- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Diving deeper on Standard Lithium?

Posted on 7/11/23 at 6:48 am to itsbigmikey

Posted on 7/11/23 at 6:48 am to itsbigmikey

It was the manner in which it happened as pointed out a couple post back

Posted on 7/11/23 at 7:34 am to jimjackandjose

Added 2k more. Y’all are welcome for the pullback.

Posted on 7/11/23 at 8:49 am to Wraytex

Some bigger orders going through this morning...

1300, 4700, 12000, 5000

I guess it's hard to know if those single numbers are large buy or sell orders. Obviously, there's enough supply on the other side to satisfy it one way or the other.

1300, 4700, 12000, 5000

I guess it's hard to know if those single numbers are large buy or sell orders. Obviously, there's enough supply on the other side to satisfy it one way or the other.

Posted on 7/11/23 at 9:26 am to Grassy1

People swinging the pop. No worried about long game

Hoping DFS gets us back to 7

Hoping DFS gets us back to 7

Posted on 7/11/23 at 1:09 pm to jimjackandjose

Bought more this morning

Posted on 7/11/23 at 4:34 pm to SuperSaint

Today is a bit more interesting to me. Gained more ground even after a big jump the day before. Daily volume is nearly twice the rolling average.

Posted on 7/11/23 at 10:31 pm to Dock Holiday

Maybe a sign that a new partner is coming in? Or existing partner is increasing its share hold?

Posted on 7/11/23 at 10:52 pm to Shepherd88

Or buying the whole damn thing

Posted on 7/12/23 at 1:06 am to jimjackandjose

They are so cheap I bought some of the YOLO calls at $5 strike for the hell of it.

Posted on 7/12/23 at 1:20 am to BuckyCheese

Oct or jan? 47 Oct contracts here.

Posted on 7/12/23 at 4:18 am to Wraytex

The YOLOs I bought expire 7/21. They were a dime so I said what the hell. Like throwing a quarter in the slot machine on your way out the door. Bought a few hundred dollars worth.

I have a fair stack of stock but may buy some of the October or January expirations as well. I see there are over 700 bids for the Jan right now on Robinhood but only 4 asks.

I have a fair stack of stock but may buy some of the October or January expirations as well. I see there are over 700 bids for the Jan right now on Robinhood but only 4 asks.

Posted on 7/12/23 at 2:00 pm to BuckyCheese

Schwab returned all of my shares which were out on loan.

Posted on 7/12/23 at 3:05 pm to Beerinthepocket

Using made-up figures, I'm gathering that lending goes something like this:

Beerinthepocket lends shares to Schwab at 10% interest --> Schwab lends shares to Mr. Short at 12% interest, pockets 2% --> Mr. Short sells shares at $4.70 and must buy new shares before Schwab demands to be repaid the shares on X date. Mr. Short buys new shares to return to Schwab the day of X date for $3.50 and pockets the $4.70-$3.50-interest.

Can't be lender --> borrower

and must be lender --> platform --> borrower

because several posters have mentioned "all" of their lent shares being returned at once.

So Schwab returning borrowed shares means that Schwab doesn't have enough Mr. Shorts to lend to, which means that sentiment toward the company is bullish.

Corrections encouraged

Beerinthepocket lends shares to Schwab at 10% interest --> Schwab lends shares to Mr. Short at 12% interest, pockets 2% --> Mr. Short sells shares at $4.70 and must buy new shares before Schwab demands to be repaid the shares on X date. Mr. Short buys new shares to return to Schwab the day of X date for $3.50 and pockets the $4.70-$3.50-interest.

Can't be lender --> borrower

and must be lender --> platform --> borrower

because several posters have mentioned "all" of their lent shares being returned at once.

So Schwab returning borrowed shares means that Schwab doesn't have enough Mr. Shorts to lend to, which means that sentiment toward the company is bullish.

Corrections encouraged

This post was edited on 7/12/23 at 10:25 pm

Posted on 7/12/23 at 4:06 pm to ev247

Perhaps right, but the percentage interest isn’t quite that favorable toward the retail lender, at least on my fidelity and TD Ameritrade accounts.

Posted on 7/12/23 at 4:36 pm to Grassy1

Added more shares today to put me at 5,075, margin was removed from my account, and fully paid lending enabled. I'm gonna sit on this setup for a while, or until the Monaco Wine Mixer.

Posted on 7/13/23 at 1:02 am to ev247

Thanks for the insight Grassy.

