- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Providing advice for parents who do not have enough for retirement (long)

Posted on 7/8/19 at 9:03 am

Posted on 7/8/19 at 9:03 am

My mother is retired due to disability (but not on disability) and my father wants to retire in two years at 63. From what I understand of their finances, they do not have enough to retire safely if they live for another few decades.

I have not seen their finances, so most of this is based on conversations with them. They would like for me to visit with them to go over their finances. I think it's because as an only child, I will be expected to take on any of the burden they bring if they have trouble. This is really the crux of the post: I do not feel that it's my responsibility to take care of their lifelong mistakes; however, they are my parents and there will be an emotional tug for me to not see them suffer. Further, they came through at a time of need for my family and allowed us to live with them for 6 months.*

My mother is receiving $1600/month for life from her teacher retirement. She had $150k in a 403b that she cashed out in order to buy back her years from Georgia in order to retire early. She has an autoimmune disease that prevented her from working past the age of 58. I was under the impression that she was on disability but apparently that wasn't true.

My father currently makes $55k/year but averages $10k/year in bonuses. He has $30k in retirement and is going to rely on social security. He wants to retire at 63 because he believes his $30k can bridge the gap between working and social security.

My parents will both draw $1900/month from social security. Medicare will help with health insurance costs eventually but due to my mother's health issues, they will purchase a supplement.

They have some debt with their mortgage (about $100k left). I'm not sure what they're paying per month, but I think it's around $1000. Their house could sell for $225k, so they have equity if they need it.

From what I understand, they are okay together - $5400/month and Medicare/Retired Teacher Insurance. But neither are in great health (mother has the illness and father is about 100 pounds overweight).

I'm worried about two future issues that are sure to pop up:

1) What's going to happen when they need assisted living and one of them has passed away? My wife's grandmother lived in an assisted living facility that was decent and cost $2500/month back around 2010. My mother claims that she will only have $3000/month if my father passes away. How is this possible if she has $1600/month from her pension, $1900/month from social security, and whatever the spousal death benefits are?

2) What might I be missing in order to help them? There seems to always be some cost or fee or tax or issue that pops up that I didn't expect.

3) My mother wants to start a Roth at age 60 because she feels that she isn't going to have enough money to support herself if my father dies. Is this smart to do? All she can do is contribute $400/month. She said they will currently have an extra $600/month.

Further, this is mostly coming out of fear from my mother -she's worried about herself but it seems like my father is in more financial trouble than my mother.

4) My parents spend outside of their means and are still hardheaded even when telling me that they don't have enough for retirement. She just bought a new car that has assisted braking to help her get around with her illness. However, she rarely uses it. They spent $15k on their bathroom two years ago and are spending $5000 updating their kitchen currently. They want to treat everyone to a big trip to Disney World (which my mother says is her "life long dream ) and stay at the park and do special shite like eat in Cinderella's Castle. I'm picturing $10k for this trip at the least - so I told her it's not happening but she says it still can. They spend a shitload of money on birthday and Christmas presents for my kids.

) and stay at the park and do special shite like eat in Cinderella's Castle. I'm picturing $10k for this trip at the least - so I told her it's not happening but she says it still can. They spend a shitload of money on birthday and Christmas presents for my kids.

How can I communicate to them that the need to live on a strict budget if they want to be fully retired at 63?

*As far as us having lived with them, I fully explained to them that we would not live with them at the time if it meant we would be expected to return the favor later on. Yes, it went longer than I wanted. It's not that I don't want to take care of my parents in their old age; it's just that we mostly won't have the means to house them. We're both teachers who do well for ourselves, but we won't have a guest house or extra bedrooms or things like that.

Sorry for the long post, but I was taken aback by my mother being honest about their finances when they have told me for years that they're more than okay and have plenty of money.

tl;dr - Parents weren't exactly honest with me about their finances until recently. My mother is concerned they don't have enough especially if one passes away. What advice should I give them for going forward?

