- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 11/10/23 at 4:22 pm to FLObserver

quote:

Yeah Boy. This Turd(SLI),AUPH, FSLY that's just right off the top of my head. Glad i dont really buy penny stocks but the recommendations on here have not been stellar but hey next year is the year.

$.51 to $12.90 was a helluva run. Pretty stellar.

Now the shares I bought since then? Down about 50%

Posted on 11/11/23 at 2:45 pm to ev247

quote:

Plan to finance majority of 1A with debt and reiterates the word “nondilutive” beyond that

Huh….that is counterintuitive to what I was told and a bit concerning.

If a majority comes from debt that would likely mean a partnership is off the table.

Maybe he meant a majority of SLI’s contribution.

Dunno. I’m not totally against SLI going it alone, probably best for the long term outlook. But with “derisking” being the buzz word, a partnership is the best way to derisk. Going it alone makes the potential to fail increase significantly.

EV do you know if this transcript/video/audio is available anywhere? Would like to listen to the whole thing.

Posted on 11/11/23 at 3:45 pm to Fe_Mike

Posted on 11/11/23 at 6:51 pm to Fe_Mike

I was listening while driving so I may have missed/mischaracterized something. I'll have to relisten to the "mostly debt" part but I think it was ambiguous whether he was talking about the whole project or just SLI's portion.

FYI Transcripts are available on YouTube videos toward the bottom of their descriptions, I've recently learned

FYI Transcripts are available on YouTube videos toward the bottom of their descriptions, I've recently learned

Posted on 11/11/23 at 7:03 pm to ev247

I feel like it will continue to be ambiguous until we get announcements on lanxess opting in/out.

Basically mentioned the trifecta.. lanxess support, debt financing(which they are in talks for), and then open to another partner but sounds like they can't really expand on that until the lanxess decision is made.

Basically mentioned the trifecta.. lanxess support, debt financing(which they are in talks for), and then open to another partner but sounds like they can't really expand on that until the lanxess decision is made.

Posted on 11/11/23 at 11:51 pm to ev247

Exxon aims to begin lithium production by 2026 in Arkansas

"Exxon Mobil (XOM.N) is set to unveil its long-awaited lithium strategy on Monday with an announcement that it aims to start production of the electric vehicle (EV) battery metal in Arkansas by 2026, according to a source with direct knowledge of the oil major's plans."

"Exxon...plans to begin producing at least 10,000 metric tons per year of lithium in Arkansas by 2026 with partner Tetra Technologies (TTI.N) in what has been labeled "Project Evergreen," according to the source."

"Exxon is not expected to publicly announce which DLE technology it has chosen, according to the source. The company has a long-standing pattern of not disclosing some vendors.

Reuters reported this year that Exxon and Chevron (CVX.N) held talks with International Battery Metals (IBAT.CD) and EnergySource Minerals about licensing DLE technology."

"Separate from its Tetra partnership, Exxon also controls more than 100,000 acres in Arkansas from which it plans to begin lithium production by 2027, according to the source."

"Exxon plans to send at least six representatives to the Benchmark Minerals conference next week in Los Angeles, according to an attendance list seen by Reuters. It would mark the company's first attendance at the major critical minerals conference."

Standard Lithium's head start: [Gone] Not Gone

Tldr Exxon planning to start producing lithium in Arkansas the same year SLI plans to start. More info coming Monday.

FWIW If Mintak is being honest about the current zeal for lithium offtake/partnership, I don't believe the race really matters and I think it's good for SLI that proven companies are validating the area.

"Exxon Mobil (XOM.N) is set to unveil its long-awaited lithium strategy on Monday with an announcement that it aims to start production of the electric vehicle (EV) battery metal in Arkansas by 2026, according to a source with direct knowledge of the oil major's plans."

"Exxon...plans to begin producing at least 10,000 metric tons per year of lithium in Arkansas by 2026 with partner Tetra Technologies (TTI.N) in what has been labeled "Project Evergreen," according to the source."

"Exxon is not expected to publicly announce which DLE technology it has chosen, according to the source. The company has a long-standing pattern of not disclosing some vendors.

Reuters reported this year that Exxon and Chevron (CVX.N) held talks with International Battery Metals (IBAT.CD) and EnergySource Minerals about licensing DLE technology."

"Separate from its Tetra partnership, Exxon also controls more than 100,000 acres in Arkansas from which it plans to begin lithium production by 2027, according to the source."

"Exxon plans to send at least six representatives to the Benchmark Minerals conference next week in Los Angeles, according to an attendance list seen by Reuters. It would mark the company's first attendance at the major critical minerals conference."

Standard Lithium's head start: [Gone] Not Gone

Tldr Exxon planning to start producing lithium in Arkansas the same year SLI plans to start. More info coming Monday.

FWIW If Mintak is being honest about the current zeal for lithium offtake/partnership, I don't believe the race really matters and I think it's good for SLI that proven companies are validating the area.

Posted on 11/12/23 at 10:26 am to ev247

I have been meaning to pick up more TT, messed around too long I guess.

