- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: There are some major issues lurking in the US financial markets

Posted on 3/20/19 at 11:00 pm to CajunTiger92

Posted on 3/20/19 at 11:00 pm to CajunTiger92

Well I appreciate that post, because it's important for any active investor to periodically make a critical reappraisal of where we are in the market cycle. Certainly, I've had a bad couple of months, and it's led me to go back and re-question my assumptions.

Having done that, however, I can't find any sufficient justification to abandon my positions. All the advice about maintaining your calm and being rational when the markets are emotional--all that advice holds for bears as well as for bulls. It's not as simple of course, because the long-term drift of the market is up, not down, but on a general philosophical level, I feel like I've got winning positions, and I just need to be calm and stay the course.

Your point about the worry of bears helping to feed opportunity for bulls is well taken. However, it's also missing the other side of the coin. Whatever bricks of worry there are that build the foundation for sustainable bull runs (think of all the worry from 1974-1982), there are also bricks of bulls feeling invincible that build the foundation for gruesome bear markets.

Which brings us to the point of how we can interpret the current signs. (Note that if you're a passive investor, you don't have to worry about this; but that also means you should be agnostic about whether we are currently in a bull or a bear market, and not give cliched "buy the dips" advice.) Some would say that it's a Rorschach test. Others would say I'm cherry picking the bad news over the good.

Well, I've gone back and re-examined what's occurred since 12/24/2018, and I see almost nothing to indicate a mixed bag here. It's been very one-sided and unquestionably worse than expectations. If you look at global leading indicators like semiconductor shipments, M1 growth, FedEx sales growth, etc., you see bad information. Here in the U.S. we have falling home prices and falling EPS projections for 2019. The falling EPS projections drove some of the correction from September to December last year, but--and this point can't be emphasized enough--those projections have continued dropping from 12/31/2018 to the present day.

This rally has been led by large institutional investors reacting to shifting expectations of monetary policy, and rosy speculation about U.S.-China trade talks. That's it. The only good economic data you can point to for 2019 are the following: (1) low unemployment (which of course is a two-sided omen); (2) good consumer confidence; and (3) well-capitalized banks showing low default rates from consumer borrowers.

But that's not going to make up for stalling sales revenue and an evaporating market for leveraged corporate debt issuance. It'll catch up to us eventually.

In addition to all that stuff about the underlying economy, you can look at the mechanics of the rally itself and be confident in assessing it as a bear market phenomenon. In and of itself, this compressed, V-shape market action is a very bearish sign. Even looking at 1987, the most hopeful analogy for bulls, this rally is nothing at all like the multi-year recovery that happened post-October-1987.