I have not seen their finances, so most of this is based on conversations with them. They would like for me to visit with them to go over their finances. I think it's because as an only child, I will be expected to take on any of the burden they bring if they have trouble. This is really the crux of the post: I do not feel that it's my responsibility to take care of their lifelong mistakes; however, they are my parents and there will be an emotional tug for me to not see them suffer. Further, they came through at a time of need for my family and allowed us to live with them for 6 months.*

My mother is receiving $1600/month for life from her teacher retirement. She had $150k in a 403b that she cashed out in order to buy back her years from Georgia in order to retire early. She has an autoimmune disease that prevented her from working past the age of 58. I was under the impression that she was on disability but apparently that wasn't true.

My father currently makes $55k/year but averages $10k/year in bonuses. He has $30k in retirement and is going to rely on social security. He wants to retire at 63 because he believes his $30k can bridge the gap between working and social security.

My parents will both draw $1900/month from social security. Medicare will help with health insurance costs eventually but due to my mother's health issues, they will purchase a supplement.

They have some debt with their mortgage (about $100k left). I'm not sure what they're paying per month, but I think it's around $1000. Their house could sell for $225k, so they have equity if they need it.

From what I understand, they are okay together - $5400/month and Medicare/Retired Teacher Insurance. But neither are in great health (mother has the illness and father is about 100 pounds overweight).

I'm worried about two future issues that are sure to pop up:

1) What's going to happen when they need assisted living and one of them has passed away? My wife's grandmother lived in an assisted living facility that was decent and cost $2500/month back around 2010. My mother claims that she will only have $3000/month if my father passes away. How is this possible if she has $1600/month from her pension, $1900/month from social security, and whatever the spousal death benefits are?

2) What might I be missing in order to help them? There seems to always be some cost or fee or tax or issue that pops up that I didn't expect.

3) My mother wants to start a Roth at age 60 because she feels that she isn't going to have enough money to support herself if my father dies. Is this smart to do? All she can do is contribute $400/month. She said they will currently have an extra $600/month.

Further, this is mostly coming out of fear from my mother -she's worried about herself but it seems like my father is in more financial trouble than my mother.

4) My parents spend outside of their means and are still hardheaded even when telling me that they don't have enough for retirement. She just bought a new car that has assisted braking to help her get around with her illness. However, she rarely uses it. They spent $15k on their bathroom two years ago and are spending $5000 updating their kitchen currently. They want to treat everyone to a big trip to Disney World (which my mother says is her "life long dream

) and stay at the park and do special shite like eat in Cinderella's Castle. I'm picturing $10k for this trip at the least - so I told her it's not happening but she says it still can. They spend a shitload of money on birthday and Christmas presents for my kids.

) and stay at the park and do special shite like eat in Cinderella's Castle. I'm picturing $10k for this trip at the least - so I told her it's not happening but she says it still can. They spend a shitload of money on birthday and Christmas presents for my kids. How can I communicate to them that the need to live on a strict budget if they want to be fully retired at 63?

*As far as us having lived with them, I fully explained to them that we would not live with them at the time if it meant we would be expected to return the favor later on. Yes, it went longer than I wanted. It's not that I don't want to take care of my parents in their old age; it's just that we mostly won't have the means to house them. We're both teachers who do well for ourselves, but we won't have a guest house or extra bedrooms or things like that.

Sorry for the long post, but I was taken aback by my mother being honest about their finances when they have told me for years that they're more than okay and have plenty of money.

tl;dr - Parents weren't exactly honest with me about their finances until recently. My mother is concerned they don't have enough especially if one passes away. What advice should I give them for going forward?

This post was edited on 7/8/19 at 9:05 am

Posted on 7/8/19 at 9:08 am to StringedInstruments

Put everything they got on bitcoin

Posted on 7/8/19 at 9:09 am to StringedInstruments

Great post, sorry for the inconvenience you will have, kind of in the same boat, just a little more water in it than yours

Posted on 7/8/19 at 9:11 am to ScaryClown

quote:

Put everything they got on bitcoin

You jest but my initial advice was that they needed to stop looking at retirement as a vacation and think of ways to generate more income.

