- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

What are your big 2026 financial goals?

Posted on 12/31/25 at 12:08 pm

Posted on 12/31/25 at 12:08 pm

Here are some of mine:

1. Hit 2m invested in the market. 20% gain.

2. Hit 4m gross income between all businesses.

3. Buy one apartment complex, increase total number of real estate doors to 35 (25 currently).

Let's get it baws. Hope everyone has a great 2026.

1. Hit 2m invested in the market. 20% gain.

2. Hit 4m gross income between all businesses.

3. Buy one apartment complex, increase total number of real estate doors to 35 (25 currently).

Let's get it baws. Hope everyone has a great 2026.

Posted on 12/31/25 at 12:50 pm to TheOcean

1. Stop buying so much shite.

2. Get back to saving more money.

2. Get back to saving more money.

Posted on 12/31/25 at 12:54 pm to TheOcean

If I can repeat 2025, then I will be extremely pleased. To put a number to it: Grow net worth by 20%.

Posted on 12/31/25 at 12:57 pm to TheOcean

quote:

TheOcean

This post was edited on 12/31/25 at 12:59 pm

Posted on 12/31/25 at 1:00 pm to TheOcean

Is real estate your full time job? I tried the rentals but found them to be more of a pain than just set it and forget it in the market. How do you manage that many properties?

Posted on 12/31/25 at 1:25 pm to TheOcean

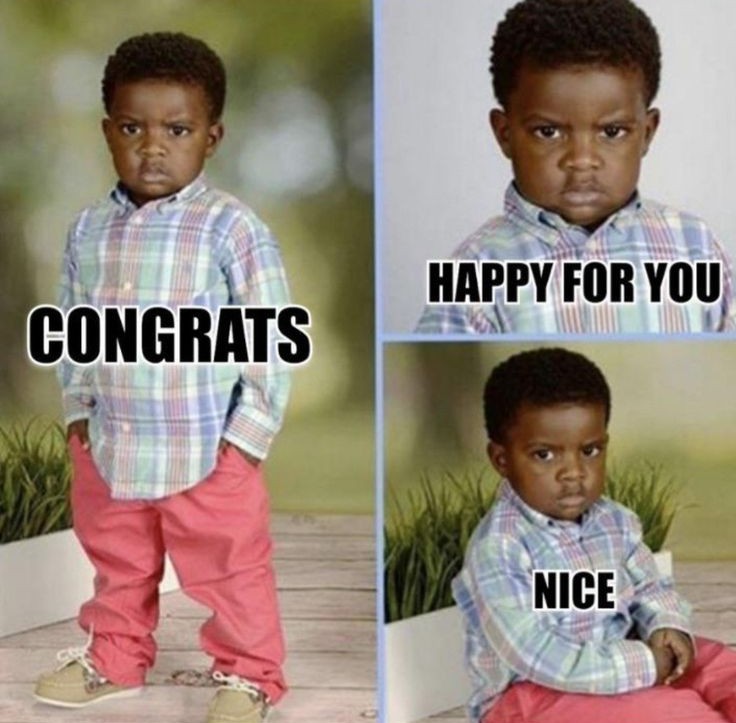

I'd just get downvoted and called a liar.

Posted on 12/31/25 at 1:31 pm to TheOcean

2026 is gonna be all over the place for me.

Wife is finishing residency in June and we will be moving back to Louisiana.

Selling current house at 2.75% to buy back in Louisiana fml

Just had first baby 3 weeks ago.

I need to figure out what some realistic goals are

Wife is finishing residency in June and we will be moving back to Louisiana.

Selling current house at 2.75% to buy back in Louisiana fml

Just had first baby 3 weeks ago.

I need to figure out what some realistic goals are

Posted on 12/31/25 at 1:35 pm to JL

Nah real estate is one of my four non main businesses. We bought our first duplex in 2021 and have been slowly buying more. Managing them isn't bad once you get a few rentals under your belt and you learn the game. It's a lot of putting out fires, but if you can do the work or you have an excellent handyman, then youre good. Hardest part is identifying the good deals

Posted on 12/31/25 at 1:35 pm to reds on reds on reds

Once you get the social security number open a 529 for your new baby. You can make a pretty substantial deposit on your inital opening of the account. Look at your states first to see if there are any advantages, if not look at other states. I live in Texas, no state income tax benefit so opened my kids plans in NY, it had good investment options.

