- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

How much would a company like Turner Industries be worth?

Posted on 7/3/23 at 6:59 pm

Posted on 7/3/23 at 6:59 pm

Was arguing with a guy about this.

CB&I bought Shaw for $3 Billion in 2012 and Shaw was by all accounts a bigger company than Turner and I think even Fortune 500.

What factors go into valuating a billion contractor company like this?

Any Finance/Economics guys want to chime in.

CB&I bought Shaw for $3 Billion in 2012 and Shaw was by all accounts a bigger company than Turner and I think even Fortune 500.

What factors go into valuating a billion contractor company like this?

Any Finance/Economics guys want to chime in.

This post was edited on 7/4/23 at 3:14 pm

Posted on 7/3/23 at 7:01 pm to TigerBaron

Shaw had an agreement to purchase Turner maybe 12-15 years ago but Turner backed out due to Shaw not agreeing to all of the conditions.

This post was edited on 7/3/23 at 7:03 pm

Posted on 7/3/23 at 7:01 pm to TigerBaron

quote:

What factors go into valuating a billion contractor company like this?

If you gotta ask, you can't afford it

Posted on 7/3/23 at 7:05 pm to TigerBaron

Enterprise valuations is a pretty bizarre thing. Different industries have wildly different EBITDA multipliers, some are asset or capital heavy, is the management team exiting or staying, is that a good or bad thing? And so much more. No one can value a company, even a publicly traded one without a ton of diligence.

Posted on 7/3/23 at 7:05 pm to TigerBaron

Assets, liabilities, backlog of work, etc.

No clue what they’d consider selling for though.

No clue what they’d consider selling for though.

Posted on 7/3/23 at 7:08 pm to TigerBaron

quote:

CB&I was by all accounts a bigger company than Turner and I think even Fortune 500.

Shaw was indeed a Fortune 500

Posted on 7/3/23 at 7:09 pm to billjamin

Still arguably it's present value of future cash flows

Posted on 7/3/23 at 7:10 pm to TigerBaron

Not interested in Performance?

Posted on 7/3/23 at 7:11 pm to TigerBaron

Would need to know EBITDA, margin profile, approximate growth, and end-market exposure (which guides to profits / growth over longer term).

From there you would triangulate against other engineering precedent multiples and comps of publicly traded E&C peers.

So an absolute shot in the dark without knowing those financial items.

From there you would triangulate against other engineering precedent multiples and comps of publicly traded E&C peers.

So an absolute shot in the dark without knowing those financial items.

Posted on 7/3/23 at 7:14 pm to stout

quote:

$3.50 Billion

According to forbes its $2.4B

Posted on 7/3/23 at 7:15 pm to tylerlsu2008

quote:

tylerlsu2008

This guy nailed it. And as someone who works in the industry doing M&A, the multiplier for Turner is likely around 8.

This post was edited on 7/3/23 at 7:16 pm

Posted on 7/3/23 at 7:22 pm to TigerBaron

As mentioned it is hard to evaluate a business without a lot of due diligence but given their revenue I wouldn't be surprised if it wouldn't trade hands for upwards of $10 billion given revenue tops $2 billion a year.

Posted on 7/3/23 at 7:42 pm to OweO

quote:

According to forbes its $2.4B

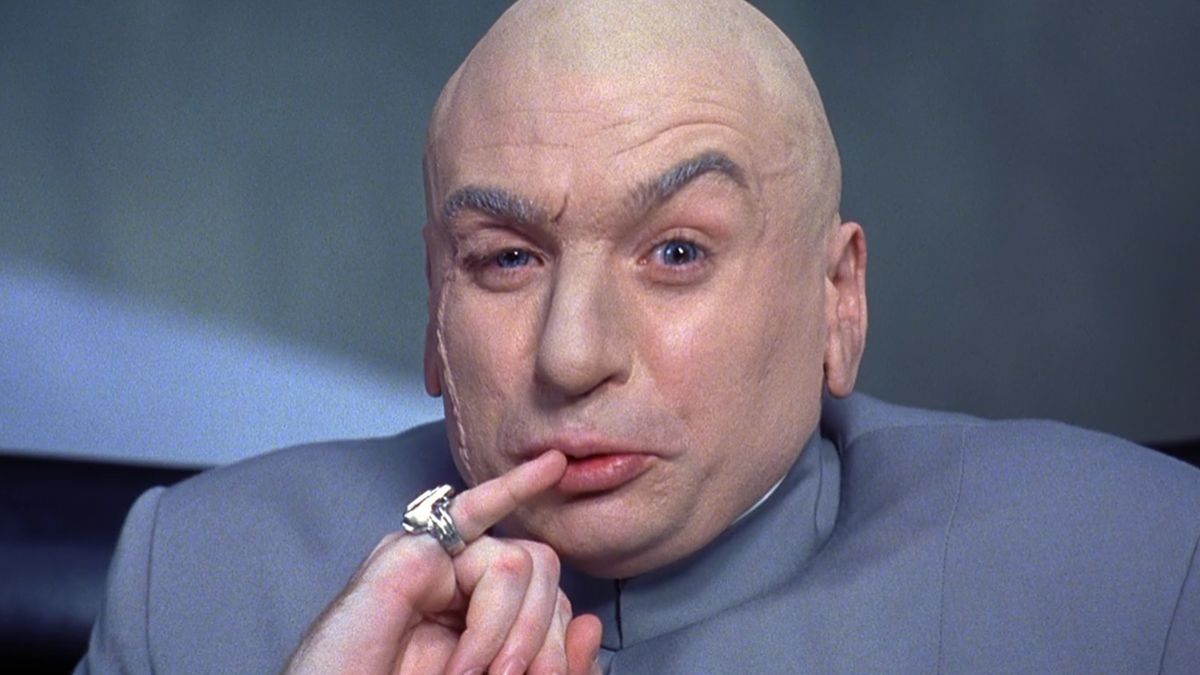

Jesus Christ, Chris

Posted on 7/3/23 at 7:52 pm to TigerBaron

Mr.Bert would be astounded.

Posted on 7/3/23 at 8:00 pm to thelawnwranglers

quote:Naw

Still arguably it's present value of future cash flows

Posted on 7/3/23 at 8:23 pm to Obtuse1

quote:

As mentioned it is hard to evaluate a business without a lot of due diligence but given their revenue I wouldn't be surprised if it wouldn't trade hands for upwards of $10 billion given revenue tops $2 billion a year.

Zero chance, that’s a 5x rev multiple. Assuming a ~15% margin profile, that’s 30+x EBITDA.

Don’t follow these types if companies, but I’d guess this is a 9-11x type of business.

Posted on 7/3/23 at 8:27 pm to TigerBaron

Seeing the 80s and 90s seem focused on needing fabricators and welders no wonder my uncle always told me to skip college and go into welding.

And now current…

Well damn

quote:

The Turner group enters the fabrication business, forming International Piping Systems, and introduces a pipe bending process that revolutionizes the pipe fabrication business in the United States. The company participates in many of the large industrial construction projects being built in the Gulf South at the time.

quote:

Industrial specialty services, such as NDE and inspection services, specialized welding, and environmental remediation are added to fill client needs as they arise. Proprietary technology is developed to better track and manage work.

And now current…

quote:

A main focus at Turner today is digitizing the wealth of data generated by our employees and at our clients’ jobsites to make data-driven decisions that reduct costs, save time, and improve safety metrics. Our ever-evolving DECIDE WITH DATA® software and services portfolio offers a digital ”toolbox” that can solve critical client productivity, reliability, and safety issues.

Well damn

This post was edited on 7/3/23 at 8:41 pm

Popular

Back to top

21

21