Speaking of, that's another question I have: if my parents start generating side income after claiming social security, how does that affect their income payments?

I advised my mother to start selling her paintings (she's really talented). Would that hurt them more than help if she's making say $500/month with it?

Posted on 7/8/19 at 9:17 am to StringedInstruments

quote:

tl;dr - Parents weren't exactly honest with me about their finances until recently. My mother is concerned they don't have enough especially if one passes away. What advice should I give them for going forward?

First off, I don't think its your job to take care of them. Do they want advice? If not, good luck.

Secondly, I'd offer to them what you are available to help them with if they have financial issues. Which honestly, could be $0. So if they go broke or make financially poor decisions, they very well could be on their own. What I mean is that while your dad is working, they need to figure this out and not wait until they are broke at 75. If they wait, you simply need to make it known you can't be of much help.

Your mom can't work at all? I would push them hard to pay off their house before retirement. They could pay $25k a year and be done in 4 years. Very very easily doable.

Could they downsize house?

Finally, I don't think they are in that bad of shape honestly. I wouldn't lose sleep over someone with an expected income of $5000/ month. They may have to reduce their lifestyle but they can survive off that easily.

Posted on 7/8/19 at 9:20 am to StringedInstruments

I think the most importan thing is for your dad to NOT retire at 63.

Posted on 7/8/19 at 9:22 am to GEAUXT

Also, its possible your dad retires from his career but still works 20 hours a week somewhere like an Ace or Lowe's or Bass Pro or whatever. That extra $15,000/ year would be huge. Working 4 5 hour shifts is very easy compared to a 40-45 hour work week.

Same thing with your mom. Its not just "work" its a social aspect that keeps you busy and the pay is an extra benefit.

Same thing with your mom. Its not just "work" its a social aspect that keeps you busy and the pay is an extra benefit.

Posted on 7/8/19 at 9:28 am to StringedInstruments

Bless you for not sticking your fingers in your ears and running in the other direction. Also, props to your parents for reaching out now, before things are in crisis, to begin to have honest conversations with you about finances.

First, have Mama take a deep breath and realize that she's far, far better off than many Americans, who have nothing other than SS and are raising grandchildren.

--assisted living: if/when that time comes, assure her that you'll help her to find the best place she can afford. But make it clear that you will not be in a position to pay for a private pay home, as you are raising your own young family. You don't want her to mis-perceive your own financial circumstances, which may look (to her) far better than her own. You say you can't house them, but don't decide this before the actual circumstances present themselves.

--missing pieces to assist: help them put "real" numbers on a Medicare supplement, have them sit down and write out a legit budget. Help both of them get all of the paperwork in order to clearly understand what spousal survival benefits are available to the other. She may be worried about "just" $3K/month, so you need to find out if this is true or not. Be prepared to spend some time with her determining who she needs to contact at her retirement plan, at SocSecurity, etc. Help them to make lists of questions they need to answer....and help them chart a plan for getting those questions answered.

--Why is she stuck on starting a Roth? Her income will decrease in future years, so her tax burden will decrease. It's clear she needs to save money, but I'd not be worried about tax consequences since her potential use horizon (thus growth, thus tax liability) is pretty small. Explain to her that she can get a money market savings account paying around 2% very easily (likely at her current bank or an online bank) and she can stick all of her spare cash into it. It's insured, accessible whenever she needs it, and guaranteed by the FDIC.

Your larger issue with them, as I see it, is curbing spending. They have/will have stopped working quite young, in today's economic terms. Can you convince your father to work until 65? Show him, on paper, that his $30K will give him an additional $1,250/month for the 24-month gap between retirement and collecting SS at 65. Show him what a Part B supplement will cost him for himself & Mama (likely around $800/mo, for a quality plan).

