- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Big Pharma Tax Shelter hurt by Tariffs: Ireland needs to be tariffed hard

Posted on 4/3/25 at 8:56 pm

Posted on 4/3/25 at 8:56 pm

"Pfizer in 2019 sold $20 billion of drugs in the U.S. Its federal tax bill? Zero.

That revelation was part of a Senate Finance Committee investigation done by Democratic staff, released in March, that examined how U.S. pharmaceutical giants exploit a loophole created by the 2017 Trump tax overhaul to shift profits offshore.

The strategy has been great for Big Pharma’s bottom line—and for countries such as Ireland, too. But as President Trump’s trade war picks up steam, that model could start to unravel.

Trump has already singled out pharma companies and countries like Ireland that reap the benefits of tax-avoidance moves. Despite its small size, Ireland ran an $87 billion trade surplus with the U.S. last year—larger than any country except China, Mexico and Vietnam"

“Ireland was very smart,” Trump said last month. “They took our pharmaceutical companies away.”

WSJ article:

LINK

What a shocker, all the money Pfizer made injecting everyone with a untested vaccine and they didnt even pay taxes on it.

Ireland owes the US hundreds of billions of dollars. They should be tariffed into oblivion.

Edit: Ireland has a population of 5.3m. That means our trade deficit with them is $16,400 per capita, every single year.

That revelation was part of a Senate Finance Committee investigation done by Democratic staff, released in March, that examined how U.S. pharmaceutical giants exploit a loophole created by the 2017 Trump tax overhaul to shift profits offshore.

The strategy has been great for Big Pharma’s bottom line—and for countries such as Ireland, too. But as President Trump’s trade war picks up steam, that model could start to unravel.

Trump has already singled out pharma companies and countries like Ireland that reap the benefits of tax-avoidance moves. Despite its small size, Ireland ran an $87 billion trade surplus with the U.S. last year—larger than any country except China, Mexico and Vietnam"

“Ireland was very smart,” Trump said last month. “They took our pharmaceutical companies away.”

WSJ article:

LINK

What a shocker, all the money Pfizer made injecting everyone with a untested vaccine and they didnt even pay taxes on it.

Ireland owes the US hundreds of billions of dollars. They should be tariffed into oblivion.

Edit: Ireland has a population of 5.3m. That means our trade deficit with them is $16,400 per capita, every single year.

This post was edited on 4/3/25 at 8:59 pm

Posted on 4/3/25 at 9:00 pm to GeauxBurrow312

Bernie and AOC must be loving this!

Posted on 4/3/25 at 9:05 pm to GeauxBurrow312

I'm as Irish as they come, and I agree. frick Ireland.

Posted on 4/3/25 at 9:08 pm to Taxing Authority

Im sure they do love the liberal hellhole that is modern day Ireland

16.4k per capita is effectively the US subsidizing their entire existence. Thats over 60k for a family of 4, courtesy of Uncle Sam.

At least with China, Canada etc, the trade deficit still results from acquiring something (goods etc), with Ireland? We get nothing. Its just US corporations paying them taxes instead of paying at home.

Would love to see some Greenland style rhetoric on these shitbags

16.4k per capita is effectively the US subsidizing their entire existence. Thats over 60k for a family of 4, courtesy of Uncle Sam.

At least with China, Canada etc, the trade deficit still results from acquiring something (goods etc), with Ireland? We get nothing. Its just US corporations paying them taxes instead of paying at home.

Would love to see some Greenland style rhetoric on these shitbags

Posted on 4/3/25 at 9:17 pm to GeauxBurrow312

quote:Nah. But they--like you--have wanted to tax foreign earning for decades. Who did you vote for?

Im sure they do love the liberal hellhole that is modern day Ireland

Posted on 4/3/25 at 9:20 pm to GeauxBurrow312

quote:

Trump has already singled out pharma companies and countries like Ireland that reap the benefits of tax-avoidance moves

quote:

That revelation was part of a Senate Finance Committee investigation done by Democratic staff, released in March, that examined how U.S. pharmaceutical giants exploit a loophole created by the 2017 Trump tax overhaul to shift profits offshore.