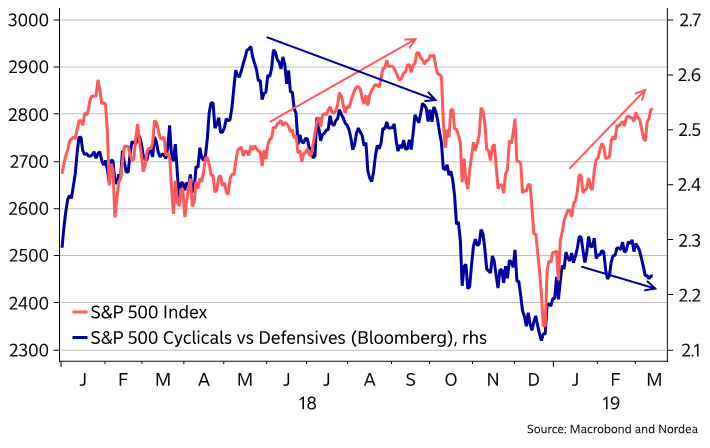

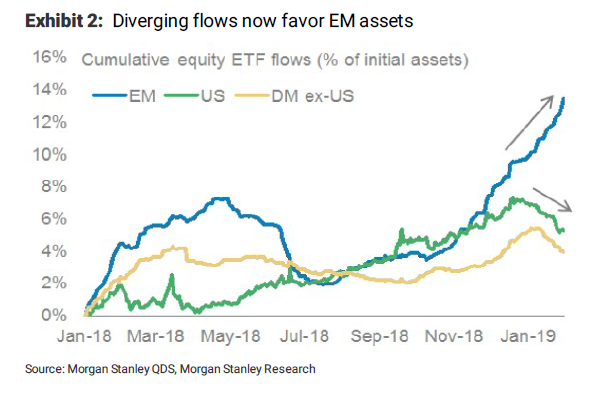

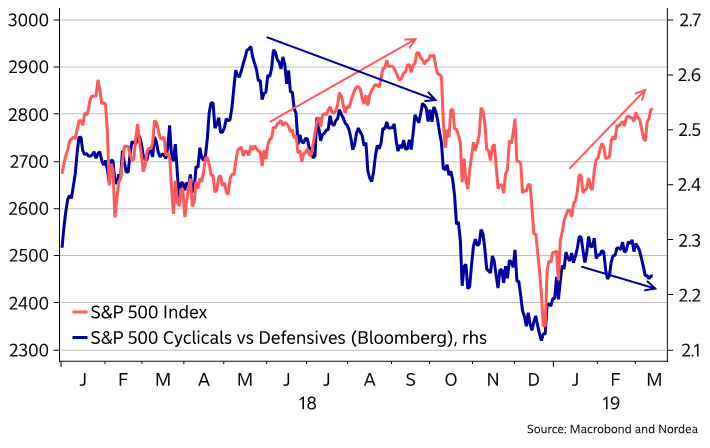

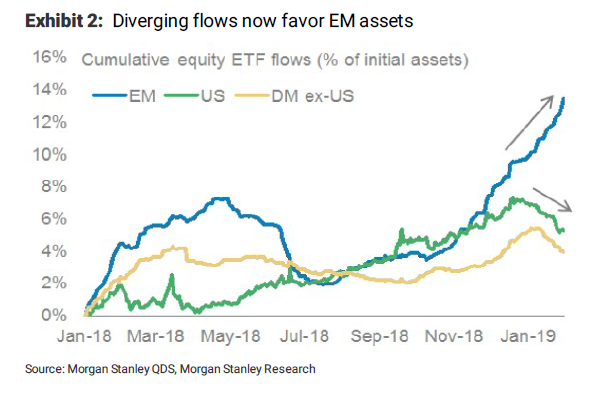

Scrolling through the financial media, you'll see example after example of so-called "alligator" charts--i.e., charts showing unusually sharp divergences that resemble the mouth of an alligator. Look at (1) the market vs. transportation indexes; (2) cyclicals vs. defensives; (3) U.S. equity ETF flows vs. EM equity ETF flows; (4) smart money flows; (5) consumer confidence rates vs. savings rates; etc. It all looks freakishly bad. Do not trust this rally as being indicative of market health.

Having done that, however, I can't find any sufficient justification to abandon my positions. All the advice about maintaining your calm and being rational when the markets are emotional--all that advice holds for bears as well as for bulls. It's not as simple of course, because the long-term drift of the market is up, not down, but on a general philosophical level, I feel like I've got winning positions, and I just need to be calm and stay the course.

Your point about the worry of bears helping to feed opportunity for bulls is well taken. However, it's also missing the other side of the coin. Whatever bricks of worry there are that build the foundation for sustainable bull runs (think of all the worry from 1974-1982), there are also bricks of bulls feeling invincible that build the foundation for gruesome bear markets.

Which brings us to the point of how we can interpret the current signs. (Note that if you're a passive investor, you don't have to worry about this; but that also means you should be agnostic about whether we are currently in a bull or a bear market, and not give cliched "buy the dips" advice.) Some would say that it's a Rorschach test. Others would say I'm cherry picking the bad news over the good.

Well, I've gone back and re-examined what's occurred since 12/24/2018, and I see almost nothing to indicate a mixed bag here. It's been very one-sided and unquestionably worse than expectations. If you look at global leading indicators like semiconductor shipments, M1 growth, FedEx sales growth, etc., you see bad information. Here in the U.S. we have falling home prices and falling EPS projections for 2019. The falling EPS projections drove some of the correction from September to December last year, but--and this point can't be emphasized enough--those projections have continued dropping from 12/31/2018 to the present day.

This rally has been led by large institutional investors reacting to shifting expectations of monetary policy, and rosy speculation about U.S.-China trade talks. That's it. The only good economic data you can point to for 2019 are the following: (1) low unemployment (which of course is a two-sided omen); (2) good consumer confidence; and (3) well-capitalized banks showing low default rates from consumer borrowers.

But that's not going to make up for stalling sales revenue and an evaporating market for leveraged corporate debt issuance. It'll catch up to us eventually.

In addition to all that stuff about the underlying economy, you can look at the mechanics of the rally itself and be confident in assessing it as a bear market phenomenon. In and of itself, this compressed, V-shape market action is a very bearish sign. Even looking at 1987, the most hopeful analogy for bulls, this rally is nothing at all like the multi-year recovery that happened post-October-1987.