Don't be judgemental, be supportive. Be honest about your own choices/mistakes/lessons learned, and that you want them to be as healthy & happy as possible.

Under no circumstances should you accept an expensive Disney grandma fantasy vacation if Pops only has $30K in savings. It's lunacy. At this point, YOU (son) should be renting a beach house or cabin where you & kids can spend time with them...do not allow them to give you things they simply can't afford. Material things can be returned; put the $$ on a gift card and give it back to them for birthday, Mother's Day, etc.

Good luck and think of this as a demonstration for your own children about how to care for family members. By all means, be completely transparent with your spouse so she isn't surprised by anything coming down the pipe. She is your ally and needs to be on the same page with you as you move forward.

ETA: you can say what you want about "not taking care of them", but unless they were completely toxic abusers, you are an only child who will bear the burden of supporting them should they be lucky enough to live to be elderly. You need to think deeply about your core values/morals, about the example you want to set for your children, etc. It's an easy thing to say that you're not obligated to take care of them, but FFS, who's damn job is it? Your family took care of you, it's gonna be your turn someday.

First, have Mama take a deep breath and realize that she's far, far better off than many Americans, who have nothing other than SS and are raising grandchildren.

--assisted living: if/when that time comes, assure her that you'll help her to find the best place she can afford. But make it clear that you will not be in a position to pay for a private pay home, as you are raising your own young family. You don't want her to mis-perceive your own financial circumstances, which may look (to her) far better than her own. You say you can't house them, but don't decide this before the actual circumstances present themselves.

--missing pieces to assist: help them put "real" numbers on a Medicare supplement, have them sit down and write out a legit budget. Help both of them get all of the paperwork in order to clearly understand what spousal survival benefits are available to the other. She may be worried about "just" $3K/month, so you need to find out if this is true or not. Be prepared to spend some time with her determining who she needs to contact at her retirement plan, at SocSecurity, etc. Help them to make lists of questions they need to answer....and help them chart a plan for getting those questions answered.

--Why is she stuck on starting a Roth? Her income will decrease in future years, so her tax burden will decrease. It's clear she needs to save money, but I'd not be worried about tax consequences since her potential use horizon (thus growth, thus tax liability) is pretty small. Explain to her that she can get a money market savings account paying around 2% very easily (likely at her current bank or an online bank) and she can stick all of her spare cash into it. It's insured, accessible whenever she needs it, and guaranteed by the FDIC.

Your larger issue with them, as I see it, is curbing spending. They have/will have stopped working quite young, in today's economic terms. Can you convince your father to work until 65? Show him, on paper, that his $30K will give him an additional $1,250/month for the 24-month gap between retirement and collecting SS at 65. Show him what a Part B supplement will cost him for himself & Mama (likely around $800/mo, for a quality plan).

Don't be judgemental, be supportive. Be honest about your own choices/mistakes/lessons learned, and that you want them to be as healthy & happy as possible.

Under no circumstances should you accept an expensive Disney grandma fantasy vacation if Pops only has $30K in savings. It's lunacy. At this point, YOU (son) should be renting a beach house or cabin where you & kids can spend time with them...do not allow them to give you things they simply can't afford. Material things can be returned; put the $$ on a gift card and give it back to them for birthday, Mother's Day, etc.

Good luck and think of this as a demonstration for your own children about how to care for family members. By all means, be completely transparent with your spouse so she isn't surprised by anything coming down the pipe. She is your ally and needs to be on the same page with you as you move forward.

ETA: you can say what you want about "not taking care of them", but unless they were completely toxic abusers, you are an only child who will bear the burden of supporting them should they be lucky enough to live to be elderly. You need to think deeply about your core values/morals, about the example you want to set for your children, etc. It's an easy thing to say that you're not obligated to take care of them, but FFS, who's damn job is it? Your family took care of you, it's gonna be your turn someday.

