- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Question about a 401k investment option

Posted on 11/8/25 at 8:41 am

Posted on 11/8/25 at 8:41 am

I know very little about the stock market. I'm more of a marathon kind of person when it come to investments. Just set it and forget it for the next 20-25 years while checking in periodically. I have a rollover IRA and my wife and I each max out a roth IRA. On advice I saw here I put those three accounts into VTSAX and the growth has been great.

My wife's employer is starting a 401k. There's a Vanguard option that jumped out at me. The name is Vanguard VIF Total Stock Market Index. Is this option the same as Vanguard Total Stock Market Index Fund (VTI) or something else? The VIF in the name is throwing me off. The only VIF in a stock ticker I see is Vanguard International Fixed Interest Index (Hedged) ETF (VIF.AX)

My wife's employer is starting a 401k. There's a Vanguard option that jumped out at me. The name is Vanguard VIF Total Stock Market Index. Is this option the same as Vanguard Total Stock Market Index Fund (VTI) or something else? The VIF in the name is throwing me off. The only VIF in a stock ticker I see is Vanguard International Fixed Interest Index (Hedged) ETF (VIF.AX)

This post was edited on 11/8/25 at 8:55 am

Posted on 11/8/25 at 9:27 am to Phate

Google "VTI vs vanguard variable insurance fund total stock market", and the AI Overview will tell you all you need to know.

It lists more detailed differences after that.

I'm nowhere near as adept at these matters as many on this site, so please double check the above information.

quote:

The primary difference is that VTI is an exchange-traded fund (ETF) available to all investors, while the Vanguard Variable Insurance Fund - Total Stock Market (VVITX) is a mutual fund product designed exclusively for use within a variable annuity or variable life insurance contract

It lists more detailed differences after that.

I'm nowhere near as adept at these matters as many on this site, so please double check the above information.

Posted on 11/8/25 at 9:29 am to W2NOMO

All are in VTSAX

My rollover IRA is at 14% since inception 8 1/2 years ago.

My Roth IRA is at 14.8% since it started 9 years ago.

My wife's Roth IRA is at 15.6% since it started 7 years ago.

My rollover IRA is at 14% since inception 8 1/2 years ago.

My Roth IRA is at 14.8% since it started 9 years ago.

My wife's Roth IRA is at 15.6% since it started 7 years ago.

Posted on 11/8/25 at 9:35 am to Phate

Is your wife’s 401k matched? If not I wouldn’t bother with it. Work 401ks are usually pretty limited in investment options

Start or continue to contribute to her own personal IRA instead which has practically anything/mutual funds available to invest in.

Start or continue to contribute to her own personal IRA instead which has practically anything/mutual funds available to invest in.

Posted on 11/8/25 at 9:40 am to Phate

Is VTSAX much better than VFIAX? Are they that different?

Posted on 11/8/25 at 10:31 am to masoncj

quote:

Is your wife’s 401k matched? If not I wouldn’t bother with it. Work 401ks are usually pretty limited in investment options Start or continue to contribute to her own personal IRA instead which has practically anything/mutual funds available to invest in.

I think he said they already max out their Roth IRA. So even if options are limited, the tax benefit of a trad or Roth 401k may still be worth a look even if no match is available.

Posted on 11/8/25 at 10:47 am to masoncj

quote:

Is your wife’s 401k matched? If not I wouldn’t bother with it. Work 401ks are usually pretty limited in investment options

I'm not sure if it's matched but I'll find out. She assumes not because it's a small office. We max our Roth IRA already so this would be another way to set aside some additional retirement funds.

Posted on 11/8/25 at 12:04 pm to Phate

Right but I still would just do a traditional ira (tax deferred) in addition to her Roth IRA if there is no match

Posted on 11/8/25 at 2:28 pm to masoncj

quote:

still would just do a traditional ira (tax deferred) in addition to her Roth IRA

You cant do that. The Roth and traditipnal IRA contribution limit is combined. OP already maxes both Roth IRAs.

Posted on 11/8/25 at 2:59 pm to TorchtheFlyingTiger

quote:

You cant do that. The Roth and traditipnal IRA contribution limit is combined. OP already maxes both Roth IRAs.

This. You can’t contribute over the annual limit. It can be a combination of traditional or Roth, but combined total still cannot exceed the annual maximum. contribution.