Scrolling through the financial media, you'll see example after example of so-called "alligator" charts--i.e., charts showing unusually sharp divergences that resemble the mouth of an alligator. Look at (1) the market vs. transportation indexes; (2) cyclicals vs. defensives; (3) U.S. equity ETF flows vs. EM equity ETF flows; (4) smart money flows; (5) consumer confidence rates vs. savings rates; etc. It all looks freakishly bad. Do not trust this rally as being indicative of market health.

Posted on 3/20/19 at 11:00 pm to Doc Fenton

The big news of the day was undoubtedly Powell's statements coming out of the Fed meeting. He seemed to take a softer tone on fighting inflation than perhaps a segment of the investing world was expecting, but the genuine news was his announcement that the Fed's balance sheet unwinding would be tapered down in May, and set to be completed by September.

CNBC: " Fed gives market what it wanted — it’s ending its balance-sheet reduction in September"

We've come a long way since Powell's "autopilot" remarks on Wednesday, December 19, 2018.

Anyway, the S&P 500 index traded as high as 2852.42 yesterday before closing at 2832.57, slightly below Monday's close. Then the index was trading as low as 2812.43 early this afternoon, before shooting up from 2819 to 2842 (about 0.8%), before dropping back down and closing the day at 2824.23 (about 0.6% off the daily peak; and about 1.0% off the peak from yesterday).

Additionally, Powell's statements had ominous effects on the inverting yield curve, which is undeniably bearish at this point. The 7-year yield is now over 4 bp below the 1-month yield, and the 10-year yield is now only 4 bp away from inverting with the 6-month yield. I don't think there are any historical cases where this hasn't spelled trouble. The bond markets are undeniably signaling poor economic prospects going forward.

Quod erat demonstrandum.

CNBC: " Fed gives market what it wanted — it’s ending its balance-sheet reduction in September"

We've come a long way since Powell's "autopilot" remarks on Wednesday, December 19, 2018.

Anyway, the S&P 500 index traded as high as 2852.42 yesterday before closing at 2832.57, slightly below Monday's close. Then the index was trading as low as 2812.43 early this afternoon, before shooting up from 2819 to 2842 (about 0.8%), before dropping back down and closing the day at 2824.23 (about 0.6% off the daily peak; and about 1.0% off the peak from yesterday).

Additionally, Powell's statements had ominous effects on the inverting yield curve, which is undeniably bearish at this point. The 7-year yield is now over 4 bp below the 1-month yield, and the 10-year yield is now only 4 bp away from inverting with the 6-month yield. I don't think there are any historical cases where this hasn't spelled trouble. The bond markets are undeniably signaling poor economic prospects going forward.

quote:

When I claimed that the Fed is out of ammunition, I meant that in the context of having ammunition to prevent the onset of a bear market, since at some juncture, we reach a tipping point where dovish actions by the Fed signals an economic contraction, and thus will tend to have the bad-economic-signals bear effects start to outweigh the looser-monetary-policy bull effects, in terms of moving the market up or down in short-term response.

Quod erat demonstrandum.

This post was edited on 3/20/19 at 11:12 pm

Posted on 3/21/19 at 11:19 am to wutangfinancial

quote:Meh, bullish is in the eye of the beholder.

Nah, I just don't think it's bullish. They also just admitted they started a game they can't win

I believe the market's reaction today indicates relief that the Fed isn't asleep at the wheel and insisting on an aggressive interest rate increase policy while ignoring the current softness in the economy.

The market looks ahead and the Fed being dovish on rate increases, while indicating we're in a slowdown period, bodes well for new economic growth in the future.

Posted on 3/21/19 at 12:40 pm to Doc Fenton

quote:

We've come a long way since Powell's "autopilot" remarks on Wednesday, December 19, 2018.

Is it because Jerome is reacting to data, as Russian suggests, or is it because he is caving to political pressure, coming directly from Trump?

Posted on 3/23/19 at 10:24 am to HYDRebs

quote:

the AT&T debt numbers after their court order to buy Comcast goes through.

No antitrust concerns?

Posted on 3/23/19 at 3:41 pm to LSURussian

No talk on the big dump today?

Posted on 3/23/19 at 3:47 pm to natsoundup

quote:The market went down yesterday.

No talk on the big dump today?

What else would you like to talk about?

This post was edited on 3/23/19 at 3:57 pm

Posted on 3/23/19 at 6:57 pm to LSUtoOmaha

What matters in the short term is earnings. They have by and large actually been pretty good.

What matters in the long term to me at a macro level is getting debt under control. This is because, the higher debt levels companies take on, the more of their future earnings have to be allocated to paying that down.