This post was edited on 7/8/19 at 9:37 am

Posted on 7/8/19 at 9:31 am to StringedInstruments

quote:

My father currently makes $55k/year but averages $10k/year in bonuses. He has $30k in retirement and is going to rely on social security. He wants to retire at 63 because he believes his $30k can bridge the gap between working and social security.

I'll come back and reply to some other things in this post...but this is not ideal given your mom's condition and their lack of savings. As long as he's able...he needs to keep working; and more importantly, saving.

Jokes aside from the Dave Ramsey thread, but they are perfect people to benefit from his "system".

Your mom also needs to look at getting on SS Disability...I'm unfamiliar with the process, but worth a shot.

Posted on 7/8/19 at 9:32 am to baldona

quote:

Finally, I don't think they are in that bad of shape honestly

I don't know how you could ever think that while reading how much money they spend, especially when they plan on going on fixed income soon and all their health problems.

Prayers sent to the OP, if they have long term health issues that require a lot of personal care they WILL go broke.

This post was edited on 7/8/19 at 9:43 am

Posted on 7/8/19 at 9:35 am to baldona

quote:

Also, its possible your dad retires from his career but still works 20 hours a week somewhere like an Ace or Lowe's or Bass Pro or whatever. That extra $15,000/ year would be huge. Working 4 5 hour shifts is very easy compared to a 40-45 hour work week.

Same thing with your mom. Its not just "work" its a social aspect that keeps you busy and the pay is an extra benefit.

Yep. I begged my dad to find a part time job after he retired at 63. He was sitting around the house every day just watching TV. He ignored me and my mom and died a few years later, and his sedentary lifestyle definitely played a big part in that.

Posted on 7/8/19 at 9:35 am to StringedInstruments

What other debt do they have outside of the mortgage? Will they be paying for these extra trips and remodels out of some cash or putting that on credit cards?

This sounds like a case that's headed straight for Medicaid. Once they spend down their assets, they'll be eligible. Medicaid will force them to use their (or individually should one of them pass) pension/social security to cover the costs and then pay for the difference. This will not be a fancy place... this will be a government run facility.

Regarding the Roth idea... it's not a horrible idea bc building cash/assets is always a good idea, but I question whether they are really going to have this much left over every month. It doesn't sound like they're making the best decisions and $400-600 is a lot of money in that situation. *You* may be better off figuring out why she thinks she has this much money left over with a budget. Most people forget the plane tickets, new tires, AC repair, etc in their budget because these things rarely happen. But if they *don't* have a pile of cash somewhere, they *aren't* in a $600/mo positive cash flow situation. This should be an easy one to figure out... "How much cash do you have in checking and savings?" If they're wishy washy on the answer... they don't.

This sounds like a case that's headed straight for Medicaid. Once they spend down their assets, they'll be eligible. Medicaid will force them to use their (or individually should one of them pass) pension/social security to cover the costs and then pay for the difference. This will not be a fancy place... this will be a government run facility.

Regarding the Roth idea... it's not a horrible idea bc building cash/assets is always a good idea, but I question whether they are really going to have this much left over every month. It doesn't sound like they're making the best decisions and $400-600 is a lot of money in that situation. *You* may be better off figuring out why she thinks she has this much money left over with a budget. Most people forget the plane tickets, new tires, AC repair, etc in their budget because these things rarely happen. But if they *don't* have a pile of cash somewhere, they *aren't* in a $600/mo positive cash flow situation. This should be an easy one to figure out... "How much cash do you have in checking and savings?" If they're wishy washy on the answer... they don't.

Posted on 7/8/19 at 10:03 am to GEAUXT

quote:

I think the most importan thing is for your dad to NOT retire at 63.

This. He may be ready to quit working, but I don't think he's ready to retire from a financial perspective. I'd try to get him to see the difference.

It may not be your "duty" to support them as they grow old, but I think you'll regret it if you don't give them as much help, both from a time/monetary perspective, as you're honestly able to give.

