- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 7/21/23 at 12:36 pm to jamiegla1

I see other lithium producers are down between 3 and 4% while SLI is up over 5%...

Posted on 7/21/23 at 12:55 pm to BuckyCheese

Already approaching 700k volume with 2 hours to go. Are we getting PR after closing bell? I wouldn't think Friday afternoon would be a good time for PR, since it leaves the weekend for everyone to cool off. I could be wrong though.

This post was edited on 7/21/23 at 12:57 pm

Posted on 7/21/23 at 12:56 pm to ColoradoAg03

Damnit I knew I should have added yesterday.

Posted on 7/21/23 at 1:13 pm to ColoradoAg03

quote:

Are we getting PR after closing bell?

you know damn well we arent lol

Posted on 7/21/23 at 1:15 pm to jamiegla1

I sure as heck hope we aren't.

Friday afternoon is for bad news PR's.

Friday afternoon is for bad news PR's.

Posted on 7/21/23 at 1:50 pm to jamiegla1

Thanks for your encouragement. I hope that we will all be able to look back and laugh at our investigatory efforts someday from our hot air balloons with spinning rims

I keep thinking about the mind-blowing scale of Exxon vs Arkansas lithum potential.

Long story short, Exxon's revenue in 2022 was 2.5x greater than the value of all the lithium in Arkansas*.

*Exxon estimates 4m tons of LCE in Arkansas. At $40,000/ton, total value of $160B.

Exxon's 2022 revenue was $413B.

As it stands, SLI's two projects will hopefully gross a combined $50B over their 25-year lives. (very rough, not accounting for hydroxide vs carbonate etc)

Just to show the drop in the bucket that this all is for Exxon.

I keep thinking about the mind-blowing scale of Exxon vs Arkansas lithum potential.

Long story short, Exxon's revenue in 2022 was 2.5x greater than the value of all the lithium in Arkansas*.

*Exxon estimates 4m tons of LCE in Arkansas. At $40,000/ton, total value of $160B.

Exxon's 2022 revenue was $413B.

As it stands, SLI's two projects will hopefully gross a combined $50B over their 25-year lives. (very rough, not accounting for hydroxide vs carbonate etc)

Just to show the drop in the bucket that this all is for Exxon.

Posted on 7/21/23 at 1:55 pm to BuckyCheese

Tetra is up a good bit today too. They’ve actually had a pretty substantial run over the past month though as well. I’m guessing both of are up with the news of Exxon moving in the territory so people are getting exposure just to the area and not necessarily the sector.

Posted on 7/21/23 at 3:05 pm to Shepherd88

I like Tetra, been slowly accumulating that one as it seems like they are well-positioned with partnerships no matter who SLI ends up dancing with.

IBATF popped right at the end of the day as well. I'm going to look into that one more; the share price has taken a beating but they seem to be producing.

IBATF popped right at the end of the day as well. I'm going to look into that one more; the share price has taken a beating but they seem to be producing.

Posted on 7/21/23 at 4:49 pm to Lightning

When Exxon talks about trains, modules. adding on. That has me excited. That is Ibatf.

Posted on 7/21/23 at 7:22 pm to Franticlethargy

Where is exxon quoted on that?

I'll be shocked to see it.

Fwiw, exxon has supported fcel for years and most don't realize that

I'll be shocked to see it.

Fwiw, exxon has supported fcel for years and most don't realize that

Posted on 7/22/23 at 3:12 am to jimjackandjose

Posted on 7/22/23 at 8:06 am to Franticlethargy

Still looking for the quotes

One of those articles specifically says Exxon declined to comment

One of those articles specifically says Exxon declined to comment

Posted on 7/22/23 at 8:16 am to jimjackandjose

NDA? Feel free to come to your own conclusions.

