- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Unemployment numbers at a 50 year low but average person does not favor economy

Posted on 5/5/23 at 8:38 am

Posted on 5/5/23 at 8:38 am

What am I missing? Also, many analysts believe there will be a recession.

Posted on 5/5/23 at 8:42 am to boogiewoogie1978

quote:

What am I missing?

Very shitty data.

Posted on 5/5/23 at 8:44 am to dewster

You seem to be fired up with jobs data and such this morning. All over it on the PT and here.

Posted on 5/5/23 at 8:45 am to boogiewoogie1978

People can’t afford their 2 largest expenses anymore.

Posted on 5/5/23 at 8:49 am to notiger1997

quote:

You seem to be fired up with jobs data and such this morning. All over it on the PT and here.

It really doesn't make sense. I also like seeing both sides of the spectrum.

Posted on 5/5/23 at 8:54 am to PhiTiger1764

Some frustration I'm having is with the quality of data we are seeing right now.

They adjusted payroll numbers down for Feb and March. They will probably do it for April again without anyone questioning why they were so broken in the first place. These weren't minor adjustments - these were 30% to 50% revisions, all downward. Hopefully that won't happen again and that people making policy decisions aren't using the bad numbers previously reported.

Housing is down, but everyone expected that. That is arguably a good thing, as it was superheated for several years. Some markets needed this correction.

Commercial real estate is way down, and will continue to fall as business leases start expiring. It will be a huge problem in NYC, Houston, Chicago, and the other big office markets. Unknown if this is just a factor of our more WFH focused culture or if there is real scale backs happening on the job front.

Also - not all jobs are created equal: And if WSJ can be trusted, the only job gains we are seeing are lower level service positions that were left unfilled during the pandemic (restaurants, hospitality, etc.). Sorry but that's not going to compensate for the massive layoffs in big tech, B4 consulting, and in the financial industry - those companies pay $150-$250k per year for a lot of those positions they are eliminating.

I'm on the pessimistic side.

They adjusted payroll numbers down for Feb and March. They will probably do it for April again without anyone questioning why they were so broken in the first place. These weren't minor adjustments - these were 30% to 50% revisions, all downward. Hopefully that won't happen again and that people making policy decisions aren't using the bad numbers previously reported.

Housing is down, but everyone expected that. That is arguably a good thing, as it was superheated for several years. Some markets needed this correction.

Commercial real estate is way down, and will continue to fall as business leases start expiring. It will be a huge problem in NYC, Houston, Chicago, and the other big office markets. Unknown if this is just a factor of our more WFH focused culture or if there is real scale backs happening on the job front.

Also - not all jobs are created equal: And if WSJ can be trusted, the only job gains we are seeing are lower level service positions that were left unfilled during the pandemic (restaurants, hospitality, etc.). Sorry but that's not going to compensate for the massive layoffs in big tech, B4 consulting, and in the financial industry - those companies pay $150-$250k per year for a lot of those positions they are eliminating.

I'm on the pessimistic side.

Posted on 5/5/23 at 8:57 am to PhiTiger1764

quote:

People can’t afford their 2 largest expenses anymore.

Well maybe it's just transitory economic pain. And not anything you should be concerned with.

Posted on 5/5/23 at 9:03 am to PhiTiger1764

quote:

People can’t afford their 2 largest expenses anymore.

Then you would think that people aren’t spending money on leisurely activities. The reality is, hotels, restaurants and airports are busier than they were pre Covid.

Posted on 5/5/23 at 9:08 am to boogiewoogie1978

The slowdown is coming, but the debate is whether or not it will be a full blown recession. The Fed is literally trying to slow down the economy.

As far as people’s opinions of the economy, the biggest factor, IMO, is how high the bar has been set. Unemployment was at all time lows in the months leading up to the pandemic, so to just get back and slightly improve those numbers feels like the last 3 years have been wasted.

As far as people’s opinions of the economy, the biggest factor, IMO, is how high the bar has been set. Unemployment was at all time lows in the months leading up to the pandemic, so to just get back and slightly improve those numbers feels like the last 3 years have been wasted.

Posted on 5/5/23 at 9:22 am to boogiewoogie1978

The “numbers” are complete garbage.

Posted on 5/5/23 at 9:24 am to SloaneRanger

quote:

The “numbers” are complete garbage.

Show your work.

Anecdotally, how many people do you know who want a job and can’t find one?

Posted on 5/5/23 at 9:24 am to boogiewoogie1978

Because using unemployment numbers as a basis for an argument about the economy misses too many other factors; underemployment issues, people no longer eligible for UE benefits do not fully count when calculating UE numbers, also doesn't factor those that have left the employment market completely.