Posted on 12/31/25 at 1:37 pm to reds on reds on reds

quote:

Wife is finishing residency in June and we will be moving back to Louisiana.

Stack cash and pay down debt before you start spending. After living the life of a med student and resident, it will be tempting to throw some cash around. She'll max out pretty quick and then income will be flat for the rest of her career if it's anything like the last 20 years. So set your expenses long term based on what you make early on. Don't anticipate COLA's. I know a lot of doctors that were living well within their means 20 years ago, but are now in a bind.

Posted on 12/31/25 at 1:40 pm to TheOcean

quote:

ut if you can do the work or you have an excellent handyman, then youre good. Hardest part is identifying the good deals

The hardest part is finding a good handyman!!! My job takes too much of my time to deal with rentals. Been there and done that. After getting a couple of bad ones, I just said f#$k it and sold them when the market was up. Was nice for awhile though.

I'm not discouraging anyone. I'm just bored and felt the need to comment.

Posted on 12/31/25 at 1:42 pm to SmackoverHawg

quote:I hear ya. My goal is to give at least 2X more than I did this year to people who I determine are trying to make an honest living but could still really use some help.

I'd just get downvoted and called a liar.

Posted on 12/31/25 at 1:46 pm to 98eagle

quote:

I hear ya. My goal is to give at least 2X more than I did this year to people who I determine are trying to make an honest living but could still really use some help.

Good goal.

Posted on 12/31/25 at 2:05 pm to TheOcean

7 figure profit in the biz.

30% in the market.

Bitcoin back to 125k

Spend less than 100k.

30% in the market.

Bitcoin back to 125k

Spend less than 100k.

Posted on 12/31/25 at 2:13 pm to SmackoverHawg

quote:

I'd just get downvoted and called a liar

I want to hear it. I'm not yet at OT baller status, but would like to hear from some real OT ballers

Posted on 12/31/25 at 2:20 pm to TheOcean

quote:

Hit 2m invested in the market. 20% gain.

Is this going to include contributions? Rumblings out there that 2026 may be a down year and 10%+ may be ambitious.

But who knows.

Posted on 12/31/25 at 2:20 pm to SmackoverHawg

quote:

Once you get the social security number open a 529 for your new baby. You can make a pretty substantial deposit on your inital opening of the account. Look at your states first to see if there are any advantages, if not look at other states. I live in Texas, no state income tax benefit so opened my kids plans in NY, it had good investment options.

We just opened one in Louisiana. Hopefully the issues with the Louisiana one recently are a one time thing.

quote:

Stack cash and pay down debt before you start spending. After living the life of a med student and resident, it will be tempting to throw some cash around. She'll max out pretty quick and then income will be flat for the rest of her career if it's anything like the last 20 years. So set your expenses long term based on what you make early on.

Yeah we plan on being extremely aggressive with what's remaining on her loans. We are in a great spot with them currently at just a hair under 6 figures left to pay on them.

I am also currently maxing my 401k and we plan to max hers as well.

We've been lucky that I have a decent paying job and we haven't had to live the traditional broke resident lifestyle for the last 4.5 years but I plan to set up her paychecks to where we never really see much more than we are currently seeing. We have too many friends that finished up last year that are talking about the lifestyle creep and how they are still broke a year out.

Posted on 12/31/25 at 2:36 pm to TheOcean

Hit $16 million net worth (not counting primary residence)

$10.5 million in stocks/cash or equivalents (crypto, etc.)

Add another $5-10k/month passive income.

Get wife to cut spending. She used to spend very little, but retired early a year and a half ago and boredom spends on bullshite.

Add some land if it's the right price or place. Timber or farmland.

Increase business profit or at least hold steady as I phase myself out.

10% gains will get me there and then some.

$10.5 million in stocks/cash or equivalents (crypto, etc.)

Add another $5-10k/month passive income.

Get wife to cut spending. She used to spend very little, but retired early a year and a half ago and boredom spends on bullshite.

Add some land if it's the right price or place. Timber or farmland.

Increase business profit or at least hold steady as I phase myself out.

10% gains will get me there and then some.

Popular

Back to top

25

25