- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

ADP Jobs Number nearly doubles expectations; recession still imminent?

Posted on 8/2/23 at 7:22 am

Posted on 8/2/23 at 7:22 am

CNBC

quote:

Job gains for the month totaled 324,000, driven by a 201,000 jump in hotels, restaurants, bars and affiliated businesses. That total was well above the Dow Jones consensus estimate for 175,000, though it marked a decrease from the downwardly revised 455,000 in June.

quote:

ADP also noted that wages increased by 6.2% from a year ago, well above the long-term pace but the lowest growth since November 2021.

This post was edited on 8/2/23 at 7:23 am

Posted on 8/2/23 at 7:32 am to slackster

How’d it go from 455,000 in June to only 175,000 in July? It’s still summer, that just seems like a very poor estimate.

Given that, summer jobs growth is always high I’m curious what this fall will bring. Im not sure a major recession is looming but people are still having a difficult time adjusting to current prices and inflation.

Given that, summer jobs growth is always high I’m curious what this fall will bring. Im not sure a major recession is looming but people are still having a difficult time adjusting to current prices and inflation.

Posted on 8/2/23 at 7:49 am to slackster

quote:

Job gains for the month totaled 324,000, driven by a 201,000 jump in hotels, restaurants, bars

It's summertime, this is to be expected.

quote:

ADP also noted that wages increased by 6.2% from a year ago

So, keeping up with COL/inflation, how nice of these employers.

Posted on 8/2/23 at 7:52 am to Rendevoustavern

quote:

It's summertime, this is to be expected.

Posted on 8/2/23 at 8:18 am to Rendevoustavern

quote:

So, keeping up with COL/inflation, how nice of these employers.

That’s beating inflation by a decent margin.

Posted on 8/2/23 at 8:39 am to slackster

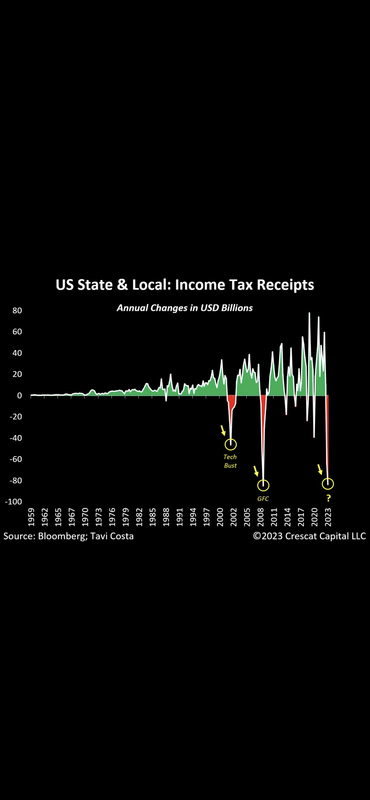

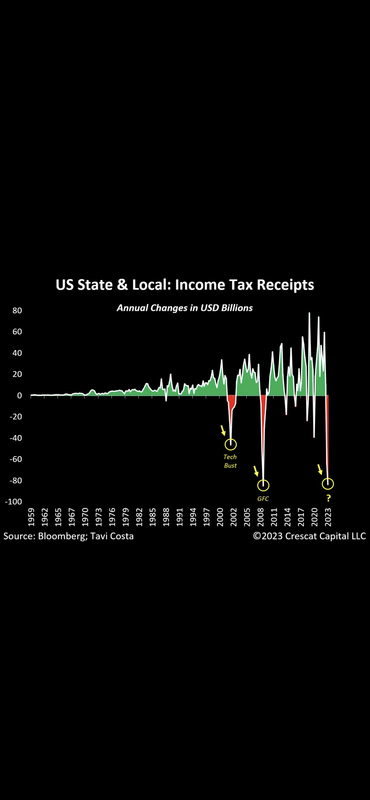

How does it jive with data points like this:

Posted on 8/2/23 at 9:22 am to slackster

quote:

recession still imminent?

We're in a recession now. They deny this fact so they can say it never happened.

Posted on 8/2/23 at 9:34 am to slackster

If you look at the tax receipts trending steadily downwards the only obvious conclusion is the jobs numbers are being rigged to justify fed rate policy.

In the months afterwards they will quietly revise downwards the jobs numbers. Just like they have been doing.

In the months afterwards they will quietly revise downwards the jobs numbers. Just like they have been doing.

Posted on 8/2/23 at 9:44 am to slackster

quote:

ADP also noted that wages increased by 6.2% from a year ago, well above the long-term pace but the lowest growth since November 2021.

That's a welcomed jump but there's still a lot left to make up as inflation well outpaced wages since March 2021.

quote:

Job gains for the month totaled 324,000, driven by a 201,000 jump in hotels, restaurants, bars and affiliated businesses. That total was well above the Dow Jones consensus estimate for 175,000, though it marked a decrease from the downwardly revised 455,000 in June.

