- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 11/29/23 at 11:38 am to SmackoverHawg

I like the confidence. I’m steady buying every week. A gov grant would be nice in Jan or Feb. Then a financial partnership announcement.

Posted on 11/29/23 at 1:04 pm to SmackoverHawg

quote:

There's no if.

There we go.

Posted on 11/29/23 at 1:17 pm to LSUSLU106

But the price drop was supposed to happen after Lanxess backs out..

Who knows how much this will drop on that day??

I hope investors are smart enough to realize that Lanxess dropping out is good news..

Who knows how much this will drop on that day??

I hope investors are smart enough to realize that Lanxess dropping out is good news..

Posted on 11/29/23 at 1:39 pm to Elusiveporpi

I was curious about the grants so I dug into them a little. Here are some basic takeaways:

Mintak specifically mentioned 48C and 45X. I'm more focused on 48C (capital funding) over 45X (operations funding) at the moment.

On 48C applications,

-Concept papers were due 7/31/23.

-Full application due 12/26/23.

-Per energy.gov, "There is no advantage to submitting a concept paper before the deadline. DOE will begin

reviewing all applications after the deadline." I take this as Standard being in the dark with us for now.

-Per IRS, "The IRS will make all Round 1 allocation decisions by March 31, 2024."

On 48C funding,

-$10B total available

-At least $4B must be allocated to projects located on census tracts that none of SLI's projects are near.

-Round 1 provides $4B of funding, $1.6B of which must go to the irrelevant census tracts. So SLI is competing for a share of $2.4B in Round 1.

-Round 2 is sometime in 2024. A third round only expected if approved projects from Rounds 1 and 2 are unable to be used.

-Insight from a fellow named Grant Thornton, this program isn't new but reloaded from 2009. IRS says that in 2009, $2.3B was allocated and it received more than $7.5B in qualified applications. So the $2.3B funded less than 1/3 of otherwise eligible projects.

Mintak specifically mentioned 48C and 45X. I'm more focused on 48C (capital funding) over 45X (operations funding) at the moment.

On 48C applications,

-Concept papers were due 7/31/23.

-Full application due 12/26/23.

-Per energy.gov, "There is no advantage to submitting a concept paper before the deadline. DOE will begin

reviewing all applications after the deadline." I take this as Standard being in the dark with us for now.

-Per IRS, "The IRS will make all Round 1 allocation decisions by March 31, 2024."

On 48C funding,

-$10B total available

-At least $4B must be allocated to projects located on census tracts that none of SLI's projects are near.

-Round 1 provides $4B of funding, $1.6B of which must go to the irrelevant census tracts. So SLI is competing for a share of $2.4B in Round 1.

-Round 2 is sometime in 2024. A third round only expected if approved projects from Rounds 1 and 2 are unable to be used.

-Insight from a fellow named Grant Thornton, this program isn't new but reloaded from 2009. IRS says that in 2009, $2.3B was allocated and it received more than $7.5B in qualified applications. So the $2.3B funded less than 1/3 of otherwise eligible projects.

Posted on 11/29/23 at 2:47 pm to SmackoverHawg

So you are saying you have lined up the crack and hookers and locked down the meeting with Hunter? You have been pumping this thing pretty hard. You better get the coke and slick willy lined up to just to be safe.

Posted on 11/29/23 at 3:21 pm to Elusiveporpi

Up 10% from yesterday’s low.

This post was edited on 11/29/23 at 3:22 pm

Posted on 11/29/23 at 5:01 pm to go ta hell ole miss

lots of volume..

