- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

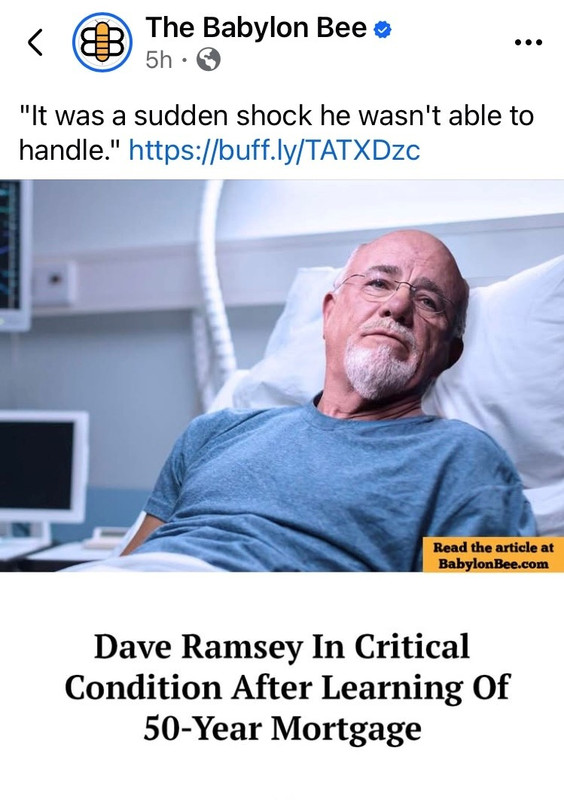

re: Trump promoting a 50 year mortgage. Dave Ramsey will lose his mind. Terrible idea - imo

Posted on 11/11/25 at 9:06 am to NC_Tigah

Posted on 11/11/25 at 9:06 am to NC_Tigah

quote:

This is not about me (I posted personal particulars re: loan leverage use earlier in the thread), or you.

quote:If they can pay it off in 30, why can't they pay it off in 30?

For owner's of a 50, if they apply the monthly difference between their 50yr note and a 30yr at the identical interest rate, they pay the 50 off in 30, with identical interest in total 30 vs 50.

quote:Well if you want to argue that 50 year borrowers have the ability to pay off their loans in 30 years (at higher rates), I guess it does.

Obviously with increasing term 15 vs 30 vs 50 there will be an associated premium, but the point stands.

EDIT: I have no idea who or why anyone downvoted your post, but FTR it wasn't me!

This post was edited on 11/11/25 at 9:08 am

Posted on 11/11/25 at 9:09 am to Taxing Authority

quote:NO!

I mean if we're going to presume that values always go up, and they're always going to go up faster than inflation...

That's the point, TA.

Assume home prices simply track inflation.

$400K in 2015 => $528K now.

Given $40K down in 2015, the $128K profit = a 320% ROI.

All a function of leverage.

Posted on 11/11/25 at 9:12 am to Taxing Authority

quote:

Had a look at our fed debt lately? The only reason is was "a few years" is because the Treasury/Fed bailed out the banks and re-inflated the bubble.

And behind the scenes of all this:

quote:

The Fed also said it was maintaining its current plan to allow up to $35 billion in mortgage-backed securities to expire each month - a target it has never achieved in more than three years of reductions - but beginning December 1 will reinvest all proceeds from maturing MBS into Treasury bills.

LINK

Buying a home right now might be a trap

Posted on 11/11/25 at 9:13 am to AncientTiger

Dave Ramsey can kiss my paid off mortgage arse. He is a has been. Put young people in houses!

Posted on 11/11/25 at 9:14 am to Taxing Authority

quote:1st time buyers sometimes just need the ability to lock-in ownership, with the knowledge they can income-grow into the note. e.g., a spouse two years away from an accounting degree.

If they can pay it off in 30, why can't they pay it off in 30?

This post was edited on 11/11/25 at 9:15 am

Posted on 11/11/25 at 9:14 am to NC_Tigah

quote:

NO!

That's the point, TA.

quote:Ummm... there is no ROI if they simply track inflation.

Assume home prices simply track inflation. ROI.

quote:All a function of giving ever-increasing terms keeps the bubble afloat with borrowed money.

