- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

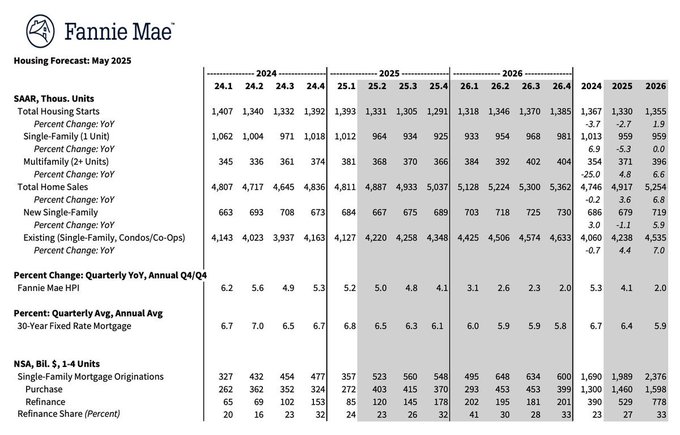

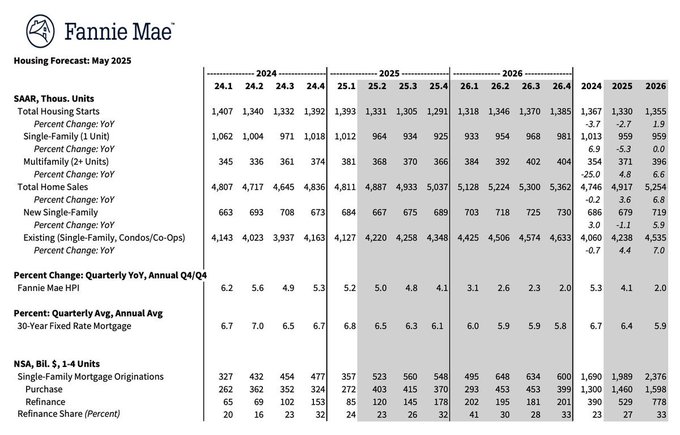

Fannie Mae and MBA updated their outlook for the 30-year fixed mortgage rates

Posted on 5/23/25 at 7:55 am

Posted on 5/23/25 at 7:55 am

Fannie

Q3 2025 -> 6.3%

Q4 2025 -> 6.1%

Q1 2026 -> 6.0%

Q2 2026 -> 5.9%

Q3 2026 -> 5.9%

Q4 2026 -> 5.8%

MBA

Q3 2025 -> 6.7%

Q4 2025 -> 6.6%

Q1 2026 -> 6.5%

Q2 2026 -> 6.5%

Q3 2026 -> 6.4%

Q4 2026 -> 6.3%

Note: Since early 2022, mortgage rate forecasts have generally been too low (i.e., mortgage rates ended up being higher than most forecasts).

People might as well get used to the new norm. Those 3% and lower rates are not coming back anytime soon. Hell, it will be major news if we sniff the lower 5s soon.

Q3 2025 -> 6.3%

Q4 2025 -> 6.1%

Q1 2026 -> 6.0%

Q2 2026 -> 5.9%

Q3 2026 -> 5.9%

Q4 2026 -> 5.8%

MBA

Q3 2025 -> 6.7%

Q4 2025 -> 6.6%

Q1 2026 -> 6.5%

Q2 2026 -> 6.5%

Q3 2026 -> 6.4%

Q4 2026 -> 6.3%

Note: Since early 2022, mortgage rate forecasts have generally been too low (i.e., mortgage rates ended up being higher than most forecasts).

People might as well get used to the new norm. Those 3% and lower rates are not coming back anytime soon. Hell, it will be major news if we sniff the lower 5s soon.

Posted on 5/23/25 at 7:58 am to stout

quote:

Q1 2026 -> 6.0%

Q2 2026 -> 5.9%

Q3 2026 -> 5.9%

Q4 2026 -> 5.8%

Someone asked on MB if rates would hit the high 5s in the next 3yrs and I said 97% it would. Slackster lold at me. Here we are

The people that say Im waiting for rates to drop to buy are never going to own a home

Posted on 5/23/25 at 7:59 am to stout

quote:

People might as well get used to the new norm. Those 3% and lower rates are not coming back anytime soon. Hell, it will be major news if we sniff the lower 5s soon.

SDVTIGER will be here shortly...

Posted on 5/23/25 at 8:00 am to SDVTiger

quote:

The people that say Im waiting for rates to drop to buy are never going to own a home

“You can always refi when the rates go down next year”

- every scumbag realtor

Posted on 5/23/25 at 8:00 am to stout

Nightmare for new buyers, I feel for them.

Locked in at 2% back in 2021. I’m never leaving this house, they’re taking me out of here feet first.

Locked in at 2% back in 2021. I’m never leaving this house, they’re taking me out of here feet first.

