- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

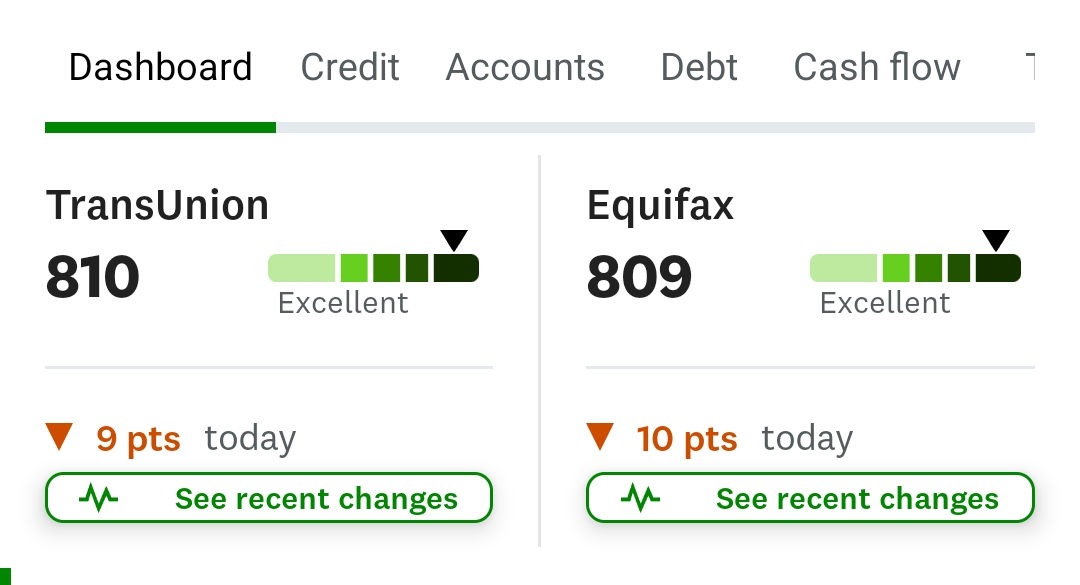

re: Credit score check in - What’s your credit score?

Posted on 9/6/25 at 1:37 am to DarkDrifter

Posted on 9/6/25 at 1:37 am to DarkDrifter

quote:

Lulz. Only about 22ish percent of the population has above 800 yet the OT batting nearly a thousand here .. Never change OT never change

Well shoot it dropped 20 points this past month, but regardless, blow me. P.s. only the poors say "lulz"

This post was edited on 9/6/25 at 1:39 am

Posted on 9/6/25 at 4:54 am to deathvalleyfreak43

Don't know, don't care.

Debt free and will never borrow again.

Debt free and will never borrow again.

Posted on 9/6/25 at 5:09 am to deathvalleyfreak43

797 last I checked a few weeks ago

Posted on 9/6/25 at 5:36 am to Artificial Ignorance

quote:

. Keep Credit Utilization Low (30%)

• Credit utilization ratio = (total balances ÷ total credit limits).

• Aim for under 30% on each card and across all accounts.

• For maximum scoring benefit, keep it under 10% — or even pay balances in full before the statement date so reported utilization is near zero.

It's pretty much this. If you want to just try to run the number as high as you can get, you have to have a larger line of credit. Which means you can't not use your cards and have them really work for you. You have to build history and time with the banks before they'll give you a 30k or 50k limit.

That's pretty much the entire thing. Carry less than 10% at any time across your credit, have 10 accounts in good standing, no negative remarks and pay your bills on time and it's easy to hit 800. Just takes time.

Posted on 9/6/25 at 5:40 am to DarkDrifter

quote:

Lulz. Only about 22ish percent of the population has above 800 yet the OT batting nearly a thousand here .. Never change OT never change

What's even more hilarious is that Louisiana has one of the lowest average credit scores in the nation.

Posted on 9/6/25 at 6:33 am to DarkDrifter

quote:

Only about 22ish percent of the population has above 800 yet the OT batting nearly a thousand here ..

A lesson in sampling bias.

It's the same reason why the same population feels a top 10% income is "middle class"

*ETA:

820 Transunion

840 FICO

This post was edited on 9/6/25 at 6:40 am

Posted on 9/6/25 at 7:02 am to deathvalleyfreak43

I have the best credit score.....I don't have a credit score. Dave Ramsey

Posted on 9/6/25 at 7:23 am to deathvalleyfreak43

Haven't checked in years

Posted on 9/6/25 at 7:28 am to deathvalleyfreak43

Was 813 last I checked

Posted on 9/6/25 at 7:36 am to fallguy_1978

quote:

Credit scores are kind of a shite way to look at financial health in many ways though. My dad has a somewhat crappy score because he doesn't owe anyone anything.

I can't seem to crack 800 because I don't have enough accounts. And it dips a bit between when I put stuff on my credit card and when I pay it off each month. I've tried to get higher limits but they won't give me a higher limit and their reasoning is I don't use what I have available. lol.

Citibank has cancelled my card twice because I didn't use it enough.

Not sure how to push over 800.

Posted on 9/6/25 at 7:37 am to deathvalleyfreak43

825 last I checked

Posted on 9/6/25 at 7:40 am to Epic Cajun

quote:

dropped 10 points when I paid off a vehicle last month

This is regarded.

They should have a decaying memory instead of dropping your score. You literally paid a loan on time very recently. 5-10 years from now it's irrelevant but any smart bank would be happy to give you a loan right now. It's the best possible time.

Posted on 9/6/25 at 7:45 am to deathvalleyfreak43

Stays around 750 range. All I have is a mortgage.

Posted on 9/6/25 at 8:09 am to fallguy_1978

quote:

Credit scores are kind of a shite way to look at financial health in many ways though. My dad has a somewhat crappy score because he doesn't owe anyone anything.

I have an uncle by marriage like this. When he was single he paid for all with cash, and his checkbook. He bought his cars, first house, parents paid for his college, everything in full and in cash. Had no borrowing history until he was in his mid-30s When he got married, they had to use my Aunt's score, which wasn't great due to lack of history mostly, and my grandpa had to cosign stuff until it got up, but grandpa knew he was good for it or just got the money from him first. Technically he probably didn't "have to" care about his score, but as he got older he started to realize how using credit could help make better financial sense in certain situations. "Using other people's money" per se.

Good lessons to pass down to kids, but also something to be careful about too.

Popular

Back to top

0

0