Posted on 7/22/23 at 10:54 am to Franticlethargy

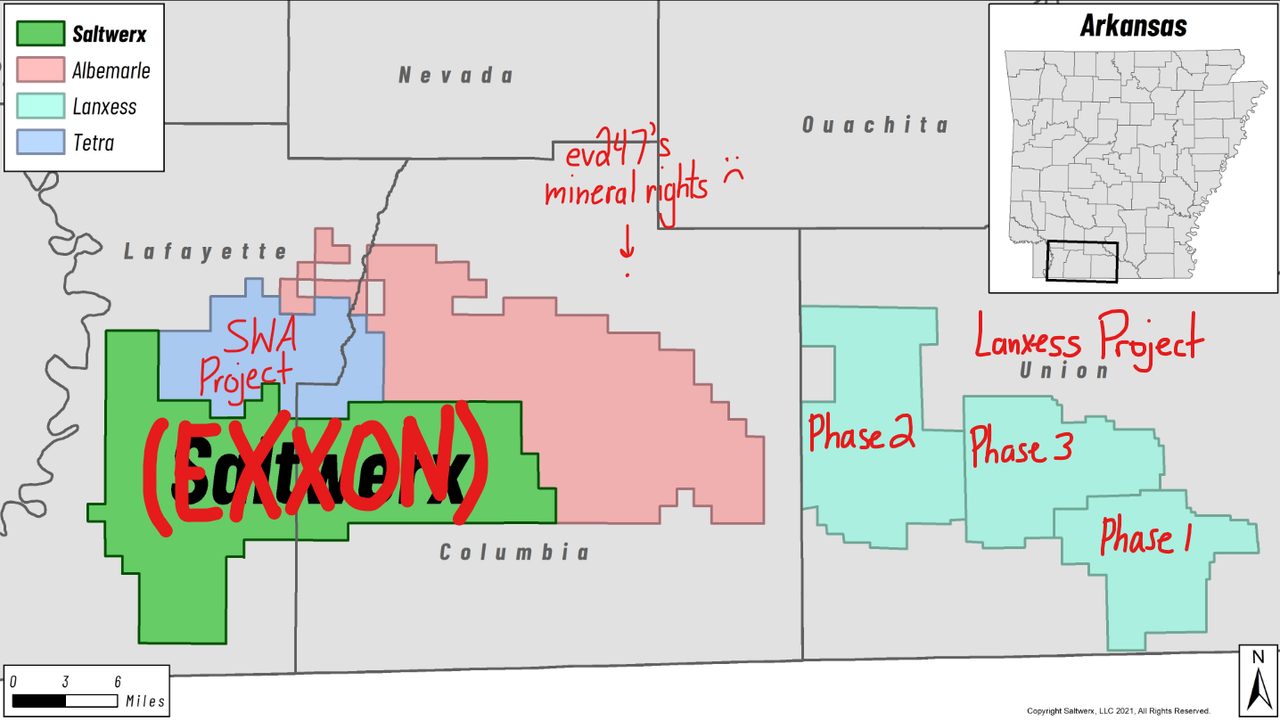

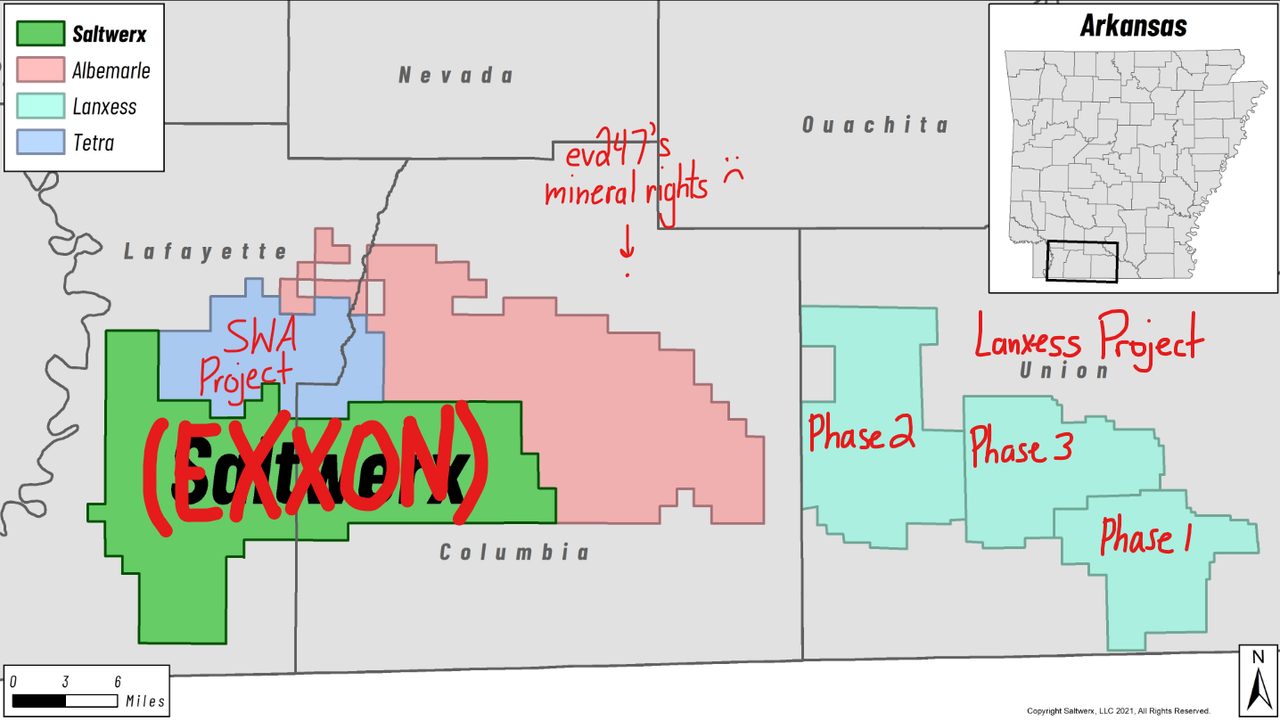

We see where Exxon bought land

Right next to SLI land

There is no concrete information that they plan to add modules or trains or even refine the lithium themselves. They have an expertise in drilling. They may just want the upstream side

Right next to SLI land

There is no concrete information that they plan to add modules or trains or even refine the lithium themselves. They have an expertise in drilling. They may just want the upstream side

Posted on 7/22/23 at 11:32 am to Franticlethargy

It sounds like the modular trains from the second link are in reference to processing and not production. Because the modular trains will be near the lithium production facilities.

"the massive project may be developed in stages, with modular trains built together or in separate locations near its future lithium production facilities..."

I don't see anything on IBAT's website about processing lithium, so I think IBAT fans would be waiting for news on Exxon's production side. I could be wrong and am open to correction.

"the massive project may be developed in stages, with modular trains built together or in separate locations near its future lithium production facilities..."