All a function of leverage.

Posted on 11/11/25 at 9:16 am to NC_Tigah

quote:

Assume home prices simply track inflation.

$400K in 2015 => $528K now.

Given $40K down in 2015, the $128K profit = a 320% ROI.

Might as well bump that down to 100K to account for realtor fees and closing costs

Still a 250% ROI but that doesn't account for maintenance costs or any of the other liabilities that come with home ownership. You'd have to include things like PMI paid over that duration to calculate true ROI.

Posted on 11/11/25 at 9:17 am to NC_Tigah

quote:Like no-doc loans, balloon payments, and variable interest rates? I feel like we've been to this destination before, just on a different path.

1st time buyers sometimes just need the ability to lock-in ownership, with the knowledge they can income-grow into the note. e.g., a spouse two years away from an accounting degree.

Posted on 11/11/25 at 9:20 am to Taxing Authority

Are there people in this thread legitimately defending 50-year mortgages?

Do they not understand simple economics? The prices of houses are going to explode making 50 year mortgages more and more necessary in the future.

Do they not understand simple economics? The prices of houses are going to explode making 50 year mortgages more and more necessary in the future.

Posted on 11/11/25 at 9:21 am to aTmTexas Dillo

quote:For folks with 2 or 3-handle low-interest home loans, Ramsey's pay-it-off approach is terrible advice.

Dave Ramsey can kiss my paid off mortgage arse.

Posted on 11/11/25 at 9:21 am to theunknownknight

Maybe we should let people start borrowing money to buy stocks, next. Think of how high the market could go! Through the roof!

Posted on 11/11/25 at 9:23 am to Taxing Authority

quote:

Maybe we should let people start borrowing money to buy stocks, next. Think of how high the market could go! Through the roof!

You laugh but we have a dangerously high amount of margin propping up the markets right now

Posted on 11/11/25 at 9:24 am to Powerman

quote:But stonks always go up. It'll be fine.

You laugh but we have a dangerously high amount of margin propping up the markets right now

Posted on 11/11/25 at 9:26 am to Taxing Authority

quote:No

Like no-doc loans

quote:Right. But those choices are helpful for some folks too.

Like balloon payments, and variable interest rates? I feel like we've been to this destination before, just on a different path.

Posted on 11/11/25 at 9:26 am to Taxing Authority

quote:

But stonks always go up. It'll be fine.

Is there a tariff stimmies futures market yet? I could see that popping off.

Posted on 11/11/25 at 9:27 am to Taxing Authority

wait, there are people defending this crap.

It’s probably the same people who make fun of others who have to buy cars with seven or eight year loans because the prices of cars have gone up partially because of those extended loans.

The banks are gonna eat the 50 year loan approach up. True, a lot more people are gonna start buying houses which is great in the short term. However, the buying price is going to drive up considerably in just a few years, making the 50 year mortgage is even more necessary going forward. And in the long term, the housing market is going to crash terribly.

It’s probably the same people who make fun of others who have to buy cars with seven or eight year loans because the prices of cars have gone up partially because of those extended loans.

The banks are gonna eat the 50 year loan approach up. True, a lot more people are gonna start buying houses which is great in the short term. However, the buying price is going to drive up considerably in just a few years, making the 50 year mortgage is even more necessary going forward. And in the long term, the housing market is going to crash terribly.

This post was edited on 11/11/25 at 9:29 am

Posted on 11/11/25 at 9:27 am to AncientTiger

Its up to the buyer who goes for it. If they decide they want a home that bad and plan to be there for the rest of their life even at obscene rates they may be happy with it.

Posted on 11/11/25 at 9:33 am to NC_Tigah

quote:

No

quote:I guess we have different goals?

Right. But those choices are helpful for some folks too.

Posted on 11/11/25 at 9:37 am to AncientTiger

Posted on 11/11/25 at 9:40 am to Powerman

quote:Right. Just keeping it simple. Assuming nothing to principal, equation of loan vs rent monthly note, etc.

Might as well bump that down to 100K to account for realtor fees and closing costs

The point is, normal investments just tracking inflation are not great financially. OTOH, if home value just tracks inflation, it can provide a leveraged buyer a nice ROI.

Popular

Back to top

1

1