- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

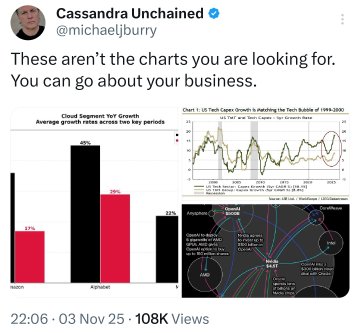

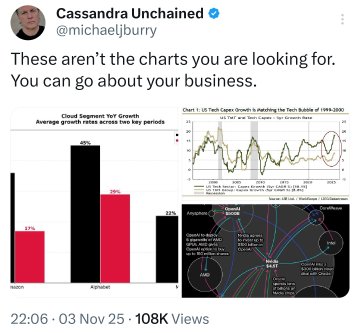

Michael Burry goes short on $PLTR and $NVDA in his latest 13F filing

Posted on 11/3/25 at 8:57 pm

Posted on 11/3/25 at 8:57 pm

Michael Burry goes short on $PLTR and $NVDA in his latest 13F filing

Scion Capital just bought put options on 1M Nvidia shares and 5M Palantir shares ??

The Big Short is feeling bearish on AI

Going hard against the big AI circle jerk.

https://x.com/MichaelJBurry__

Scion Capital just bought put options on 1M Nvidia shares and 5M Palantir shares ??

The Big Short is feeling bearish on AI

Loading Twitter/X Embed...

If tweet fails to load, click here. Going hard against the big AI circle jerk.

https://x.com/MichaelJBurry__

Posted on 11/3/25 at 9:19 pm to GhostOfFreedom

He's drawing some questionable conclusions regarding CAPEX investment. There are clear differences between the dot com era and what we are seeing today. And while his mind map is not wrong, it still doesn't equal a problem. If AI increases productivity, then value is still created.

Posted on 11/3/25 at 10:13 pm to RoyalWe

Side question: if AI’s big benefit is productivity gains, does there come a point where all these companies engage in a price war to the bottom? Prices aren’t dropping yet. But if sales fall off, will they start giving up their obscene margins for “pretty good” margins to grow/defend market share?

Posted on 11/3/25 at 10:30 pm to TDFreak

I think that depends on what companies do with the productivity gains. Increased efficiency doesn’t automatically trigger a race to the bottom — that’s a business strategy question, not a law of economics.

Firms can take those savings and choose to maintain prices (and expand margins), reinvest in innovation, or build new revenue streams. Only in highly commoditized markets do productivity gains reliably translate into price wars.

Companies like Nvidia or Palantir aren’t selling interchangeable widgets — they have ecosystems, switching costs, and intellectual property that give them pricing power. In that context, higher productivity can actually strengthen profitability, not erode it.

So while price competition is one possible outcome, it’s hardly inevitable. It really comes down to management decisions and market structure, not productivity alone.

Firms can take those savings and choose to maintain prices (and expand margins), reinvest in innovation, or build new revenue streams. Only in highly commoditized markets do productivity gains reliably translate into price wars.

Companies like Nvidia or Palantir aren’t selling interchangeable widgets — they have ecosystems, switching costs, and intellectual property that give them pricing power. In that context, higher productivity can actually strengthen profitability, not erode it.

So while price competition is one possible outcome, it’s hardly inevitable. It really comes down to management decisions and market structure, not productivity alone.

Posted on 11/3/25 at 10:38 pm to GhostOfFreedom

Looks like his short position on NVDA was established in Q1. So he bought puts when the price per share was between $100 and $150.

Posted on 11/4/25 at 5:18 am to T-Jon

Didn’t Burry take a big L earlier this year?

Posted on 11/4/25 at 5:26 am to Upperdecker

Maybe he’s right. Maybe he’s wrong.

I don’t plan to retire until about 10 years out so we can ride out the waves.

I don’t plan to retire until about 10 years out so we can ride out the waves.

Posted on 11/4/25 at 5:47 am to kaaj24

That’s cool but some people try to win in the market instead of just existing

Posted on 11/4/25 at 6:06 am to Upperdecker

He’s taken quite a few big L’s lately.

Posted on 11/4/25 at 6:20 am to GhostOfFreedom

quote:

The Big Short is feeling bearish on AI

the Big Short is feeling bearish about the global, macro economy…. and rightfully so

This post was edited on 11/4/25 at 6:34 am

Posted on 11/4/25 at 6:28 am to cadillacattack

When has that guy ever been bullish though? In the past 5 years I feel like he’s constantly been trying to find the next short on AI

Posted on 11/4/25 at 7:14 am to Shepherd88

“He’s predicted 10 of the last 2 recessions”

I doubt he’s putting up a ton of leverage on any of these bets. He’s already set for life

I doubt he’s putting up a ton of leverage on any of these bets. He’s already set for life

Posted on 11/4/25 at 7:25 am to Upperdecker

I want people to earn as much as they can.

I don’t stress over market swings. things go on sale…..

I don’t stress over market swings. things go on sale…..

Posted on 11/4/25 at 8:33 am to RoyalWe

quote:

Companies like Nvidia or Palantir aren’t selling interchangeable widgets — they have ecosystems, switching costs, and intellectual property that give them pricing power. In that context, higher productivity can actually strengthen profitability, not erode it.

CUDA is the moat of the Nvidia business, and because performance is king and advancing quickly. Writing any sort of wrapper around CUDA for broader chip support was not a worthwhile investment.

However, the chips are "fast enough" for some of the workloads we had in house and have definitely taken notice that their are are some CUDA wrappers starting to pop up allowing you to run on other hardware without much changes to the existing software.

Its only a matter of time, but CUDA will be the standard for a while.

Posted on 11/6/25 at 11:18 am to RoyalWe

Is it too early to ping this post back to the front page?

Posted on 11/6/25 at 7:57 pm to Upperdecker

Posted on 11/6/25 at 8:42 pm to GhostOfFreedom

The market is sometimes irrational and is impossible to predict. I still stand by my statements regarding AI and the dot com era.

Posted on 11/6/25 at 10:41 pm to GhostOfFreedom

Going from short position to short position these days is insanity unless your primary thesis is macro driven.

Posted on 11/6/25 at 10:45 pm to RoyalWe

quote:dot com stocks were essentially the first meme stocks. In most cases it was obvious there was nothing there at the time. Quantum computing is a better analog.

There are clear differences between the dot com era and what we are seeing today.

Posted on 11/6/25 at 10:47 pm to beaverfever

Sooo my my new shite is better than your old shite? Got it

Popular

Back to top

4

4