Posted on 11/13/23 at 8:38 am to ev247

Would be nice if Exxon would just purchase SLI

Posted on 11/13/23 at 3:21 pm to Puffoluffagus

quote:

I feel like it will continue to be ambiguous until we get announcements on lanxess opting in/out.

Basically mentioned the trifecta.. lanxess support, debt financing(which they are in talks for), and then open to another partner but sounds like they can't really expand on that until the lanxess decision is made.

Starting to wonder if Lanxess is going to opt out. With all the penny pinching they've been doing, everyone has assumed that they weren't going to. Also comments that they weren't planning any spending that wasn't already in the budget, but SLI may already be in there. I wouldn't think it would take very long to say "No" if their minds were made up.

If they did, that could speed up development of the SWA project, especially if they attract some deep pockets and gov't dollars. I'm going to quit guessing or trying to read the tea leaves from those near the projects. Since Koch came in, I've decided nobody on sight knows jack shite. As it should be, but it'd be nice to have a little insight.

Posted on 11/13/23 at 3:22 pm to ev247

So is Tetra the partner or we awaiting some news today of someone different?

This post was edited on 11/13/23 at 3:42 pm

Posted on 11/13/23 at 8:02 pm to Shepherd88

Tetra is Exxon's partner for Exxon's first lithium project in Arkansas-Project Evergreen.

Exxon formally announced today the drilling of their first lithium well in Arkansas.

Standard didn't need to drill any wells for Lanxess projects and first SWA wells were in Mar23, so 8 month head start on Exxon re drilling.

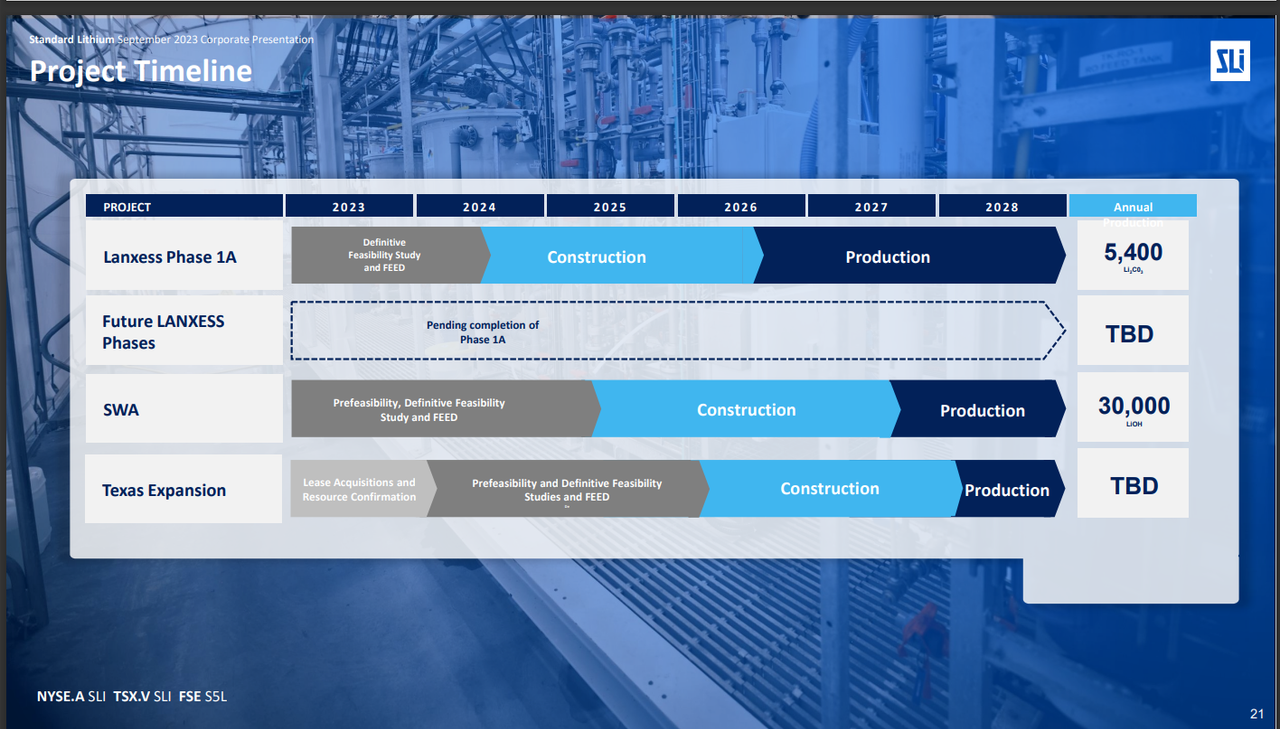

Contrary to yesterday's report, Exxon is targeting first production in 2027, not 2026 like SLI. Neat.

Only reason I'm comparing SLI's situation to Exxon's is to pass time in this quiet period that FeMike (accurately) warned us about.

Exxon formally announced today the drilling of their first lithium well in Arkansas.

Standard didn't need to drill any wells for Lanxess projects and first SWA wells were in Mar23, so 8 month head start on Exxon re drilling.

Contrary to yesterday's report, Exxon is targeting first production in 2027, not 2026 like SLI. Neat.

