- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Inflation still a problem....

Posted on 9/14/22 at 8:51 am to I Love Bama

Posted on 9/14/22 at 8:51 am to I Love Bama

quote:

I Love Bama

Posted on 9/14/22 at 9:18 am to Niner

quote:

Is it as bad as the fall of the Roman Empire or the beginning of one of the worst economic periods in the history of our country?

Just playing devil's advocate here, but if we lost reserve currency status, would it?

We've held it for a long time and we are in a jacked up situation where we have little to no manufacturing, labor market requirements are a huge disadvantage compared to most EM economies, and the politics of the day mean we can't use our natural resources like we should. Throw in a mental health crisis that's beyond the scope here... Could get really bad compared to what the last 40+ years have looked like. I'm not sayin', just sayin'.

Posted on 9/14/22 at 9:30 am to slackster

quote:

Are companies not far more profitable?.

It is a mirage. The S&P at 4700 last year was a mirage.

What would earnings be/have been over the last 13 years if the discount rate wasn't 0.50% over most of that span. Add to that the QE and the spending. It would hurt earnings, especially tech.

IMO, passive equity investors are in for a different ball game the next 3-4 years. It will be a stock pickers market. Some will move into bonds and t-bills. The TINA trade is over.

This post was edited on 9/14/22 at 9:58 am

Posted on 9/14/22 at 10:21 am to Niner

quote:

but your statement is the epitome of exaggerating the impact of specificity of circumstances on the broader outlook. Your statement is the epitome of the losing perspective that "this time is different" and you should do something drastic and emotional and inconsistent with the historical behavior of the markets and economy.

Perhaps you should go back and re-read the conversation, it seems you've missed some very important context in your rush to be glib.

The market always rebounds, that's not in question. Removing all the comments, the context is that one poster was saying "it's buying time" while the other was saying "not yet" with both making comments to defend their stances.

If someone is fine with taking a substantial loss by buying now and then recovering it years later, so be it. For others, they see it as there is a lot more downturn coming and would rather wait to by closer to the bottom so their loss less and subsequent gain is greater (no one is trying to actually time the actual bottom though).

quote:

Just because inflationary periods have not historically been caused by the exact sequence of events you mention in your statement (10 years QE and then six months gov't overspending) doesn't mean this inflationary period won't likely end the same way the rest have...a recovery both in the markets and economy eventually.

Yes and no. What you've outlined is a very generalized result from what you're looking at as very generalized events then trying to apply all of that to a very specific event which is foundationally different. In doing so you ignore that the way part of those recoveries happened was through government intervention through pushing more money into the economy (lowering rates, Fed buying securities, TAARP, etc). By ignoring this you are also ignoring that too much government intervention through pushing too much money into the economy is why we are in this situation in the first place. In other words, the very tools which have been used in the past to help ease the downturn and spur a rebound are not available this time (at least not in the near to medium term). This is why someone like Bama is saying it's not time to buy yet.