Posted on 5/23/25 at 8:01 am to SDVTiger

quote:

Someone asked on MB if rates would hit the high 5s in the next 3yrs and I said 97% it would. Slackster lold at me. Here we are

No offense, but being in the high 5s isn't really a win compared to your other stances a year or two ago. You were pushing sub 5s at one point.

Good on you for adjusting your outlook, though.

Posted on 5/23/25 at 8:03 am to MyRockstarComplex

quote:

“You can always refi when the rates go down next year”

- every scumbag realtor

Let's revisit my thread on this from 2023

New Realtor talking point: "Marry the house, date the rate"

Go look at the first response

This post was edited on 5/23/25 at 8:15 am

Posted on 5/23/25 at 8:06 am to mwade91383

quote:

Nightmare for new buyers, I feel for them.

It's not doom and gloom guys. Try buying a house at 10-15% rates.

Everything is relative and it is more difficult to purchase real estate, but the big modern difference is the marketing of independence versus family. Apartment dwellers and single employees need to push off that narrative of going it alone. Diversity is NOT strength; it's weakness. Find a mate, grow your family, work together, and solve the problems together.

Eta: And you pay for what you want. Far too many pay way too much monthly for subscriptions and tennis shoes. Oh, and don't forget the experiences purchased on credik.

This post was edited on 5/23/25 at 8:15 am

Posted on 5/23/25 at 8:12 am to BestBanker

quote:

It's not doom and gloom guys. Try buying a house at 10-15% rates.

Yes, its not doom and gloom. Sellers who bought right will be fine. A lot of people in a city like Austin, where prices have dropped 23% since the 2021 peak, are screwed. It's all relative to your market but there is not a 2008 waiting around the corner.

Even though I have a reputation here of hoping for the worst, I am still buying. I am bidding on a potential flip today actually. I am confident I can still flip, but I just have to be better and smarter than the other flippers who have never been through a market adjustment and have only ridden the wave up. A lot of those guys will get washed out over the next few years and I think some already have, because there seems to be less competition at sheriff's sales and other auctions.

IMO its the perfect time to buy if you have the means, and the approach I am taking is that if I can't flip it now, I will rent it out and wait or rent it out and keep it since I want to build more rentals to fund my retirement at 50 in 5 years.

Posted on 5/23/25 at 8:14 am to MyRockstarComplex

quote:

“You can always refi when the rates go down next year”

- every scumbag realtor

That's one of the most disingenuous things they say to make a quick buck.

Posted on 5/23/25 at 8:17 am to stout

quote:

No offense, but being in the high 5s isn't really a win compared to your other stances a year or two ago

If Bankrate says the 30yr fix is at 5.8 then you will have sub 5 rates for FHA

When they were 6.2 or when the 10yr was 3.6 in Sept they were in the 4s

Posted on 5/23/25 at 8:21 am to stout

I have a mortgage question for you. Can you text me?

Posted on 5/23/25 at 8:21 am to SDVTiger

quote:

The people that say Im waiting for rates to drop to buy are never going to own a home

You could be right. Here's a historical chart of rates. 6% is below average thus far. And if this operates like a heartbeat, they could go much higher, and property values may go much lower?

Posted on 5/23/25 at 8:25 am to BestBanker

quote:

You could be right. Here's a historical chart of rates. 6% is below average thus far. And if this operates like a heartbeat, they could go much higher, and property values may go much lower?

If Fannie Mae is correct its going to be a frenzy of Buying/Refinancing

Values are going to go up. Ppl in here think realtors are doing a disservice by saying marry the home date the rate but they arent

Telling someone not to buy cause rates or muh 2008 is what that Idiot Diana Olyick has been saying for the last 15yrs. How has that turned out

Posted on 5/23/25 at 8:26 am to SDVTiger

quote:

If Bankrate says the 30yr fix is at 5.8 then you will have sub 5 rates for FHA

That is only for perfect credit. You and I both know a lot of FHA buyers have shite credit and will not see the prime rates.

Posted on 5/23/25 at 8:27 am to Broke

quote:

I have a mortgage question for you. Can you text me?

Just did

Posted on 5/23/25 at 8:28 am to mwade91383

It’s more a function of new buyers wanting more house than they can afford. When I bought my first home in 2005 6.25% was a good rate and it didn’t stop me.

Posted on 5/23/25 at 8:32 am to stout

quote:

That is only for perfect credit. You and I both know a lot of FHA buyers have shite credit and will not see the prime rates.

If you have a 620 you will have that opportunity with Gov loans

Posted on 5/23/25 at 8:36 am to stout

Historically these rates aren’t bad but the rise in prices from the cheap rates and supply have risen to levels where the current rates aren’t in line with house prices. Seems like the answer is just more time..

Posted on 5/23/25 at 8:38 am to SDVTiger

quote:

If you have a 620 you will have that opportunity with Gov loans

There is speculation that is changing. Later this year, Fannie and Freddie are transitioning to what they are calling a bi-merge credit reporting system and people think that will put a baseline for FHA loans closer to a 640 score. Not by FHA changing, but by lenders adjusting their lending practices.

Popular

Back to top

7

7