What matters in the long term to me at a macro level is getting debt under control. This is because, the higher debt levels companies take on, the more of their future earnings have to be allocated to paying that down.

Posted on 3/27/19 at 5:55 pm to Doc Fenton

Some thoughts of mine on the yield curve inversions, assisted by some recent tweets from the fintwit realm:

#1. The zero bound for the inversion signal is not a magic level. Logically speaking, it becomes much more difficult for poor future economic growth signals to cause a yield curve to invert as short-term bond yields get closer to zero. Ergo, an inversion in a near-ZIRP environment is a much stronger signal than an inversion in, say, 1980. If you normalize a 0bp-inversion in normal times to a 75bp-inversion in the current low-rate environment (see Raoul Pal below), then the signal occurred a long time ago, somewhere between Nov 2017 and Feb 2018.

#2. You have to place the inversion in context of where we are in the secular interest rate cycle. Whereas the period around 1980 was near the top of the cycle, the period around 2016 (or 1946 previously) is near the bottom of the cycle. So we should already be in a secular cycle of increasing yields (remember all those high yield projections last year?), which makes the sharp decrease in nominal growth expectations even more remarkable. Additionally, you might add on the concern that interest rate cuts by the Fed in the immediate aftermath of a cycle of continued hikes is usually a bad time for markets.

#3. You have to look at the inversions across different maturity points in context. Some have claimed that nothing matters until there's a 10-2-yr inversion (which has not yet happened) or a 10yr-3mo inversion (which has now happened), but from a common sense theoretical approach (see Guy LeBas below), it's the portion out to about 2-3 years that matters for "imminent" growth signals.

#4. Empirically speaking, stocks have not had good returns during inversions (see Jesse Felder below), and the "Nike Swoosh" pattern across the whole yield curve could be ominous (see "OddStats" below).

Raoul Pal on 3/24/2019

Guy LeBas on 3/24/2019

Jesse Felder on 3/25/2019

" OddStats" on 3/27/2019

#1. The zero bound for the inversion signal is not a magic level. Logically speaking, it becomes much more difficult for poor future economic growth signals to cause a yield curve to invert as short-term bond yields get closer to zero. Ergo, an inversion in a near-ZIRP environment is a much stronger signal than an inversion in, say, 1980. If you normalize a 0bp-inversion in normal times to a 75bp-inversion in the current low-rate environment (see Raoul Pal below), then the signal occurred a long time ago, somewhere between Nov 2017 and Feb 2018.

#2. You have to place the inversion in context of where we are in the secular interest rate cycle. Whereas the period around 1980 was near the top of the cycle, the period around 2016 (or 1946 previously) is near the bottom of the cycle. So we should already be in a secular cycle of increasing yields (remember all those high yield projections last year?), which makes the sharp decrease in nominal growth expectations even more remarkable. Additionally, you might add on the concern that interest rate cuts by the Fed in the immediate aftermath of a cycle of continued hikes is usually a bad time for markets.

#3. You have to look at the inversions across different maturity points in context. Some have claimed that nothing matters until there's a 10-2-yr inversion (which has not yet happened) or a 10yr-3mo inversion (which has now happened), but from a common sense theoretical approach (see Guy LeBas below), it's the portion out to about 2-3 years that matters for "imminent" growth signals.

#4. Empirically speaking, stocks have not had good returns during inversions (see Jesse Felder below), and the "Nike Swoosh" pattern across the whole yield curve could be ominous (see "OddStats" below).

Raoul Pal on 3/24/2019

quote:

I swore I wouldn’t discuss YC twitter but...

If you normalize the curve for ultra low rates my work suggests that 75bps = 0bps ( roughly) and the curve is probably suggesting a deep inversion already. This is consistent with Japan and Europe.

... it’s too late.

Guy LeBas on 3/24/2019

quote:

Different parts of curve provide economic signals over different time periods.

A 3m/2s inversion is an imminent growth signal while a 10s/30s inversion would most likely be about decadal inflation trends.

Jesse Felder on 3/25/2019

quote:

Stocks have historically lost money on an annualized basis when the yield curve’s been inverted. LINK

" OddStats" on 3/27/2019

quote:

The Yield Curve right now looks like a Nike Swoosh and you were wondering when that's happened in the past.

I looked at every time since 1982 that the 2yr yield was below both the 3mo yield and 10yr yield (like now).

Here it is on a $SPX chart.

Oof.

Posted on 3/27/19 at 5:55 pm to LSUtoOmaha

It's always difficult to tell how much Fed officials are swayed by political pressure, but clearly the 60 Minutes appearance earlier this month demonstrates his concern for the need to project political legitimacy for his decision-making process.

