- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: IRS collected a gargantuan $7 billion estate tax from a single source, nobody knows who

Posted on 4/19/24 at 3:33 pm to Bjorn Cyborg

Posted on 4/19/24 at 3:33 pm to Bjorn Cyborg

quote:

So we should only worry about things that affect us personally?

Or maybe worry about things that affect people that are actually suffering.

I've often wondered why the call it "trickle down" when the rich people realize a windfall, but they call it "inflation" when the working class realizes a windfall.

What happened in the 80's...?

Just so many things to think about besides why rich people have to pay so much to get money they never worked for.

Posted on 4/19/24 at 3:38 pm to Jones

quote:

its the topic of the thread

How astute. Glad to see you're back on board.

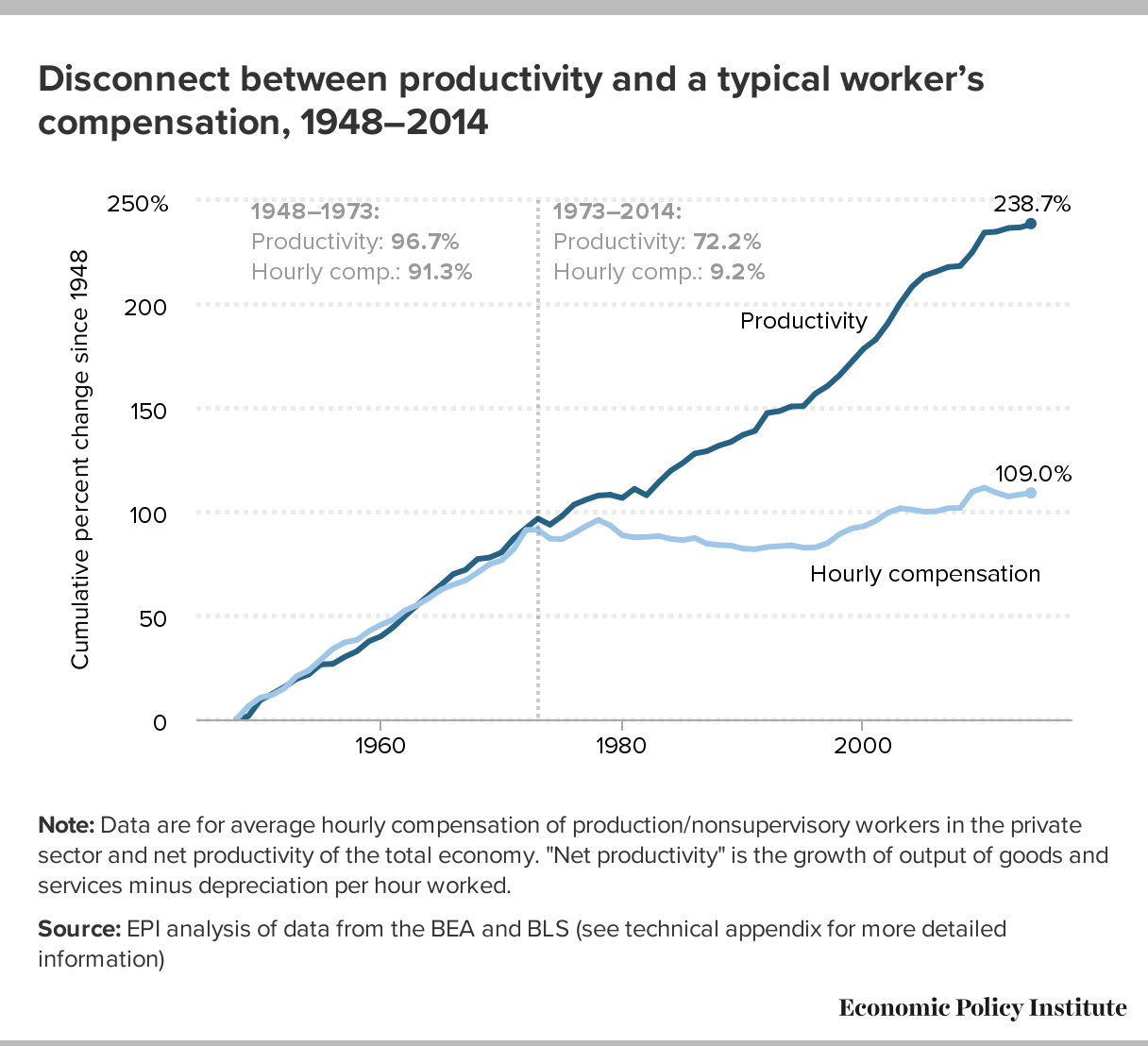

This topic has been discussed many times. Yet the topic of the disparity between workers' productivity and their compensation since the 70s is rarely discussed, and that is a topic that affects far more posters on the board than the death tax.

I'm really not sorry that I find that odd.

Posted on 4/19/24 at 3:41 pm to WildTchoupitoulas

Estate tax is theft plain and simple. Many times the estate involved an active business that may be paid for and will now have to incur debt just because Uncle Sam wants their cut.

Posted on 4/19/24 at 3:48 pm to WildTchoupitoulas

What happened in 1973/1974?

is it a reflection of technology?

What is "productivity" and how is it measured? Is it still a valid metric?

What is included in "compensation"? Health benefits? Pension/401k? Leave?

What about prior to 1948? How were productivity and compensation measured? And how did they compare?

is it a reflection of technology?

What is "productivity" and how is it measured? Is it still a valid metric?

What is included in "compensation"? Health benefits? Pension/401k? Leave?

What about prior to 1948? How were productivity and compensation measured? And how did they compare?

Posted on 4/19/24 at 4:07 pm to WildTchoupitoulas

I’m not limited in the amount of things I can think about.

