- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

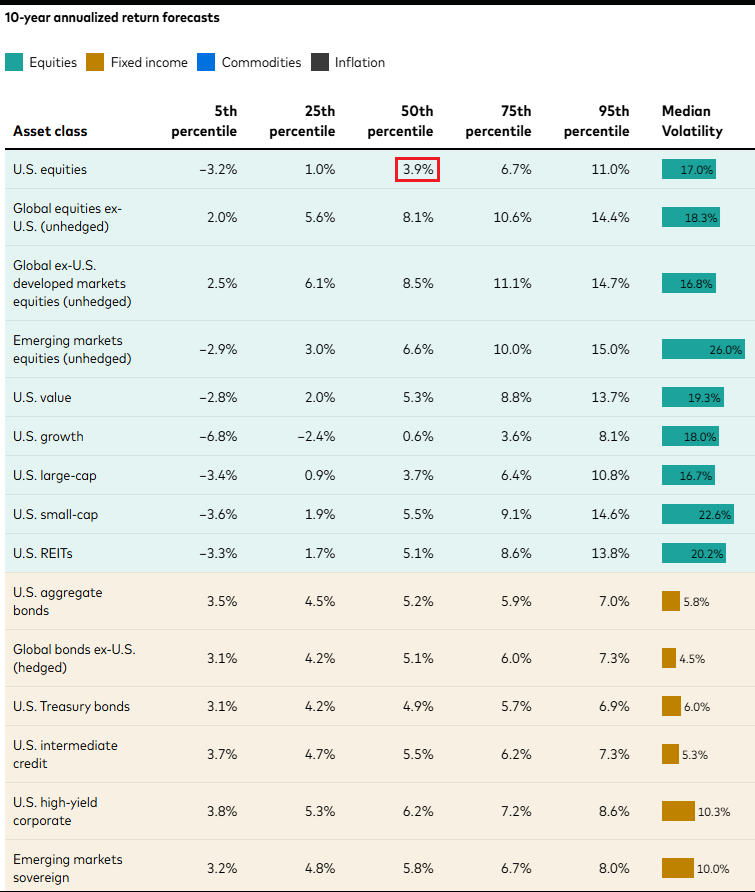

Vanguard’s 10y median forecast for US stocks is 3.9% annually, .6% for large cap growth

Posted on 3/10/25 at 9:15 pm

Posted on 3/10/25 at 9:15 pm

This was the 12/31/24 expectations, so before markets turned south for the year in the last week. I hadn’t seen it mentioned though. A lot of unloved areas significantly outperforming large cap stocks and growth stocks in particular. Hell, cash is expected to outperform growth stocks.

LINK

Hope some of you are a lot more diversified than VUG if this materializes.

Posted on 3/10/25 at 9:18 pm to slackster

This would wreck me for retirement.

Posted on 3/10/25 at 9:21 pm to slackster

Slackster if you can not whine to the mods this time about ancient tiger we might get a white boy summer again before they impeach Trump and prez aoc sends us to the fema camp

Posted on 3/10/25 at 9:33 pm to slackster

Domestic small caps have become garbage. More quality companies stay private and when they actually do go public they are large caps.

If small caps outperform, then it’s because we are melting up.

If small caps outperform, then it’s because we are melting up.

Posted on 3/10/25 at 9:38 pm to slackster

Do you have any of their projections from ten years ago?

One thing to keep in mind is that the companies in the US stock market will seek profits. They will do that by getting into new markets, acquiring new business units, expanding into foreign markets, or investing in new technologies, or some other method.

No CEO not named Immelt is going to survive as CEO for a decade while producing only 0.6% price appreciation.

One thing to keep in mind is that the companies in the US stock market will seek profits. They will do that by getting into new markets, acquiring new business units, expanding into foreign markets, or investing in new technologies, or some other method.

No CEO not named Immelt is going to survive as CEO for a decade while producing only 0.6% price appreciation.

Posted on 3/10/25 at 9:45 pm to fallguy_1978

quote:

This would wreck me for retirement.

It would add years to mine. A lot of mine depends on my

PE investment. It’s probably about 40% of my investments now.

Posted on 3/10/25 at 9:46 pm to fallguy_1978

quote:

This would wreck me for retirement.

That’s on buy and hold projections. DCA and other strategies can perform better with a little luck.

Posted on 3/10/25 at 9:47 pm to CharlesUFarley

quote:

No CEO not named Immelt is going to survive as CEO for a decade while producing only 0.6% price appreciation.

We lost an entire decade of returns from 2000-2009. It’s certainly not impossible.

Posted on 3/10/25 at 9:55 pm to el Gaucho

quote:

Slackster if you can not whine to the mods this time about ancient tiger

Too late.

Posted on 3/10/25 at 9:56 pm to CharlesUFarley

quote:

Do you have any of their projections from ten years ago?

Not easily. I’ll see if I can find more. There were around 6% median coming into 2023 so it makes sense the back to back 20% returns would lower their expectations going forward.

Posted on 3/10/25 at 9:57 pm to CharlesUFarley

quote:

Do you have any of their projections from ten years ago?

They projected about 6% annualized for the 10 years going forward in September of 2014.

Actual was 11.1%

Posted on 3/10/25 at 10:00 pm to slackster

Btw the biggest bear signal came at the beginning of the year when poster I Love Bama predicted that we'd see 15% annualized returns (on the low end) the next 4-5 years.

That dude was a massive bear through a 3 year period that saw a cumulative 57% percent gain in the S&P500.

When he flipped to bull that was a good signal.

That dude was a massive bear through a 3 year period that saw a cumulative 57% percent gain in the S&P500.

When he flipped to bull that was a good signal.

This post was edited on 3/10/25 at 10:01 pm

Posted on 3/10/25 at 10:02 pm to JohnnyKilroy

quote:

Actual was 11.1%

No clue what their percentile ranges were.

Like it or not, it’s quite unrealistic to expect 7% annualized returns when you’re coming into things at 21x forward earnings on S&P 500.

Posted on 3/10/25 at 10:07 pm to slackster

Posted on 3/10/25 at 10:09 pm to JohnnyKilroy

Thanks for finding it.

Posted on 3/10/25 at 10:15 pm to slackster

Not if the share of passive keeps growing which it should and credit spreads are tight with relatively low interest rates

Posted on 3/10/25 at 11:51 pm to slackster

quote:It makes sense. It's hard to envision bull markets STARTING at a 25 P/E.

Vanguard’s 10y median forecast for US stocks is 3.9% annually, .6% for large cap growth

I like to average these with GMO's also.

Posted on 3/11/25 at 1:10 am to slackster

quote:

We lost an entire decade of returns from 2000-2009. It’s certainly not impossible.

I think the lost decade refers to the S&P 500.

I was more into value, international, and small cap. It wasn't lost for me, though 2009 looked pretty dark for a while.

Posted on 3/11/25 at 5:38 am to wutangfinancial

quote:

Not if the share of passive keeps growing which it should and credit spreads are tight with relatively low interest rates

You’d think Vanguard of all places would understand the growth of passive investing, but I understand your point.

Posted on 3/11/25 at 5:56 am to slackster

Does that include dividends?

Popular

Back to top

9

9