- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

What % of your portfolio do you leave in cash?

Posted on 1/31/23 at 5:01 pm

Posted on 1/31/23 at 5:01 pm

I already have my emergency savings sitting outside my brokerage so I’m not talking about that.

I invest a certain amount every month but I’ve always debated myself on how much cash to leave uninvested until a big opportunity comes and let’s me buy cheap.

I invest a certain amount every month but I’ve always debated myself on how much cash to leave uninvested until a big opportunity comes and let’s me buy cheap.

Posted on 1/31/23 at 5:08 pm to Weagle25

Buy cheap when you get an opportunity and sell cheaper after you buy it. Stock markets never coming back baw

Posted on 1/31/23 at 6:29 pm to Weagle25

Most of the data supports dollar cost averaging. Sure there are situations (initial COVID time) where the market crashes, but those are few and far between. Also, at that point, what makes you think you are going to buy? You’ll likely still be waiting on the bottom as it makes its run up.

I personally don’t see any advantage of keeping money in your investment account purely on waiting on opportunity.

I personally don’t see any advantage of keeping money in your investment account purely on waiting on opportunity.

Posted on 1/31/23 at 7:36 pm to Weagle25

Have 10% to 12% cash waiting to use if something big hits but every time i see a good company drop on bad news especially when it's a big drop i cant help myself i buy a few shares. It's worked out pretty good.

Posted on 1/31/23 at 7:36 pm to Weagle25

Right now, i'm like 50%, maybe 60%. I'm 20 years from retirement so i'm not super worried about it, i think a big drop is coming so i'll try to slowly open more positions on the way down. At SPY 3k i'll probably got 100% in. At 2700 i would double that on margin.

Posted on 1/31/23 at 7:58 pm to Weagle25

4% including 6-mos emergency fund

A little heavy for long term.

A little heavy for long term.

Posted on 1/31/23 at 8:12 pm to GeauxTigers777

quote:

Most of the data supports dollar cost averaging.

I would still be dollar cost averaging as i take an amount every month and invest it. It’s just should I have 100% in the market at all times or have like 5-10% in cash to throw in when the market has taken a hit.

Basically thinking about a system where I’m 2% cash when I feel the market is down and 5-10% when I think the market is up. But wanted other thoughts on it as I do know the general idea is just DCA.

quote:

Sure there are situations (initial COVID time) where the market crashes, but those are few and far between. Also, at that point, what makes you think you are going to buy? You’ll likely still be waiting on the bottom as it makes its run up.

What makes me think that is I was sitting there during the down periods wishing I had cash in the side to throw in. Now obviously that’s a little biased saying that now but I don’t think I’m a guy that worries about finding the compete bottom. If I throw money in the market and it keeps going down, sure I beat myself up a little bit but I keep it in at that point knowing it will come back up.

Basically comes from regret back in Fall of 2021, when you know the market is up and don’t sell anything and keep DCAing because that’s the hard rule.

quote:

I personally don’t see any advantage of keeping money in your investment account purely on waiting on opportunity.

Appreciate the input

Still considering staying 100% invested but toying with my idea.

This post was edited on 2/1/23 at 6:58 am

Posted on 1/31/23 at 9:52 pm to Weagle25

quote:

I invest a certain amount every month but I’ve always debated myself on how much cash to leave uninvested until a big opportunity comes and let’s me buy cheap.

Here is a little different spin on your question:

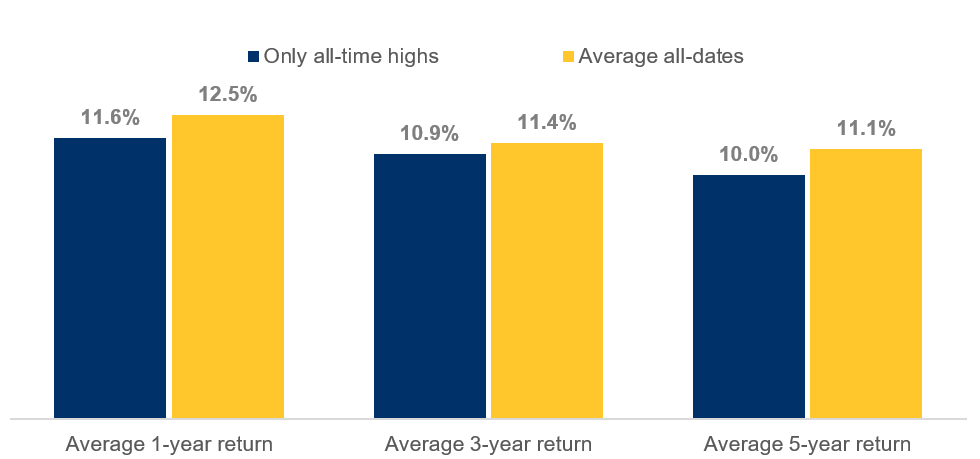

This chart shows rolling 1, 3, and 5 year S&P 500 returns from 1950-2020 if you invested on one of the 1,130 all time high days vs any one of the other random days. Even if you “only” bought in on all time highs, your 5-yr average return was 10% vs 11.1% for the other days. That’s not nothing, but it’s hardly worth worrying about, especially since you’re not going to only invest on all time high days.

