- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Why is crypto crashing?

Posted on 5/19/22 at 5:57 am to tenderfoot tigah

Posted on 5/19/22 at 5:57 am to tenderfoot tigah

quote:Comments like this are intriguing.

If more explanation is needed, I can further simplify.

They say nothing, but do so under pretext of being the smartest post on the board.

The problem with crypto, of course, is potential ease of manipulation by nefarious players. If crypto "investors" don't understand that, they surely should. That isn't to say, all crypto is always manipulated, or any current price moves are solely or partially due to whale tinkering.

In terms of risk assessment though, it's clear that if a smarmy little group in the Caribbean can manipulate crypto pricing, players like Iran, NoKo, Russia, etc. certainly could. Right?

The follow-on being, how would the "smartest man in the crypto thread" recognize artful state incursions before the same player(s) snatched the rug out?

In a related way, Russia knew its plans for Ukraine by late-summer, early-autumn 2021. It knew the result of war would be sanctions, and transient ruble weakness. Would it not make sense for Russian oligarchs in-the-loop to accumulate BTC at that point? Then when the ruble plummeted, use BTC reserves to bridge ruble restabilization?

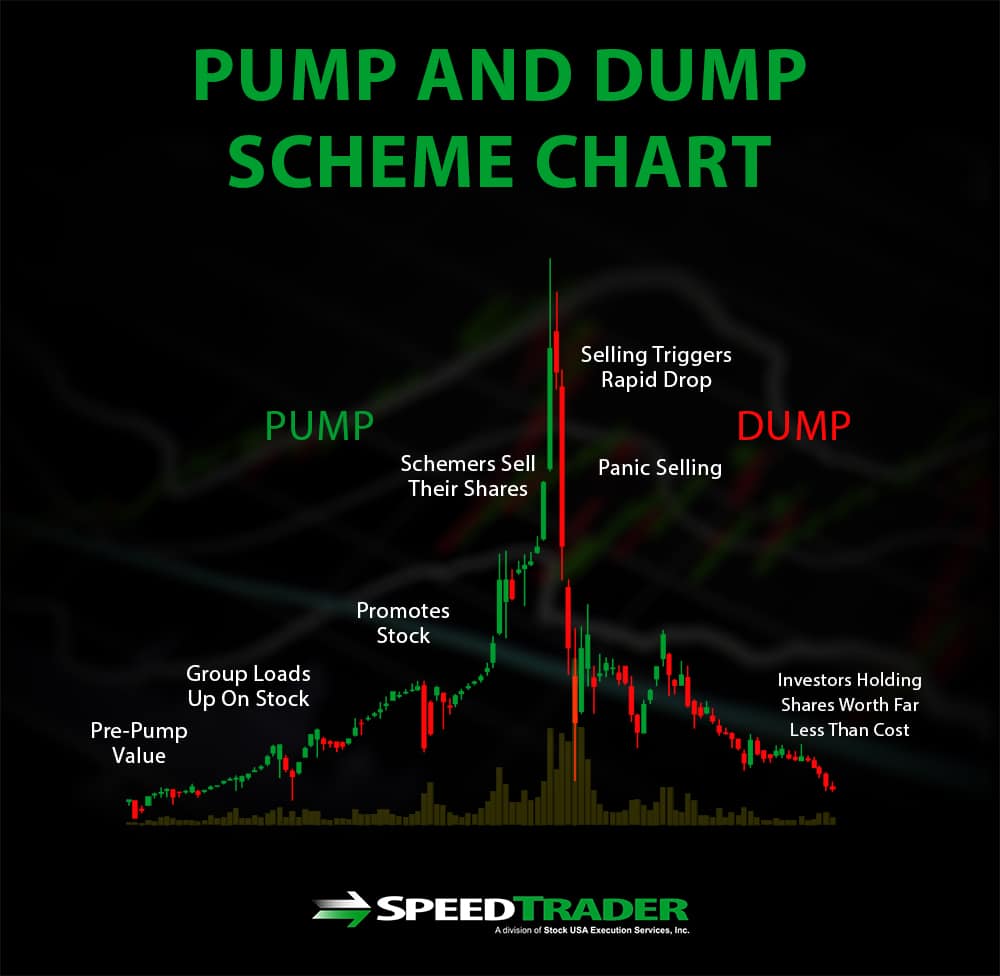

e.g., I don't know what it means, if anything, but one of these charts is not like the rest.