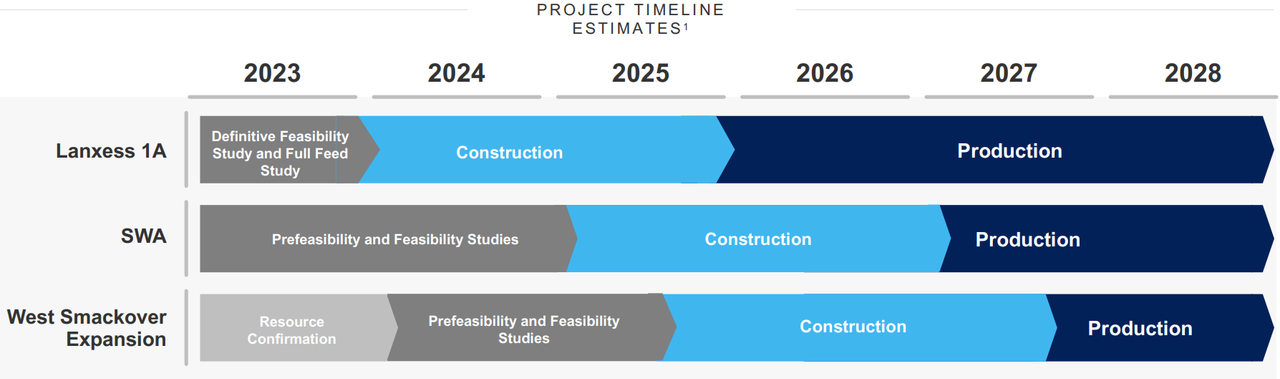

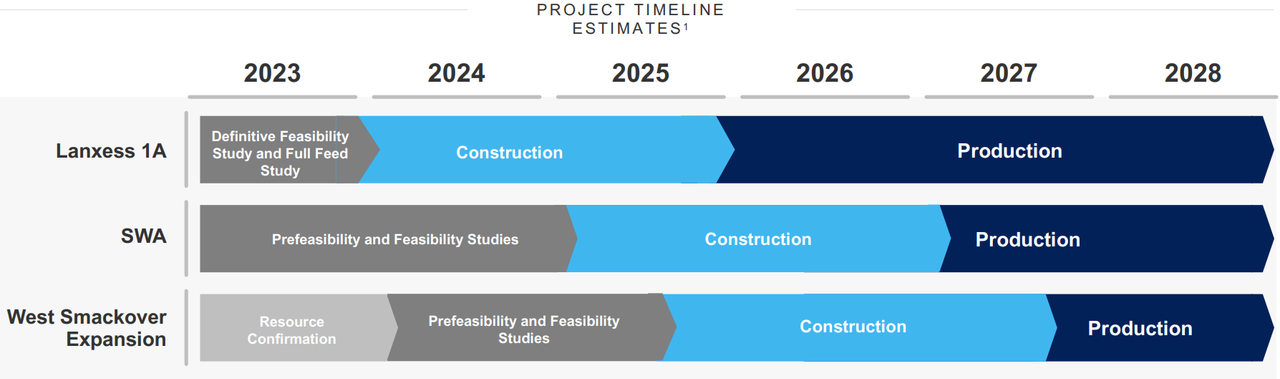

Unrelated, but today I stumbled upon SLI's latest Presentation from their most recent conference on June 27. This graphic was new:

Also noticed an after-hours purchase of 87,028 shares. I guess FeMike got his money this week after all

Unrelated, but today I stumbled upon SLI's latest Presentation from their most recent conference on June 27. This graphic was new:

Also noticed an after-hours purchase of 87,028 shares. I guess FeMike got his money this week after all

Posted on 7/13/23 at 8:45 am to ev247

quote:

after-hours purchase of 87,028 shares

Big orders hit this morning. Already near 150K volume in 15 minutes of trading.

Posted on 7/13/23 at 10:02 am to ev247

quote:

after-hours purchase of 87,028 shares. I guess FeMike got his money this week after all

Live look @FeMike after-hours trading

Posted on 7/17/23 at 6:12 pm to SuperSaint

All quiet today. Somebody throw a rock in the pond to make some ripples!

Posted on 7/17/23 at 7:32 pm to Auburn1968

14 more days until the end of "early Q3"?

I cant remember who said that but I got foolishly hopeful

I cant remember who said that but I got foolishly hopeful

Popular

Back to top

1

1