It’s not a choice.

It’s not a choice.

Posted on 4/19/24 at 4:12 pm to TigersnJeeps

quote:

What happened in 1973/1974?

is it a reflection of technology?

What is "productivity" and how is it measured? Is it still a valid metric?

What is included in "compensation"? Health benefits? Pension/401k? Leave?

What about prior to 1948? How were productivity and compensation measured? And how did they compare?

All good questions.

That leads me further to wonder why this never really discussed.

Perhaps you should a start a thread on it.

Posted on 4/19/24 at 4:13 pm to Bjorn Cyborg

quote:

I’m not limited in the amount of things I can think about.

And yet you choose this one.

quote:

It’s not a choice.

Are you saying it's programming?

Posted on 4/19/24 at 4:21 pm to WildTchoupitoulas

quote:

But I'm surprised to see so many people ITT arguing for others to get stuff they didn't earn

Indoctrination - liberal paid bots on TD doing work as well

Posted on 4/19/24 at 4:31 pm to WildTchoupitoulas

quote:

What happened in 1973/1974?

US involvement in Vietnam ended - protests and revolt of American youth. Country shut down after Watergate. At the same time, the explosion of welfare programs triggered by LBJ’s ‘Great Society’ cratered the US Economy.

All of this was topped with 2 scoops of Jimmy Carter.

Need I go on?

Posted on 4/19/24 at 4:41 pm to BourreTheDog

quote:

US involvement in Vietnam ended - protests and revolt of American youth. Country shut down after Watergate. At the same time, the explosion of welfare programs triggered by LBJ’s ‘Great Society’ cratered the US Economy.

First of all, I didn't ask it originally.

Second of all, you skipped right over the Oil Embargo.

Not to mention Nixon unilaterally ending Bretton-Woods and taking us off of the gold standard.

quote:

All of this was topped with 2 scoops of Jimmy Carter.

And, let me guess, you don't remember Executive Order 11615

quote:

Need I go on?

I don't think you need to, but you may want to in another thread.

Posted on 4/19/24 at 4:41 pm to WildTchoupitoulas

quote:

and that is a topic that affects far more posters on the board than the death tax.