Posted on 9/14/22 at 10:28 am to frogtown

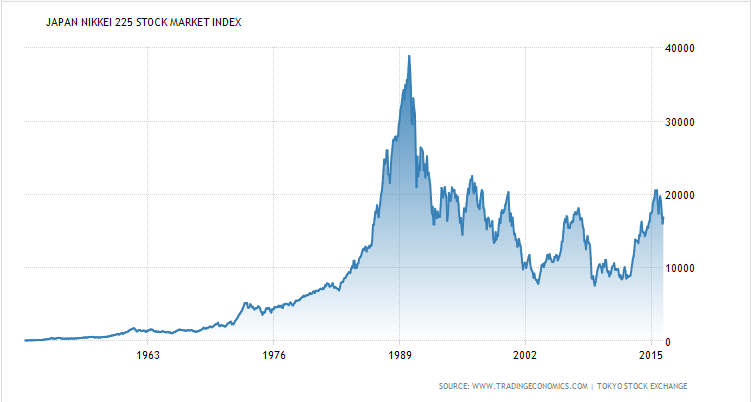

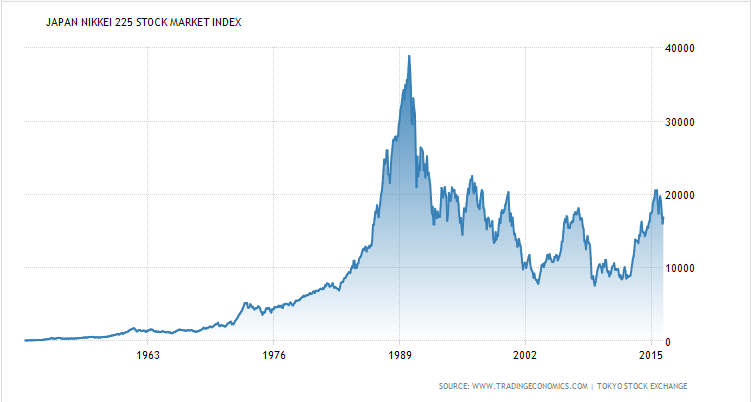

For those who say stocks only go up over longer time frames, just buy the dip:

Don’t be so prideful as to say it can’t happen to us, as well.

Regarding the Roman Empire parallels (as well as the British, Russian, French, etc) the fall was preceded by monetary and economic collapse. Put simply: if people get hungry and you can’t pay the soldiers with anything of value you don’t stay in power for very long. It can certainly happen, but things will have to get much worse first.

Don’t be so prideful as to say it can’t happen to us, as well.

Regarding the Roman Empire parallels (as well as the British, Russian, French, etc) the fall was preceded by monetary and economic collapse. Put simply: if people get hungry and you can’t pay the soldiers with anything of value you don’t stay in power for very long. It can certainly happen, but things will have to get much worse first.

Posted on 9/14/22 at 11:20 am to Decisions

So I'm jumping in this thread, maybe this has been addressed but it's interesting to see long term yield moving down after that cpi print. Someone is very wrong, either the fed or the bond market. I'm watching this closely because I bought a bunch of tlt calls later next year and Jan 24. This is playing out almost exactly like I predicted in that other thread where we talked about this trade.

To me, it seems painfully obvious that cpi won't move meaningfully until December print when novemember yoy data falls out which is after the fed signaled their pivot in 2021.

Is it really as simple as them just using a shitty arse year lagged indicator and they are trying to effect a number now that they have no control over because it's flawed in multiple ways. Or am I mistaken in my understanding of cpi. It's not telling us price levels but rate of change yoy which seems like a horrible thing to anchor your current inflation policy to. I know in my personal professional insight, wholesalers really started moving prices again in February 22, so im thinking by March of 23, fed will realize they fricked up and we will be in a bad situation economically.

To me, it seems painfully obvious that cpi won't move meaningfully until December print when novemember yoy data falls out which is after the fed signaled their pivot in 2021.

Is it really as simple as them just using a shitty arse year lagged indicator and they are trying to effect a number now that they have no control over because it's flawed in multiple ways. Or am I mistaken in my understanding of cpi. It's not telling us price levels but rate of change yoy which seems like a horrible thing to anchor your current inflation policy to. I know in my personal professional insight, wholesalers really started moving prices again in February 22, so im thinking by March of 23, fed will realize they fricked up and we will be in a bad situation economically.

This post was edited on 9/14/22 at 1:14 pm

Posted on 9/14/22 at 11:40 am to Pendulum

Posted on 9/14/22 at 12:15 pm to Bard

quote:Rich coming from the guy whose post was oozing sarcasm with a nice little "#TIL" at the end.

in your rush to be glib

quote:This is my entire point Bard. I believe it is absurd to tell someone to hold onto cash when US markets are down over 17% YTD knowing what markets do over 5-10-20 year time periods. You are trying to convince people to time the bottom of the market because you believe a bigger crash is coming. You believe this because apparently this time is different.