I don't see anything on IBAT's website about processing lithium, so I think IBAT fans would be waiting for news on Exxon's production side. I could be wrong and am open to correction.

Posted on 7/22/23 at 1:35 pm to ev247

If anyone's interested in where Exxon has moved in. Includes my suboptimal investment for a chuckle

Posted on 7/22/23 at 2:03 pm to ev247

Can someone explain the "modular trains" thing?

I'm sure it's somewhere in this thread but finding it....

It seems this is a way to discern which company is being referenced?

I'm sure it's somewhere in this thread but finding it....

It seems this is a way to discern which company is being referenced?

Posted on 7/22/23 at 5:22 pm to BuckyCheese

Don’t know how to post pics bu go to the website and take a look at the finished mobile DLE/module/trains. It will make much more sense. For the record jimjack, I sold SLI as dead money 2 years ago? Got back in at 4 with 10k shares. Love SLI, just not ready. The reason I posted here is because of the galvanic-Exxon-Ibatf-Arky-Tetra-SLI connection. Didn’t mean to offend.

Posted on 7/22/23 at 6:12 pm to Franticlethargy

No offense taking

Fwiw, investment in all DLE isn't a bad idea waiting for one to hit gold

Fwiw, investment in all DLE isn't a bad idea waiting for one to hit gold

Popular

Back to top

1

1