1.42M shares yesterday at 1.47 pm and 500k shares at 2:10 pm today

1.42M shares yesterday at 1.47 pm and 500k shares at 2:10 pm today

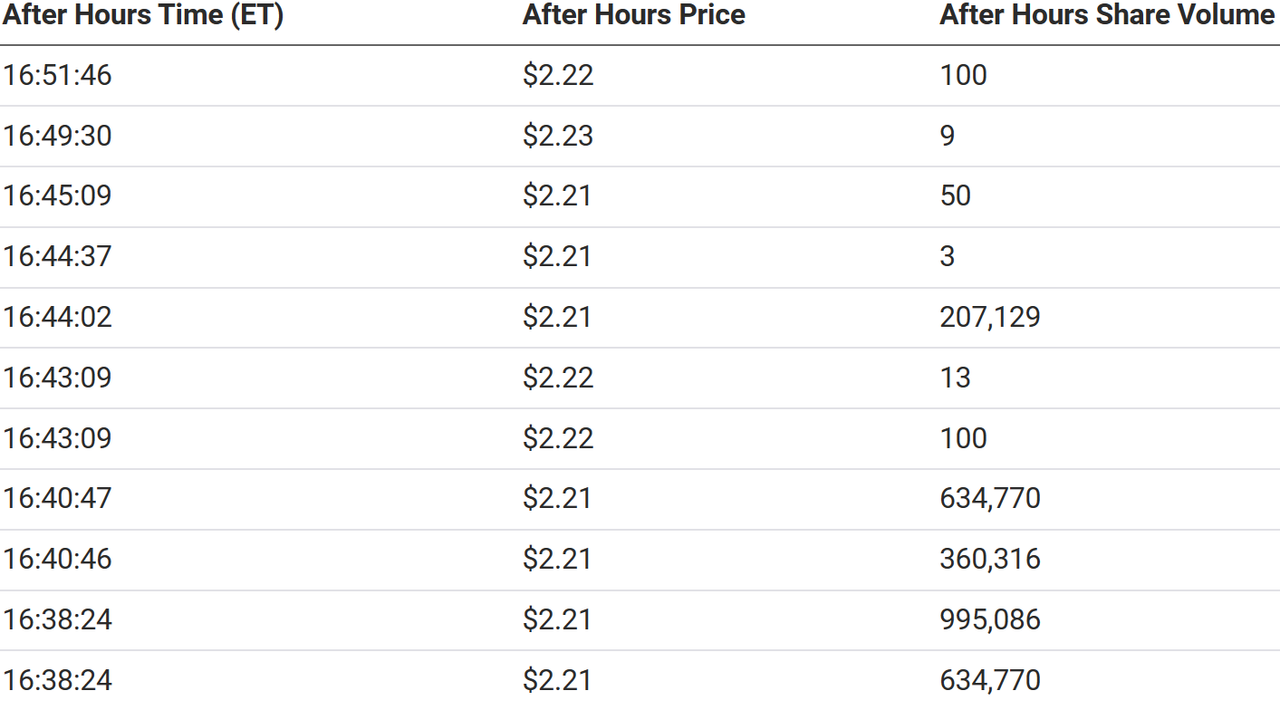

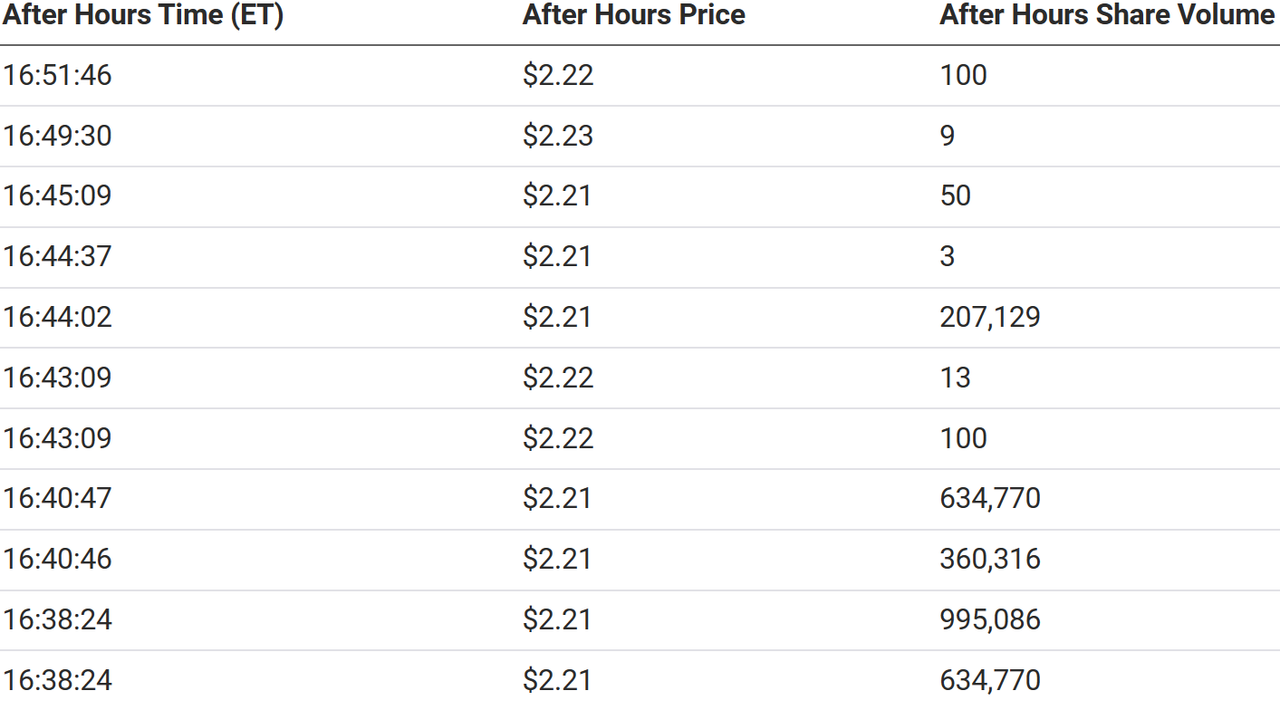

Posted on 11/29/23 at 7:44 pm to gautamj

Yep. Almost 3M on the day and these after hours. Seems substantial?

ETA the 995,086 trade was cancelled 20 min later. Still some heavy buys

ETA the 995,086 trade was cancelled 20 min later. Still some heavy buys

This post was edited on 11/29/23 at 7:56 pm

Posted on 11/30/23 at 11:23 am to jamiegla1

quote:This is all my fault honestly, my apologies. If I buy a stock, it's going to plummet miserably.

i would have but i recently rode another one into the ground and found out that the pleasure of being a martyr didnt outweigh the financial pain

Posted on 12/1/23 at 9:00 am to The Mick

Lanxess PR

Looking this over now.

ETA: Dear Lord what an unclear and hazy PR. What the hell are they doing?

What does any of this mean? It sounds like they are saying they have agreed to let them use the tailbrine and lease the land (this was already a done deal...?) but that they are not investing any capital. So that means they shouldn't get any of the lithium. But they are saying they are hoping to benefit from the lithium market and increase profitability with this deal...huh?

I'm guessing giving the brine to SLI instead of reinjecting themselves reduces their opex on the bromine extraction thus improving profitability? I am lost.

Gonna forward to SLI IR and see if they have comments, but I assume we'll be getting a SLI PR either today or early next week.

Maybe SLI helped them massage this PR so it doesn't look so much like Lanxess is opting out/decline/doesn't want to participate. They are just 'participating in a different capacity'. Seems like things are on track/dare I say slightly ahead of schedule.

Looking this over now.