The market always rebounds, that's not in question. Removing all the comments, the context is that one poster was saying "it's buying time" while the other was saying "not yet" with both making comments to defend their stances.

quote:How in the hell do you define timing the bottom of the market? It's literally what you're suggesting people do...right now...in this thread.

(no one is trying to actually time the actual bottom though)

quote:This whole paragraph is just trying to again make your argument that this time is different. You all hate this phrase, but markets price in information so much quicker now-a-days than decades ago. We have taken a pretty hefty hit this year already. Could it go lower? It very well might. But to assume that because someone buys in now, they are "fine with taking a substantial loss" is an exaggeration. They are willing to take the risk of their investments dropping further (thought they may not...) before getting back in the green versus taking the risk that the "bottom" never comes and that 17.49% discount shrinks...then it's REAL hard to get back in the market.

Yes and no. What you've outlined is a very generalized result from what you're looking at as very generalized events then trying to apply all of that to a very specific event which is foundationally different. In doing so you ignore that the way part of those recoveries happened was through government intervention through pushing more money into the economy (lowering rates, Fed buying securities, TAARP, etc). By ignoring this you are also ignoring that too much government intervention through pushing too much money into the economy is why we are in this situation in the first place. In other words, the very tools which have been used in the past to help ease the downturn and spur a rebound are not available this time (at least not in the near to medium term). This is why someone like Bama is saying it's not time to buy yet.

Posted on 9/14/22 at 12:37 pm to BearsFan

quote:

Even if it is what am I supposed to do? Somehow luckily guess what the next empire is and go invest there?

Buy land and keep enough cash on hand to pay the property taxes till you die.

Posted on 9/14/22 at 1:16 pm to bayoudude

quote:

Buy land and keep enough cash on hand to pay the property taxes till you die.

If the "empire" falls, your deed/title will be worthless. Hope you have enough means to defend from the next person and their potential army who wants it. If the "empire" falls the last thing I am worried about is property taxes.

Posted on 9/14/22 at 1:37 pm to Niner

quote:

I continue to be amazed at the perspectives of this site.

That makes two of us (at least).

Posted on 9/14/22 at 2:01 pm to Niner

quote:

Rich coming from the guy whose post was oozing sarcasm with a nice little "#TIL" at the end.

Exactly. I was responding to you at the sarcasm level of your "AKA" response.

I'm going to pull some quotes together because my response to them will be the same.

quote:

I believe it is absurd to tell someone to hold onto cash when US markets are down over 17% YTD knowing what markets do over 5-10-20 year time periods. You are trying to convince people to time the bottom of the market because you believe a bigger crash is coming.

quote:

How in the hell do you define timing the bottom of the market? It's literally what you're suggesting people do...right now...in this thread.

"Timing the bottom" refers to trying to get the lowest price over a period of time. Looking at the fundamentals and seeing that the market has no other place to go but lower is not the same thing.

quote:

You all hate this phrase, but markets price in information so much quicker now-a-days than decades ago.

They do... sometimes. Sometimes they price in their wishcasting, which is what we're seeing right now. We saw the perfect example of this a couple of weeks ago when Powell did nothing more than re-iterate the Fed's commitment to getting the Fed Fund rate up to 3.4% by the end of the year. There had been nothing -N-O-T-H-I-N-G- from the Fed to indicate they were going to change course, but the market had begun to inexplicably convince itself that the Fed was going to pause or pivot after the July rate hike. So once Powell spoke, the market shite itself for a whole week before levelling out.

CPI crushed the attempted rally when it came out. Anyone paying any sort of attention knows the only real relief we've seen for inflationary issues is that domestic gasoline prices have dropped since their highs and that drop is primarily due to Biden draining the SPR to feed demand as supplies haven't returned to pre-COVID levels.

Food? Still rising in many categories.

Rent? Rising.