The things that Fed officials say (including Bernanke, Yellen, and Powell) are often nonsense, and evince a lack of wider understanding on their part, but from a technical perspective, I do sympathize with their plight. The ECB is considering buying equities, the FRB is no longer afraid to bring up the subject of negative interest rates, and you have Yellen and Stephen Moore recently sending signals for even more rate cuts. And yeah, it seems kind of ridiculous how blase they are about this.

From my perspective though, the damage was already done from erroneous policy decisions made from 2011 to 2017. And even for that, it's difficult to fault the Fed decision-makers themselves, since they're obligated to pay attention to employment and consumer inflation, and aren't allowed to base their decisions primarily on other considerations that I think are more important. (This is why I advocate for a different monetary policy regime than the one we currently have.)

That being said, Jerome is clearly looking at market signals (which was the standard scouting report on him from the get-go) and is making things outside of employment & inflation a huge part of his decision-making process. I'm willing to give him wide latitude even for that though, since it is true that those things will ultimately affect U.S. consumer inflation. (I still think it's funny how he's careful to always cite global conditions outside the U.S., rather than admit that it's worrisome U.S. conditions that might be influencing him.)

Bottom line: It's the Fed decisions in the middle of bull cycles that worry me. The Fed decisions during transition periods (like the one I believe we're in right now) are probably too late in the game to change things very much.

The things that Fed officials say (including Bernanke, Yellen, and Powell) are often nonsense, and evince a lack of wider understanding on their part, but from a technical perspective, I do sympathize with their plight. The ECB is considering buying equities, the FRB is no longer afraid to bring up the subject of negative interest rates, and you have Yellen and Stephen Moore recently sending signals for even more rate cuts. And yeah, it seems kind of ridiculous how blase they are about this.

From my perspective though, the damage was already done from erroneous policy decisions made from 2011 to 2017. And even for that, it's difficult to fault the Fed decision-makers themselves, since they're obligated to pay attention to employment and consumer inflation, and aren't allowed to base their decisions primarily on other considerations that I think are more important. (This is why I advocate for a different monetary policy regime than the one we currently have.)

That being said, Jerome is clearly looking at market signals (which was the standard scouting report on him from the get-go) and is making things outside of employment & inflation a huge part of his decision-making process. I'm willing to give him wide latitude even for that though, since it is true that those things will ultimately affect U.S. consumer inflation. (I still think it's funny how he's careful to always cite global conditions outside the U.S., rather than admit that it's worrisome U.S. conditions that might be influencing him.)

Bottom line: It's the Fed decisions in the middle of bull cycles that worry me. The Fed decisions during transition periods (like the one I believe we're in right now) are probably too late in the game to change things very much.

This post was edited on 3/27/19 at 6:06 pm

Posted on 3/27/19 at 7:37 pm to Doc Fenton

quote:

including Bernanke, Yellen, and Powell) are often nonsense, and evince a lack of wider understanding on their part

Posted on 3/28/19 at 1:21 am to LSURussian

quote:

Doc Fenton

quote:

LSURussian

You assholes didn't tell me the party started again on MT.

Ugh... I can only get through 3 sentences of Doc's nonsense on the Fed without getting my heart rate up...

*rolls up sleeves*

This post was edited on 3/28/19 at 1:28 am

Posted on 3/29/19 at 11:20 am to Hussss

quote:Anybody remember this post I quoted above?

This Spring we will go down through it to the 1800's.

Spring began last week.....

Posted on 3/29/19 at 11:22 am to BennyAndTheInkJets

quote:That's "Mister a-hole" to you, fella'.

Doc Fenton

quote:

LSURussian

You assholes didn't tell me the party started again on MT.

Posted on 3/29/19 at 11:30 am to Doc Fenton

SPX is ~4% from its high, oil is up 32% from Dec low and UST yields are materially lower than Dec.

Someone is gonna be wrong with the trade deal is resolved.

Someone is gonna be wrong with the trade deal is resolved.

Posted on 3/29/19 at 1:12 pm to Shepherd88

This shitshow is still going?

Posted on 3/30/19 at 12:30 pm to BennyAndTheInkJets

Good to see you again, and I didn't mean to get your heart rate up!

Posted on 4/1/19 at 9:14 am to Doc Fenton

Any analysis of the news coming out of China?

Posted on 4/23/19 at 11:18 am to Thib-a-doe Tiger

Bump

Please unban Husss

Please unban Husss

This post was edited on 4/23/19 at 11:19 am

Popular

Back to top

0

0