Only reason I'm comparing SLI's situation to Exxon's is to pass time in this quiet period that FeMike (accurately) warned us about.

Posted on 11/13/23 at 9:13 pm to ev247

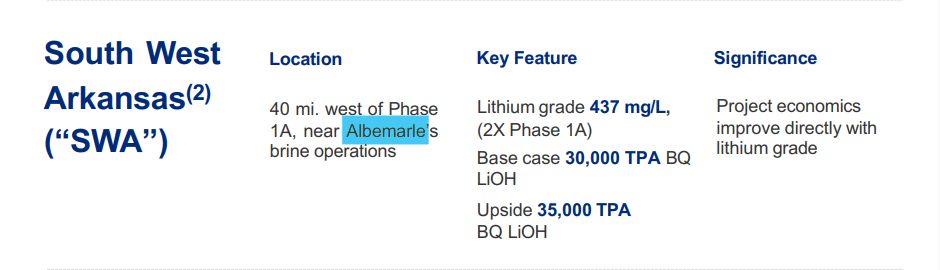

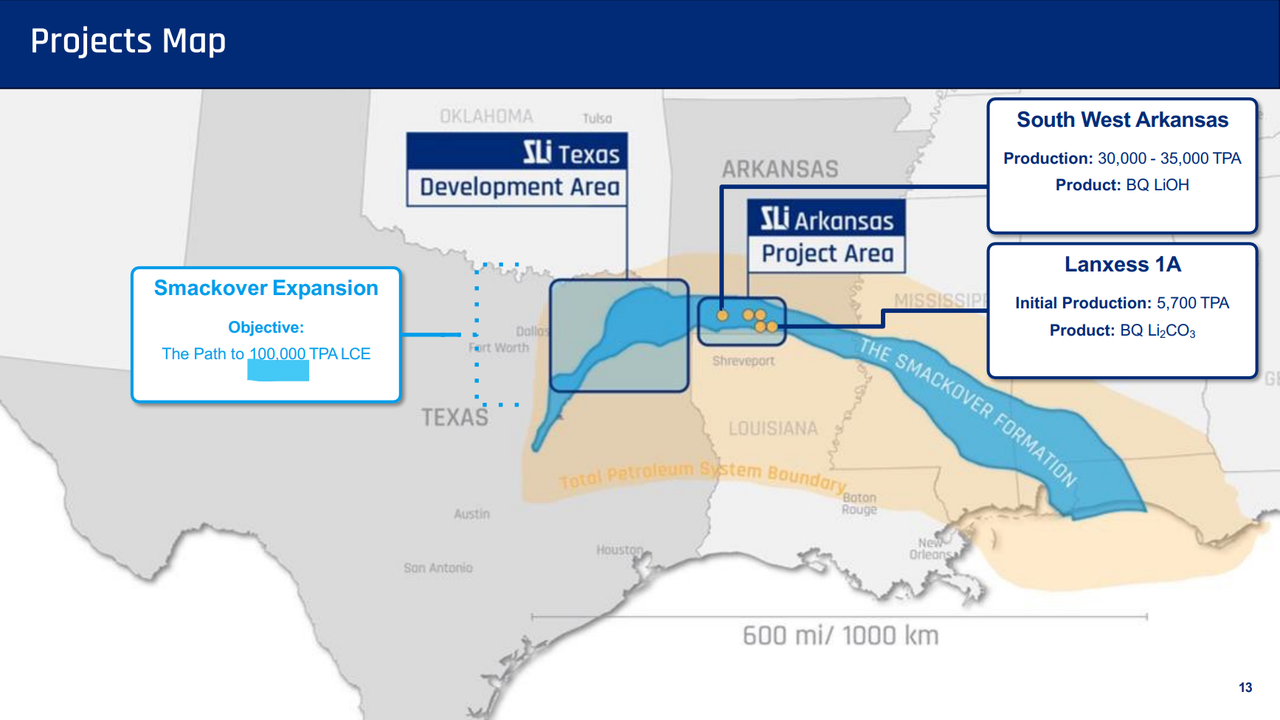

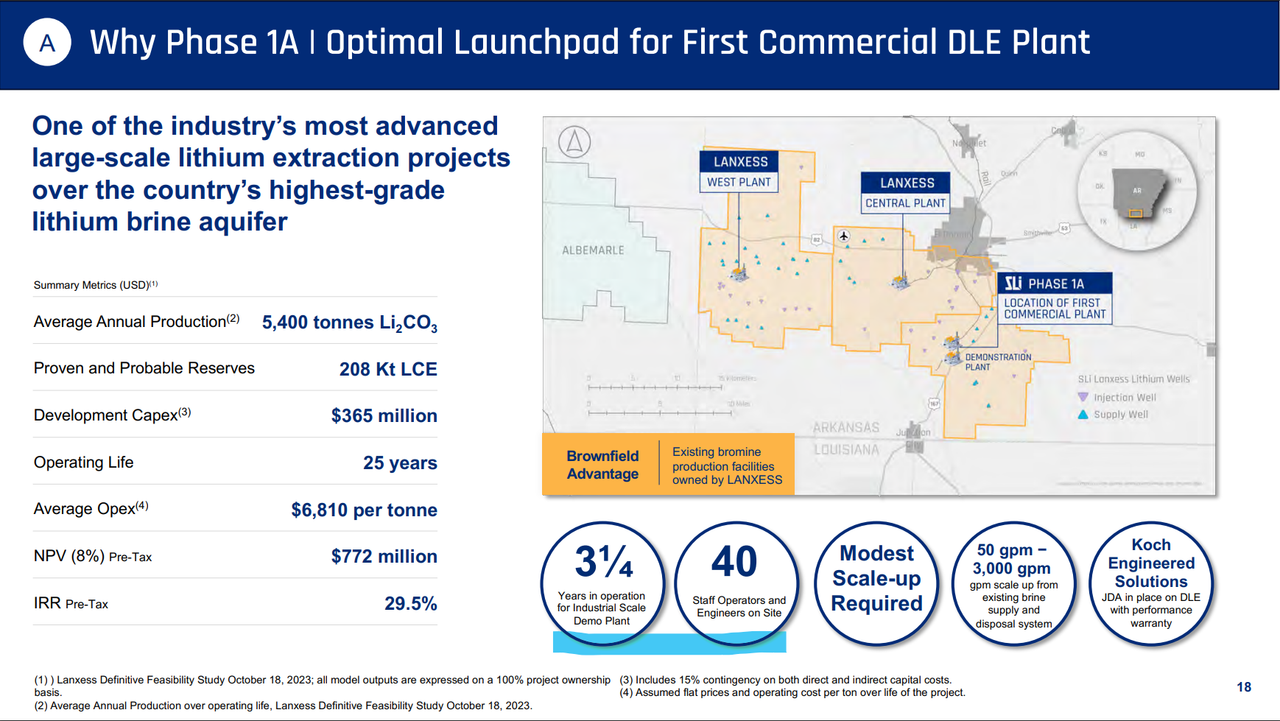

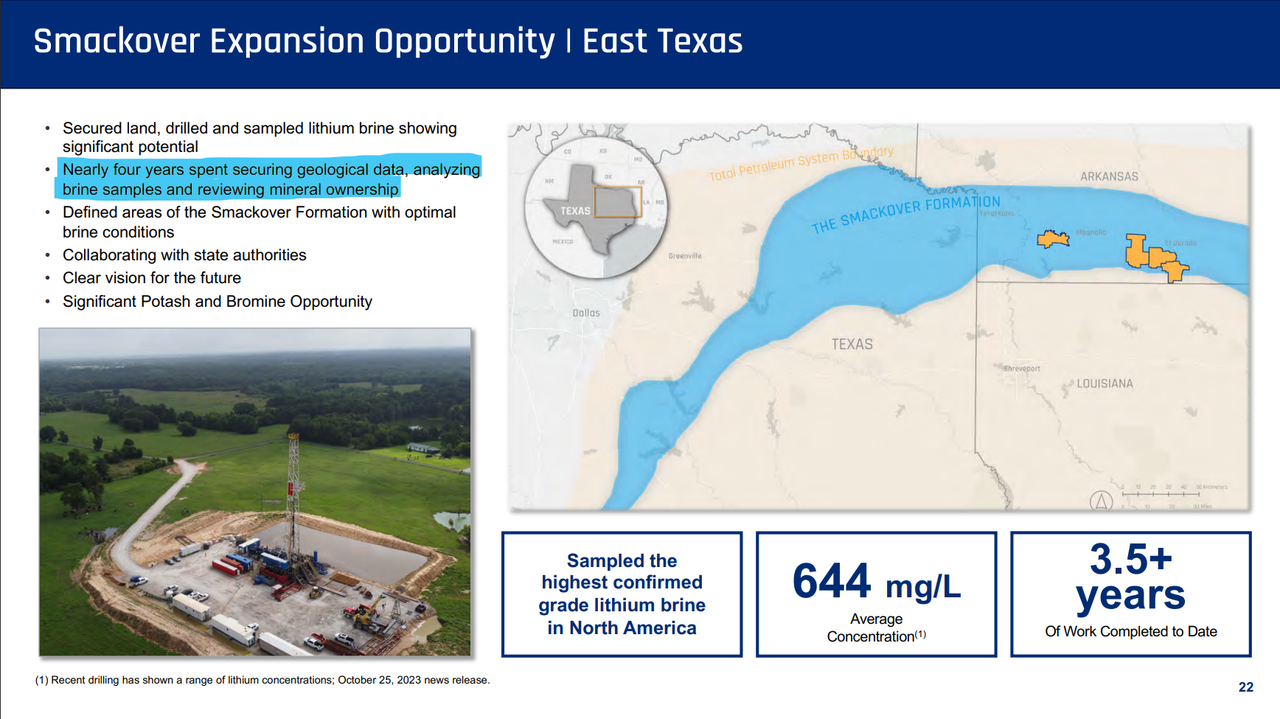

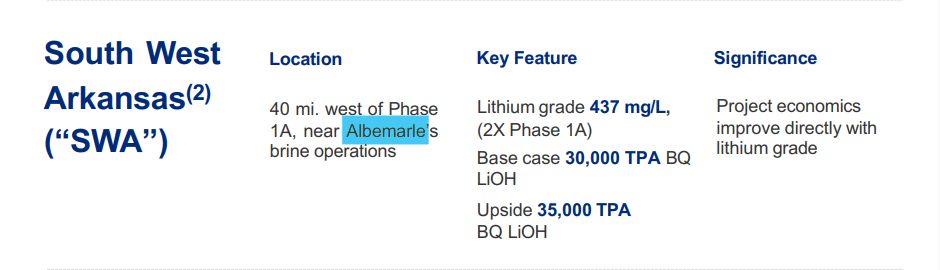

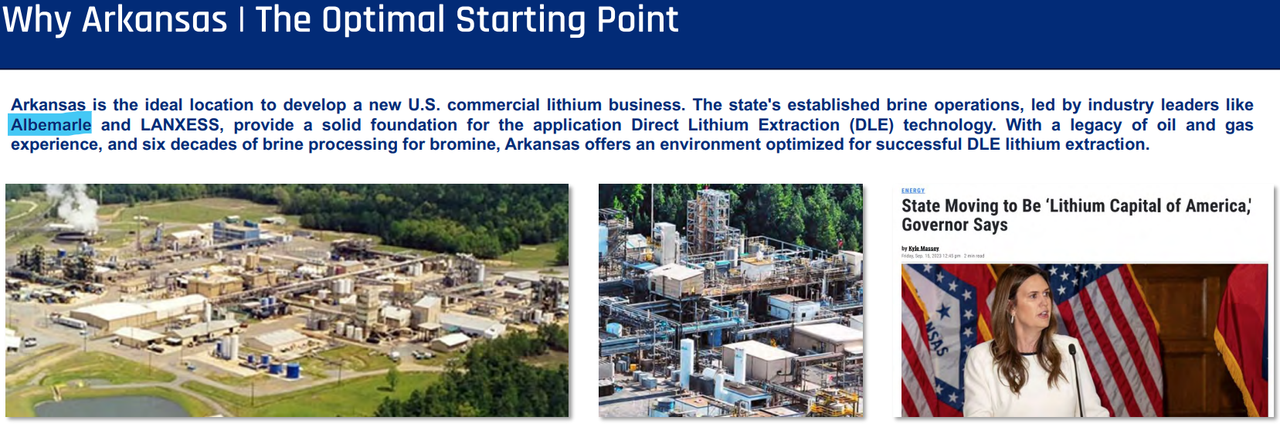

