- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: 1Q GDP projection holding steady at a vigorous 2.0%

Posted on 2/14/18 at 10:39 am to 90proofprofessional

Posted on 2/14/18 at 10:39 am to 90proofprofessional

Pics or gtfo

Posted on 2/14/18 at 10:40 am to Lou Pai

quote:

Pics or gtfo

it's in op, but here it is anyway

Posted on 2/16/18 at 9:47 am to Lou Pai

housing & import/export data in today, not surprises big enough to change from 3.2%

Posted on 2/16/18 at 9:53 am to 90proofprofessional

Why are we tracking the Atlanta Fed? Who are in the "consensus" and who has the best track record?

Posted on 2/16/18 at 10:01 am to GumboPot

quote:

Why are we tracking the Atlanta Fed?

As you know damn well, it was touted here all the time most of 2017. I like their historical chart, frequent updates, good explanations of those updates, although as I said the WSJ forecasting survey has been much better over that same time frame.

The NY Fed one has seemed mostly out to lunch, although last week's update is close to this one (they said 3.3%, but hadn't updated for the week at the time I bumped this thread). I'd have mentioned it before if it weren't 7 days old.

If you think this thread has no use, you can certainly contribute some commentary or some more projections, or see yourself out as well.

Posted on 2/16/18 at 10:07 am to 90proofprofessional

I also wanted to point out that there was no shortage of threads & references covering when this projection was above 5%.

Goose, gander

Goose, gander

This post was edited on 2/16/18 at 10:08 am

Posted on 2/16/18 at 10:14 am to 90proofprofessional

quote:

As you know damn well, it was touted here all the time most of 2017. I like their historical chart, frequent updates, good explanations of those updates, although as I said the WSJ forecasting survey has been much better over that same time frame.

I know why the Atlanta Fed was tracked in the past. I just wondering now why it's being tracked now and into the future.

Do you know of a consensus report where the data for each entity tracking is in a table format? That would probably be a better picture going forward.

Posted on 2/27/18 at 9:09 am to 90proofprofessional

With release of advance durables and advance economic indicators. See updated chart in OP

NY Fed still at 3.1%

WSJ (monthly) at 2.9%

STL Fed at 2.7%

NY Fed still at 3.1%

WSJ (monthly) at 2.9%

STL Fed at 2.7%

This post was edited on 2/27/18 at 9:12 am

Posted on 3/1/18 at 10:12 am to 90proofprofessional

bump for the big bounce in March!

Posted on 3/7/18 at 9:18 am to 90proofprofessional

bump for projection based on new net exports, real consumer spending, and real nonresidential equipment investment figures

starting to look like a real chance this quarter isn't that great despite the new tax cuts

starting to look like a real chance this quarter isn't that great despite the new tax cuts

Posted on 3/7/18 at 9:47 am to 90proofprofessional

The jobs market is red hot right now.

American businesses added 235,000 jobs in February, ADP and Moody’s Analytics said Wednesday. January’s private sector payroll number was revised upward to 244,000 from the initial report of 234,000.

That was far more than the 195,000 expected by economists.

“The job market is red hot and threatens to overheat,” Mark Zandi, chief economist at Moody’s, said in a statement. “With government spending increases and tax cuts, growth is set to accelerate.”

The economy has added more than 200,000 jobs in seven out of the last 12 months, roughly the period in which President Trump has held office.

LINK /

American businesses added 235,000 jobs in February, ADP and Moody’s Analytics said Wednesday. January’s private sector payroll number was revised upward to 244,000 from the initial report of 234,000.

That was far more than the 195,000 expected by economists.

“The job market is red hot and threatens to overheat,” Mark Zandi, chief economist at Moody’s, said in a statement. “With government spending increases and tax cuts, growth is set to accelerate.”

The economy has added more than 200,000 jobs in seven out of the last 12 months, roughly the period in which President Trump has held office.

LINK /

This post was edited on 3/7/18 at 9:48 am

Posted on 3/7/18 at 9:53 am to USA Dan

quote:

The economy has added more than 200,000 jobs in seven out of the last 12 months

not all that great for being at the top of the business cycle

but it's still good

it has been interesting to me though for a while that we haven't been able to sustain annualized 3% growth for more than a few quarters (or 2% inflation), yet we're still worrying about "overheating"

eta: also thanks for polluting my thread with some breitbart trash

This post was edited on 3/7/18 at 9:54 am

Posted on 3/7/18 at 9:57 am to 90proofprofessional

quote:

eta: also thanks for polluting my thread with some breitbart trash

You're welcome

How about this one instead...