----

This post was edited on 5/19/22 at 6:49 am

Posted on 5/19/22 at 7:02 am to BottomlandBrew

quote:

Just like I can explain that the term "cryptocurrency" is an outdated misnomer and you don't understand that?

I don’t understand everything but I know that the term cryptocurrency is used widely as the general term for the varied currencies being mined.

Are you confusing cryptocurrency with blockchain?

Posted on 5/19/22 at 7:10 am to NC_Tigah

quote:

The problem with crypto, of course, is potential ease of manipulation by nefarious players. If crypto "investors" don't understand that, they surely should. That isn't to say, all crypto is always manipulated, or any current price moves are solely or partially due to whale tinkering.

In terms of risk assessment though, it's clear that if a smarmy little group in the Caribbean can manipulate crypto pricing, players like Iran, NoKo, Russia, etc. certainly could. Right?

What do you think the Fed does guy?

Also, if some group sold a trillion worth of gold, would that affect the price?

Is this what the talk is now? Reducing it down to price movement because of low marketcap?

Posted on 5/19/22 at 7:40 am to NC_Tigah

quote:

Comments like this are intriguing. They say nothing, but do so under pretext of being the smartest post on the board.

Yep. 100%

very defensive and patronizing posts which I attribute to some sort of bias which enables a lack of awareness of the pitfalls within the crypto world.

Blockchain is not what I’m talking about either. I’m talking about the traded currencies which have had significant volatility.

This post was edited on 5/19/22 at 7:41 am

Posted on 5/19/22 at 7:49 am to SlidellCajun

quote:

Blockchain is not what I’m talking about either. I’m talking about the traded currencies which have had significant volatility.

BTC IS the blockchain....

Posted on 5/19/22 at 8:02 am to JayDeerTay84

Bitcoin is both an asset and a network

This post was edited on 5/19/22 at 8:04 am

Posted on 5/19/22 at 8:03 am to Hulkklogan

This is why people tell these guys they dont understand.

They are failing to grasp that a lot of these projects utilize token utility. Meaning, the token has use cases in its given network.

Instead, they focus on shitcoins and apply that to the entire space.

They are failing to grasp that a lot of these projects utilize token utility. Meaning, the token has use cases in its given network.

Instead, they focus on shitcoins and apply that to the entire space.

This post was edited on 5/19/22 at 8:04 am

Posted on 5/19/22 at 8:07 am to JayDeerTay84

Right.

BTC and ETH have the network (specifically block space) as the driver of value.

Tokens on top of Ethereum will have use cases for the application(s) they represent. Chainlink, for example, is an application that provides real-world data feeds to Ethereum applications. It is a major piece of infrastructure to the Ethereum ecosystem and the majority of apps built on Ethereum use Chainlink.. though i dont think LINK is required to use it.

Shiba Inu.. is not.

I'm tryna stack up 1 ETH during this bear, then i want to go in hard on Arweave.

BTC and ETH have the network (specifically block space) as the driver of value.

Tokens on top of Ethereum will have use cases for the application(s) they represent. Chainlink, for example, is an application that provides real-world data feeds to Ethereum applications. It is a major piece of infrastructure to the Ethereum ecosystem and the majority of apps built on Ethereum use Chainlink.. though i dont think LINK is required to use it.

Shiba Inu.. is not.

I'm tryna stack up 1 ETH during this bear, then i want to go in hard on Arweave.

