- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Fed hides weekly M1 supply, says "money doesn't matter"

Posted on 9/13/21 at 12:49 pm to wutangfinancial

Posted on 9/13/21 at 12:49 pm to wutangfinancial

Posted on 9/13/21 at 1:19 pm to Strannix

Everybody’s eyeing owners equivalent rent to heat up a ton next year. Too much trickery and politics to predict anything at this point. The Feds inflation models have never worked.

Posted on 9/13/21 at 1:20 pm to wutangfinancial

quote:

Too much trickery and politics to predict anything at this point. The Feds inflation models have never worked.

Unless they can unprint a few trillion claims I dont see a way out

Posted on 9/13/21 at 1:24 pm to Strannix

That’s effectively what tightening does it just won’t happen for multiple years more than likely.

Posted on 9/13/21 at 1:43 pm to wutangfinancial

How do you figure the credit market cannot collapse?

Posted on 9/13/21 at 2:13 pm to wutangfinancial

quote:

The Feds inflation models have never worked.

Is Wutang joining the good side?

Posted on 9/13/21 at 2:21 pm to TigerTatorTots

My entire portfolio minus cash and a few active trades is setup for secular inflation. The supply chains and labor issues are far worse than I ever believed and we have politicians actively sabatoging growth and covid hysteria isn't going away unfortunately. I'm not on a side but the signals are all extremely wonkish right now for how this plays out over the next 12-18 months.

Posted on 9/13/21 at 2:23 pm to down time

quote:

How do you figure the credit market cannot collapse?

It can we just know there would be an immediate move to step in a stabilize spreads after they blowout. They were purchasing fallen angel bonds at par last year they'll just have to stretch what they purchase again to signal they're "doing more."

Posted on 9/13/21 at 2:29 pm to wutangfinancial

quote:Sounds like you are trying to say us inflation sky screams at the beginning of the year may have been right

I'm not on a side but the signals are all extremely wonkish right now for how this plays out over the next 12-18 months.

I'll allow it, you're forgiven

Posted on 9/13/21 at 2:31 pm to wutangfinancial

quote:

setup for secular inflation

Care to expand on this? I would love someone to give a little class on what to invest in when expecting inflation.

Posted on 9/13/21 at 2:40 pm to GREENHEAD22

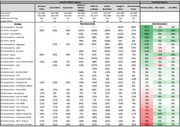

Sorry this pic sucks. Commodities and trend following bonds are the best performing strategies. But trend following in general is the best way to hedge. If inflation resets bond and tech stocks I'm planning on putting all of my cash into long dated options in HYG and QQQ when the IV is completely drained.

This post was edited on 9/13/21 at 2:46 pm

Posted on 9/13/21 at 2:43 pm to TigerTatorTots

I mean I see hyberbolic panic about inflation in the 10-20% range and it gets a little ridiculous. The price increases this year were very predictable it's the next several years that is unclear. We'll see, it looks like the QQQ and bonds are at odds with the inflation narrative but we all know mispricing happens all the time.

Posted on 9/13/21 at 2:49 pm to wutangfinancial

Can you give a couple examples of the options strategy you personally use to hedge "secular" inflation?

Posted on 9/14/21 at 9:56 pm to RedStickBR

I can’t find recent estimates but the demand function is deteriorating. I think they’re basically saying real gdp will be negative if you factor in new inflation estimates above 4%.

Posted on 9/15/21 at 10:51 am to wutangfinancial

I haven’t seen that yet, but I don’t doubt it. Can you imagine if they overcooked this thing so much so that Real GDP is negative this year?

Also a good read:

LINK /

Also a good read:

LINK /

This post was edited on 9/15/21 at 10:54 am

Posted on 9/15/21 at 1:13 pm to slackster

quote:

People have been worrying about runaway inflation since 2009 and it simply hasn’t even come close to materializing in this country.

Mmhmm

Posted on 9/15/21 at 1:27 pm to Nguyener

Why are you mhmming? He’s exactly right

Posted on 10/1/21 at 5:34 am to wutangfinancial

Highest inflation in 40 years, I will get much much worse. I've been telling this board what would happen.

LINK

LINK

This post was edited on 10/1/21 at 5:42 am

Posted on 10/1/21 at 6:55 am to Strannix

I don't remember you telling this board that. link?

Popular

Back to top

1

1