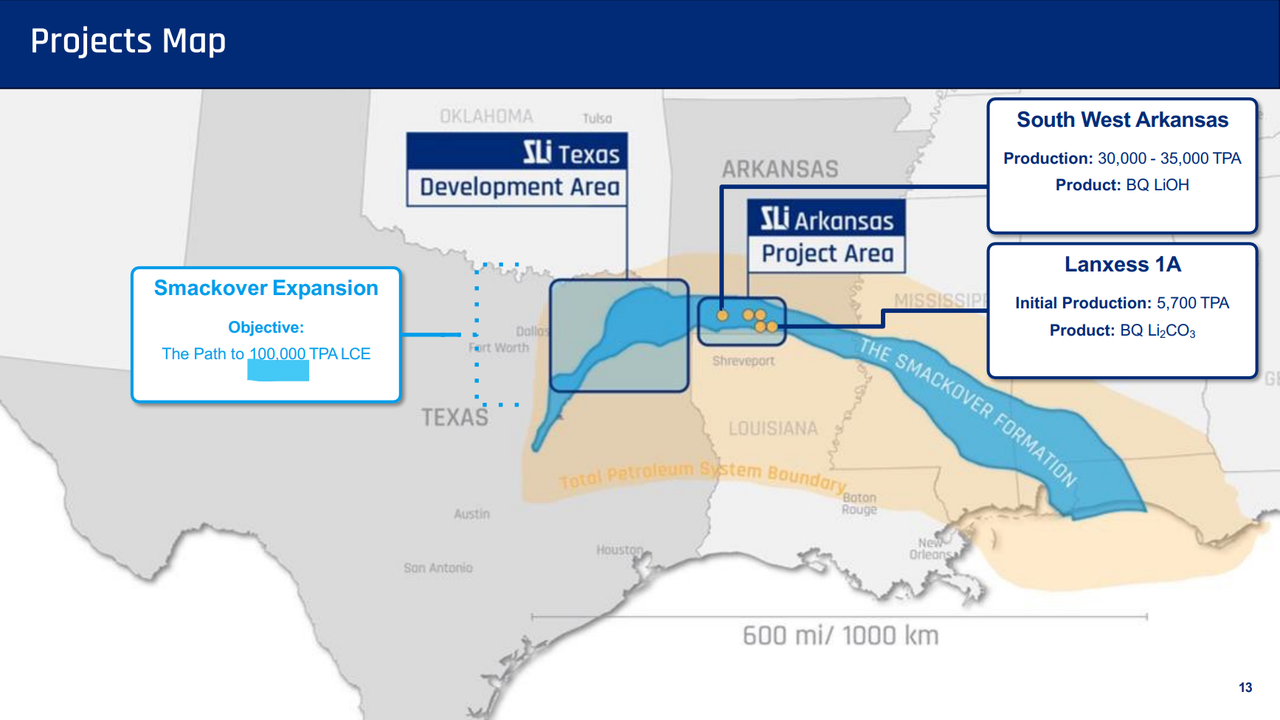

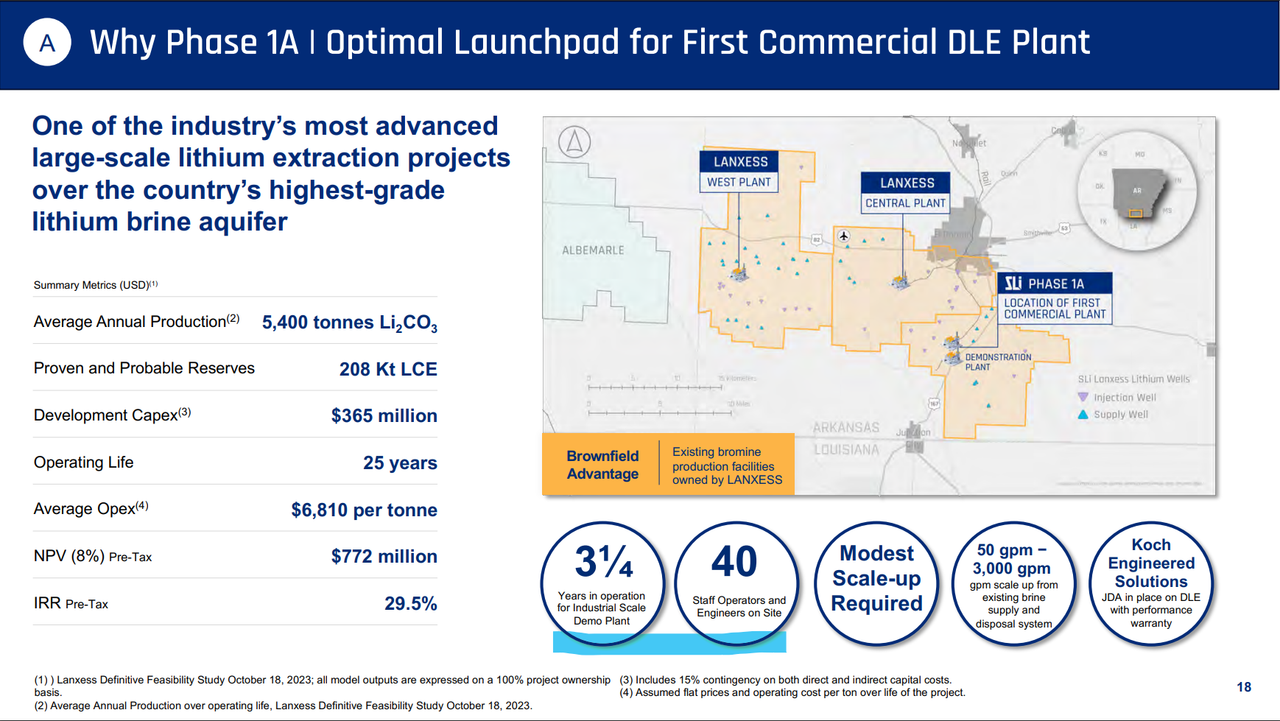

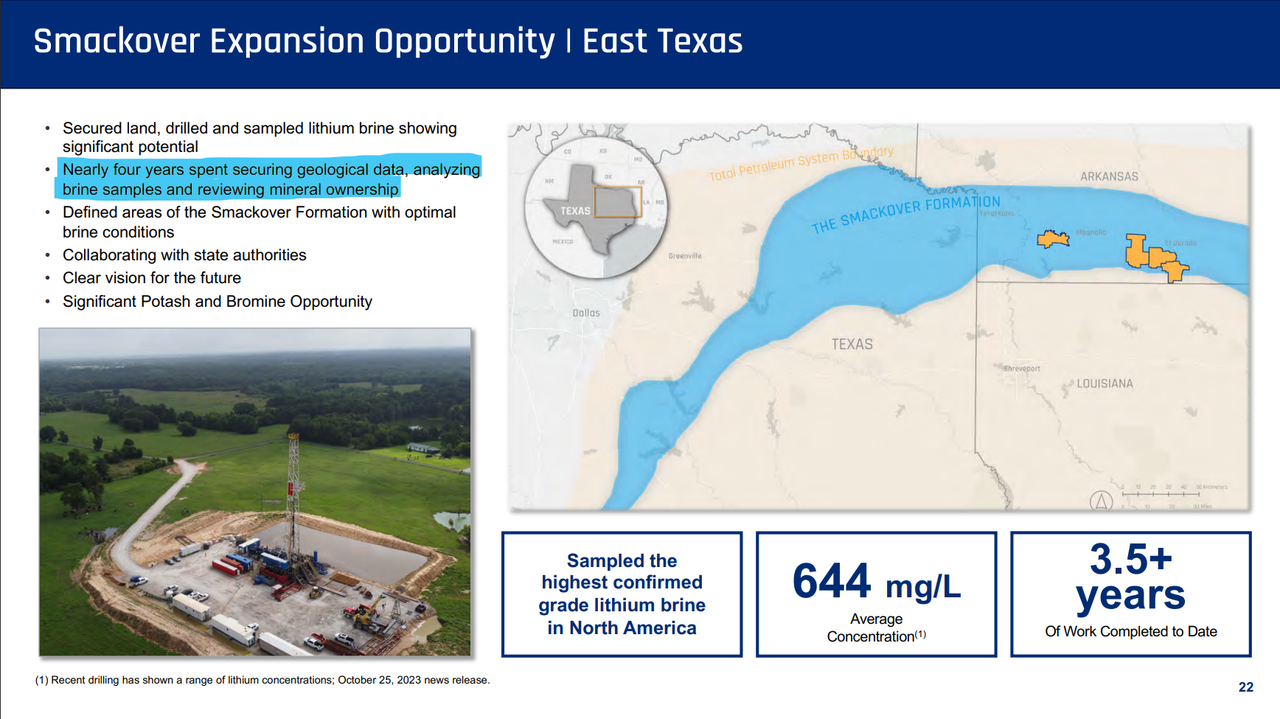

SLI quietly posted a new presentation to the website this month.

