at 30

Actually I lied, I think I started right at 30

This post was edited on 3/13/25 at 10:49 am

Posted on 3/13/25 at 12:03 pm to DarthRebel

quote:I have made zero value judgments on people's overall level of wealth.

Some of us have been poor enough in life, that while $38,000 or $100,000 might not mean much now, it still means something psychology. My salary out of college was $22,000/yr. In the past 2 weeks, I have lost the equivalent of 5 years of salary from my younger years. Does not matter it is a single digit % drop, it still hurts man

You should try to break yourself of that effect and get in touch with your actual denominator.

Posted on 3/13/25 at 4:07 pm to Big Scrub TX

quote:

I have made zero value judgments on people's overall level of wealth.

You should try to break yourself of that effect and get in touch with your actual denominator.

Still a pompous arse hole

Liberals really just cannot help themselves.

Posted on 3/13/25 at 6:24 pm to DarthRebel

quote:It's a money board. People come here for advice/recommendations on how to be prudent with their money and investing. I'm recommending what I consider to be the most elemental/fundamental piece of the puzzle I can think of: actually understand the size of your balance sheet so that your risk/reward decisions can be made as rationally as possible. If that's pompous, don't care I guess.

Still a pompous arse hole

quote:I'm not sure who you're talking to.

Liberals really just cannot help themselves

Posted on 3/13/25 at 9:03 pm to Big Scrub TX

You, BS. He’s talking straight at you, buddy.

Posted on 3/13/25 at 9:11 pm to fareplay

quote:

Mind I ask how old you are? My Ira nowhere near close. I’m early 30s

It’s probably a rollover from a 401k.

Posted on 3/13/25 at 9:14 pm to DarthRebel

quote:

Some of us have been poor enough in life, that while $38,000 or $100,000 might not mean much now, it still means something psychology. My salary out of college was $22,000/yr. In the past 2 weeks, I have lost the equivalent of 5 years of salary from my younger years. Does not matter it is a single digit % drop, it still hurts man

It’s an illogical way to judge your investments. Thats the man’s point.

I have people tell me they’re down $300k over whatever period as if that’s supposed to mean something on its own. If you’re saving for retirement, and you’ve been doing it for 30-40 years, a 10% stock market pull back is supposed to cost you a lot of dollars since you should have saves a lot of dollars.

If you’re down $100k now, and you’ve keep saving and investing, one day you’re going to be down $200k. When your account is making more in a year than you made in entire decade, sometimes it’s going to lose a decent bit too. Congrats. That’s the way this works.

ETA- Elon Musk lost nearly $20B on Monday. Have some perspective. Bigger accounts mean you’ll lose bigger amounts and make bigger amounts.

This post was edited on 3/13/25 at 9:17 pm

Posted on 3/14/25 at 5:37 am to Tomatocantender

My stocks are down. Gold hit new all-time highs all night. Silver finally broke through that pesky $34 resistance barrier. Market is rocking in pre-market. The market may end up down today, on news that we put tariffs on cumin and chili powder from Ecuador.

It seems as if small events, really just a pimple on a gnat's arse, are being used to artificially drive the markets down.

ETA: The market will reach new highs again in 2025, so whatevs.

It seems as if small events, really just a pimple on a gnat's arse, are being used to artificially drive the markets down.

ETA: The market will reach new highs again in 2025, so whatevs.

This post was edited on 3/14/25 at 5:41 am

Posted on 3/14/25 at 5:42 am to Tomatocantender

I look at mine about once a month or less, and I have an app on my phone (one click).

I'm in it for the long run so I don't jump out of the window every time it swings .

I'm in it for the long run so I don't jump out of the window every time it swings .

Popular

Back to top

0

0