Posted on 11/8/25 at 3:16 pm to masoncj

quote:

Right but I still would just do a traditional ira (tax deferred) in addition to her Roth IRA if there is no match

Posted on 11/9/25 at 6:29 am to Phate

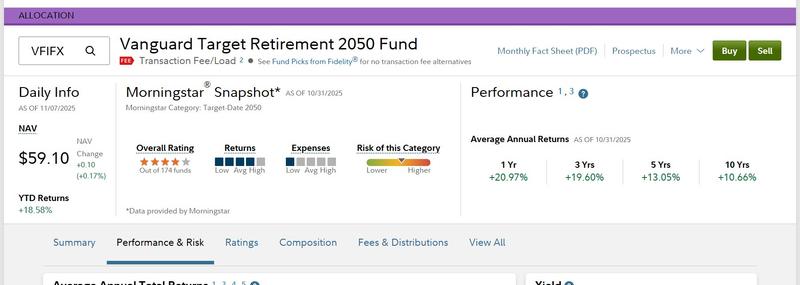

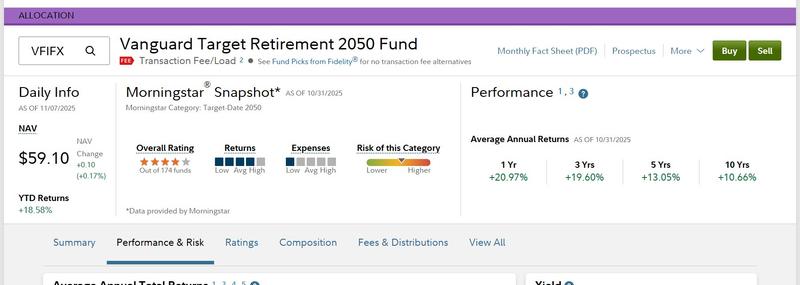

If you're a set it and forget it type, I recommend you seek a Target fund, maybe Vanguard Target Retirement 2050 Fund NASDAQ:VFIFX. if available. This fund will reallocate for you as you approach retirement at age near the year 2050, if this is close to your time. If sooner, go with a 2045, etc.

Some will poo poo this selection, yes you can get a better ROR selecting indexed funds or individual stocks etc. The reason I suggest for you a retirement date based fund is because you're not an active trader. The fund will automatically reallocate to more secure investments as you age. You don't want to be 2 years from retirement and the market takes a dump, do you.

Below is a 3 minute YouTube video explaining how a date based retirement Glide Path works.

https://www.youtube.com/watch?v=0BBEa3jNNNs

This is the performance of Vanguards 2050 retirement fund I referenced set it and forget it type fund. I'm thinking that your company may offer these types of funds in your 401K options. I'm pretty sure that Vanguard uses their index funds anyway to create this retirement date fund. You just don't have to watch it all the time as an active investor might. Good Luck.

Some will poo poo this selection, yes you can get a better ROR selecting indexed funds or individual stocks etc. The reason I suggest for you a retirement date based fund is because you're not an active trader. The fund will automatically reallocate to more secure investments as you age. You don't want to be 2 years from retirement and the market takes a dump, do you.

Below is a 3 minute YouTube video explaining how a date based retirement Glide Path works.

https://www.youtube.com/watch?v=0BBEa3jNNNs

This is the performance of Vanguards 2050 retirement fund I referenced set it and forget it type fund. I'm thinking that your company may offer these types of funds in your 401K options. I'm pretty sure that Vanguard uses their index funds anyway to create this retirement date fund. You just don't have to watch it all the time as an active investor might. Good Luck.

Posted on 11/9/25 at 4:12 pm to TigerToGeaux

Oh I didn’t realize that…I guess I thought you could do both a trad and Roth

I am able to do a back door Roth amd the normal 401k

But to y’all’s point it’s through work

I am able to do a back door Roth amd the normal 401k

But to y’all’s point it’s through work

Posted on 11/10/25 at 6:52 am to masoncj

you can do a 7K or 8K personal ROTH even if you max out your non-Roth 401K.

Posted on 11/11/25 at 7:28 am to Victor R Franko

Not a fan of target funds due to expense ratios. This one indicates it is considered low expense, but does show the expense ratio.

It typically does not take much effort to beat them on returns, but the numbers on this one are solid. I also think they become too conservative based on age.

It typically does not take much effort to beat them on returns, but the numbers on this one are solid. I also think they become too conservative based on age.

Popular

Back to top

4

4