Also, when you have inflation growing at the rate we have experienced over the past 2+ years, people are not going to have favorable views of the economy regardless of any of the other factors.

Also, when you have inflation growing at the rate we have experienced over the past 2+ years, people are not going to have favorable views of the economy regardless of any of the other factors.

Posted on 5/5/23 at 9:37 am to boogiewoogie1978

They made a regulation change for payment processing companies that added gig economy jobs to the payroll numbers. They also model out labor supply increases based on population growth and new business applications that more than likely won't reflect reality.

Posted on 5/5/23 at 9:51 am to Paul Allen

quote:

Then you would think that people aren’t spending money on leisurely activities. The reality is, hotels, restaurants and airports are busier than they were pre Covid.

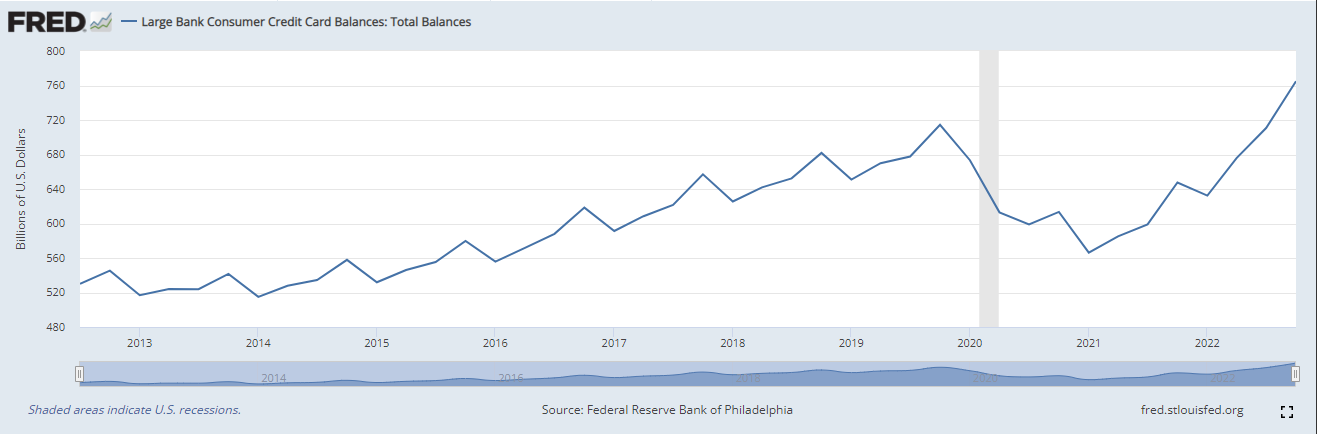

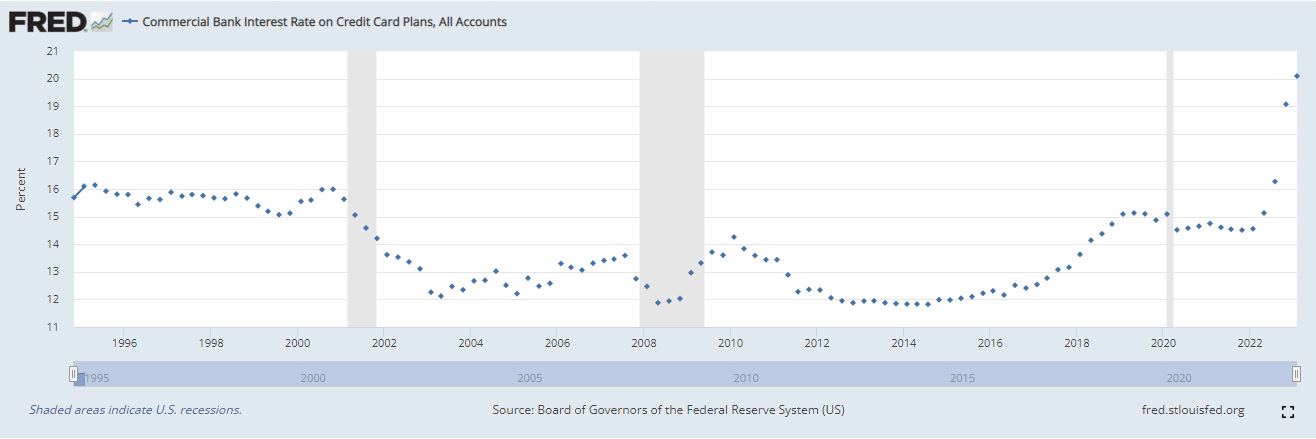

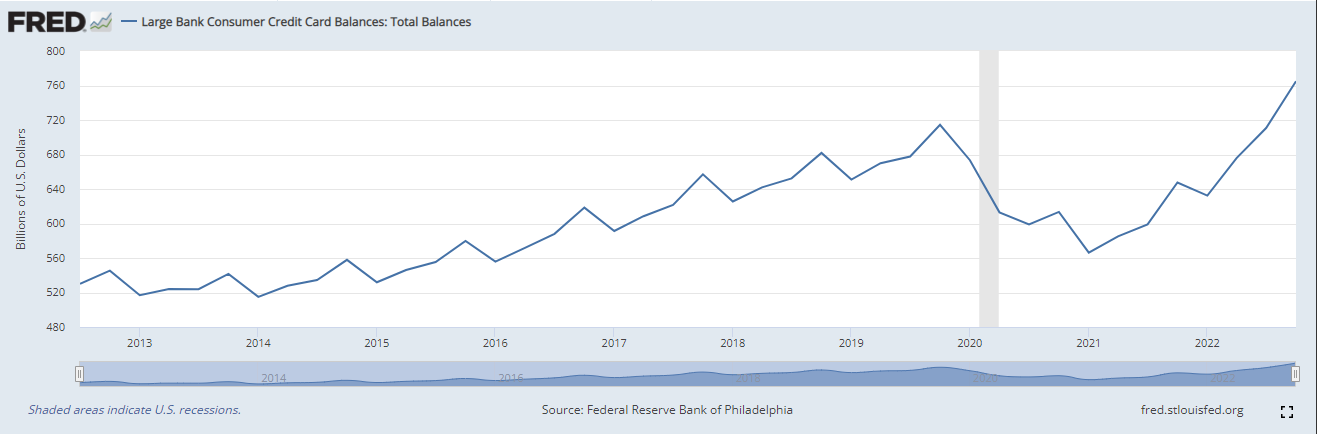

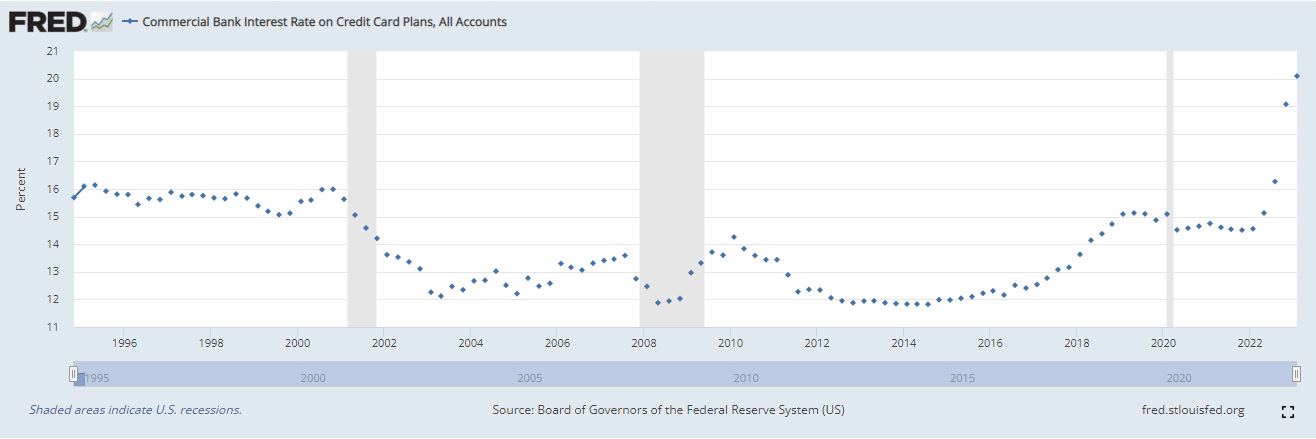

Which is why I think we're in a consumer credit bubble. Consumers seem to have been trying to maintain their lifestyles on their credit cards even though the average interest rate now hovers around 20%. That's simply unsustainable in a slowing economy.

Posted on 5/5/23 at 10:05 am to frequent flyer

quote:

And if WSJ can be trusted

Posted on 5/5/23 at 10:09 am to slackster

quote:

The slowdown is coming, but the debate is whether or not it will be a full blown recession.