I might need to start taking drugs to make sense of this one

Posted on 4/3/25 at 9:21 pm to Taxing Authority

AOC & Bernie want to charge corp tax rates so high that corps have no choice but to flee overseas. Trump advocates for low corp tax rates.

What Ireland did was structure their tax code with the specific intention of being a tax haven for US corps. Ireland needs to pay the price for conducting a $500b theft

What Ireland did was structure their tax code with the specific intention of being a tax haven for US corps. Ireland needs to pay the price for conducting a $500b theft

Posted on 4/3/25 at 9:21 pm to GeauxBurrow312

This is starting to sound like a Bernie rally

Posted on 4/3/25 at 9:21 pm to GeauxBurrow312

Let’s be fair to Ireland – we may have a huge trade deficit with them, but they did take Rosie O’Donnell out of the United States. Seems like a fair trade to me.

Posted on 4/3/25 at 9:23 pm to Powerman

quote:

That revelation was part of a Senate Finance Committee investigation done by Democratic staff, released in March, that examined how U.S. pharmaceutical giants exploit a loophole created by the 2017 Trump tax overhaul to shift profits offshore.

I might need to start taking drugs to make sense of this one

Evidently he made bad trade deals and doesnt like his own tax code.

Posted on 4/3/25 at 9:28 pm to GeauxBurrow312

quote:

For Big Tech companies, a U.S. tariff hike would be an inconvenience—but one that could be managed with some legal and accounting maneuvers.

Big Pharma has a bigger problem. It has made Ireland a critical hub not just for profit shifting but for manufacturing as well. That setup could become a liability that companies can’t easily walk away from, said Brad Setser, a senior fellow focused on global trade at the Council on Foreign Relations.

quote:

A Pfizer spokeswoman wrote that the information published by Senate Finance Committee ranking member Ron Wyden (D., Ore.) isn’t an accurate portrayal of the 2017 Tax Cuts and Jobs Act’s effect on Pfizer. She said Pfizer has paid more than $12.8 billion in income taxes in the U.S. over the past four years.

quote:

Pharmaceuticals have historically been exempt from tariffs to protect patient access to essential medicines. That means the industry is now scrambling to prepare, said Chris Desmond, a leader in the U.S. Global Trade Services team at PwC.

This post was edited on 4/3/25 at 9:31 pm

Posted on 4/3/25 at 9:29 pm to RogerTheShrubber

“We’re gonna try to fix a whole bunch of these tax scams,” U.S. Commerce Secretary Howard Lutnick said in the All-In podcast recently. “Ireland is my favorite…You’d say, Ireland, what do they do? Oh, they have all of our IP.”

For Big Tech companies, a U.S. tariff hike would be an inconvenience—but one that could be managed with some legal and accounting maneuvers.

Big Pharma has a bigger problem. It has made Ireland a critical hub not just for profit shifting but for manufacturing as well. That setup could become a liability that companies can’t easily walk away from, said Brad Setser, a senior fellow focused on global trade at the Council on Foreign Relations. “Your tax strategy runs squarely up against the tariff,” he said."

So sad that Pfizer is going to get fricked

Meanwhile, Trump's tariffs are working:

"In the long term, major pharmaceutical companies are looking to shift more production to the U.S. Recently, Eli Lilly and Johnson & Johnson announced plans to invest more than $80 billion in U.S. manufacturing and R&D over the next four to five years.

These large-scale projects take time, so companies aren’t likely to downsize overseas plants anytime soon. But with the growing risk of changes to tariffs and the tax code, companies are taking reshoring seriously—especially for newer, high-margin products. ?The upshot is that profitability will be affected either way: Overseas goods may incur tariffs, while domestic manufacturing faces higher labor costs."

For Big Tech companies, a U.S. tariff hike would be an inconvenience—but one that could be managed with some legal and accounting maneuvers.

Big Pharma has a bigger problem. It has made Ireland a critical hub not just for profit shifting but for manufacturing as well. That setup could become a liability that companies can’t easily walk away from, said Brad Setser, a senior fellow focused on global trade at the Council on Foreign Relations. “Your tax strategy runs squarely up against the tariff,” he said."