ETA: Dear Lord what an unclear and hazy PR. What the hell are they doing?

quote:

LANXESS will supply the brine required for the extraction of lithium. In addition, LANXESS will lease a plot of land to Standard Lithium for a production facility and provide certain infrastructure services.

quote:

With the intended cooperation model, LANXESS can benefit efficiently from the promising market for electromobility and strengthen the profitability of its specialty additives – without risk and additional costs.

quote:

In view of the planned model of cooperation, LANXESS will no longer pursue the possibilities of a financial investment into a project entity or a direct lithium sourcing

What does any of this mean? It sounds like they are saying they have agreed to let them use the tailbrine and lease the land (this was already a done deal...?) but that they are not investing any capital. So that means they shouldn't get any of the lithium. But they are saying they are hoping to benefit from the lithium market and increase profitability with this deal...huh?

I'm guessing giving the brine to SLI instead of reinjecting themselves reduces their opex on the bromine extraction thus improving profitability? I am lost.

Gonna forward to SLI IR and see if they have comments, but I assume we'll be getting a SLI PR either today or early next week.

Maybe SLI helped them massage this PR so it doesn't look so much like Lanxess is opting out/decline/doesn't want to participate. They are just 'participating in a different capacity'. Seems like things are on track/dare I say slightly ahead of schedule.

This post was edited on 12/1/23 at 9:10 am

Posted on 12/1/23 at 9:03 am to SuperSaint

Lanxess issued a press release. They will provide the brine and lease the land to SLI, but it looks like they will not be participating in the infrastructure for the extraction plant. It will be interesting to see who SLI partners with now.