There are plenty of topics that impact my life more than the death tax right now. Doesnt mean I cant think its bullshite. Both of those things can happen and it be ok

At what point am I allowed to have an opinion on a subject?

Posted on 4/19/24 at 4:44 pm to Jones

quote:

At what point am I allowed to have an opinion on a subject?

Why do you think you're not allowed to? I never said you couldn't.

Are you telling me I can't have the opinion that it's weird that so many people so often fixate on something that doesn't affect them over issues that do?

Posted on 4/19/24 at 5:26 pm to Jones

quote:No, I didn't receive an 8 figure inheritance, and that's part of the point.quote:So you received an 8 figure inheritance recently and are cool with the govt taxing it when whoever died giving it to you?

I believe in estate taxes, and I received a substantial inheritance two months ago.

There is no estate tax on estates at or under $13,610,000.

The inheritance I received was from an estate less than $13 million, and the vast majority of estates are far less than $13 million.

Posted on 4/19/24 at 5:30 pm to HailHailtoMichigan!

quote:

and nobody knows who it is

The IRS knows

Posted on 4/19/24 at 5:43 pm to HailHailtoMichigan!

They should absolutely call me and they will be thankful that they did: 318-452-5877. The IRS is no one to play with.

Posted on 4/19/24 at 5:47 pm to Salviati

So you would have been OK with your inheritance being taxed?

Posted on 4/19/24 at 5:48 pm to PerplenGold

quote:The examples given demonstrate that taxes typically involve transfer of property including money: sales taxes, gift taxes, property taxes, income taxes, estate taxes.

Many of the examples being used involve different taxing authorities (state & local) or completely unrelated transactions (sales, inventory, etc) with 3rd parties.

The federal govt taxing income and then again inheritance has all the makings of double dipping. The inheriting party will be taxed on any subsequent gains or other taxable events once in their possession but the money has already been federally taxed prior to the original earner's death. The sheer act of passing already taxed wealth to another person and generating another taxable event in itself is established only because it's in the tax code. It is double dipping in my opinion.

quote:This statement describes income tax as easily as it describes estate tax.

The sheer act of passing already taxed wealth to another person and generating another taxable event in itself is established only because it's in the tax code. It is double dipping in my opinion.

The money received by the employee like the money received by the beneficiary/heir has likely been taxed before they received it. The employee has worked for the money received. The beneficiary/heir is not required to work to earn the money received. Why should the employee pay a tax and the beneficiary/heir should not?

Again, how the taxes are spent is a different issue than how the taxes are generated.

Posted on 4/19/24 at 6:02 pm to Jones

quote:The question is not whether I would have been OK with my inheritance being taxed. That's kind of a stupid question. Who is OK with paying taxes under any circumstances? I don't like paying sales taxes, income taxes, capital gains taxes, property taxes, etc.

So you would have been OK with your inheritance being taxed?

I think everyone can agree that some level of taxes or individual contribution for common benefits are necessary. Nevertheless, the point of this thread is not whether taxes are OK. That's the topic of a different thread.

The point of this thread is whether taxes paid on estates received by beneficiary/heirs is a rational way to generate tax revenues.

It is, and it is the most fair and rational way to generate tax revenue.

Compare, for example, income taxes and estate taxes. Is it better to generate revenue from someone working for the money received, or is it better to generate revenue from someone who has not worked for the money received? Don't we want to incentivize people being productive?

If we had only two options to generate tax revenue, income tax or estate tax, would we not want to decrease income tax by generating estate tax revenue?

This post was edited on 4/19/24 at 6:04 pm

Posted on 4/19/24 at 6:07 pm to HailHailtoMichigan!

Sounds very Chinese

Posted on 4/19/24 at 6:22 pm to Salviati

Outside of individuals living in high crime areas. The biggest threat to the American citizen is the Fed government, taxation being part of that.

Popular

Back to top

2

2