This post was edited on 5/19/22 at 8:18 am

Posted on 5/19/22 at 9:27 am to NC_Tigah

quote:

The problem with crypto, of course, is potential ease of manipulation by nefarious players.

comments like this are so intriguing.

It's almost as if you don't realize exactly how rigged and manipulated legacy finance is. All the cards are stacked against you. At least with most crypto, all transactions are on-chain. There is literally 100x the transparency in crytpo markets than legacy. Like someone said below most are grouping all "crypto" together akin to comparing enron to amazon.

Posted on 5/19/22 at 9:43 am to JayDeerTay84

quote:Well guy, a couple of dudes in a shell corp can't actually manipulate the USD, so I'm not sure you know WTF you're asking.

What do you think the Fed does guy?

quote:

Is this what the talk is now?

The "talk"??

When a relatively small foreign company manipulates USD valuation 2X-4X over a 3 month period as occurred w/ BTC, we can have "the talk".

Posted on 5/19/22 at 9:54 am to NC_Tigah

quote:

When a relatively small foreign company manipulates USD valuation 2X-4X over a 3 month period as occurred w/ BTC, we can have "the talk".

Why limit to a foreign company when the Fed can just print 3X the supply?

YOU made the claim Crypto was susepetical to foreign companies and governments yet, Fiat is MORE susepetical to these factors than BTC.

The only thing someone could do to BTC is "dump" their coins. Thats it.

However, this applies to EVERYTHING else you invest it. What do you thing happens when Hedge funds unload on the little guys?

This post was edited on 5/19/22 at 9:57 am

Posted on 5/19/22 at 9:57 am to deNYEd

quote:Au contraire. E.g. George Soros.

It's almost as if you don't realize exactly how rigged and manipulated legacy finance is.

It's almost as if you don't realize the difference in scale, regulation, oversight, and control you're addressing.

It's almost like you don't realize just because a group of grocery store robbers cleaned out a couple of Krogers, they're not going to enjoy the same success emptying the vaults of Chase-Manhattan Bank.

Posted on 5/19/22 at 9:59 am to NC_Tigah

quote:

It's almost as if you don't realize the difference in scale, regulation, oversight, and control you're addressing.

Its clear you dont because Crypto solves all of this, yet you continuedly point to scale and scale alone. Because scale is the only reason for the volatility as it is a relatively low marketcap when compared to all your examples.....

Posted on 5/19/22 at 10:00 am to NC_Tigah

quote:

It's almost as if you don't realize the difference in scale, regulation, oversight, and control you're addressing.

would you happen to be referring to the SEC which had its teeth removed by a federal ruling yesterday?

SEC Ruling

This post was edited on 5/19/22 at 10:02 am

Posted on 5/19/22 at 10:04 am to NC_Tigah

quote:

It's almost as if you don't realize the difference in scale, regulation, oversight, and control you're addressing

It's almost as if you think the folks "regulating" and giving "oversight" give two fricks about you

Posted on 5/19/22 at 10:06 am to deNYEd

scale and lack of institutional control is the reason you can see the exponential gains in crypto that you will NEVER see in legacy

Posted on 5/19/22 at 10:24 am to JayDeerTay84

quote:

Crypto solves all of this

I'll keep it simple for you, since you'd prefer to argue than think.

Neither crypto nor fiat "solves" it.

Got it?

However, scale and lack of oversight leaves crypto far easier to manipulate.

If Iran issues a truckton of (basically) worthless IRR over time, and with each rial created immediately trades it for BTC, BTC price will concomitantly escalate. FOMO will draw in BTC "investors" resulting in further escalation. If Iran then cashes the BTC for western currency, it fills its coffers as BTC respondantly plummets beneath its would-be baseline.

What did crypto solve?

Posted on 5/19/22 at 10:24 am to deNYEd

quote:

scale and lack of institutional control is the reason you can see the exponential gains in crypto that you will NEVER see in legacy

Unfortunately it's also the reason you can get scammed or dumped on so easily

Popular

Back to top

3

3