Time to comb through and make much out of probably nothing...

2 Takeaways

1. Is it Albemarle? Why do they keep mentioning Albemarle??

2. Aiming for 100k tons per annum in East Texas!

Screenshots incoming:

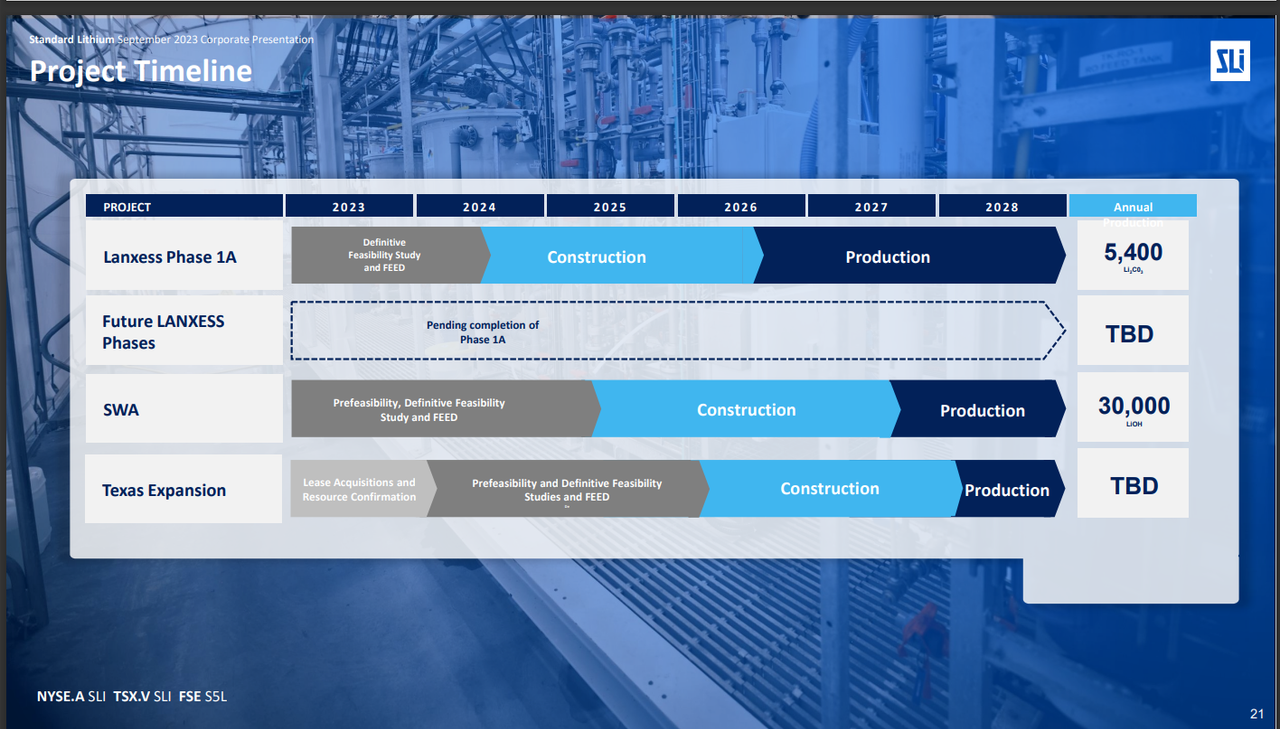

Not sure why but they took out this Project Timeline slide that was in the September Presentation

Time to comb through and make much out of probably nothing...