LINK

LINK

This post was edited on 12/1/23 at 9:06 am

Posted on 12/1/23 at 9:09 am to bet84

quote:

What does any of this mean? It sounds like they are saying they have agreed to let them use the tailbrine and lease the land (this was already a done deal...?) but that they are not investing any capital. So that means they shouldn't get any of the lithium. But they are saying they are hoping to benefit from the lithium market and increase profitability with this deal...huh?

I'm guessing giving the brine to SLI instead of reinjecting themselves reduces their opex on the bromine extraction thus improving profitability? I am lost.

Gonna forward to SLI IR and see if they have comments, but I assume we'll be getting a SLI PR either today or early next week.

That's what it looks like to me. What a word salad.

Posted on 12/1/23 at 9:10 am to Fe_Mike

This is from the February 2022 agreement:

If Lanxess does not acquire an ownership interest:

Standard Lithium will own 100% of the Project including customary dividends, distribution, or similar rights;

Standard Lithium can elicit bids from other interested parties to buy up to 49% of the Project Company; and,

Lanxess will have the right to acquire some, or all of the lithium carbonate off-take produced at the commercial plant at a price of market minus up to 20%, to be agreed by Lanxess and Standard Lithium and taking into consideration several key commercial agreements (including the costs of brine supply and disposal for the Project, the Project site lease cost and rights of way, infrastructure, and other services for the Project).

If Lanxess does not acquire an ownership interest:

Standard Lithium will own 100% of the Project including customary dividends, distribution, or similar rights;

Standard Lithium can elicit bids from other interested parties to buy up to 49% of the Project Company; and,

Lanxess will have the right to acquire some, or all of the lithium carbonate off-take produced at the commercial plant at a price of market minus up to 20%, to be agreed by Lanxess and Standard Lithium and taking into consideration several key commercial agreements (including the costs of brine supply and disposal for the Project, the Project site lease cost and rights of way, infrastructure, and other services for the Project).

Posted on 12/1/23 at 9:13 am to ThermoDynamicTiger

Okay, so assuming this was the gentlest way possible to say Lanxess is opting out, I would guess (since it is a negative PR) we get something released from SLI late this afternoon to dampen the negative impact. Friday afternoon PR's, always fun.

Hopefully the new partnership deal is revealed in the next couple of weeks.

Hopefully the new partnership deal is revealed in the next couple of weeks.

Posted on 12/1/23 at 9:15 am to ThermoDynamicTiger

As predicted, Lanxess has opted not to invest in the current project. They had right of first refusal and are not doing well. I believe the recent drop in price is due to that $50million stock offering being filled.

Just added 5000 more shares. Have a feeling SLI's next PR will be announcing who ponied up the $50million. I have a feeling it's Koch. A bigger investment by Koch should be very reassuring as they have been in the mix of things for awhile. Lanxess has been OUT since late 2021.

Just added 5000 more shares. Have a feeling SLI's next PR will be announcing who ponied up the $50million. I have a feeling it's Koch. A bigger investment by Koch should be very reassuring as they have been in the mix of things for awhile. Lanxess has been OUT since late 2021.

Posted on 12/1/23 at 9:16 am to Fe_Mike

quote:

Diving deeper on Standard Lithium?

Okay, so assuming this was the gentlest way possible to say Lanxess is opting out, I would guess (since it is a negative PR) we get something released from SLI late this afternoon to dampen the negative impact. Friday afternoon PR's, always fun.

Hopefully the new partnership deal is revealed in the next couple of weeks.

I think we'll have it sooner than later. Lanxess decision may seem bad but it's not. They are a shitshow now. Things have really gone to shite there since COVID.

Posted on 12/1/23 at 9:23 am to bet84

I'm not sure how Lanxess right to buy potentially all of the off-take will affect SLI's ability to find a partner to share the build-out costs? I believe most of the companies looking to partner may be interested in the lithium for themselves so I assume the new agreement will limit Lanxess rights to all of the off-take.

Posted on 12/1/23 at 9:35 am to SmackoverHawg

Thankfully the news hasn't led to the price dropping below the 52w low that was set recently.

Hoping for some good news from SLI soon..

Hoping for some good news from SLI soon..

Popular

Back to top

3

3