Posted on 1/31/23 at 10:03 pm to Weagle25

quote:

Basically thinking about a system where I’m 2% cash when I feel the market is down and 5-10% when I think the market is up. But wanted other thoughts on it as I do know the general idea is just DCA.

If you Google dollar cost averaging v lump sum investing, you'll find that the math says lump sum investing wins. DCA is based on wage earners/regular income investing a percentage every payday. That is better than saving up and putting it all end at the end of the year (or market timing or whatever). If you already have money, the lump sum investing data shows that putting it all in ASAP is the best bet. Time in the market is the trump card.

Posted on 1/31/23 at 10:11 pm to Weagle25

quote:

cash to leave uninvested until a big opportunity comes and let’s me buy cheap.

Did y’all not consider a 20% decline in the S&P last year a big opportunity? I was buying as much as I possibly could last year.

Posted on 1/31/23 at 10:21 pm to slackster

quote:

This chart shows rolling 1, 3, and 5 year S&P 500 returns from 1950-2020 if you invested on one of the 1,130 all time high days vs any one of the other random days. Even if you “only” bought in on all time highs, your 5-yr average return was 10% vs 11.1% for the other days. That’s not nothing, but it’s hardly worth worrying about, especially since you’re not going to only invest on all time high days.

Definitely a fair thing to consider but don’t think it’s accurately showing you the potential returns.

Say you’re good at it (I’m not pretending to be but do like trying with smaller amounts), you wouldn’t be investing on just a random day. You’re likely not investing at the complete bottom either because no one is that good. But you would likely be in the bottom 20% of days for the period. Then you’re riding you’re way up to the top 20% of days and sell. Obviously way easier said than done but those are the true potential returns you would be looking at which would probably be a much bigger spread.

I know the old saying that the best days in the stock market are immediately after the worst days which makes it much harder. And honestly it’s why I’m still in theory mode.

I’m probably honestly underestimating how hard it is to actually do. Might track how I’d do without putting money at risk before I actually start doing it.

Posted on 1/31/23 at 10:25 pm to SaintsTiger

quote:

If you Google dollar cost averaging v lump sum investing, you'll find that the math says lump sum investing wins. DCA is based on wage earners/regular income investing a percentage every payday. That is better than saving up and putting it all end at the end of the year (or market timing or whatever). If you already have money, the lump sum investing data shows that putting it all in ASAP is the best bet. Time in the market is the trump card.

Right now, I put it in as I earn it. So that just kind of naturally dollar cost averages anyways even though I’m putting it all in as soon as I get it.

Posted on 1/31/23 at 10:45 pm to Weagle25

Right now? About 25% of my portfolio is in I-Bonds and 3-6 month Treasuries.

Posted on 2/1/23 at 12:33 am to Weagle25

quote:

Obviously way easier said than done

This caveat is carrying so much weight you don't even realize.

You can't even predict if you're in that 20% from bottom or not when the market moves. Most people are fooling themselves that there's a pattern or they can easily notice these things.

If money managers could spot that 20% threshold and "ride it up and sell" that you just mentioned they'd be killing it every year. They don't do that well.

This post was edited on 2/1/23 at 12:35 am

Posted on 2/1/23 at 1:10 am to FLObserver

quote:Depending on your portfolio, that could be six figures in cash, which is maybe a pretty steep amount to keep in cash, especially if the SHTHF stuff happened and cash were suddenly worthless. May want to shift to investing in some on-hand gold, medical supplies, water, antibiotics and ammunition, which, by itself is an alternative form of currency between adults, driven by bad times.

Have 10% to 12% cash waiting to use if something big hits

Posted on 2/1/23 at 4:25 am to Weagle25

quote:

Still considering staying 100% cash

Are you one of the it's all going to burn down then i'll swoop in and make a fortune guys that this board seems to have ?

Posted on 2/1/23 at 4:46 am to FLObserver

quote:

Are you one of the it's all going to burn down then i'll swoop in and make a fortune guys that this board seems to have ?

Posted on 2/1/23 at 5:14 am to Weagle25

Probably not enough. I’m very pessimistic about the next 6 months.

Posted on 2/1/23 at 6:57 am to FLObserver

quote:

Are you one of the it's all going to burn down then i'll swoop in and make a fortune guys that this board seems to have ?

Sorry. Mistype there.

I meant 100% invested 0% cash.

Popular

Back to top

11

11