2 Takeaways

1. Is it Albemarle? Why do they keep mentioning Albemarle??

2. Aiming for 100k tons per annum in East Texas!

Screenshots incoming:

Not sure why but they took out this Project Timeline slide that was in the September Presentation

This post was edited on 11/13/23 at 10:08 pm

Posted on 11/14/23 at 8:07 am to SmackoverHawg

quote:

Starting to wonder if Lanxess is going to opt out.

Same here. Crazy to think, given the conviction with which I was told Lanxess is not interested.

However, I got around to watching Mintak's conference discussion and the way he talks about Lanx is not indicative of a company that is about to opt out. There were a lot of "finalizing the deal with Lanxess" and "moving forward with lanxess" lines. I know he's not going to undercut them before a decision is made but it's odd that he was so "pro" Lanxess.

Also, Lanx actually has a decent chunk of cash after a shockingly positive cash flow they just reported. With the 'imminent' sale of their urethane business, they actually could be in the market for something like this.

I think I'd still be okay with Lanxess, it could accelerate the timeline because of the familiarity and mutual vested interest. Might not have as much of a catalytic price impact as announcing a shiny new partnership with a "household US name" but I think it would definitely be the quickest and safest way to start getting these dominoes falling.

This post was edited on 11/14/23 at 8:17 am

Posted on 11/14/23 at 8:21 am to Fe_Mike

I think any path that advances to production is going to give us a significant boost, at this point, I’ll take anything that moves the needle.

Posted on 11/14/23 at 11:35 am to ev247

quote:

FWIW If Mintak is being honest about the current zeal for lithium offtake/partnership, I don't believe the race really matters and I think it's good for SLI that proven companies are validating the area.

This gives me the image of a skate boarder holding on to a moving semi.

Posted on 11/14/23 at 11:51 am to ApexHunterNetcode

Well look at that...our PR dept doing work. They need to be cranking these out monthly.

Posted on 11/14/23 at 12:10 pm to AUHighPlainsDrifter

When the partnership/buyout time comes. I want SLI to realease this the day before the news drop:

Posted on 11/14/23 at 1:14 pm to AUHighPlainsDrifter

Gotta say I don't understand this PR at all.

That's something you pay an e-rag or blog or investment website to put out for you. Nothing material in here at all.

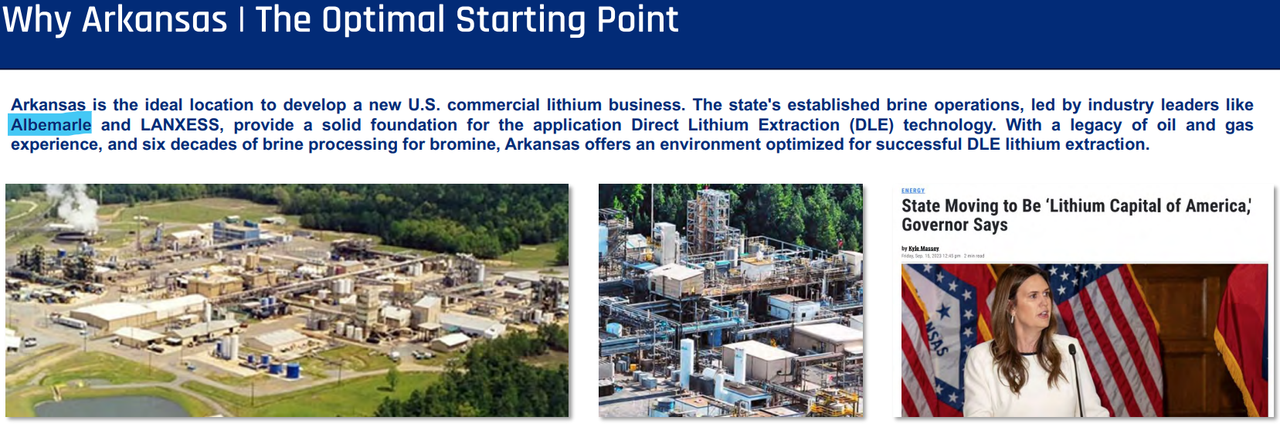

They didn't just throw the names "Exxon" "Albemarle" and "Lanxess" in there for no reason; something strategic to this quote in particular:

No idea what, but that is very purposeful. It's almost like they are trying to plant google hits.

It feels like they are posturing for something.

My guess? Albemarle and Exxon are in a huge bidding war and Standard is just trying to drive that price on up. Yeh....that's gotta be it. Definitely what this PR means.

That's something you pay an e-rag or blog or investment website to put out for you. Nothing material in here at all.

They didn't just throw the names "Exxon" "Albemarle" and "Lanxess" in there for no reason; something strategic to this quote in particular:

quote:

In a region that has captured the attention of major industry players like Exxon, a company with roots extending back to Standard Oil, Standard Lithium's partnerships with Koch Industries and LANXESS are catalyzing a new wave of energy innovation. Alongside the notable presence of Albemarle,

No idea what, but that is very purposeful. It's almost like they are trying to plant google hits.

It feels like they are posturing for something.

My guess? Albemarle and Exxon are in a huge bidding war and Standard is just trying to drive that price on up. Yeh....that's gotta be it. Definitely what this PR means.

Popular

Back to top

0

0