Posted on 7/8/19 at 10:26 am to StringedInstruments

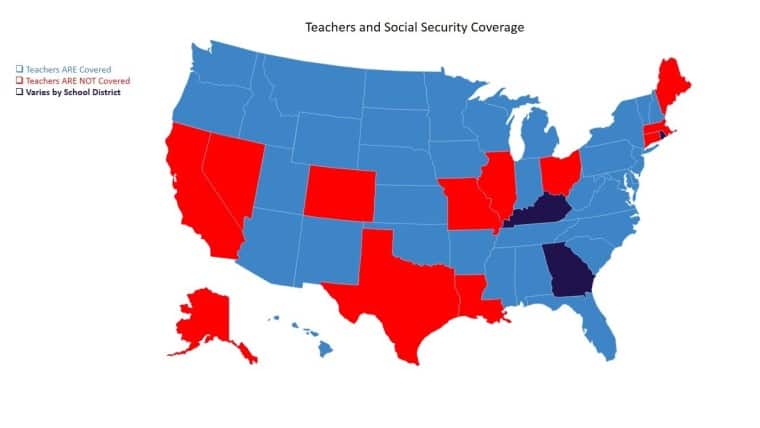

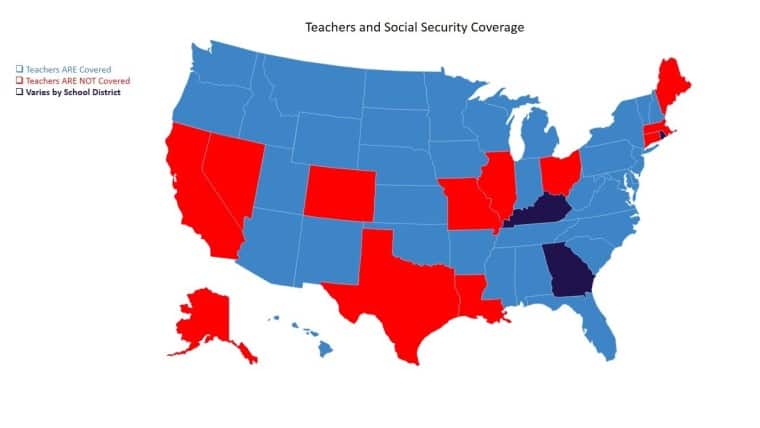

first thing you need to figure out are your social security #s right for your mother. She is a retired teacher with a state pension, did she pay into social security?

Not all states require their employees with state pensions to pay social security. Some where around 15 states used to be higher, don't have pay into social security taxes. Also may be a reason she isn't collecting SSI

Not all states require their employees with state pensions to pay social security. Some where around 15 states used to be higher, don't have pay into social security taxes. Also may be a reason she isn't collecting SSI

Posted on 7/8/19 at 10:40 am to StringedInstruments

I don't have anything to add other than good on you for helping and good on you for being better at finances than you parents. That last thing is no easy task.

Posted on 7/8/19 at 11:03 am to TigerintheNO

Also, if she did pay into social security, she may have a reduced benefit due to the pension windfall rule.

Posted on 7/8/19 at 11:10 am to StringedInstruments

Circling back to say a few more things:

--Mama is clearly a person with emotional spending issues: expensive presents for grandkids, "dream" trip to Disney. You need to step up here and tell her loud and clear that she doesn't need to buy your kids' affection, and then you need to make good on it. Do you not make time to visit when she's not doling out presents? Are big vacations the lure she casts out to see her only child & grandchildren? Do you repeatedly tell her NOT to spend her retirement money on you, or are you (pardon my harshness) a bit of a spoiled only child who just expects that parents do that sort of thing?

--You are a grownup now too and can change the dynamic. Declare birthdays and Christmas presents off limits, suggest time spent together as an alternative. Tell her to teach your kids to paint & let her buy art supplies. But stop being a passive participant in her spending problem by accepting stuff "for the kids". Do not give her positive feedback for her spending---tell her that you worry about her spending what she doesn't have.

