- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Give me three stocks you’re buying right now. No day trading.

Posted on 8/5/20 at 4:32 pm to DiamondDog

Posted on 8/5/20 at 4:32 pm to DiamondDog

RUTH has me intrigued. I put it on my watch list.

As it is low now it was very solid with restaurants in it's lineup.

Things start to open up I think it'll be a good investment.

I also like Sasol, but only until they announce theybhave sold their partnership into their ethylene project here in my backyard. After that it will be stagnant.

Especially after they just went into talks about using a solar farm to power two of their facilities overseas. Again getting out of their wheelhouse.

As it is low now it was very solid with restaurants in it's lineup.

Things start to open up I think it'll be a good investment.

I also like Sasol, but only until they announce theybhave sold their partnership into their ethylene project here in my backyard. After that it will be stagnant.

Especially after they just went into talks about using a solar farm to power two of their facilities overseas. Again getting out of their wheelhouse.

Posted on 8/5/20 at 4:36 pm to Enos Burdette

quote:

JPM looks a shitload (that's a technical term) better than their peers. I want to buy into big banks right now so bad I can taste it, but reading up on Wells, JPM, and BA has got me skiddish and thinking there's still some bloodletting coming as we get into the fall.

I guess I didn't answer the question. Here's mine:

VBTLX

SO

KO

Posted on 8/5/20 at 4:38 pm to thejudge

quote:

RUTH has me intrigued. I

I took a little gamble on RUTH.

My two big covid gambles are CCL and SYY.

This post was edited on 8/5/20 at 4:46 pm

Posted on 8/5/20 at 4:39 pm to thejudge

quote:

RUTH

Do you think that current yield can survive? I just can’t bet on if/when restaurants will be smart investments again

Posted on 8/5/20 at 5:16 pm to natsoundup

I've been watching RUTH for a while and I don't like it right now to go long.

They recently announced permanent closures and suspended their expansion plans. On top of limited capacities due to COVID, I don't see much upside potential. The stock also fluctuates wildly between $6.50-$8 so it's good for a swing trade.

I like these three right now:

PLD

LHX

CME

They recently announced permanent closures and suspended their expansion plans. On top of limited capacities due to COVID, I don't see much upside potential. The stock also fluctuates wildly between $6.50-$8 so it's good for a swing trade.

I like these three right now:

PLD

LHX

CME

Posted on 8/5/20 at 5:18 pm to DiamondDog

I bought more AAPL and AMZN. Seriously though, is there anything other than an internal scandal to derail these companies from double digit growth for the next 20 years? The Justice Department breaking them up?

Posted on 8/5/20 at 5:40 pm to ynlvr

quote:

Do you think that current yield can survive

It could. I'm looking at it for a swing trade. Like Sasol I don't see it getting back to it's normal for a while.

I could see it bounce up and down and be able to buy dips and resell. Especially as it lags coronaviris lockdowns.

Same with SAVE airlines. Been swing trading the hell out of that one. Made at least 3k on it.

Again watching it follow the lockdowns. Things open up you'll see RUTH, SAVE, and Carnival all rebound enough to sell off and make a decent profit.

Posted on 8/5/20 at 6:07 pm to LSUneaux

quote:

The Justice Department breaking them up?

I think this could end up becoming the case, but not with respect to the entire companies. Rather, antitrust regulators may look at specific segments in which they operate to determine whether there is too much concentration. If you consider, for instance, based on this link that Amazon has 49% of the ecommerce market, followed by eBay at 6.6%, Apple at 3.9% and Walmart at 3.7%, it's likely that the ecommerce market already has a Herfindahl-Hirschman Index in excess of 2500, which is a threshold regulators look to in determining excessive concentration. If I assume that in addition to the 4 aforementioned companies there are 46 other ecommerce companies in the Top 50 each having 0.8% share of the market, I get to an HHI of 2503. If Amazon's share were to jump from 49% to 55%, the next 3 stayed flat, and the bottom 46 dropped to 0.67% each, the HHI would jump to 3118.