So sad that Pfizer is going to get fricked

Meanwhile, Trump's tariffs are working:

"In the long term, major pharmaceutical companies are looking to shift more production to the U.S. Recently, Eli Lilly and Johnson & Johnson announced plans to invest more than $80 billion in U.S. manufacturing and R&D over the next four to five years.

These large-scale projects take time, so companies aren’t likely to downsize overseas plants anytime soon. But with the growing risk of changes to tariffs and the tax code, companies are taking reshoring seriously—especially for newer, high-margin products. ?The upshot is that profitability will be affected either way: Overseas goods may incur tariffs, while domestic manufacturing faces higher labor costs."

Posted on 4/3/25 at 9:33 pm to RogerTheShrubber

quote:

Evidently he made bad trade deals and doesnt like his own tax code.

Trusting an opinion written by a Democrat.

No one is surprised.

This post was edited on 4/3/25 at 9:35 pm

Posted on 4/3/25 at 9:37 pm to GeauxBurrow312

quote:

"Pfizer in 2019 sold $20 billion of drugs in the U.S. Its federal tax bill? Zero.

While Americans subsidized Big Pharma through Government research grants and exorbitant prices for prescription drugs, while the rest of the world pay virtually nothing

Posted on 4/3/25 at 9:38 pm to Taxing Authority

at this rate, AOC might be running to the right of JD Vance in 2028

Posted on 4/3/25 at 9:53 pm to GeauxBurrow312

quote:

That revelation was part of a Senate Finance Committee investigation done by Democratic staff, released in March, that examined how U.S. pharmaceutical giants exploit a loophole created by the 2017 Trump tax overhaul to shift profits offshore.

This journalist doesn't understand shite about tax. Profits were being shifted before 2017 and you had permanent deferral of US tax on foreign earnings. The TCJA took aim at that albeit with certain chinks in the armor that could be exposed. The TCJA didn't incentivize profit shifting. That was an existing problem.

This post was edited on 4/3/25 at 9:58 pm

Posted on 4/3/25 at 10:09 pm to Jorts R Us

I find it comical you guys talk about "tax scams" when your "billionaire " president pays less than 1k in taxes every year.

Posted on 4/4/25 at 8:16 am to Faurot fodder

quote:

Ireland

Is now Irestanbul.

Posted on 4/4/25 at 8:30 am to GeauxBurrow312

quote:Yes, and you say...

AOC & Bernie want to charge corp tax rates so high that corps have no choice but to flee overseas.

quote:

They should be tariffed into oblivion.

quote:So a US corp found a pay to lower taxes, and you're against it?

Trump advocates for low corp tax rates.

What Ireland did was structure their tax code with the specific intention of being a tax haven for US corps.

Posted on 4/4/25 at 8:40 am to Taxing Authority

quote:

So a US corp found a pay to lower taxes, and you're against it?

Ireland has made $500b in the last 8 years off taxes from US corps. In case you haven't noticed, we have a 36t and counting national debt. They also moved some manufacturing jobs to Ireland.

Ireland should be tariffed into oblivion. They schemed to frick the US, making an example out of them will ensure other countries do not try it in the future. Taking Big Pharma back from Ireland will ruin their economy, makes up vast majority of their GDP

This post was edited on 4/4/25 at 8:42 am

Popular

Back to top

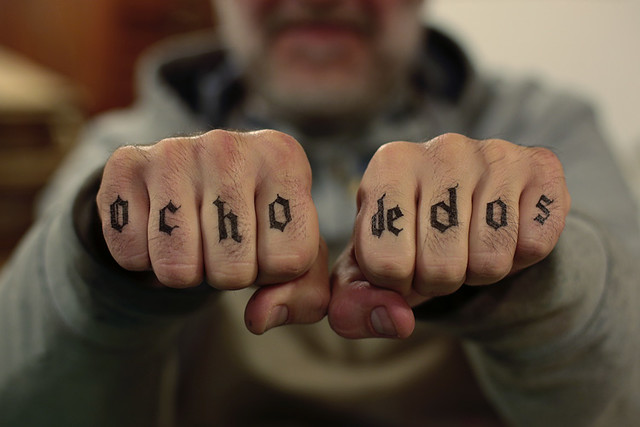

8

8