Look, lots of unmet emotional needs and psychological baggage come out into the open as we age. Many of our elders weren't raised in open, sharing ways: they were walled off by rigid gender roles ("ladies don't worry about the bills, that's the husband's job" kind of BS), by financial insecurity in earlier generations so they didn't grow up with good models for fiscal behavior....be prepared to ask questions and listen.

Ask gently why they didn't plan better for retirement: you may be surprised at the answers.

--Mama is clearly a person with emotional spending issues: expensive presents for grandkids, "dream" trip to Disney. You need to step up here and tell her loud and clear that she doesn't need to buy your kids' affection, and then you need to make good on it. Do you not make time to visit when she's not doling out presents? Are big vacations the lure she casts out to see her only child & grandchildren? Do you repeatedly tell her NOT to spend her retirement money on you, or are you (pardon my harshness) a bit of a spoiled only child who just expects that parents do that sort of thing?

--You are a grownup now too and can change the dynamic. Declare birthdays and Christmas presents off limits, suggest time spent together as an alternative. Tell her to teach your kids to paint & let her buy art supplies. But stop being a passive participant in her spending problem by accepting stuff "for the kids". Do not give her positive feedback for her spending---tell her that you worry about her spending what she doesn't have.

Look, lots of unmet emotional needs and psychological baggage come out into the open as we age. Many of our elders weren't raised in open, sharing ways: they were walled off by rigid gender roles ("ladies don't worry about the bills, that's the husband's job" kind of BS), by financial insecurity in earlier generations so they didn't grow up with good models for fiscal behavior....be prepared to ask questions and listen.

Ask gently why they didn't plan better for retirement: you may be surprised at the answers.

Posted on 7/8/19 at 11:19 am to Mingo Was His NameO

quote:

I don't know how you could ever think that while reading how much money they spend, especially when they plan on going on fixed income soon and all their health problems.

Because OP needs to have his parents write down their needs and their wants. They can financially cover their needs. They can do things very easily to be out of debt by age 65 as long as they don't have major consumer debt. Work longer, save more, pay off debts, and sell crap like new cars and their house to downsize. I think OP's parents are in Alabama? Very easy to find a 2 bedroom house in Alabama for $150k or less. Hell they could find a lake house for that.

Determine the parents financial needs and if they can get there. On $60k two people with health issues that are not very active can likely live a very cheap lifestyle.

Honestly OP, I'd plan the Disney Trip with your mom. IF, IF they get their finances in order and pay for it in cash. You can go to disney for $3,000 per family or $6000 very easily. That includes plenty of splurges. Plan that trip for 2-3 years down the road so they have something to look forward to when their finances are in order and you and your wife pay your share. Anyone can save $100/ month if they care enough.

This post was edited on 7/8/19 at 11:20 am

Posted on 7/8/19 at 11:23 am to baldona

quote:

Because OP needs to have his parents write down their needs and their wants. They can financially cover their needs. They can do things very easily to be out of debt by age 65 as long as they don't have major consumer debt. Work longer, save more, pay off debts, and sell crap like new cars and their house to downsize. I think OP's parents are in Alabama? Very easy to find a 2 bedroom house in Alabama for $150k or less. Hell they could find a lake house for that.

The problem with this logic is they haven't done any of this for the last 60 years, but I'm sure they'll start doing it overnight

Posted on 7/8/19 at 11:30 am to StringedInstruments

quote:

2) What might I be missing in order to help them?

That's enough money to live on, on paper. You have to put them on a budget. I might even consider them giving you power of attorney so you can enforce it, including putting them on an allowance.

quote:

My parents spend outside of their means

Boom. I predicted it before I read it. There is no reason for you to make up any gap. If they make you responsible, they have to give you the power. I'm not saying walk away, but make it non-negotiable.

quote:

How can I communicate to them that the need to live on a strict budget if they want to be fully retired at 63?

Tell them, quite truthfully, that there is no other way. No matter the income, the budget must be under that.

Popular

Back to top

22

22