- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Citi to cut 20K jobs as bank posts worst fourth-quarter loss in 15 years

Posted on 1/12/24 at 2:50 pm

Posted on 1/12/24 at 2:50 pm

Posted on 1/12/24 at 2:53 pm to Heisman U

Job market is phucking terrible right now. I'm looking at linkedin job postings and seeing a couple hundred to sometimes over a thousand applicants for jobs.

Posted on 1/12/24 at 3:00 pm to Heisman U

As these rates continue to stay high, we're likely to see more and more job cuts (although nothing like that, 20k over two years is insane).

Posted on 1/12/24 at 4:14 pm to Heisman U

quote:

The Biden economy is booming if you just ignore your eyes & ears.

We're living in an Orwellian prophecy.

It was supposed to be a warning, not a blueprint.

Posted on 1/12/24 at 4:41 pm to Heisman U

The cuts were in place prior to losses and contributed to the loss.

Barron’s

quote:

Citigroup reported a net loss for the fourth quarter of $1.8 billion. The loss comes after Citigroup previously disclosed a litany of one-time charges, which included a $780 million charge due to severance and other costs related to its restructuring efforts.

Citigroup reported revenue of $17.4 billion. Wall Street analysts expected Citi to report earnings per share of 10 cents and revenue of $18.7 billion.

The company is in the midst of a turnaround effort under CEO Jane Fraser, who has moved to cut layers of management and staffing and reorganize the business.

Citi reported a slew of charges and hits to earnings, including a $1.7 billion FDIC special assessment, a reserve build of $1.3 billion associated with "transfer risk" in Russia and Argentina, and a hit of $880 million associated with the devaluation of the Argentine peso. All told, the charges and losses shaved $2 off earnings per share. Without those items, Citi said, EPS would have been $0.84 in the quarter.

Citi added that revenue decreased 3% from the year-ago period but would have increased 2% excluding divestitures and the impact of Argentina's peso devaluation.

Barron’s

This post was edited on 1/12/24 at 4:42 pm

Posted on 1/12/24 at 4:43 pm to Heisman U

That will get calculated as a 20,000 job increase in the jobs report.

Posted on 1/12/24 at 4:44 pm to Heisman U

BUT THAT UNEMPLOYMENT RATE!

filled with people who quit looking for work and all those GUBMENT JOBS AND shite PART TIME JOBS!

filled with people who quit looking for work and all those GUBMENT JOBS AND shite PART TIME JOBS!

Posted on 1/12/24 at 4:48 pm to the808bass

quote:

That will get calculated as a 20,000 job increase in the jobs report.

Minimum wage full time jobs get split into 2 part time minimum wage jobs

The White House: “DOUBLING AMERICAN JOBS!”

Posted on 1/12/24 at 4:58 pm to Heisman U

frick Citi bank. Remember when they hand picked Obama's cabinet.

I feel sorry for the everyday good folks who lost their jobs tho.

I feel sorry for the everyday good folks who lost their jobs tho.

Posted on 1/12/24 at 5:15 pm to Heisman U

Fairly disingenuous to leave out that those 20k are over 2 years. Still sucks, feel badly for those affected

Posted on 1/12/24 at 5:17 pm to Heisman U

Good news though, more people available for door dash and Uber now.

Posted on 1/12/24 at 7:11 pm to cwill

quote:the cuts contributed to the losses?

The cuts were in place prior to losses and contributed to the loss.

Posted on 1/12/24 at 7:13 pm to UncleFestersLegs

Looks like they stayed overstaffed for too long?

Posted on 1/12/24 at 7:45 pm to goatmilker

quote:

Making room for AI bots.

Talking with my Fidelity investment dude a while back and he said Fidelity's Robo Investing service is getting very popular with Fidelity customers.....investing at the speed of light with an AI Robo Investment bot using algorithms.

Posted on 1/12/24 at 8:02 pm to Powerman

quote:

Looks like they stayed overstaffed for too long?

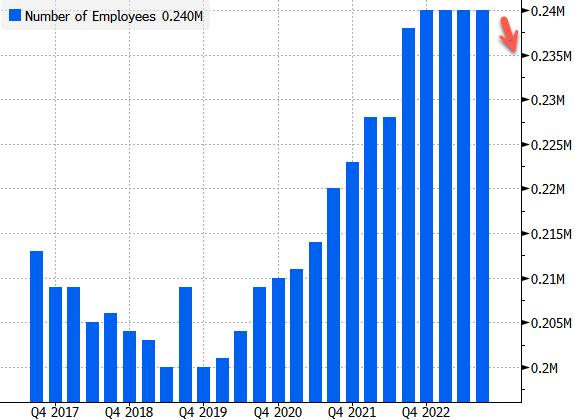

This is attributable to a massive restructuring that should have happened years ago. They collapsed management layers from 12 to 8 and realign the business units to reduce management redundancies in all the countries they operate in. Citi is by far off the most international of the big U.S. money center banks. They had multiple management redundancies with business lines and in-country management. They have already agreed to sell Banamex which transfer out another 20,000 employees by 2025

This post was edited on 1/12/24 at 8:03 pm

Posted on 1/12/24 at 8:09 pm to 14&Counting

Dumb fa ggots (nod to 808) hate facts is the lesson to take from this thread.

This post was edited on 1/12/24 at 8:10 pm

Popular

Back to top

16

16