Wages? Stagnant or falling.

Electricity? Rising.

What's things do you see in place for reversing these (or just holding them at their current rates) over the next few months? That's not a "gotcha", it's a sincere question.

This post was edited on 9/14/22 at 2:04 pm

Posted on 9/14/22 at 2:02 pm to Billzbobo

Not for General Lee. That bitch loves the inflation. He's making money on whatever turd he promotes. He's probably losing money and has terrible investments.

Commodities, bitch.

Commodities, bitch.

Posted on 9/14/22 at 2:43 pm to Bard

quote:Except it wasn't sarcasm. His sentiment is literally Also Known As "this time is different".

Exactly. I was responding to you at the sarcasm level of your "AKA" response.

quote:Surely you cannot be serious. Can someone other than me call this BS? Please? No sane person truly expects to get something at the exact lowest price, Bard. No one that I have ever met or talked to in this industry defines market-timing by the same standard as you. Wow.

"Timing the bottom" refers to trying to get the lowest price over a period of time. Looking at the fundamentals and seeing that the market has no other place to go but lower is not the same thing.

quote:You keep repeating yourself.

They do... sometimes. Sometimes they price in their wishcasting, which is what we're seeing right now. We saw the perfect example of this a couple of weeks ago when Powell did nothing more than re-iterate the Fed's commitment to getting the Fed Fund rate up to 3.4% by the end of the year. There had been nothing -N-O-T-H-I-N-G- from the Fed to indicate they were going to change course, but the market had begun to inexplicably convince itself that the Fed was going to pause or pivot after the July rate hike. So once Powell spoke, the market shite itself for a whole week before levelling out.

CPI crushed the attempted rally when it came out. Anyone paying any sort of attention knows the only real relief we've seen for inflationary issues is that domestic gasoline prices have dropped since their highs and that drop is primarily due to Biden draining the SPR to feed demand as supplies haven't returned to pre-COVID levels.

quote:The next few months? I will quickly admit I don't know the answer to that question. Goof ball economists go on CNBC all the time and predict what's going to happen in 3 months, 8 months, 2 years, etc. and they are wrong FAR more often than they are right. Trying to predict what the economy and what markets will do in a time period defined as "a few months" is a fools errand. That, my friend, is what separates you and me. My time horizon is way, way longer than 2-3 months. Yours appears to be far shorter.

What's things do you see in place for reversing these (or just holding them at their current rates) over the next few months? That's not a "gotcha", it's a sincere question.

With that, I'm signing off this conversation. No need to take up more space in this thread. I hate typing out all this crap anyways.

Posted on 9/14/22 at 3:55 pm to Niner

quote:

Except it wasn't sarcasm.

In that case, my apologies. Text can often leave out nuances (and I spend too much time on Poli).

quote:

Surely you cannot be serious. Can someone other than me call this BS? Please? No sane person truly expects to get something at the exact lowest price, Bard.

Where did I say I was trying to get the exact lowest price? Now you seem to be simply making stuff up.

quote:

You keep repeating yourself.

In the hopes that eventually you'll understand it.

quote:

The next few months? I will quickly admit I don't know the answer to that question.

Thus, we have differing views on buying right now because I know the answer. The answer is: nothing. There's absolutely nothing currently in play to stabilize food, energy nor rent over the next couple of months, much less reverse them. As long as that's the environment, the market is going to continue to slide downward.

I've been calling this timeframe for the beginning of the market's downturn for months and I've been far more correct than incorrect (the only thing I've been wrong on has been the timing of the rise in Unemployment, but it's coming).

quote:

My time horizon is way, way longer than 2-3 months. Yours appears to be far shorter.

This is correct, at least for this economic event. I generally buy when I see good deals, but every now and then there are times which almost mandate waiting to buy (see: the COVID lockdown), this is one of those times.

Posted on 9/14/22 at 4:08 pm to Bard

quote:

"Timing the bottom" refers to trying to get the lowest price over a period of time. Looking at the fundamentals and seeing that the market has no other place to go but lower is not the same thing.

