- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

World's Largest Telecom Provider Underperforming Market - Why?

Posted on 8/27/21 at 12:15 pm

Posted on 8/27/21 at 12:15 pm

AT&T symbol T

It's down 9% in the last year.

S&P is up 29%.

DJI is up 25%.

You can do the same spread over 5 years and the gap is even worse.

What's going on? Is T the new F?

It's down 9% in the last year.

S&P is up 29%.

DJI is up 25%.

You can do the same spread over 5 years and the gap is even worse.

What's going on? Is T the new F?

Posted on 8/27/21 at 12:27 pm to deeprig9

Is this a serious question? They are spinning off profits. They performed horribly in the acquisition of directtv. What have they done well?

Posted on 8/27/21 at 12:39 pm to C

quote:

Is this a serious question?

Yes

quote:

They are spinning off profits.

What does this mean, and why?

quote:

They performed horribly in the acquisition of directtv

ok

quote:

What have they done well?

I don't know, just asking some questions here. Why does my question seem to irritate you?

Posted on 8/27/21 at 1:38 pm to deeprig9

quote:

does my question seem to irritate you?

Cause I own it!

Posted on 8/27/21 at 1:39 pm to deeprig9

Took on massive debt to buy DirecTV and then sells it for half that a few years later.

Took on massive debt to buy time Warner to spin it off later..

They literally been running the company into the ground

Took on massive debt to buy time Warner to spin it off later..

They literally been running the company into the ground

Posted on 8/27/21 at 2:07 pm to deeprig9

Att is cringe baw

Anyone who’s ever dealt with them has nothing but bad experiences

Anyone who’s ever dealt with them has nothing but bad experiences

Posted on 8/27/21 at 9:27 pm to deeprig9

It’s a dividend stock. Sucks if you bought it 2 years ago and now have a huge loss but I don’t see it going down from current level. It’s paying 7% now. I’ll take that all day from a stock with little volatility I can easily liquidate. It’s basically a high paying bond. I buy it every time it’s around $27 just to add to my holdings.

This post was edited on 8/28/21 at 10:14 pm

Posted on 8/27/21 at 9:41 pm to Drizzt

quote:

It’s a dividend stock.

Wlll that DIV % continue?

Posted on 8/27/21 at 10:21 pm to Marcus Aurelius

The street says the dividend will be cut. I sold.

Posted on 8/28/21 at 12:03 am to Marcus Aurelius

The dividend has been safe for a long time. Realistically if it’s cut from 7.7 to 6.5….it’s still a great dividend. I think it’s more likely they don’t increase the dividend but I still think T and XOM are great dividend stocks.

Posted on 8/28/21 at 3:51 am to Drizzt

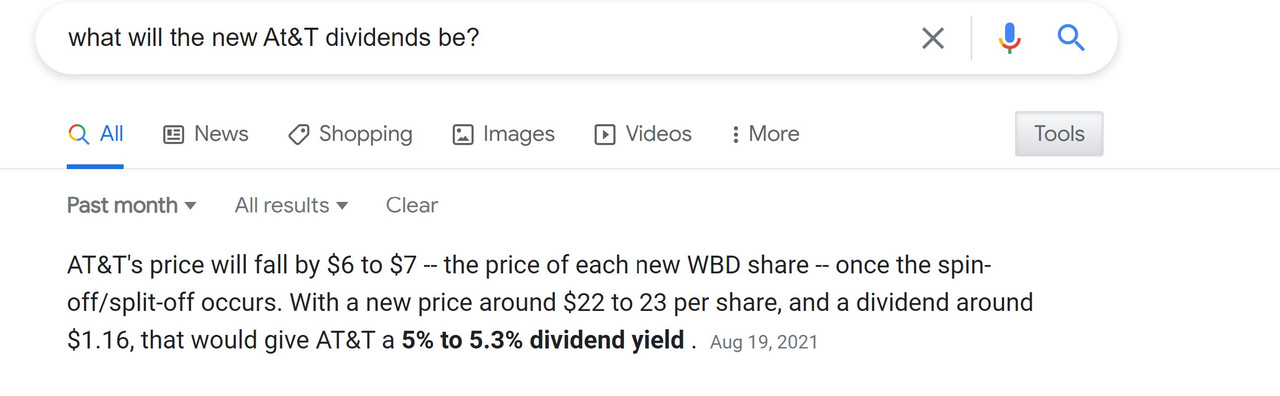

Where are you getting a minor drop in Dividend? This is the consensus on the Div Cut coming early 2022.

This is a major reason people bailed on this stock. That and some bad deals

quote:

AT&T shareholders are looking at a dividend that is almost half of the current dividend. So, if we estimate that the dividend is cut approximately in half, investors will have a dividend yield slightly below ~4% at the current stock price. This is not bad in absolute terms, but it is much lower than the current dividend yield of ~7.3%.

This is a major reason people bailed on this stock. That and some bad deals

Posted on 8/28/21 at 5:33 pm to FLObserver

bullshite. No way the dividend is cut to 4%. I’ll believe it when I see it…which will be never. It’s a classic case of floating a fuzzy number so that when it’s less than that people feel relieved. Even if it’s cut to 5% dividend to reduce debt that is still a great dividend and they will grow it from there. I plan to buy more of this just for income from the dividend. I hope there is a huge sell off when the new dividend is announced so I can buy more cheap. The P/E is 8. It’s a money making machine. You keep buying some overpriced tech stock with a P/E greater than 50 and I’ll keep buying value.

Edit: I just put in a limit order for 2000 shares at $20. Please sell off.

Edit: I just put in a limit order for 2000 shares at $20. Please sell off.

This post was edited on 8/28/21 at 10:11 pm

Posted on 8/28/21 at 7:53 pm to Drizzt

quote:

Realistically if it’s cut from 7.7 to 6.5

Where are you showing its being cut to 6.5 only ? Don't see it it dropping to $20.00 but don't see it heading into the high 30's anytime soon. It is a great value but a lot of people were upset with Div cut. I think in a few years if the spinoff goes well the div will be back to where it was or maybe even better. I Put this in google. here's what it showed:

This post was edited on 8/28/21 at 8:11 pm

Posted on 8/28/21 at 10:10 pm to FLObserver

I think you are googling wrong

Posted on 8/28/21 at 10:20 pm to deeprig9

Going nowhere fast you're essentially getting a large dividend st this point which is great but with no price movement or major dividend growth.

Posted on 8/29/21 at 4:41 am to Drizzt

quote:

I think you are googling wrong

No finding your result will be much harder

Posted on 8/30/21 at 3:12 pm to deeprig9

You ever used their website for billing or technical support? Endless cycle of useless endless cycles!

Posted on 8/30/21 at 4:21 pm to deeprig9

another strategy to help your T holdings is selling covered calls while using your shares as leverage.

Posted on 8/30/21 at 4:32 pm to Drizzt

quote:

bullshite. No way the dividend is cut to 4%. I’ll believe it when I see it…which will be never.

I recall a lot of GE stockholders with this mindset and it didn't go well for them. T has had terrible top management and has that changed?

Popular

Back to top

7

7