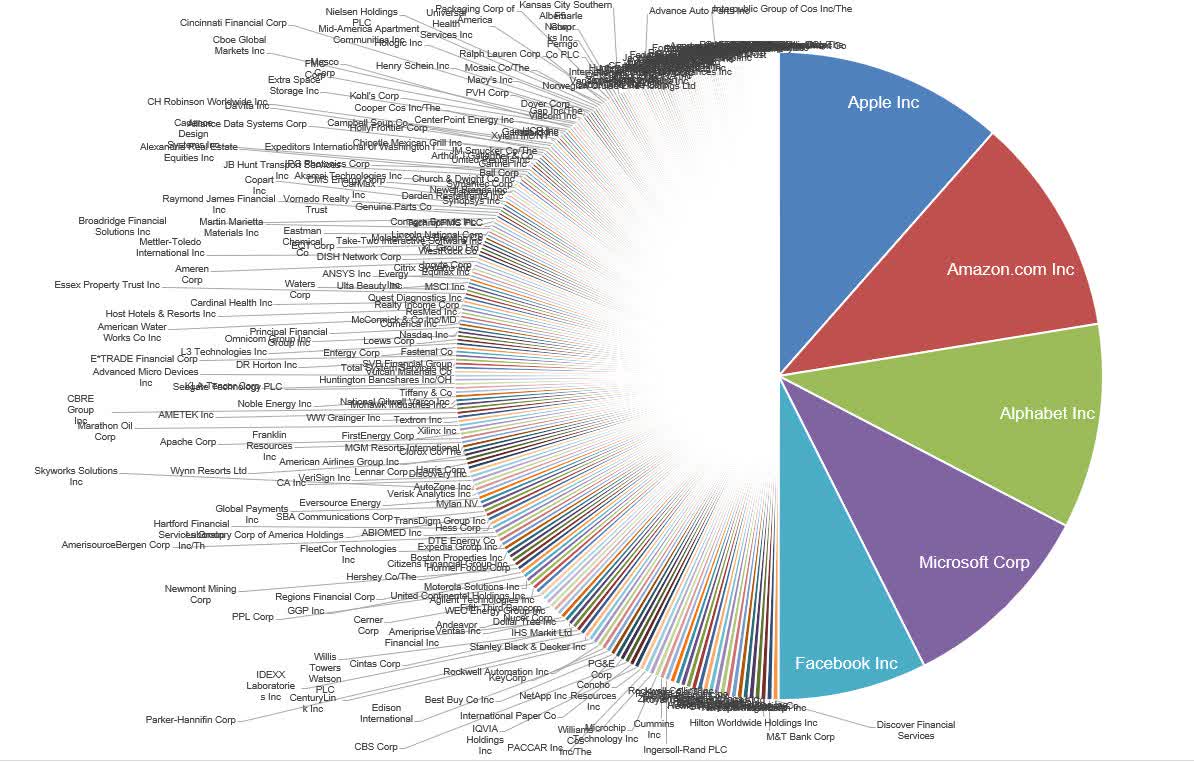

Also, just because:

This post was edited on 8/5/20 at 6:30 pm

Posted on 8/5/20 at 6:19 pm to DiamondDog

AUPH and PLUG are my money makers right now

Posted on 8/5/20 at 6:29 pm to DiamondDog

Things I bought this year as a buy and hold:

CONE

D

LTC

KEY

I drip the divs on them and have owned all for about 3-5 years. I added to them all in the last 2 months on dips.

CONE

D

LTC

KEY

I drip the divs on them and have owned all for about 3-5 years. I added to them all in the last 2 months on dips.

Posted on 8/5/20 at 7:19 pm to RedStickBR

quote:That pie chart you posted is, as they say on the O-T Lounge Board, mind bottling...

RedStickBR

Posted on 8/5/20 at 7:30 pm to RedStickBR

Considering that chart is from 2018 and doesn't have a ton of companies on it, im sure if you took those same names and recreated that chart, it would be drastically even more slanted towards the big 5

This post was edited on 8/5/20 at 7:31 pm

Popular

Back to top

2

2