The issue is that if you are trying to time the market then you are relying on yourself buying in at the lowest price. Today you are not buying because you think it will go lower even though it is already down 18% ytd.

Lets say you are correct that it will go lower and in 6 months it is lower than today. At that time you will have to reassess if you think it will go lower still and every time you go to buy you will have to answer that question if you think it will go lower. If you don't buy today because you think it will go lower then what stops you after it drops another 20% from thinking it will still go lower and not buy. This same thought process will lead you to wait and only buy when you think it will not go lower.

Timing the market is a losing prospect and even teams of people who get paid millions a year can't do it effectively in the long run. Even if you are successful one time which is definitely possible it will lead you to doing it more in the future which increases your probability of losing out. The easy part is selling before the market goes lower because plenty times the market goes lower. Where most people fail is buying in when its lower. I also think the prospect of trying to time the market means you think you know more than all of the big market movers else it would already be lower.

Posted on 9/14/22 at 4:30 pm to bod312

quote:

Lets say you are correct that it will go lower and in 6 months it is lower than today. At that time you will have to reassess if you think it will go lower still and every time you go to buy you will have to answer that question if you think it will go lower. If you don't buy today because you think it will go lower then what stops you after it drops another 20% from thinking it will still go lower and not buy. This same thought process will lead you to wait and only buy when you think it will not go lower.

Dude. You are over thinking this.

If Bard sells at 4700 because he thinks the S&P is overvalued and then he buys back in at 4000 because it is a better valuation...he wins.

He doesn't have to guess the "exact" bottom. That is foolish.

Posted on 9/14/22 at 7:14 pm to bod312

quote:

The issue is that if you are trying to time the market then you are relying on yourself buying in at the lowest price.

You realize the idea is to buy low and sell high, right?

I'm not trying to time the bottom to get the absolute lowest price, it's just that the indicators I see show nothing but more downward movement in the near future. If that's what I'm seeing, then why the hell would I buy right now?

quote:

Today you are not buying because you think it will go lower even though it is already down 18% ytd.

I'll pose the same question to you that I did to niner: what do you see in place to stop the market from going lower?

With rates to be cut at least another .75 next week (the market is working itself into a tizzy to expect a full point, that way if it's "only" .75 they can continue trying to go back to hoping the Fed will pause or pivot), natural gas and coal prices multiples of what they were less than a year ago and looking to continue climbing well into winter, rent climbing as home purchases move out of the price range for more and more people and food prices continuing to rise, what is in place -or even just "on deck"- to cause prices to hold (much less reverse) over the next few months?

This post was edited on 9/14/22 at 7:15 pm

Posted on 9/14/22 at 8:20 pm to bod312

quote:

If the "empire" falls, your deed/title will be worthless. Hope you have enough means to defend from the next person and their potential army who wants it. If the "empire" falls the last thing I am worried about is property taxes.

For sure.

You either need to

1)Have your money somewhere safe (whatever currency holds up) and escape to whatever the next good place to live is

or

2)Be full on prepper style on a farm with good hunting, fresh water, stocked pond, and whatever supplies you plan to need (seeds, ammo, and such).

Taxes probably werent relevant after the fall of the roman empire.

Hence, why I feel like I am stuck investing here in USA (even if it is going down).

This post was edited on 9/14/22 at 8:22 pm

Posted on 9/14/22 at 8:44 pm to frogtown

quote:

If Bard sells at 4700 because he thinks the S&P is overvalued and then he buys back in at 4000 because it is a better valuation...he wins.

Except the indicators haven’t change so he thinks it will go lower than 4000 and doesn’t buy. There will be another run up after another drop without the indicators changing. The issue is by the time his indicators are pointing that we are in a better situation the bottom was likely 6-18 months prior to that and it very likely will be higher than it is today.

Popular

Back to top

0

0