I posted this in another thread but it works here as well:

For those who don't understand the graph, longer-term securities normally have better yields. For shorter-term yields to be above longer-terms, it means market players are purchasing many more long-term securities (driving the price down and the price of shorter-term securities up). In other words, during normal market expansion we see the 10yr outperforming the 2yr. This is the "inverted yield curve".

While the yield curve isn't a driver nor is it a true predictor of recession, it's a representation of how investors see the upcoming economy. With that said, it's been accurate enough to be mistaken for a predictor.

Currently we are in a period of inversion that we haven't seen since the economic woes of the late 70s/early 80s (based on range of inversion combined with time length).

This post was edited on 5/5/23 at 10:41 am

Posted on 5/5/23 at 10:24 am to Bard

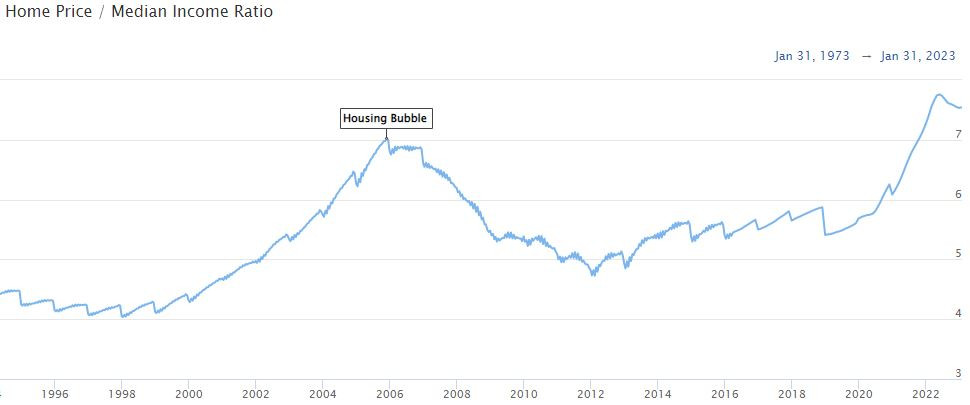

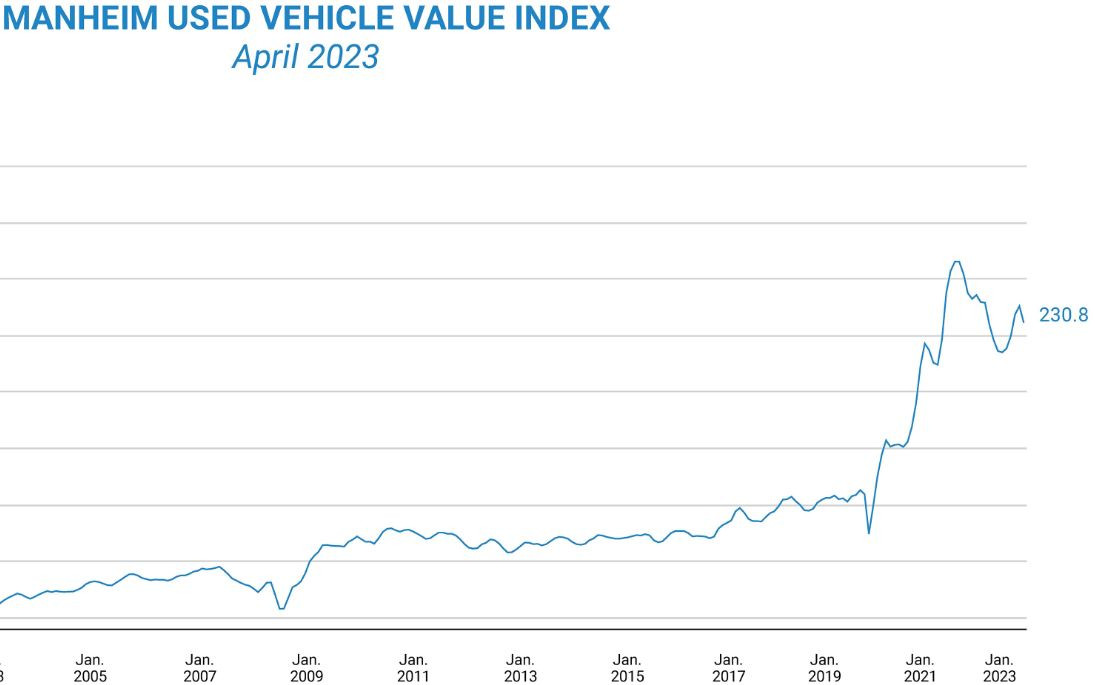

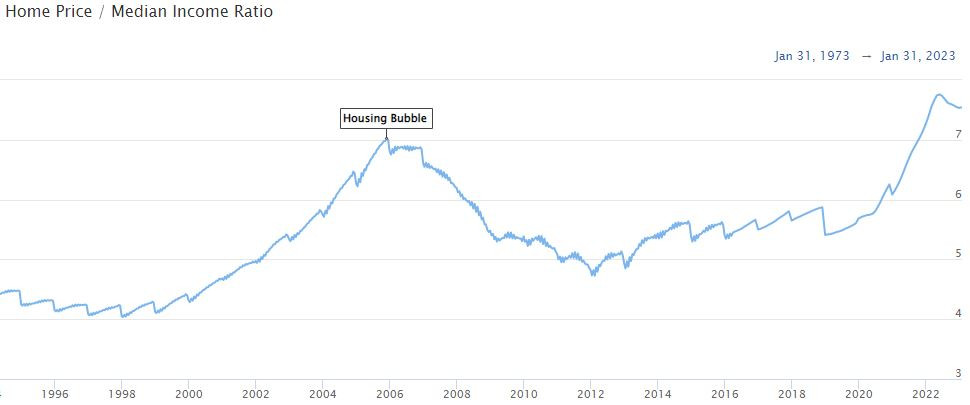

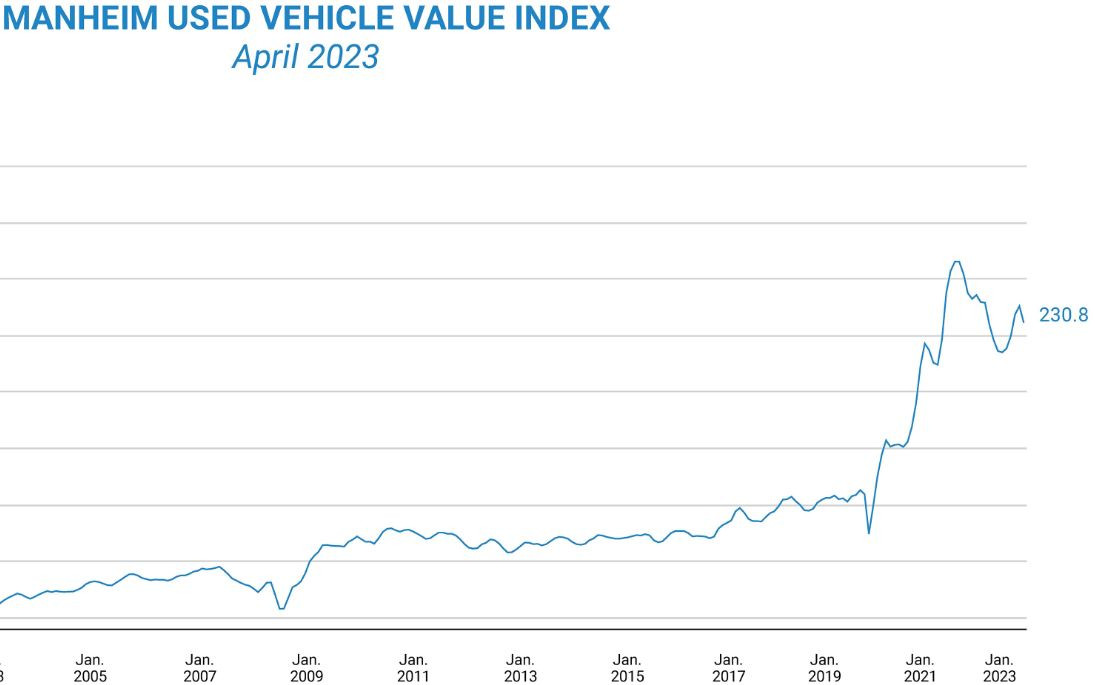

@Bard, here's a couple to go along with previous post... nothing bad gonna happen here.

Posted on 5/5/23 at 10:34 am to boogiewoogie1978

quote:

What am I missing?

COVID pushed a lot of people who were delaying retirement over the edge. Gig work is bigger than ever, people who were flipping burgers started ubering and dashing and then service jobs had to raise wages. The infrastructure bill has created a lot of jobs/work for people in certain industries.

Like I've said before in a thread about inflation, they can say that we have to get unemployment up to fix the problem but the market is clearly saying it needs workers.

Posted on 5/5/23 at 10:35 am to UpstairsComputer

Posted on 5/5/23 at 10:38 am to Bard

Interesting to see 2008-2016 and then 2016-2020 there

Popular

Back to top

9

9