The problem we're still facing is: where are the workers? I know the Baby Boomers were a large portion of the workforce for decades, but the LFPR has remained flat for most of the year (the only other time we've seen it remain flat for more than 3 months was just before COVID hit, which makes me think we're at full employment for at least those looking for work). We aren't seeing anything abnormal with Initial Claims nor Continued Claims (although it's still slightly above pre-COVID levels). I can't help but think the worker shortages we're seeing is a combination of not only Boomer retirement but also addiction-caused homelessness (primarily fentanyl).

If this is true, we can expect wages to continue to rise as the impact of last year's rate hikes expand through the economy.

That's a good thing.

The bad thing is that the federal government is still spending deficit money like a drunken, heartbroken sailor on shore leave in Thailand (the recent "limit" agreement on deficit spending is a fricking joke).

Until/Unless deficit spending gets wrangled down, we're still looking at an economic Russian Roulette situation where after every non-fire, we add another bullet to the mix.

We're also watching fuel spike. As we've learned (or at least should have), high fuel prices can keep various CPI categories "sticky" (Food, for example). We're still below pre-COVID production and refinement levels ( LINK and LINK) while has cut production and plans to keep it cut for at least the near-term. Should this spike go high enough and/or last long enough, it could erase wage gains by pushing inflation back up.

All that said, there's a lot of red in the market today. August is usually the worst month for the market, so no idea if it's just August being August or that traders don't like those numbers (or both, or something else altogether).

Posted on 8/2/23 at 10:28 am to slackster

What proportion of those gains are from the birth-death model?

Edit: my bad that's ADP

Just want to point out the stupidity of looking at the one lagging indicator that is last to go considering every other data point we have that is pointing to global deflation/economic contraction.

Edit: my bad that's ADP

Just want to point out the stupidity of looking at the one lagging indicator that is last to go considering every other data point we have that is pointing to global deflation/economic contraction.

This post was edited on 8/2/23 at 11:13 am

Posted on 8/2/23 at 2:21 pm to molsusports

quote:

If you look at the tax receipts trending steadily downwards the only obvious conclusion is the jobs numbers are being rigged to justify fed rate policy. In the months afterwards they will quietly revise downwards the jobs numbers. Just like they have been doing.

Lol this is a private company payroll report.

Biden has gotten to ADP?

Posted on 8/2/23 at 2:45 pm to slackster

FRED

Zoom in over the last 12 months. Dropped off by 10% in only a quarter. That is not good and not consistent with job creation. At the very least people are working lower paying jobs and/or fewer hours.

I'm open to being convinced otherwise. Just show me a reversal in the FRED data.

Zoom in over the last 12 months. Dropped off by 10% in only a quarter. That is not good and not consistent with job creation. At the very least people are working lower paying jobs and/or fewer hours.

I'm open to being convinced otherwise. Just show me a reversal in the FRED data.

Posted on 8/2/23 at 3:26 pm to molsusports

quote:

Zoom in over the last 12 months. Dropped off by 10% in only a quarter.

So take "lower revenue coming in" and compare that to combination of "ever-increasing debt" and "higher interest rates on debt servicing".

And pundits will be wondering why Fitch lowered the US credit rating...

Posted on 8/2/23 at 3:30 pm to molsusports

quote:

you look at the tax receipts trending steadily downwards the only obvious conclusion is the jobs numbers are being rigged to justify fed rate policy.

This is ADP data. That should be more reliable than the government numbers.

What's incongruous is every other news story is a large employer announcing job cuts.

Posted on 8/2/23 at 5:42 pm to slackster

This is another data point for Powell and the Fed to point to to justify continuing to raise interest rates.

The Fed has to be worried that inflation is going to become sticky and we won't be able to get back to their stated goal of 2%.

I think they continue to raise interest rates until something breaks again (see SVB in March) in an attempt to flight inflation.

The Fed has to be worried that inflation is going to become sticky and we won't be able to get back to their stated goal of 2%.

I think they continue to raise interest rates until something breaks again (see SVB in March) in an attempt to flight inflation.

Posted on 8/2/23 at 6:49 pm to slackster

we had a complete shut down, shite load of lost jobs, and people not wanting to work, and your proud of this????

any president was going to get these numbers, or you are beyond shite.

seriously, for reals?

any president was going to get these numbers, or you are beyond shite.

seriously, for reals?

Posted on 8/2/23 at 7:51 pm to SeeeeK

quote:

we had a complete shut down, shite load of lost jobs, and people not wanting to work, and your proud of this???? any president was going to get these numbers, or you are beyond shite. seriously, for reals

Idgaf about the president, I’m here to make money. Run back to the political talk.

Posted on 8/2/23 at 7:52 pm to BestBanker

There has to be a drop in GDP for 2 consecutive quarters for the economy to be in a recession. This is not the current situation.

Im sure you were just speaking about the subject without the knowledge to do so effectively.

Im sure you were just speaking about the subject without the knowledge to do so effectively.

Posted on 8/2/23 at 7:57 pm to I Love Bama

quote:

Inflation is already at 2%.

The danger is now is deflation.

Out of curiosity, what's a good way to hedge against the impending deflation?

Popular

Back to top

11

11