LINK

Posted on 3/7/18 at 10:01 am to USA Dan

oh i don't doubt the numbers

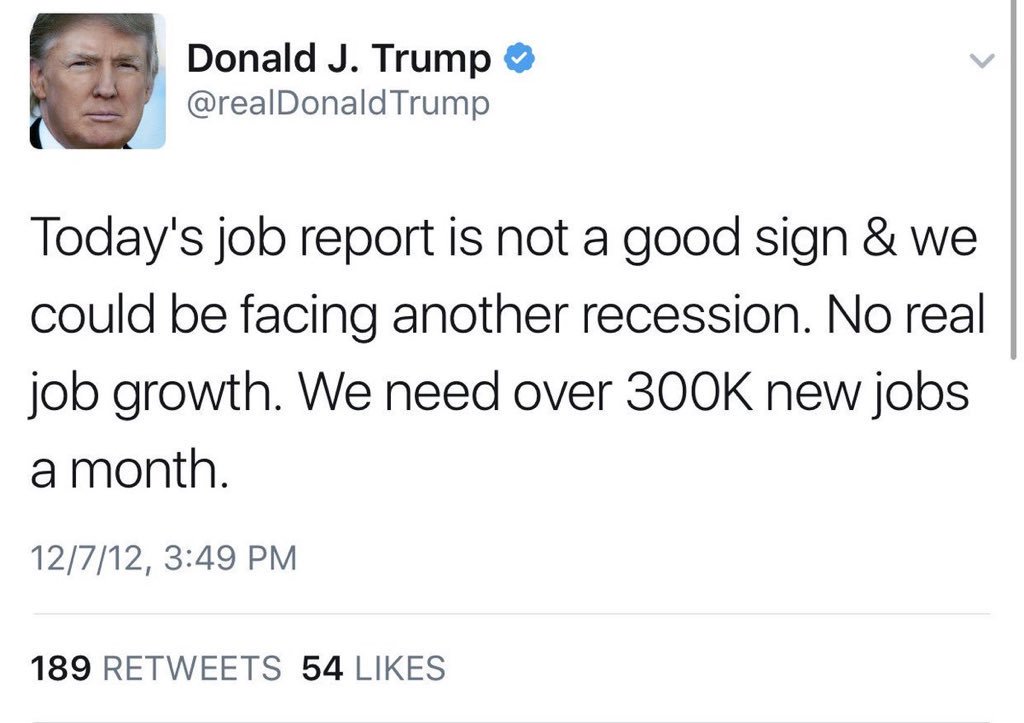

but i do think i might as well dust this one off:

but i do think i might as well dust this one off:

Posted on 3/7/18 at 10:21 am to 90proofprofessional

quote:

He also notes that the relationship between labor market strength and inflation seems to have weakened over time, and argues that we will keep seeing lower inflation than we'd expect.

So, this means the Philip's curve isn't the typical short run Philip's curve we think about, but more or less moving on to a long run Philip's curve where unemployment and inflation don't depend on one another.

Can you explain the graph? If the Philip's curve has a slope of 0, then we would be free to do whatever we want to with the money supply as inflation would remain at some constant level.

Posted on 3/7/18 at 10:24 am to 90proofprofessional

quote:

not all that great for being at the top of the business cycle

This doesn't bother me as much. We are essentially at full employment. Diminishing returns has likely set in.

Posted on 3/7/18 at 10:26 am to 90proofprofessional

FWIW here are some additional predictions for 1Q18:

Trading Econmics: 2.2

WSJ: 2.9

New York Fed: 3.02

Trading Econmics: 2.2

WSJ: 2.9

New York Fed: 3.02

Posted on 3/7/18 at 10:29 am to Jyrdis

quote:

If the Philip's curve has a slope of 0, then we would be free to do whatever we want to with the money supply as inflation would remain at some constant level

i was thinking about it more along the lines of: since the indicators aren't negatively tied together as they appeared to be for a long time now, which one do we lean on more as an indicator of where we are in the business cycle.

i mean we've been in the 4's for unemployment for a while now, but have still remained on the short side of the inflation target

Popular

Back to top

1

1