- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Hope you have some diversification in your portfolio

Posted on 11/21/25 at 9:38 am

Posted on 11/21/25 at 9:38 am

Because it looks like the rotation out of tech is underway. How long it goes is anyone's guess?

Posted on 11/21/25 at 9:44 am to FLObserver

S&P500 takes care of that itself

Posted on 11/21/25 at 9:47 am to jamiegla1

Agree if you own a fund or ETF with S&P 500 you should be fine. Was referring more to folks that own individual stocks.

Posted on 11/21/25 at 9:53 am to FLObserver

Be careful with etfs like SPY. They are very heavy tech. Look for ones like RSP if you want more equal weight of the S&P.

Posted on 11/21/25 at 9:53 am to FLObserver

Nah. In the next 5 years there will be more AI, more compute, more chips.

Posted on 11/21/25 at 10:17 am to FLObserver

I'm heavily exposed to NVDA, but I'm holding long term

Posted on 11/21/25 at 10:50 am to FLObserver

Staying the course with QQQ.

Tech is the future.

Tech is the future.

Posted on 11/21/25 at 11:14 am to FLObserver

Every market that matters is going to be transformed and dependent on AI to stay competitive. Long term rotating out of AI is not an option

Posted on 11/21/25 at 11:28 am to FLObserver

I bought more META and more NFLX today.

Posted on 11/21/25 at 11:39 am to LordSaintly

quote:Market cap was $5T, although it's sold off some. What market cap over what time period do you think would be possible?

I'm heavily exposed to NVDA, but I'm holding long term

Posted on 11/21/25 at 12:21 pm to FLObserver

Best to stick to your plan.

20%+ annual gains don’t come without some heartburn. No free lunch

20%+ annual gains don’t come without some heartburn. No free lunch

Posted on 11/21/25 at 12:44 pm to Big Scrub TX

quote:

Market cap was $5T, although it's sold off some. What market cap over what time period do you think would be possible?

Jensen Huang says $20T in 5 years. I was listening to a panel of Wall Street analysts and a few were saying he is not wrong based on current trends.

Posted on 11/21/25 at 1:21 pm to FLObserver

My 30day went negative a couple days ago, my 90 days just dropped negative.

Would be cool if people would quit selling for Christmas spending money.

Would be cool if people would quit selling for Christmas spending money.

Posted on 11/21/25 at 1:39 pm to jamiegla1

quote:I don’t think I agree with that.

S&P500 takes care of that itself

Posted on 11/21/25 at 1:48 pm to beaverfever

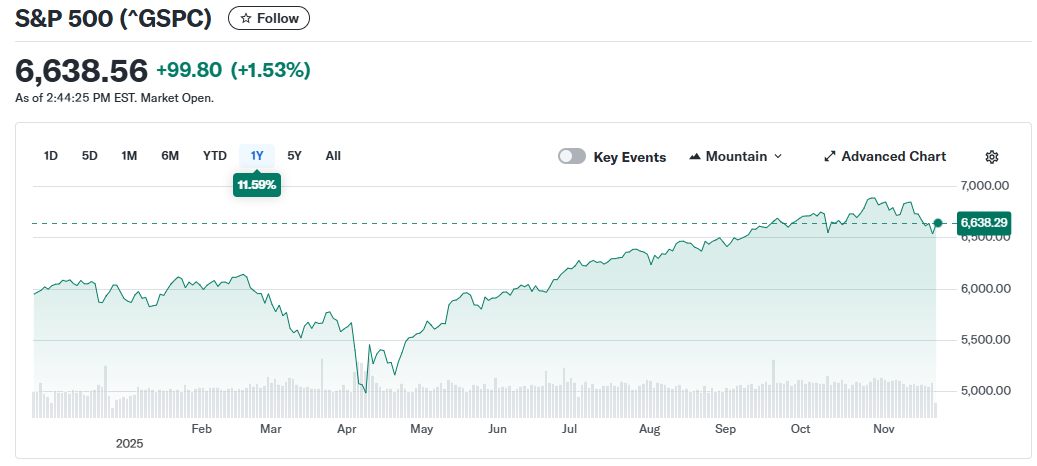

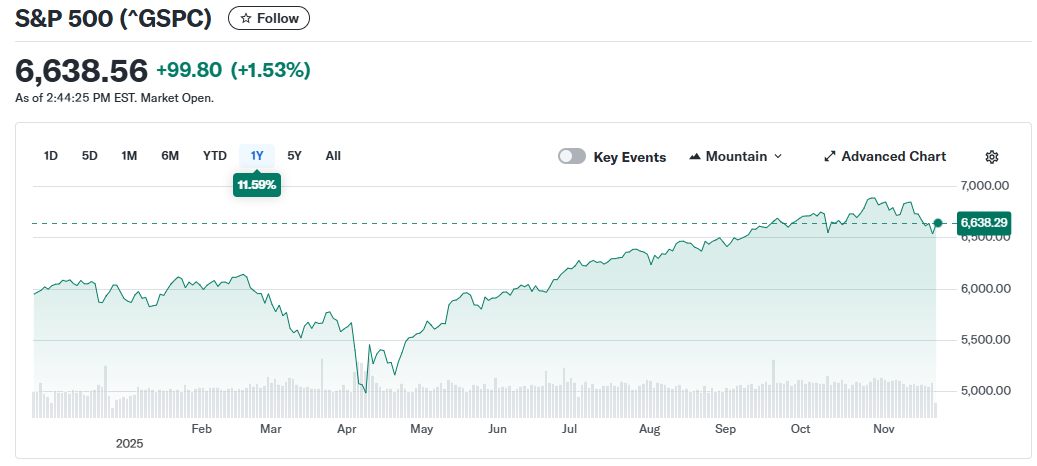

In the big picture view, nothing really has happened

I forget how brutal that Feb --> April go was.

I forget how brutal that Feb --> April go was.

Posted on 11/21/25 at 2:36 pm to FLObserver

VTSAX. Contribute monthly. Check yearly. Enjoy wealth.

Posted on 11/21/25 at 3:10 pm to GEAUXT

quote:

VTSAX. Contribute monthly. Check yearly. Enjoy wealth.

So easy I could do it. And it's worked better than I could've ever expected.

Posted on 11/21/25 at 6:17 pm to beaverfever

quote:

I don’t think I agree with that.

why not

Posted on 11/21/25 at 8:04 pm to FLObserver

At least a decade, esp. For American stocks.

Popular

Back to top

16

16